The Following Example Shows How The Credit Reporting Timeline Of A Charge

1/1/15: You become 30-days late on a payment to Imaginary Bank and Trust . 7/1/15: At 180-days past-due, IBT closes your account and marks it as a charge-off.1/1/22: The charged-off account must be deleted from your credit report by this date.

The credit bureaus and creditors can make mistakes. Whether on purpose or intentional, a mistake could result in a charge-off remaining on your credit report for too long.

Do you think a charge-off has been on your credit report longer than seven years? You or your credit repair professional may need to dispute the outdated account to try to fix the problem.

Know Your Rights When Dealing With Collectors

One important thing to keep in mind before you start calling debt collectors, or before you answer their phone calls, know your rights as a consumer. The Fair Debt Collection Practices Act protects you from abusive debt collection practices. However that doesn’t mean that all collectors actually follow the rules.

With that in mind, here’s what debt collectors are not allowed to do:

- Talk about your debts to anyone except you or your attorney. They are, however, allowed to call friends or family members for the purposes of finding out how to get in touch with you.

- Harass you. They can’t keep making debt collection calls repeatedly and can’t use foul language when speaking with you.

- Keep calling if you request they stop. You can submit a request in writing to ask them to stop making collection calls. If you do that, they can only contact you to say that they’ll be stopping collection efforts or taking legal action against you. This is my preference, as it’s easier to deal with collectors in writing — plus having written records helps protect you.

- Make any claims that they can’t legally follow through on. They can’t threaten to have you arrested for not paying, or foreclose on your house.

- Lie about who they are or the purpose for their contact. Before the FDCPA, it was common practice for a collector to call pretending to be an old friend just to get you on the phone. A legitimate debt collector will not do this today.

Put Together The Details Of The Debt

After youve learned how to get a credit report and done some sleuthing, its time to gather and confirm all the details of the past due debt. This step is especially important because if something isnt correct, you have some disputing rights that could provide some relief ranging from reducing your debt to removing the charge-off from your credit or even updating your credit report with more favorable information regarding the negative account.

Here are the details you need to check:

- Account number: This is the account number with the original creditor.

- Original creditor name: The company that originally billed you for the product or services

- Open date: When you first opened your account with the original creditor

- Charge-off date: When the original creditor deems your debt uncollectible and writes it off their books

- Payment history: A record of when you made or missed payments along with when your account was last active

- Borrower names: Whose name is attached to the debt

- Balance: How much is owed

Pay special attention to things like the dates, the amount owed and the type of debt. For instance, collection agencies may report the date they purchased your delinquent account as the date the account was last active rather than the date the original lender or creditor charged off the account. This practice can actually prolong the time frame during which this debt affects your credit score, as older charge-offs affect your credit less as time passes.

You May Like: How To Check Credit Score Without Affecting It

Writing A Goodwill Letter To Remove A Charge

When attempting to get a charge-off taken off your credit reports, youll need to write a goodwill letter to the creditor that currently owns the debt. This is a letter that acknowledges you made some missteps with your debt and asks the creditor to make a goodwill adjustment. If you are delinquent on the debt because of some extenuating circumstances, such as losing your job or experiencing a medical emergency, it can help to explain the situation in your letter. LendingTree has a template you can use when crafting your letter.

Be sure to save all your communications and agreement in writing, and dont send any money until you have written confirmation from the creditor that they will remove the charge-off.

Also, note that if you settle for less than the full amount you owe, know that the forgiven debt may be considered taxable income. So plan for a potentially larger tax bill that year.

There are many considerations that go into handling a delinquent debt. The choices you make can have a major impact on your credit and finances as a whole. So consider consulting with a professional about your next steps. You can call the Tayne Law Group at 890-7337 or fill out our short contact form to get a free consultation and learn about your options.

Mail A Copy Of Your Documents Along With Your Request To Confirm/update Your Address To:

TransUnion LLC

P.O. Box 1000

Chester, PA 19016

When providing proof of your current mailing address, please ensure that any bank statements, utility bills, cancelled checks, and letters from a homeless shelter are not older than two months. All state issued license and identification cards must be current and unexpired. P.O. Box receipts may not exceed more than one year in age. Please note that any electronic statements printed from a website cannot be accepted as proof of address.

You May Like: Repo On Credit Report

Recommended Reading: What Credit Score Is Needed For A Mortgage

How Can You Remove A Charge

In most cases, youll have to be patient where charge-offs and your credit reports are concerned. The FCRA states that credit reporting agencies must remove charge-offs from your credit reports after seven years. But nothing forces a credit bureau or creditor to remove a charge-off early.

Still, there are a few potential ways to get a charged-off account deleted from your credit reports before the seven-year clock runs out.

Discount For Family Members Couples And Active Military

Lexington Law now offers $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Recommended Reading: How Does Credit Utilization Affect Your Credit Score

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

Dont Miss: How To Get Repos Off Your Credit

Consult With A Credit Repair Company Buyer Beware

People with charge-offs sometimes choose to speak with a credit repair company. These companies charge a fee.

However, some work on your behalf to challenge negative items creditors may have placed on your credit reports with the three credit bureaus.

Services like perform a full analysis of your credit history, challenges the damage you disagree with and sets you up with a plan to build credit.

The service comes highly-regarded by other users, showing 4.9 out of 5 stars with almost 170 reviews on ConsumerAffairs.com.

Consider this service if you need assistance with repairing your credit. Set up a consultation to learn more about and whether it can help with your charge-offs.

You May Like: How Often Does Discover Report To Credit Bureaus

Debt Charge Offs And Subsequent Collection Process

As many may or may not be aware, debts owed to creditors travel down many paths of classification according to creditors. Examples of such classifications include any of the following: continuous late and delinquent status, judgment status, or charged off status. The purpose of this article is to discuss charge off status and how the cycle may continue towards collections after the charged-off classification.

A charged-off account is an outstanding balance that the lender/creditor considers a business loss. How long it takes before the creditor/lender declares the account a loss varies from creditor to creditor, but this typically happens after several months of attempting to collect the money. Once an account has been charged off, the lender may sell it to a collection agency, either immediately or at a later date. At the time the account is charged off, the creditor usually stops the clock on interest charges, but the collection agency may add fees of its own. On your credit report, this kind of debt is designated as R9 for revolving credit charge-off or I9 for installment credit charge-off.

Another question typically posed is how long can they collect? In Michigan, the statute of limitations on debt varies by the type of debt. But for consumer debt, the statute of limitations is six years. This applies to all four types of contracts.

- Open Ended Accounts

You Can Ask The Creditor Or Collection Agency For Deletion In Exchange For Payment

This strategy is tricky and often doesnt work. You can try to negotiate with a creditor to delete a charge-off from your credit reports early in exchange for payment. A creditor could ask the credit bureaus to delete the account early if it desires to do so. Credit reporting, after all, is a voluntary process.

The catch is that the credit bureaus dont like payment for deletion deals and might not honor them. The Credit Reporting Resource Guide instructs creditors and collection agencies not to make such arrangements with consumers. If a creditor or collection agency gets caught offering pay-for-delete settlements, a credit bureau might close that companys account. Then the company could no longer pull credit reports or report any credit information to the bureau.

If you do convince a creditor to accept payment in exchange for deletion, get the offer in writing before you hand over your payment information. In the event the account doesnt come off of your credit report after payment as promised, you might need to speak with an attorney or submit a complaint to the Consumer Financial Protection Bureau.

MoneyFactIts Tricky

Payment for deletion is legal, but the credit bureaus tell creditors and collection agencies not to make such arrangements.

Read Also: What Is Elan Financial Services On My Credit Report

Other Products & Services:

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. . JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Chase Private Client is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

Its Past The Statute Of Limitations

This last scenario varies from state to state because collection laws are different. However, if the charge-off is past the statute of limitations, you have a built-in defense against having a judgment brought against you for non-payment.

The catch is, you must go to court and defend yourself against any lawsuit brought by the collection agency.

Most debt collectors dont bother filing a lawsuit if your debt is past the statute of limitations. Some people choose not to pay the debt and instead let the charge-off drop from their credit report after seven years.

This doesnt help your credit score in the short term, but it can save your finances if you are attempting to pay down debts on currently open accounts.

Read Also: How Long Does Information Remain On Your Credit Report

Will Paying A Charge

Paying a charge-off will not automatically get it removed from your credit report. The status will change to show that it has been paid, but the mark remains on reports for seven years since the first missed payment.

Before you pay a charge-off, you can sometimes make an agreement with the credit issuer that they will remove the charge off in exchange for your payment. If you make this type of agreement, make sure to get it in writing.

Tax Lien: Once Indefinitely Now Zero Years

Paid tax liens, like civil judgments, used to be part of your credit report for seven years. Unpaid liens could remain on your credit report indefinitely in almost every case. As of April 2018, all three major credit agencies removed all tax liens from credit reports due to inaccurate reporting.

Limit the damage: Check your credit report to ensure that it does not contain information about tax liens. If it does, dispute through the credit agency to have it removed.

Read Also: What Credit Score Do You Need To Rent A House

How Much Does A Charge

As with any other negative entry on your credit report, the number of credit score points a charge-off will cost you depends on the scoring system used , what your score was before the entry appeared and how many other negative entries already appear on your credit report.

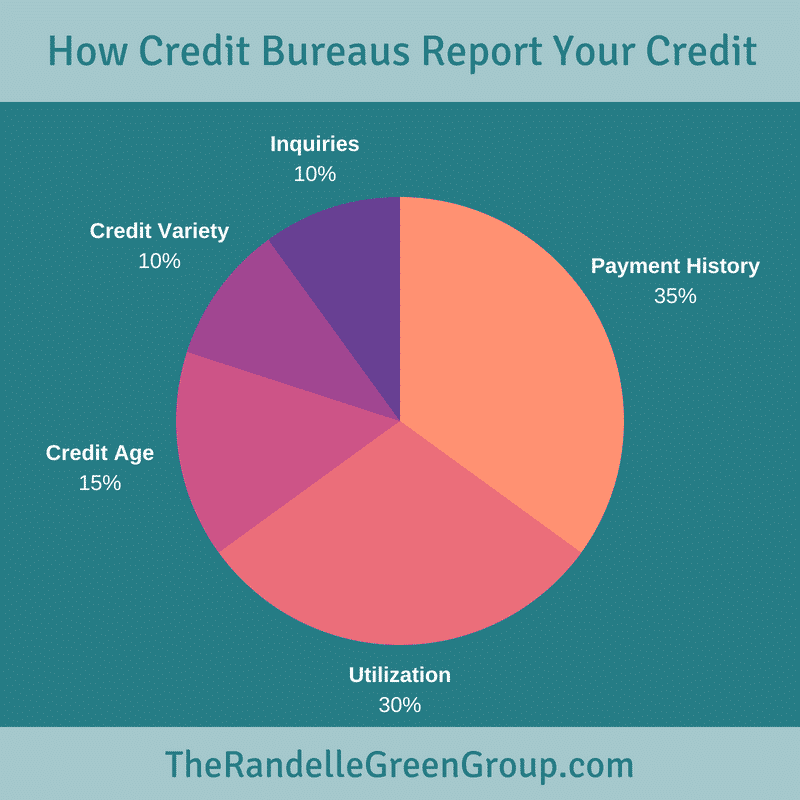

The appearance of a charge-off on your credit report might not actually lower your score by much, but only because you would have have acquired many other negative entries on the way to getting a charge-off. The charge-off itself is simply the cherry on top. Late and missed payments do more damage to your credit scores than any other single factor: The first payment that’s 30 days late often has the most significant impact, and your score suffers more every month the bill remains unpaid. Since a charge-off typically appears after six consecutive months of score reductions due to missed payments, your score may be so degraded by then that there aren’t a lot of points left to lose.

Charge Offs Will Drag Down Your Credit Score

Whether you call it a charge off or a write off or come up with some entirely new bit of fun financial jargon the impact to a credit score of a charged off account remains the same: big and bad. A super-powered delinquency, charge offs can eat several dozen points off your credit score and the higher your score before the charge off, the larger the number of points youll lose.

The best way to deal with a charge off is to avoid ever having one in the first place. Pay your credit accounts as agreed every month, and eliminate the hassle altogether.

Even if you do fall behind on your payments, as long as your account has yet to be charged off so, as long as you arent more than 180 days past due you can still recover your credit score by paying your balance and returning your account to good standing.

We all have financial ups and downs, and at times may feel like just ignoring all of our debts and payments. But this will only lead to more problems in the long run. While it may seem like an insurmountable obstacle at times, working to pay any balances before that 180 day point is well worth the effort it may take.

Read Also: A Low Credit Score Can Lead To

Whats The Difference Between A Charge

A charge-off is just a written-off debt amount reported to credit bureaus. The borrower still pays back the original lender if they want to. Collections refer to when that charged-off debt is sold to a collection agency, which then takes on the job of getting the borrower to repay the amount owed. A new entry will appear on your credit report titled collections where you can view all the information on your loan. Once the debt is sent to collections, borrowers will no longer hear from or directly pay their original lender.

You Can Dispute Incorrect Or Questionable Information On Your Credit Reports Including Charge

A credit bureau can only leave a charge-off on your credit report for 7 years when it follows the rules. If the account contains incorrect information or if anything about the account looks suspicious, you can ask a credit bureau to investigate.

At that point, the credit bureau has 30 days to verify that the account is 100% accurate or delete it from your report. You can manage these disputes on your own, or you can hire a professional credit repair company to help you.

Don’t Miss: How Does A Credit Rating Rank Individuals

Rebuild Your Credit After A Collection Or Charge

Two of the worst types of account delinquencies are debt collections and charge-offs, both of which are the result of not paying bills for several months. Because they show a serious late payment, which will influence 35% of your credit score, both have severe negative impacts on your credit score. You might have a hard time getting new credit applications approved as long as theres a charge-off or collection on your credit report. Fortunately, with some effort, you can overcome the damage.