Ask Your Current Creditor For Better Terms

If you have a revolving credit account with a good payment history, then consider contacting your creditor and asking for better terms, such as a higher credit limit or lower interest rate. Highlight your strong payment history and loyalty as a customer. Some creditors are willing to make accommodations to keep you from looking elsewhere for better terms.

In addition to helping your finances, this can help improve your credit score. For example, getting an increase in your credit limit will automatically reduce your credit utilization rate, as long as you dont start spending more.

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Smart Tips To Improve Your Cibil Score

- Dont be a co-signer for a loan unless you dont need to borrow around the same time

- Avoid acquiring too many debts over a short period of time

- Ensure you repay all your EMIs and credit card bills on time

- Use debt consolidation loans as and when necessary so that your dues arent handed over to a debt collection agency

- Be cautious about borrowing loans without a proper repayment plan in place

- Always negotiate your rate of interest with lenders to keep your costs down

- Dont borrow the entire amount you receive a sanction for

- Choose a shorter loan tenor to repay your loan fast and at a lower interest payment

- Talk to a CA or financial planner to get help on saving taxes and managing your money more efficiently

- If you dont have any credit history, borrow a small personal loan and repay it on time to build a credit score

Now that you know everything about your CIBIL credit score, be smart about your financial practices. Try to keep your CIBIL score high and youll be able to access funds on your terms.

Additional Read:What is CIBIL and what does it have to do with your credit score?

Considering your credit score and financial profile, Bajaj Finserv brings you pre-approved offers for personal loans, home loans, business loans, and other financial products. This simplifies the process of availing of financing and helps you save on time and effort. All you have to do is share a few basic details and check out your pre-approved offer.

*Terms and conditions apply

Also Check: How To See My Credit Score Free

How Fico Credit Scores Are Calculated

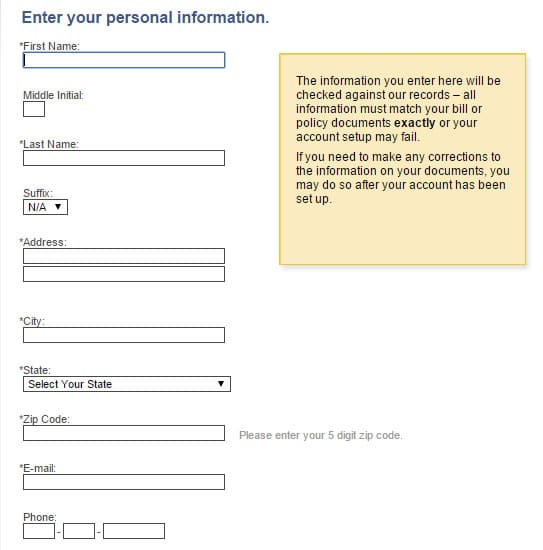

Here is the breakdown of how a credit score is calculated, by myFico:

There are several different ways to calculate a credit score and a bunch of companies that do it a bit differently, and each method has various pros and cons.

Each method also has a range, with the main ones having a 300-850 range. The chart above shows the default way that the general FICO score is calculated, by the FICO company.

Generally speaking, having over 750 puts you in the very top bracket, where youll get access to the best credit cards and the best loan terms, and will have no problems when employers or landlords check your credit.

If you can go further, t0 800+, then youre comfortably in the top tier and roughly at the maximum end of the range.

35% Payment History

This is the single biggest factor: how reliably you pay your bills. By never, ever missing a payment over the course of years, your credit score will start to climb.

This can actually be kind of forgiving. Even if a payment is a few days late by mistake, most companies have a grace period where they wont report you to the credit agencies. You generally have to be quite late in order for it to officially become a late payment. Its best not to take chances though pay all your bills every month like clockwork.

Automate your payments if it helps you. I personally like to sit down in the third week of each month and check every one of my accounts to pay them and keep everything tidy. It takes about ten minutes.

10% Credit Mix

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 776

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

You May Like: Why Is It Important To Check Your Credit Report

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 716 in 20212.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Get A Secured Credit Card

If your credit score is very low or nonexistent, and you dont have any credit cards, then consider getting a secured credit card.

A secured credit card is a low-limit card that a bank can issue to you, that requires you to pay them a security deposit up front. That way, their risk is low and they can afford to give a small credit line to people with low or no credit. Many of the major issuers, like Discover and Capital one, have good offers on secured cards.

Typically, the credit limits are tiny, like $200 or less. Pretty much the only reason secured credit cards exist is to help people build credit. Start making some purchases with the card, and pay it back in full every month. Over time, youll start building a positive credit history. Make sure your other payment types are paid on time as well.

Eventually, when your credit score is higher , ask your issuing bank to convert your account to a normal, unsecured card. This way, you can get a higher limit, get better rewards, and get your security deposit back.

Whatever you do, dont close your secured card, unless for some reason you absolutely cant handle having credit. You want to start building a long-lasting credit account, because average credit age is a big factor for your credit score. So, once your score is up, convert it to a better card.

Also Check: What Is The Highest Credit Score Available

Background Of Credit Score In India

The RBI has licensed four companies to access and manage credit information in India. CIBIL started its activities in 2001 and has since been one of the most popular credit information companies in the country. Others include Equifax, Experian, and High Mark. Each of these organisations has its unique scoring system.

However, one thing that is common between all scores is that if you have no credit history, your score will be -1. Likewise, if you have a credit history that is less than 6 months old, you will receive a credit rating of 0. Apart from this, these credit information companies also provide an in-depth credit report. Your credit report is the basis on which you are given a credit score.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

Also Check: How To Get Hospital Bills Off My Credit Report

Can I Get A Mortgage & Home Loan W/ A 776 Credit Score

Getting a mortgage and home loan with a 776 credit score should be easy. Your current score is in the second highest credit rating category that exists. You shouldn’t have any issues getting a mortgage or a home loan.

The #1 way to get a home loan with a 776 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

How To Improve A 770 Credit Score

Its a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law. They can help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items from your credit report. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

Read Also: How To Get Free Credit Report From Transunion

Shield Your Credit Score From Fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

was the most common form of identity theft , followed by employment or tax-related fraud , phone or utilities fraud , and bank fraud in 2017, according to the FTC.

How To Read Your Credit Report

Your credit reports contain both personal information and financial information. Your credit reports illustrate who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. A credit report is the report card of your credit life and understanding how to read it can help you take control of your credit and be prepared for any of your future credit needs.

You May Like: How To Remove Bad Debt From Credit Report

Getting Mortgages With 776 Credit Score

776 FICO credit score qualifies you for the best mortgage terms available, which can mean saving up to 1% on your mortgage interest overall. Over the course of your loan, this means thousands of dollars in savings. Interest rates should hover around 4%. While improving your credit wont make much of a difference at this point, you can decrease your interest rates further in a variety of ways, such as making your home environmentally friendly or making a larger down payment.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 776 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 776 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

Read Also: What’s A Perfect Credit Score

Mortgage Rates For Very Good Credit Score

If you have a credit score of 776 or higher, you’re eligible for any type of standard mortgage. Here are all the different types of mortgages you can get:

VA loan: If you are a member of the military or a family member of someone who is, you are eligible for a VA home loan. The US Department of Veteran Affairs backs these loans, so you can be sure you’re getting a good deal.

Conventional mortgage: If your credit score is above 620, you should be able to get a mortgage from most lenders. This is because 620 is the minimum score required by the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation . Therefore, if your score is at or above this number, you should not have any trouble securing financing for a home.

Jumbo loan: If your credit score is very good, you may be able to qualify for a jumbo mortgage. Jumbo mortgages are larger than conventional conforming mortgages and exceed the maximum value that Fannie Mae and Freddie Mac will accept when buying mortgages from lenders. Because jumbo mortgages come with a higher risk, lenders will only consider giving you one if your credit score is very good. If you have a good credit score, a jumbo mortgage could be a great option for you.

Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues, you should contact a local attorney regardless of your use of our service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

Recommended Reading: How To Place Fraud Alert On Credit Report