How Public Records Are Added To Credit Reports

Most of the items on your credit reports appear there because a company to which you owe money supplies the credit bureaus with the information.

Your credit card issuer, for example, sends the credit bureaus data each month about how youre managing your account. The reported data will include information like your payment history, your balance, and whether youre currently on time or past due.

If a data furnisher does choose to send information to the credit bureaus, it has to follow the rules set forth in the FCRA. If a credit bureau accepts your data and includes it on your credit reports, those same rules apply.

Public records are different. Theres no data furnisher supplying information to the credit bureaus. A court house doesnt send the credit bureaus information about who has filed bankruptcy.

Rather, the credit bureaus seek out public record information on their own. They accomplish this by using electronic public records services, like Public Access to Court Electronic Records .

Get Copies Of Your Credit Reports For No Cost

Under state and federal law, Equifax, Experian, TransUnion and other, less well-known consumer credit reporting agencies must provide consumers with one copy of the contents of their credit report per year at zero cost. Equifax, Experian, and TransUnion set up the Web site AnnualCreditReport.com to comply with the law. Go to AnnualCreditReport.com and get a copy of each of your three credit reports. You may be offered extra services that cost $15 or so per month, but these are optional and you need not sign-up for anything to see your credit reports.

Review each of your three reports. You mentioned a public record. Look for the public record or public information section in your reports. This is usually found at the bottom of your reports. If any information is incorrect in your report, you can file a dispute with the CRA reporting the error. As mentioned above, these are Equifax, Experian, and TransUnion.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you cant resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Read Also: How To Dispute Student Loans On Your Credit Report

Why Public Records Are Different From Other Credit Report Items

Public records arent added to credit reports in the same way as other types of accounts. With most accounts, such as credit cards or auto loans, your lender sends information to the credit bureaus when you open an account.

From there, your lender updates your payment and balance history with the credit bureaus on a monthly basis. The credit reporting agencies then updates your credit reports each month with the new data.

Its worth noting that the credit reporting process is voluntary. No law makes your creditors report information to the credit bureaus. Likewise, no law forces firms like Experian to add information from a creditor to your report. However, both creditors and credit reporting agencies have to obey the Fair Credit Reporting Act if they choose to include any information on your credit reports.

With public records, however, there is no data furnisher sending information about you to the credit bureaus. The IRS, for example, doesnt send Experian, TransUnion and Equifax a list of everyone who has a tax lien filed against them. Instead, the credit reporting agencies proactively add public record data to credit reports.

Public records, as the name suggests, are available to anyone. By using services like PACER , the credit bureaus can obtain public record information and add it to their databases.

How To Get Started

Get the certainty of a reliable screening solution. Reveal the whole story with a fit2work public record/basic credit check.

Can I use the fit2work platform for more than public record/basic credit checks?

Yes, the fit2work platform offers a single centralised place to order, track and manage more than 100 different background checks. It helps business mitigate and manage risk in a changing human resource environment by providing support across the entire employee lifecycle, from initial hiring through to separation.

With seamless integration into your existing onboarding and due diligence programs, the fit2work platform offers a range of customisable tools to suit your business needs. Its a fast and easy-to-use service that certifies employees are compliant, up to date and fit to work all from a single dashboard.

How reliable are fit2work public record/basic credit checks?

fit2work began processing background checks in 2008 and today we are one of Australias leading providers of online screening services. With years of experience, we are experts in mitigating and managing employment risk. Government departments and corporations around Australia look to us as a respected and trusted source of advice and innovative solutions.

Read Also: Does Care Credit Affect Your Credit Score

Applying For Your Credit Report Whilst In Prison

Experian are able to provide free credit reports to anybody in prison. Citizens Advice caseworkers and others who work with people in prison on issues surrounding unmanageable debt can obtain application forms to obtain free credit reports for people in prison by emailing .

A credit report application form must still include proof of identity. You may be able to use the template contained in PSI 35/2009 as identification.

Dont Miss: How Long Does Negative Information Stay On Chexsystems

Why Were Tax Liens And Civil Judgments Removed From Credit Reports

In 2015 the three major credit reporting companies entered into a settlement with 31 states. The settlement required the companies to adopt tighter standards for some types of credit reporting.

Most information on credit reports is voluntarily submitted by creditors. Public records were sourced through searches conducted through various electronic databases. Some of this information was provided by third-party vendors. The settlement was designed to prevent inaccuracies in this system.

The credit reporting companies initially deleted records of tax liens and civil judgments that did not include a persons name, address, Social Security Number or Date of Birth. They subsequently decided to eliminate all civil judgments and tax liens from credit reports. As of April 2018, all civil judgments and bankruptcies were removed from credit reports.

It is important to note that the Fair Credit Reporting Act does not prohibit the reporting of tax liens or civil judgments. Credit reporting companies may resume reporting them at any time, subject to safeguards to assure accuracy.

You May Like: How To Check Credit Score Chase

Not A Permanent Change

Its crucial to note that tax liens and civil judgments might not stay off credit reports forever. This is because reporting on them isnt illegal and the credit bureaus only promised to remove them for a time. This could change sometime in the future, so you still want to avoid incurring these types of public records if possible.

You May Like: Open Sky Loans

Understanding The Updated Public Record Policy

In 2017, the National Consumer Assistance Plan went into effect and changed how data is collected for civil judgments and tax liens before these entries appear as public records on credit reports. The act was initially launched in 2015 by the three major credit bureaus to modify credit reporting rules and set stricter standards. These new standards would ensure that the data found on credit reports are more accurate and up to date.

There are two primary ways this act affects how credit bureaus obtain and report tax lien and court judgment data on consumer credit reports. First, for either of these types of entries to appear on a credit report, the public record must contain a persons:

- Social Security number or date of birth

This standard applies to both new and existing records that are already on credit reports.

Secondly, public records reported on credit reports must be checked by the credit bureaus for updates every 90 days to ensure their accuracy. If the records are not checked, they should be removed from the credit report.

Bankruptcy records already hold these strict requirements, which is why the changes dont impact this type of public record. However, many tax liens and civil judgments do not uphold these standards, in large part due to different standards of record-keeping at various courthouses.

Read Also: How To Clear Defaults On Your Credit Report

How Can I Get A Free Credit Report

You have a right to a copy of your credit report, as required by The Fair Credit Reporting Act of 1970. The Consumer Financial Protection Bureau is tasked with enforcing the act.

You can request a free annual credit report from all three credit bureaus at annualcreditreport.com, the only government-sanctioned website for free credit reports.

Due to the pandemic, Equifax, Experian and TransUnion are offering free weekly credit reports that will remain available through April 2022.

Public Records Arent Necessarily Gone Forever

Although the credit reporting agencies have agreed to remove certain public records from credit reports for now, that doesnt mean tax liens and judgments wont be added back to credit reports in the future. There are two reasons: Its not illegal to put them on a credit report, and the credit bureaus only agreed to remove them for a time.

You May Like: Which Credit Score Do Lenders Look At

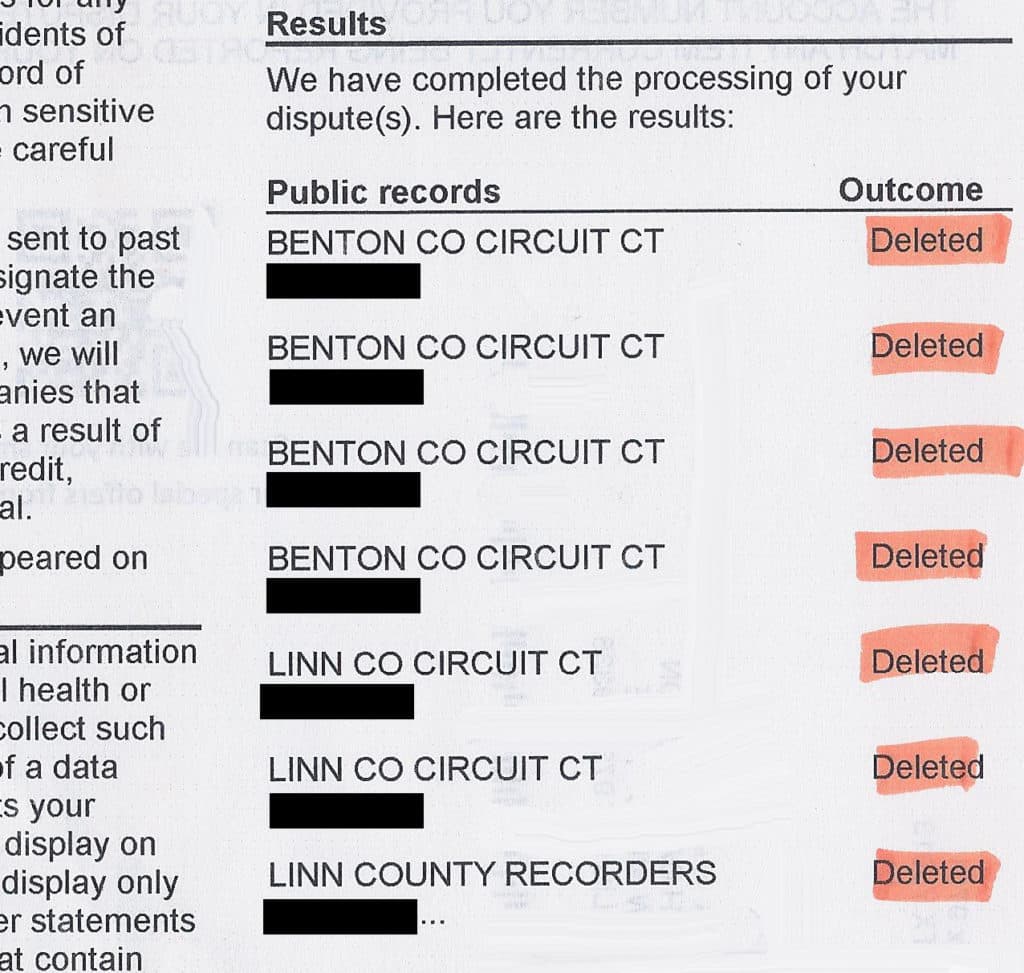

How To Remove A Public Record From The Credit Report

If a public report has crept into your credit report by mistake, then the credit report dispute can be used to get it removed. You can also dispute the error with the court in case the credit bureau doesnt help you and doesnt remove the error. Thus, in case of a wrong public report, you have the support to get it set right but not in the case of a real public report. For a real public record on your credit report, well you cant dispute it as it will not help you. You have to work your way out of it according to the law.

How Much Do Public Records Affect Credit Scores

Bankruptcy can cause a FICO score to drop by 200 points or more. A filing may lower credit scores for seven to 10 years and be difficult to remove from a credit report unless any information is inaccurate.

The decision to exclude other public records slightly increased FICO scores for many consumers and resulted in increases of 20 to 40 points in some cases.

You May Like: How Do You Increase Your Credit Score

How Long Does Information Stay On My Credit Report

Positive credit information, like information about paid accounts with no negative history, may remain on your credit report for up to twenty years. By sharing this information with creditors, lenders see the types of credit you managed successfully in the past and recognize your previous good credit history, even when you have limited or no current credit history.

Adverse credit history, collections and defaulted accounts that were not settled through a debt repayment program , are removed automatically from your credit report after six years from the date the account first went delinquent.

Public records such as judgments and bankruptcies may report on your file for 6 to 10 years depending on the province.

In the case of multiple bankruptcies, each bankruptcy will report for 14 years from the date of discharge.

TransUnion may delete credit information reported about you by a data supplier if our relationship with the data supplier comes to an end. The end of a data supplier relationship may impede our ability to maintain a current and accurate credit file and/or carry out our investigation procedures. We delete credit information in these circumstances to ensure that your credit file remains as accurate, complete and up-to-date as possible.

Read Also: How Do I Unlock My Transunion Credit Report

What Is A Credit Score

A credit score is the score that a credit provider will use to help them decide which customers to lend to. Its broadly based on three sets of information:

- your application form

- your credit report

- any information they have about you already.

Guide credit scores are created by credit reference agencies. Theyre based on the information included in your credit record, and are only available to you. Theyre designed to help you understand how firms might use your credit information to decide whether to offer you credit.

Guide scores only offer a general indication of how likely it is that firms might offer credit to you. Having a high score doesnt guarantee any particular lender will actually offer you credit. This is because each firm uses its own criteria, which might vary depending on which credit product youre applying for.

The information held on your credit report and your credit application form might be used to decide:

- whether to offer you credit

- how much credit youll be offered

- how much interest you would be charged.

The most recent information on your report will have the most impact. This is because lenders will be most interested in your current financial situation.

However, information about your financial transactions over the last six years good or bad will still be on record.

Also Check: Does Closing A Credit Card Hurt Your Credit Score

How To File A Dispute To Remove Public Records From Your Credit Report

You can check your credit report for free and also access personalized tips on how to improve your score here at WalletHub.

How do I remove negative items from my credit report?

You cannot remove a negative items from your credit report unless the information listed is incorrect. If the entry is an error, you can file a dispute with the three major credit bureaus to have it removed, but the information will remain on your report for seven years if it is accurate.read full answer

How To File a Dispute To Remove a negative items From Your Credit Report

If the information is correct and you pay off the outstanding debt, you can then ask the lender via phone or in writing to make a goodwill adjustment, removing the derogatory mark from your credit report. Although the lender is under no legal obligation to do so, goodwill requests are successful in many cases.

Note, the lender may also sell your debt to a collection agency, if it remains unpaid. The agency has the right to pursue further legal action against you.

How do I remove inquiries from my credit report?

How A Public Record Impacts Your Credit Score

If youve filed for bankruptcy, you can expect it to lower your credit score considerablysome financial experts estimate the average credit score plummets by as much as 200 points after a bankruptcy.

Because potential creditors assess your level of risk based on whether you have a good track record of paying your bills, bankruptcy is a huge red flag, as it tells creditors you couldnt keep up with your obligations.

After the initial plunge, however, your credit score will eventually start to recover, albeit slowly in most cases.

Although bankruptcy will stay on your credit report for up to 10 years, the impact will diminish over timeespecially if you focus on raising your score while you wait for the bankruptcy to drop off.

Read Also: How Long Does Delinquency Stay On Credit Report

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Read Also: When Will A Repo Show On Your Credit

Can You Check Someones Credit Without Them Knowing

A: No, you cant check your spouses personal credit reports. Despite the fact that it is illegal to request someone elses credit reports without a legitimate reason for doing so, some individuals have obtained their spouses reports illicitly. Usually they get access to them online.

What is a good credit score 2020?

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750.

Recommended Reading: How To Get A Perfect Credit Score