What Happens To Your Credit Score

Once your creditor transfers your debt to a collection agency, your credit score will go down.

A low credit score means:

- lenders may refuse you credit or charge you a higher interest rate

- insurance companies may charge you more for insurance

- landlords may refuse to rent to you or charge you more for rent

- employers may not hire you

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

Who Looks At Credit Reports

The Fair Credit Reporting Act and some state laws attempt to restrict who can access your credit report and how that information can be used, but generally speaking, any business you seek credit from or anyone who has legitimate business need, can request to see your report.

Businesses with access to credit reports:

One thing worth noting: by law, you have the right to know who has inquired about or requested your credit report in the last six months. When you request a copy of your report, a list of all businesses or individuals should be on it.

Recommended Reading: Sync Ppc On Credit Report

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Q Where Do You Get The Personal Information That Is On My Credit Report

A. The personal information appearing in our credit-reporting system is generally reported to us by credit grantors or other institutions that are responsible for obtaining consumer consent to do so. However, it may also be obtained from other sources permitted by law, including public records, federal and provincial government offices and public registries, or collected directly from individual consumers in response to communications TransUnion has had with them. It is our policy to limit our collection of personal information to include only what is necessary to supply our clients with accurate and up-to-date information so they can make meaningful decisions about consumers. TransUnion periodically reviews the data in its credit-reporting system to ensure that it only contains information relevant to the services we provide.

You May Like: Paypal Credit Hard Inquiry

How You Can Check Your Credit Reports

You can get a free copy of your credit report from each major credit reporting agency every 12 months at AnnualCreditReport.com.

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports, so that you can manage your credit during the COVID-19 crisis.

What Is A Credit Freeze

A credit freeze or security freeze allows you to restrict access to your . Freezing your credit can help prevent identity thieves from applying for new credit in your name if that requires a hard inquiry of your credit reports.

Freezing your credit doesn’t mean your credit history is completely off-limits to everyone, however. Any companies that you have an existing credit relationship with will still be able to see your credit history even with a freeze in place. And government agencies executing a court order or search warrant will also be able to access your credit file.

Don’t Miss: Nfcu Pre Approval Mortgage

How Do You Get Something Removed From Your Credit Report After 7 Years

In theory, debts should be automatically removed from your credit report once they reach their legal expiration . If you see debts on your credit report that are older than that, youll want to contact both the creditor and the credit bureau by mail requesting a return receipt. In your letter, include all documentation about the debt, including any inaccuracies.

How To Safeguard Your Identity

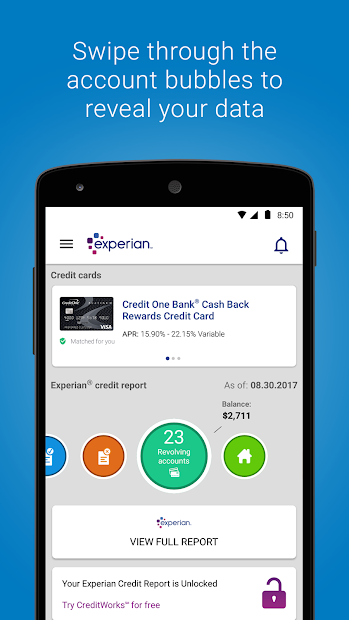

If you find accounts listed on your credit reports that you did not open or if you are worried about identity theft, you might consider filing a free fraud alert on your credit file that remains active for one year through the Experian fraud center. The fraud alert notifies lenders pulling your credit report to take extra steps to verify your identity.

You can also freeze your credit reports, another free measure that prevents lenders from issuing new credit in your name altogether. Or try Experian CreditLock, a benefit of your Experian membership, which allows you to lock and unlock your report in real time, with no waiting period.

You May Like: How To Get Repo Off Credit

Q: Should I Order A Report From Each Of The Three Nationwide Consumer Reporting Companies

A: Its up to you. Because nationwide consumer reporting companies get their information from different sources, the information in your report from one company may not reflect all, or the same, information in your reports from the other two companies. Thats not to say that the information in any of your reports is necessarily inaccurate it just may be different.

Hard Pulls Vs Soft Pulls

When you apply for credit of any kind, you effectively authorize a business or individual to do what is called a hard pull or hard inquiry on your credit report. There likely will be a negative effect on your credit score from hard pulls, especially if several occur over a short period of time.

Hard pulls are another issue. Hard pulls are viewed as an indication that you need financial help to complete whatever transaction you are making, thus it has a negative effect on your credit score. The effect usually is slight, maybe 5-to-7 points, but if your credit score is on the borderline, it may drop to the wrong side of that line after a hard pull and affect the interest rate you are charged.

This should not discourage you from shopping at several lenders for auto or home loans. Fair Isaac Corporation calls this rate shopping, and allows a 45-day window where the numerous hard inquiries are treated as just one.

You May Like: How Many Points Is A Repo On Credit Score

Reasons You May Not Recognize Security Question Information

There may be several reasons you could have difficulty answering the security questions. While the presence of fraudulent activity on your report is one possibility, there may be several other explanations that are unrelated to identity theft:

If none of those reasons apply, there may be accounts opened in your name fraudulently. If you have been the victim of identity theft, you may not recognize accounts or personal information asked about in the security questions. If Experian is unable to sufficiently match your identifying information or response to the verification questions, you will need to provide documentation to verify your identity.

Q I Corrected Things On My Credit Report And My Score Went Down Can You Explaina The Effect On Your Score Due To Changes Made To Your Transunion Credit Report Depends On The Nature Of The Information That Was Changed What Information Is Left Intact And What Other Items On Your Credit Report Have Been Updated During The Time That The Corrections Were Made

Some specific reasons why your score may not have improved include:

- Your TransUnion credit report included several negative items and some but not all of them were removed. The presence of one or more negative items may still have an adverse impact on your score.

- Your TransUnion credit report reflects some positive changes but there may have been new updates to your file that offset them such as higher balances reported on accounts, new account openings or new credit inquiries.

Don’t Miss: Cbc Innovis Credit Inquiry

Q Will Transunion Accept Tty & Trs

Once all required elements have been met, the standard operating procedure for handling Consumer calls will apply.

Why Its Important To Check Your Credit Report

Checking your credit report should be done periodically to screen for reporting errors and unrecognized activity. The first signs of identity theft usually appear on your credit report, and the earlier you spot them, the easier it is to stop the theft. Even if all the information you find is accurate, seeing your credit activity at a glance can give insight into how to manage debt more efficiently and raise your credit score.

Requesting a free credit report should also be an early step in any upcoming plans involving applying for a loan, such as buying a home or car. Pull a copy at least six months before a major purchase because if you do need to work on your credit, dispute errors, etc., it can take several months or longer to address these issues, says Bringle.

As long as youre entitled to a free report, theres no harm in requesting one. A common myth is that getting your own report will hurt your credit scores, says Rod Griffin, senior director of public education and advocacy at Experian. It wont. This is because there are two types of credit checks: hard inquiries and soft inquiries. While the former can temporarily ding your score, the latter which includes requesting your personal credit report will not. Soft inquiries do not affect credit scores or lending decisions, says Griffin.

Don’t Miss: Paypal Credit Inquiry

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Q How Do I Know If Im A Victim Of Fraud

A. If a creditors fraud department, government agency or law enforcement agency referred you to the TransUnion Fraud Victim Assistance Department , you may already know that you are a fraud victim. Otherwise, you may merely suspect that fraud has occurred. If you are the victim of a credit fraud crime, you should take certain steps to protect yourself and your rights.Common Signs of FraudSigns of Fraud can vary but typical indicators of fraud and / or stolen identity include:

- One of your creditors informs you that they have received an application for credit with your name, address and/or Social Insurance Number.

- Telephone calls or letters state that you have been approved or declined by a creditor to which you never applied.

- You no longer receive your credit card statements or you notice pieces of mail are no longer delivered to you.

- Your credit card statement includes unusual purchases.

- A collection agency informs you they are collecting for a defaulted account that has been established with your identity but not opened by you.

Read Also: Does Klarna Hurt Your Credit Score

How To Get Your Annual Credit Report From Experian

Starting April 20, 2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports for the next year through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion®– once every 12 months. Every consumer should check their credit reports from each of the 3 bureaus annually. Doing so will make sure your credit is up-to-date and accurate. Each reporting agency collects and records information in different ways and may not have the same information about your credit history.

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

Also Check: Does Checking Credit Karma Affect Your Credit Score

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

Q What Is The Age Of Majority In My Province In Which I Can Place A Fraud Warning On My File

A. TransUnion does not maintain credit records for individuals under the age of majority in their current province of residence. You must be the age of majority in your province in order to place a fraud alert.The age of majority in the individual provinces and territories of Canada is as stated below.

Province Age of Majority:

- Yukon Territories 19

Read Also: 626 Credit Score Credit Card

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Don’t Miss: Experian Temporary Unlock

How To Unfreeze Your Credit

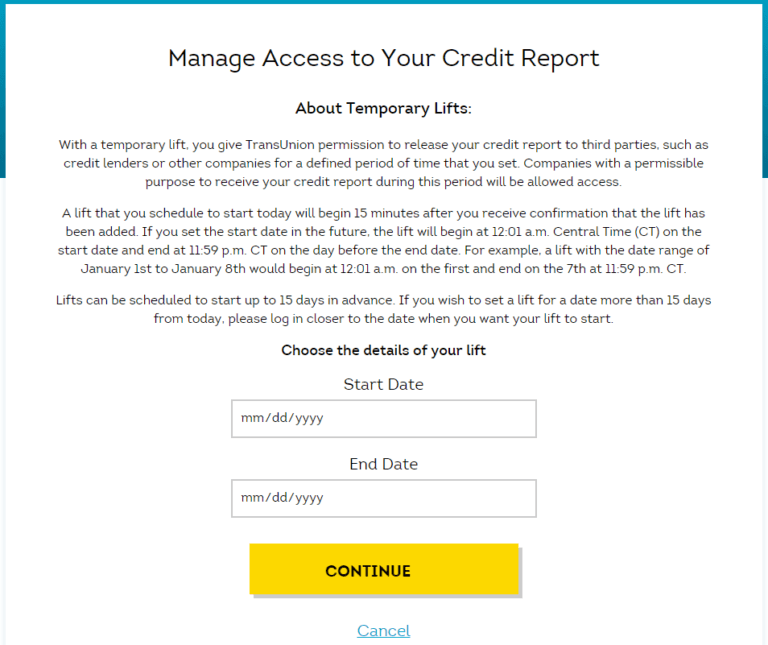

At some point, you may decide that you no longer need the credit freeze. Or you may want to temporarily lift the credit freeze so you can apply for a mortgage, credit card, or other loans.

If you want to unfreeze one or all three of your credit reports you’ll have to contact the credit bureaus individually. With TransUnion and Experian, you’ll need to provide the PIN you set up earlier.

Once you ask a credit bureau to lift your credit freeze, it must do so within a specific time frame. For requests made by phone or online, the freeze must be lifted within one hour. If the request is made by mail, the freeze must be lifted no later than three business days after it’s received.

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Don’t Miss: Does Comenity Bank Report To Credit Bureaus