Experian Boost Now Includes Your Rent Payments

Experian Boost is a free service that launched in 2019 and works by collecting positive information about your on-time monthly payments for bills such as utilities, certain subscription services and now, rent to help raise your credit score. And if users are ever late when making their tracked payments, that negative information isn’t included.

Experian Boost recently announced a new beta release, saying it would be partnering with 1,500 rent and leasing management companies across the country to include information on rent payments in credit reports.

Learn more about eligible payments and how Experian Boost works.

While Experian isn’t disclosing the specific management companies it’ll be partnering with, tenants who pay their rent directly to their property management company or through platforms such as AppFolio Property Management, Buildium®, Yardi® Breeze and Zillow® Rental Manager can add qualifying positive rent payments to their credit file, according to Rod Griffin, senior director of public education and advocacy at Experian.

Note that not all rent payments qualify for the service payments must be paid online through certain management companies or platforms, and not through a third-party money-transfer app such as PayPal, Venmo or Zelle. Rent payments made via cash, money order or personal check aren’t eligible either.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Using A Credit Card To Pay Your Rent

You can use a credit card to pay your rent and boost your credit score in an indirect way. Open a credit card, and use it to pay your rent , then pay your credit card balance in full each month. The timely credit card payments will help boost your credit score.

Some landlords may charge a processing fee if you use a credit card to pay your rent.

Recommended Reading: Will Increasing Credit Limit Hurt Score

Does Your Rent Payment Influence Your Credit Score

Have you been wondering, âcan I pay rent with a credit card?â Yes, you can, but for something to impact your credit score, it has to be reported to one or more of the major credit bureaus: Experian, Equifax, and TransUnion. And many renters are surprised to discover that most property management companies and landlords donât report to the credit bureaus.

In fact, although 35% of adults in the U.S. live in rental housing, rental data makes up less than 1% of all credit data being reported to the credit bureaus.1

When rent payment is reported to the credit bureaus, your apartment lease will appear as a tradeline in the âaccountsâ section of your credit report. Your report will show the date your lease started, your monthly payment amount, and your payment history for up to 25 months.2

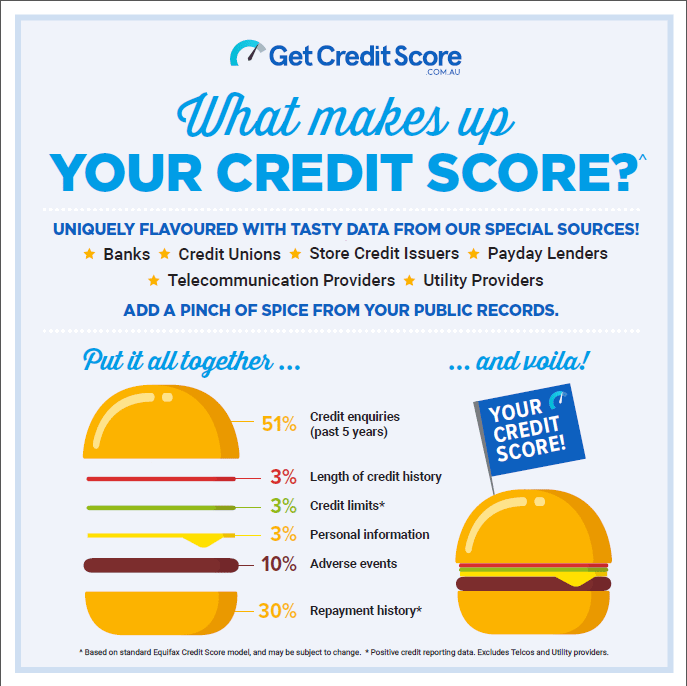

Since payment history is one of the main factors influencing how credit scores are calculated, a history of on-time rental payments on your credit report might improve your score.

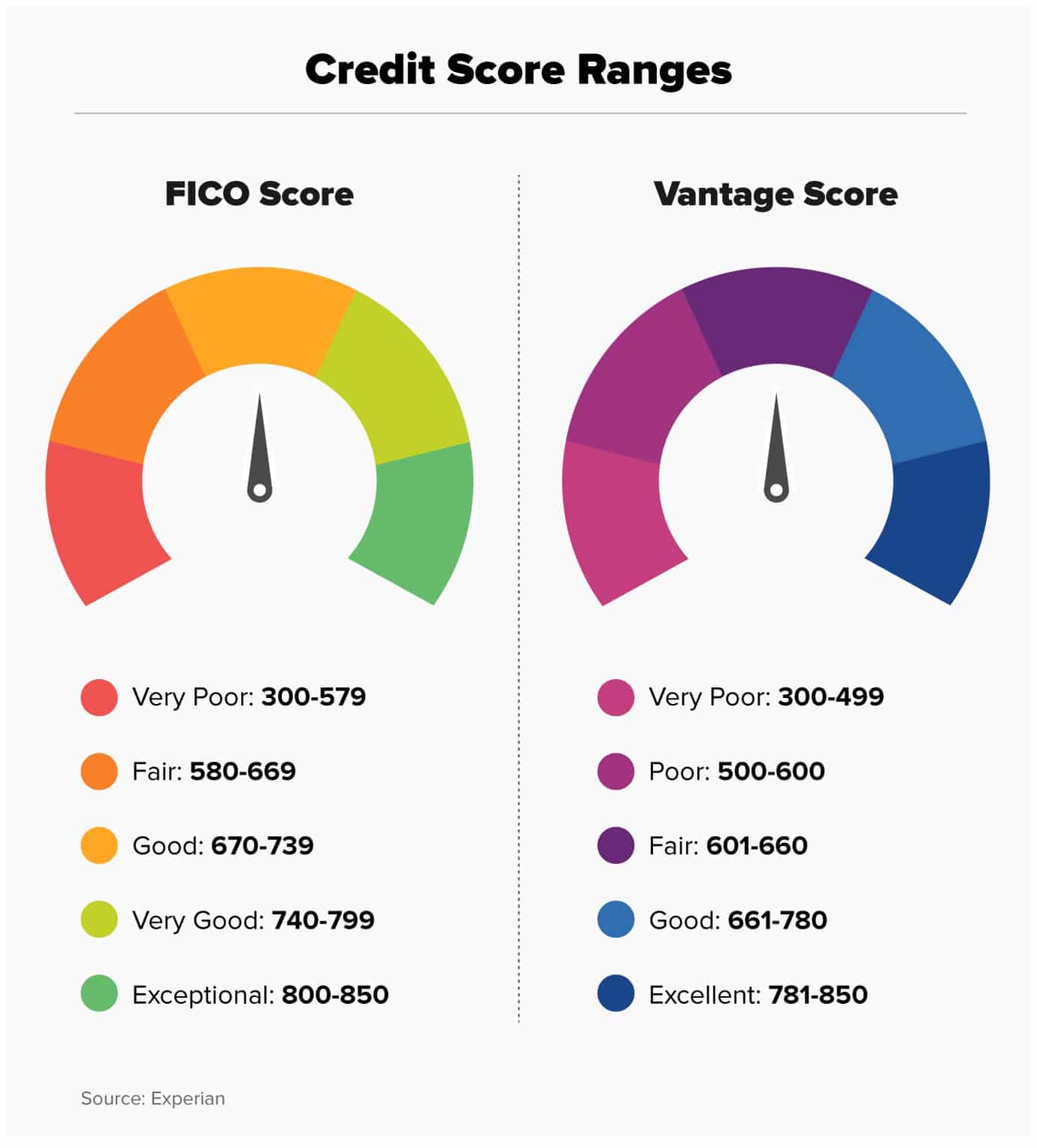

Notice I said it might improve your score rather than it will improve your score. Thatâs because only some consider rental data. Newer versions of the FICO Score, such as FICO 9 and FICO 10, and VantageScore take rental history into account, but many lenders still base credit decisions on older versions.2

Rent Reporting Services And Fees

If you’re willing to pay for a rent reporting service, find out which credit bureaus they report to. It would make the most sense to have the service report to all three bureaus.

For some fees, such as a transaction fee, some services leave it up to your landlord to split the cost with you.

Here’s a quick comparison:

Don’t Miss: How Often Credit Card Companies Report

Other Ways To Build Credit

It takes time, effort and responsible financial behaviors to build credit, and there are many ways to do it. If youâre trying to build credit, donât forget about some of the more traditional approaches to building credit. There are even ways to build credit without a credit card.

And if you want to get an idea where your credit stands today, you could use . Itâs free for everyone, and it has loads of features to help you monitor your credit. Best of all, using it wonât hurt your credit score. You can also get free copies of your credit reports from each of the major credit bureaus by visiting AnnualCreditReport.com.

So now you know how paying rent on time could help you build and maintain credit. Itâs kind of funny when you think about it: Todayâs rental payments could be a factor that helps you in the future when you try to get a new apartment or buy a house of your own.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

What Happens If I Miss A Rent Payment

Itâs always a good idea to stay up to date with billsârent or otherwise. Checking with your landlord to understand how late rent payments are handled is a good first step to learn more.

Depending how far behind you are, your landlord could use a debt collector. And that could wind up on your credit report if the debt collector makes a negative report to the credit bureaus. You can learn more about how debt collections work from the CFPB.

Falling too far behind could also put you at risk for eviction. If youâre having trouble, there may be government rental assistance available.

Also Check: What Is China’s Credit Rating

Look For More Ways To Improve

Follow our tips to build your credit even without a credit card. These include improving your payment habits, getting a credit card alternative, finding a loan you can qualify for without credit, and staying on top of your credit report.

Are you ready to improve your credit, build a positive tenant record, skip the line and get the rental unit or home you deserve? to report your on-time rent payments.

DisclaimerThe information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

In October 2021, the LCB organization re-branded some of the services it offers under FrontLobby. Until this point, the LCB organization has consisted of two companies handling different services under the umbrella trademark of Landlord Credit Bureau. The introduction of FrontLobby enables each company to maximize its focus and impact. Read More

How Fast Can You Build Credit Through Rent Payments

Just like with any other type of payment, you can build up your credit within a few months after getting your rental history reported. Credit bureaus usually update the information on your report after 30 days once your credit card accounts get updated.

In the case of reporting previous rent payments, you might be able to expect the results even faster. Namely, some rent-reporting services have stated that you can expect an increase from 30 to 100 FICO points within the first month upon reporting past payments!

Of course, it also depends on your credit score level before updating rental payment information, but its quite an effective way of boosting your history of timely payments.

Its especially useful for consumers with a bad credit score since every on-time payment counts towards earning a higher score in this case.

Read Also: Where Is The Best Place To Get A Credit Report

How To Enroll With A Rent

There are a few things to keep in mind when enrolling with a rent-reporting service. First, make sure the service reports to all three major credit bureaus: Experian, TransUnion and Equifax. Second, be aware that there may be a fee associated with the service. And finally, keep track of your payment history so you can dispute any errors that may appear on your credit report.

Enrolling on a rent-reporting service is easy and can help you improve your credit score. By following these simple steps, you can make the most of this opportunity to build your credit history.

1. Inform your landlord.

Since the landlord will be paid through the service, he or she should be open to participating. He will need to accept your rental payment each month through the service.

He or she may already be enrolled in a rent-reporting service, which can reduce or limit the fees you pay for the service.

2. Research rent reporting services.

The rent reporting service you will choose will depend on the service cost and the number of credit bureaus that receive your rental history from the service.

Be certain that the services you will commit to will report to the three credit bureaus.

3. After choosing your service, create your profile online. In case of any questions regarding setting up your profile, do not hesitate to ask for help from them.

4. Make sure your landlord is set up to receive payments through the service.

What Laws Are There About Rent Reporting To Credit Bureaus

In recent years, thereâs been a push to require landlords to offer rental payment reporting to their tenants â especially for lower-income people who are more likely to be credit invisible or have thin credit files.

According to a report from HUD, one-half to two-thirds of public housing tenants have credit scores that are rated as subprime , and many are credit invisible. Because landlords and property managers routinely use a credit check to decide whether or not to rent to potential tenants, having a low or no credit score can limit their housing choices and employment opportunities.

For many of these individuals, rent constitutes their single largest monthly expense. So adding rental payments to their credit history could help them qualify for more affordable mainstream credit options and even move out of renting and into homeownership.5

California is leading the way. The stateâs new law, SB 1157, requires landlords of assisted housing developments with more than 15 units to give all new and existing renters the option to report rent payments, although the landlord can charge up to $10 per month to cover the cost of reporting.6

To date, California is the only U.S. state with such a law on the books, although other states may follow Californiaâs lead.

Recommended Reading: What’s My Credit Score

How To Build Your Credit Scores In Canada

Depending on the credit scoring model used and the information reported to the credit bureaus, the calculation of your credit scores will vary. Meaning when you check your credit scores with Transunion, Equifax, or any third-party credit score provider, they all may be different.

However, there are generally five common factors that are used to calculate your credit scores. Understanding how these can impact your credit scores can help you develop financial habits that can help improve your credit.

Make Sure They Report To All Three Bureaus

One of the most important things to look for when picking a rent-reporting agency is to confirm that they report to all the major credit bureaus. This includes Experian, Equifax, and TransUnion, and youll be able to check it by taking a look at your free credit report from each bureau.

Rent reporting services sometimes just report to one or sometimes two bureaus, but youll still want to go with one that reports to all three. You never know which bureau a future creditor will use when pulling your credit history and credit report.

On top of that, every bureau uses a different credit scoring model. We already discussed how it all depends on the exact credit model used to determine whether your rental information will affect your credit score.

For instance, Equifax uses a VantageScorer model which is similar to FICO scoring models, but it uses slightly different metrics.

If the service is reporting rent payments to every important credit bureau, youll have the highest chances of rent payments helping you build your credit.

Also Check: Is 585 A Good Credit Score

Ask To Become An Authorized User On Another Account:

While this isnt an option available to everyone, this trick can be very helpful if you have access. If you have a friend or family member with good or excellent credit who is willing to add as an authorized user on their account, you can essentially piggyback off of their credit. You will have a credit card in your name that is linked to the primary cardholders account, but you dont have to use the card to gain the benefits.

Keep in mind that the primary cardholder is responsible for bill payments. Misuse will directly impact their finances and credit. Few people may be willing to assume the risk of adding another person to their credit.

If you are added to another persons account, its imperative to use this tactic responsibly. This is an excellent way to boost or build your credit particularly if you are a young adult and have a parent willing to add you to their account.

Why Is Good Credit Important

Good credit is vital for several reasons. For instance, landlords are more likely to rent you an apartment, you could be approved for a loan quicker, and an employer could choose you for a job above someone else. Here are a few other ways good credit can benefit you throughout your life.

- Lower Interest Rates If you have good credit, youll likely get a lower interest rate compared to people with low credit scores.

- Easier Credit Approval Additionally, banks and lenders are more likely to approve your applications if you have good credit. In other words, when you apply for a mortgage, auto loan, or credit card, you get approved easier.

- Better Loan Terms People with good credit often get better loan terms than people with poor credit. For instance, you could get a higher credit limit or a low fixed-rate mortgage.

Overall, your credit is essential because it can benefit you financially. Whether you need a credit line increase or a mortgage loan, good credit can make it easier to obtain. Next, lets go over how you can build credit by paying rent.

Recommended Reading: How To Remove Hard Inquiries From Credit Report Online

What Is Experian Boost

Experian Boost is a feature that can help you boost your FICO® Score when you add on-time payments through the platform for utility, telecom, video streaming services and more. Boost now includes rent, which can be added along with your other payments.

To use Experian Boost, simply connect your bank accounts or credit cards that you use to pay bills to your Experian account. Boost searches your payment data looking for eligible payments. You’ll verify any payments you want to add, and then sit back and wait for your .

Experian Boost is a first-of-its-kind feature that gives consumers the control to add information to their and potentially raise their score in just minutes. As a completely free feature, Boost makes it easy for consumers to get credit for positive financial habits without extra cost or time commitment.

Are These Services Right For You

Paying a few bucks a month to have your rent payments reported to the credit bureaus may be worth your while, but it may also be a waste of your money. If youve got a good credit history, or even just a couple of loans and a credit card, adding rent payments may not make a big difference. Here are the two situations in which you might want to pay for these services:

Your score is below 650

The studies on the impact of rent payments on credit scores found the biggest changes for renters with subprime credit scores. If your current score is below 650, it might be worth your while to pay for a service like this especially if youre hoping to take out a major loan in the near future.

Youre currently unscorable

Having no credit history is something of a catch-22. You need to have credit to get credit. So, if you dont have enough credit history to have even a low score, adding rent payments could make the difference. Even if your starting score isnt very high, it could be enough of a foundation to work on building a great credit score over time.

Resource:How to Get Your Totally Free Credit Score

Recommended Reading: How To Get Official Credit Report