Getting Citicards Cbna Off Your Credit Report

In most cases, a hard inquiry should be the least of your credit concerns.

They barely impact your credit score, and theyre an essential part of the process of getting approved for new credit.

If you applied for a CBNA credit card, the best thing you can do for your credit is to borrow and spend responsibly, maximizing the positive effects of your credit to boost your score.

However minimal the effect of a hard inquiry might be, you shouldnt let one stay on your report if you didnt apply for a card.

Disputing an inaccurate entry couldnt be easier, and if you need help, you have several great credit repair companies at your disposal.

Adding Information Showing Stability

Creditors like to see evidence of stability in your file. If any of the items listed below are missing from your file, consider sending a letter to the credit reporting agencies asking the agency to add that the information. You can use Nolo’s Letter to Request Addition of Information Showing Stability. You can also make your request online.

Include any documentation that verifies the information you’re providing, such as copies of your driver’s license, a canceled check, a bill addressed to you, or a pay stub showing your employer’s name and address. Remember to keep copies of all correspondence.

Where Can I Find Out More About Credit Credit Reports And Scores Repairing My Credit Scores And Protecting Myself Against Credit Fraud And Identify Theft

The Federal Trade Commission’s website and the Consumer Financial Protection Bureau’s website offer helpful information about credit and other related topics.

Federal Trade Commission Articles:

What should I do if I think someone is using my personal information?

Visit identityTheft.gov to report identity theft and get a personal recovery plan that will:

- Walk you through each recovery step

- Pre-fill letters and forms for you to send to businesses, debt collectors, and others

- Track your progress and adapts to your changing situation.

Is it safe to provide my Social Security Number to AnnualCreditReport.com?

Yes. The site’s security protocols and measures protect the personal information you provide. You must enter your Social Security Number to receive a free credit report through AnnualCreditReport.com.

Can I use my Individual Taxpayer Identification Number to get my free annual credit reports?

Not if you use the AnnualCreditReport.com site. We believe your Social Security Number is the most secure number to use, so our site accepts only that number.

However, since the ITIN has a similar format, you can use your ITIN if you submit your request to one of the three nationwide consumer credit reporting companies by mail. Once the company receives your request, they will verify your identity using their own procedures.

How can I submit a suggestion or comment about the Annual Credit Report Request Service or this website?

Read Also: How To Report To Credit Bureaus On Tenants

So Whats The Solution

The best option is to pay off the outstanding debt. Connect with your lender and pay the remaining owed amount in full. Once you have paid off all your dues, the lender will report this to the credit bureaus, and the remark status will be changed from “settled” or “write-off” to “closed.”

Even if you’re unable to settle the outstanding amount in full, work with your lender to arrive at a settlement amount. As mentioned above, a settlement amount is lower than the total amount you owe to the creditor. When you pay the agreed amount, the lender notifies it to the credit bureau, and the remark on your report will be changed from “write-off” to “settled.” Though “settled” is still a negative remark, it’s marginally better than having a written-off status on your credit report.

You Should Add Information Showing Stability And Unreported Positive Accounts To Your Credit Report Here’s How

By , Attorney

Get Free Credit Reports Weekly During the Coronavirus Crisis

During the coronavirus national emergency, the three major credit reporting bureaus are offering free weekly credit reports to consumers.

In addition to disputing incorrect or incomplete information and adding explanations for negative information the won’t remove, you might want to ask the credit reporting agency to add information to your report that makes you look more creditworthy. This information usually includes:

- information demonstrating your stability, and

- positive account histories that are missing from your report.

Also Check: Does Wells Fargo Business Secured Credit Card Report To Bureaus

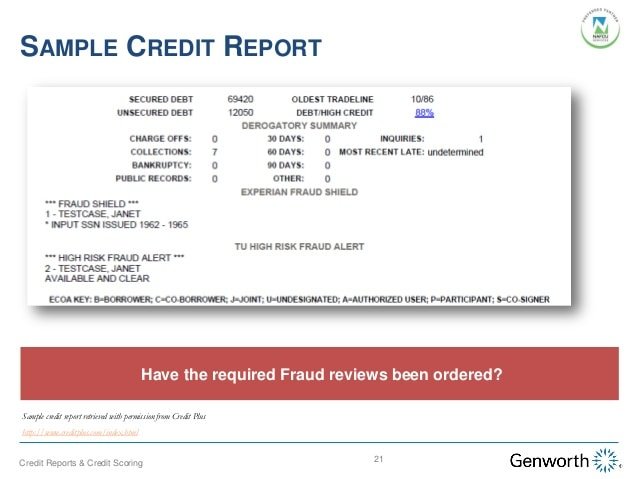

How Do Derogatory Accounts Hurt Your Credit Score

Every derogatory account on your credit is like another strike against you when it comes to getting a loan or improving your credit score. Each bad mark will lower your FICO, resulting in higher rates, and may get to the point where you get denied a loan.

How much a derogatory account hurts your credit scoredepends on a few factors:

- Your credit score before the derogatory remark The higher your score is, the more points youll lose with a bad mark. You know what they say, The bigger they are,

- The number of derogatory remarks on your report can affect your credit score. A lender might overlook one late payment against a history of being on-time. Its more difficult to overlook if youre constantly late or in default.

- The type of debt or derogatory remark will affect how bad it hurts your score.

- How long youve had credit and the number of on-time payments on your report will affect how much a derogatory mark affects your FICO.

This table shows the differing effects a derogatory account can have on your credit score. Bankruptcies and foreclosures affect your FICO much more than late payments. Starting from a higher credit score, youll see more points lost for the different types of bad remark.

Will The Comment Affect Your Credit Score

You may be worried about how a comment indicating your credit grantor closed the account will affect your credit score. After all, having a good credit score is critical to having your credit card and other applications approved.

Fortunately, any comment stating that your credit card issuer closed your account or the fact that your creditor closed your credit card won’t hurt your credit score. Comments aren’t factored into your credit score. Only activity on your accounts is factored into your credit score.

Often, prospective creditors check credit scores rather than reviewing your credit report because it’s a faster way to approve applications. A comment that your account was closed by the credit grantor may go unnoticed. Even so, it typically won’t count against you, especially if the rest of your credit report contains positive information.

Your could be affected by a closed if you still have the balance on the credit card or if your other credit cards have balances. An account closure could also affect your score if the card was your only credit card. If the account was closed because of late payments, the late payments would also affect your credit score.

If you feel your account was closed in error, you can contact your credit card issuer to ask about re-opening it. Otherwise, paying off any outstanding balance quickly is the best way to protect your credit score.

Read Also: Sync Ppc Credit Card

Q How Is The Transunion Personal Score Calculated

The credit industry uses various types of credit scores to assess risk for different types of credit. For example, a creditor may use one type of score when assessing risk for a credit card account and another type of score when assessing risk for a mortgage account.

Q How Do I Initiate A Dispute

A.There are three ways you can launch a dispute into item on your report:

- Online: to visit our self-service website.

- Over the telephone: simply call 1-800-663-9980 to reach one of our TransUnion representatives for assistance with your inquiry.

- In writing: for mailing instructions and TransUnion requirements.

Don’t Miss: How To Get Repo Off Credit

Paying Off Derogatory Credit Items

It can be beneficial to pay off derogatory credit items that remain on your credit report. Your credit score may not go up right away after paying off a negative item however, most lenders wont approve a mortgage application if you have unpaid derogatory items on your credit report. Make sure the accounts are valid before sending payment, especially with debt collection accounts.

Dispute Comments And Appearance On Credit Reports

- An investigation will be conducted if you question the legitimacy of an account.

- Normally, this investigation takes 30 days after being marked as disputed

- Accounts that are in dispute are not taken into consideration by the Fico credit scoring systems. The specific account may show up on your credit report, but it would not contribute to your credit score.

- There are two possible scenarios after the 30-day investigation.

Scenario 1: The account is going to be deleted. Your mind will be at ease because the dispute comments will not appear in your credit report.

Scenario 2: The investigation did not lead to account deletion. The creditor will then ask the credit bureaus to put a consumer disputes account remark. This mark tends to artificially increase your credit score. However, lenders would want this comment removed so they can see the accurate credit score.

Different kinds of dispute remarks

Type 1: Account Disputed:

This comment does not contribute to the credit score. Lenders demand its removal. The account is either updated or removed after the re-investigation. The status can be changed to account disputed, making it not a factor of the credit score.

Type 2: Account that was disputed now resolved

This comment affects the credit score. It happens after the completion of the investigation. Banks and potential lenders do not mind this specific dispute comment.

Also Check: When Do Creditors Report To The Credit Bureaus

Q What Do Lenders Look At When Deciding Whether Or Not To Approve A Loan Or Credit Card

A. Typically, lenders want to see how you have managed your credit obligations in the past. This helps them determine whether or not they should approve your application for credit and the term of the credit extension. Example – a gold card vs. a platinum card.A credit score based on your TransUnion credit report is one of several tools that lenders use when evaluating your application for credit. It provides a summary of how likely you are to repay a loan as agreed and based on how you have managed your credit obligations in the past. Lenders may also evaluate other information in their loan evaluation process. This may include information you provide on the credit application .

How To Get Negative Remarks Off My Credit Report

Negative remarks on your credit report are not only an indicator of your past mistakes, but they also hamper your future prospects. Negative remarks on your report also impact your credit score negatively. Additionally, they also prevent you from securing loans in the future. Even if you’re sanctioned a loan, the interest rates won’t be in your favour.

Any negative remark on your credit report like settled or write-off, remains on your report for a long time. So, you need to take corrective action to remove it.

Read Also: Which Credit Bureau Does Carmax Use

Negative Codes On An Experian Credit File

For example, here are a variety of negative credit scenarios, and the Experian codes used to describe them:

-

30 Days Past Due: 30

-

60 Days Past Due: 60

-

90 Days Past Due: 90

-

120 Days Past Due: 120

-

150 Days Past Due: 150

-

180 Days Past Due: 180

-

Collection: C

-

Claim filed with government: G

-

Insurance claim: IC

-

Voluntarily surrendered: VS

Again, none of these is a flat-out credit deathblow in and of themselves.

But if your credit reports show a repeated pattern of late payments and an inability or unwillingness to pay your obligations, then banks, credit unions and other financial institutions definitely wont be beating down your door to offer you credit.

How To Improve Your Credit Score

No matter what your history looks like, its always possible to start improving your credit score. By paying your bills on time, paying off debt, and working to get your balances low relative to your overall credit limit, you can increase your score and establish a positive credit history.

Some of those negative marks may stick around for a while, but their impact decreases over time. And in the meantime, those positive habits will help you build a more stable financial foundation.

Don’t Miss: Does Paypal Credit Affect My Credit Score

One Free Report Every 12 Months

Everyone is entitled by law to look at their credit report from each of the three credit bureaus once every 12 months free of charge, or you can buy a credit report from each of the three bureaus if you want to view your report more often.

The three large U.S. credit bureaus Equifax, Experian and TransUnion were required by a 2003 federal law to set up AnnualCreditReport.com as a central online resource for report requests. You can also request your reports by calling 877-322-8228 or by downloading a request form and mailing it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Upon visiting AnnualCreditReport.com, users are directed to a form page and asked to provide personal identifying information, including name and address, Social Security number and date of birth.

After submitting your basic information, you go to a page allowing you to select reports from the three large credit bureaus by checking boxes next to the Equifax, Experian and TransUnion logos. You can select one or all of the credit bureaus. Instructions discuss whether you should review all three reports immediately, or whether you should spread the requests over a period of time.

If you use up your free credit report and want to check again for some reason, you can pay about $20 for each report. Or, you can get a free TransUnion credit report from CreditCards.com

Q How Does The Dispute Process Work

A. At your request, TransUnion will verify any credit information disputed by you. In order to complete this request, we contact the organization reporting the information and verify its accuracy. We recommend that you not apply for credit while a dispute is pending. Investigations are typically concluded within 30 days of the date we receive your request. If we cannot verify the disputed information, the item is removed from your credit report or updated as requested. We notify the companies that have made a recent inquiry to your file that an amendment was made and we send you notice, by Canada Post, at the conclusion of the investigation.If our investigation verifies that the information is reporting correctly, you may add a 100-word explanatory statement in your report to explain your dispute. Exception: 200 words in Saskatchewan.

Read Also: Qvc Synchrony Card Pay

Q How Can I Update My Contact Information In My Fraud Alert

A. To change the contact information in your alert, please contact our Fraud Victim Assistance Department . Any changes to the statement need to be sent in writing with two photocopied pieces of identification.

All information should be supplied to:Correspondence in EnglishTransUnion Fraud Victim Assistance Department3115 Harvester Road,Suite 201 Burlington ON L7N 3N8Correspondence in FrenchService daide aux victimes de la fraude TransUnion3115 Chemin Harvester,Suite 201 Burlington ON L7N 3N8

A Credit Report Is Divided Into Several Parts:

A credit score is a three-digit numeric summary of your credit history, which ranges between 300 and 900. It is calculated using details from the account and the enquiry section of your Credit Report. Your credit score is considered during credit approval because it is calculated according to algorithms that combine your credit behaviour and your account information to determine your eligibility. If your score meets the lenders eligibility criteria, then they will offer you credit at favourable terms. Here you can have a look at the different credit score range and its meaning.

Also Check: Affirm Delinquent Loan

What Is A Credit Grantor

The credit grantor is another term used to describe your or the company that has granted some form of credit to you.

As your credit grantor, the credit card issuer can make a lot of decisions about your account as outlined in your credit card agreement. They can raise or lower your credit limit and your interest rate. They can charge fees to your account for certain transactions, and they can charge fees as a penalty if you’re late with a payment. However, your credit grantor can also close your credit card account, sometimes without warning.

How Much Does A Derogatory Mark Affect Your Credit Score

While all derogatory marks will hurt your credit score, the amount your score will drop varies based on a variety of factors. For one thing, the type of derogatory mark matters. A hard inquiry is likely to reduce your credit score by about 5 to 10 points, while a late payment if youve missed the due date by a whole billing cycle can reduce your score about 90 to 110 points.

A bankruptcy is another example of a derogatory mark that will reduce your credit score significantly. For example, someone with a credit score in the mid-700s is likely to see their score decrease by 100 points or more, according to the credit scoring company FICO.

Also Check: How To Delete Hard Inquiries On Credit Report