Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Why Is A Good Credit Score Valuable

Now you know a little about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit card or loan applications, but their influence goes beyond that.;

Good scores can affect interest rates, credit limits, housing applications and even job prospects. And they can offer more options, more bargaining power and more financial flexibility.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit card offers if you have a good score. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how credit inquiries can affect your credit.

Interest Rates and Credit Limits

If youâre approved for a loan or a credit card, a good credit score could mean higher credit limits, lower interest rates or both. And when youâre paying less in interest, you may have smaller payments and be able to pay off your debt faster.;In general, that means that higher credit scores could decrease the cost of borrowing money.

Beyond Credit Cards and Loans

Finally, good credit scores could affect other parts of your life, too:

The Biggest Credit Score Myths

Like any industry, credit and lending is always changing. As the economy fluctuates up and down and federal regulations change to provide new guidelines and protections for consumers, it’s no surprise that credit card issuers change the qualifications for their financial services and products. You’ve probably heard a lot of credit card myths from people who’ve been in the game for a long time. But the truth is you shouldn’t always listen to them.

Below, we outline some of the most persistent credit card myths and explain exactly what’s true for today’s credit card user.

- Myth 1: You should never close your oldest credit card

- Myth 2: You need a perfect credit score

- Myth 3:;Carrying a balance helps your credit score

- Myth 4:;Checking your credit score will lower it

Recommended Reading: 524 Credit Score

Why Do Credit Scores Start At 300

Sometimes, industries adopt a standard because of habit even though it might be difficult for individuals to understand. Fair Isaac and Company built the flagship FICO score, which utilized this range, to help lenders improve risk underwriting.Their product dominated the market, so the 300 to 850 became the lender standard. The strange scaling range became a problem later when consumer interest grew, but it was too late to change by then.Similarly, the US uses the Fahrenheit scale because of habit even though the Celsius is much easier for people to grasp. When you grow up thinking in Fahrenheit, it is hard to transition.

Search the Site

What’s A Good Credit Score

With the 300 850 credit scoring range in mind, what’s a good credit score? A higher score shows that you have better creditworthiness. Therefore, a credit score of 700 or above is considered good, while a credit score of 800 or above is considered excellent. Similarly, a credit score below 670 is generally considered bad.

Credit checks that landlords do when renting apartments tend to be a little different from other types credit checks. Read how.

myFICO

A good credit score is important for your financial reputation and can also save you money. For example, you can obtain favorable terms when borrowing money from a bank, purchasing an insurance policy, or buying a house if you have a good credit score.

Read Also: Does Speedy Cash Report To Credit Bureaus

Howis Your Starting Credit Score Calculated

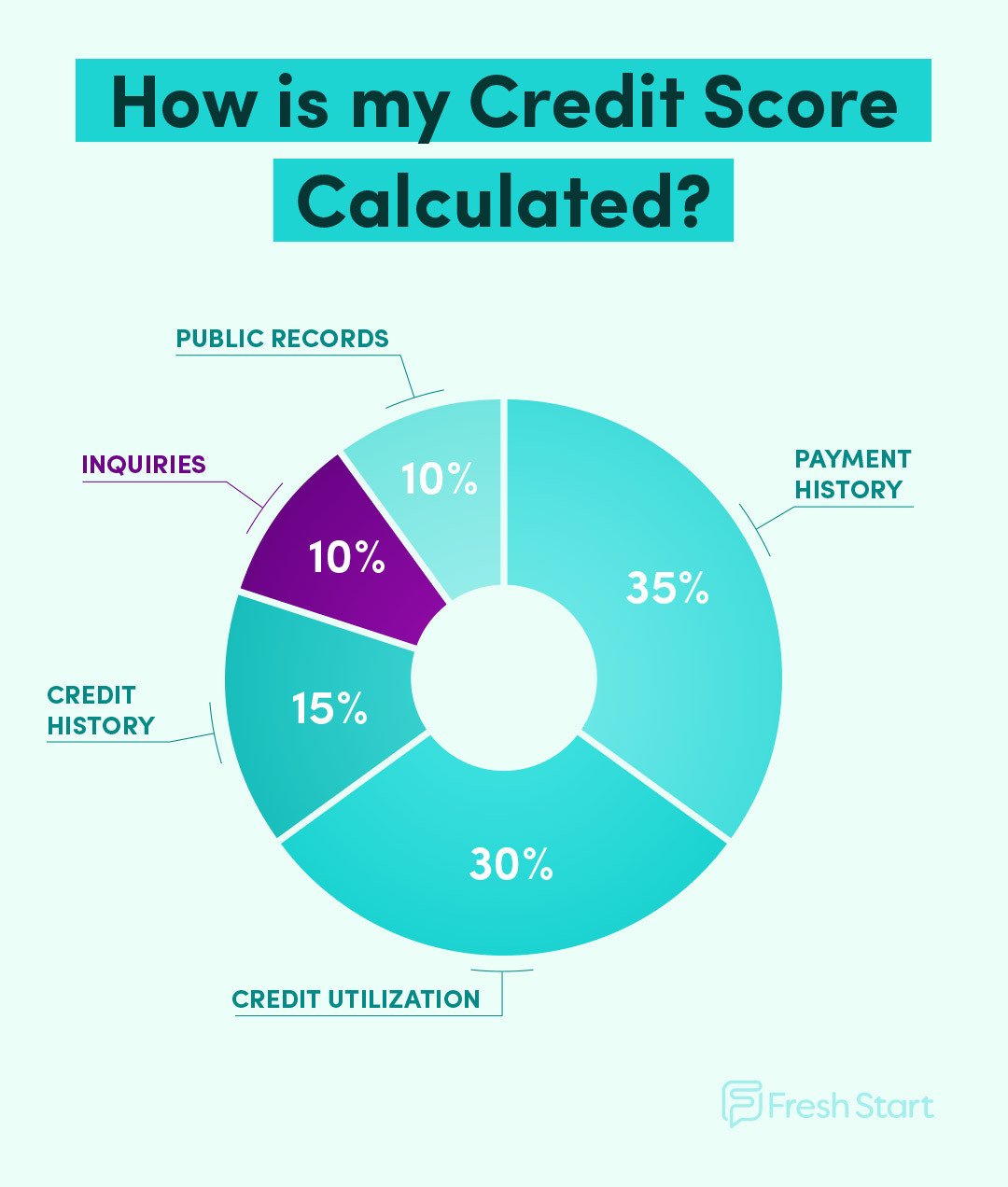

Credit scores are calculated using information from your credit reports. This information is summarized into a three-digit score that lenders can use to determine your financial trustworthiness. When talking about credit scores and credit utilization, youll be referring specifically to your FICO score the vast majority of the time.

FICO scores are compiled from five main data points:

- Another10% of your credit score is calculated based on your credit mix. Thisincorporates the different types of credit accounts you have in your records,such as credit cards, mortgages, student loans, installment loans and more. Typically,this isnt a key part of determining your credit score but is used as a way topaint a picture of your overall credit history.

- Length of History 15%: A largerchunk of your credit score is calculated based on the length of your credithistory. This looks at the age of all your credit accounts and how long theyvebeen active. In general, people with a longer credit history will have a higherscore.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

What Makes Up Your Fico Score

There are five categories of information that are used to calculate your FICO® Score, each with its own weight in the formula. So, what does your credit score start at? Well, it will depend on how you do in each category.

Payment history: Approximately 35% of your score comes from your payment history. The number one thing lenders want to know is whether youll pay your bills on time, so this category is the primary factor if you want to know what does your credit score start at? Late payments or other irresponsible behavior can quickly tank your score, so make all your payments on time every month.

Amounts owed: Up to 30% of your FICO® Score will be based on your amounts owed. This is measured, in part, through your , which looks at how much debt you have versus your available credit. Make sure your credit card, and other revolving account balances, are at a low percentage of your credit limits. Paying down your loan balances also boosts this part of your score.

The length of your credit history counts for 15% of your score and includes several time-related types of information. The age of your oldest credit account, the average age of all of your accounts, and the age of each of your individual accounts are all considered. The general rule is that older is better, so when asking What does your credit score start at? keep in mind that your limited credit history will play a role in your initial score.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Can I Get A Credit Card With A 524 Credit Score

When Is My First Credit Score Created

Your credit score wont just randomly appear once youre old enough to apply for credit. You have to actually have a line of credit in your name to start generating a score. Once youve opened a line of credit typically your first credit card your credit score will begin to be calculated. This usually happens within six months.

Contrary to popular belief, your credit score doesnt start at zero. The lowest scores start at around 300, but its unlikely that youll start this low, either. The main factor that could negatively impact your credit score when youre first establishing credit is the length of your credit history, which will likely be very short. But fear not after a few years of smart money management, you could be on your way to a good or even excellent credit score.

What Affects Your First Credit Score

When someone is building their credit, there are a few situations that might determine what their credit score will be its important to make sure you understand certain situations when you are looking at applicants with fresh credit scores.;;

1: Short History and Few Accounts

If someone only has one account open, that means they have a short history to pull data from. This means they will most likely have a relatively low credit score. Even if they have been making payments on time and have no negative behavior, they may pull a mid-range score because there is insufficient data to project a higher number. Essentially, there is uncertainty someone will keep paying on time when there has only been a short amount of time to analyze their behavior.

2: Short History and Poor Payments

If someone starts their credit history with missed payments or other negative factors, they can start with an extremely low score. With a short history and missed payments, the forecast of how that consumer will behave moving forward is considered negative.

3: Young Age and High Credit Score

Read Also: Does Paypal Credit Report To Credit Bureaus

If You Are Approved You’ll Get Less Favorable Loan Terms

If you’re approved for credit, odds are you’ll receive less favorable terms, such as high;interest rates;or annual fees, compared to applicants with good credit. For example, one of Select’s;best credit cards for bad credit, the;OpenSky® Secured Visa® Credit Card, has a $35 annual fee; though there are no annual fee options.

See;our methodology, terms apply.

Dont Try To Overdo It

Building credit is a marathon, not a 100-yard dash. While some actions can positively impact your credit quickly, as a young person youre unlikely to have a super robust credit history in just a few months.

Take your time and dont try to engage in every credit-building tactic at once. You certainly dont want to max out your debt in an effort to build credit. That could leave you unable to make your payments, which tanks your credit score before you have time to really build it.

Also Check: Aragon Collection Agency

The Best Ways To Establish Credit

If the question What does your credit score start at? is at the top of your mind, here are some suggestions that can help you establish a strong FICO® Score and set you on the path to excellent credit:

- A secured credit card can be a great way to establish credit. Secured cards work just like regular credit cards and report your payment record to the three credit bureaus, but they do require a refundable security deposit. I used a secured credit card to help establish my own credit, and highly recommend this route.

- Alternatively, being added as an authorized user to a parent or guardians account can help you establish a FICO® Score. Just be sure the person who adds you uses their card responsibly — otherwise, it could have the opposite effect.

- Pay your card in full and before the due date every month. If you absolutely must carry a balance, be sure to make at least the minimum required payment to keep your account in good standing.

- Keep your credit card debt balances below 30% of your available credit. Experts generally agree that credit utilization above 30% can hurt your credit score.

- Apply for new credit sparingly. A flurry of new credit accounts and applications all at once can be a big negative for your score, especially if you have a limited credit history.

How To Check Your Credit Score For Free

Once you understand how your credit score is calculated, you should check your score. This will give you insight into what products you may qualify for and what interest rates to expect. If you have a low score, you can take steps to improve it. If you have a good or excellent score, you can work to maintain it.

Checking your credit score doesn’t hurt your credit, and even if you’re not applying for a new card or a loan, it’s smart to get into the habit of checking it regularly.;

Most credit card issuers provide free credit score access to their cardholders, making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.;

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access even if you don’t have a credit card yet:

- Chase Credit Journey: Free VantageScore from TransUnion

- Discover Credit Scorecard: Free FICO Score from Experian

Recommended Reading: 779 Credit Score

Whats Considered A Good Credit Score

Most major credit score models range from 300 to 850, with the highest number representing the strongest score. However, credit companies such as FICO or VantageScore dont officially decide what constitutes a good or bad score. This is all up to lenders. Theyll use your credit score to determine a variety of things, including:

- The interest rate theyll charge for a loan

- The discount they may offer on an insurance policy

- Whether to approve credit and how much to approve

- Whether to increase or decrease credit limit

- Whether to close a risky account

So what do lenders consider a good or bad credit score? Every credit score model uses a slightly different scoring system. For this example, well use the FICO score system of 300850, as its very commonly used.

- 300599: bad credit

- 700749: good credit

- 750850: excellent credit

Remember that the system is relative. What one lender may consider an unacceptable score, another may accept. For example, most mortgages require a minimum credit score of 620 or even as low as 500 for an FHA or bad credit loan. But if youre applying for a low-interest credit card, lenders may not accept anything below a 700.

You’ll Have Limited Credit Card Choices

Bad credit limits which credit cards you can qualify for; the options you have will be primarily;secured cards. While a secured card, such as the;Capital One® Secured Mastercard®, can help you rebuild credit, you’re required to make a security deposit typically $200 in order to receive an equivalent line of credit.

Even if your credit score falls within the bad range, it’s not a guarantee you’ll be approved for a credit card requiring bad credit, as card issuers consider more than just your credit score.

If you have a less-than-stellar credit score, you should take action as soon as possible, so you can work toward;good credit;and increase your odds of being approved for financial products like credit cards and loans.;

Don’t Miss: What Credit Report Does Comenity Bank Pull

Get A Starter Credit Card

For those who want to know how to start credit building without someone else, a secured credit card might be a good place to start. Some credit card companies also offer unsecured credit cards for those with no credit. These tend to have low credit limits and may have high interest rates.

If you cant find an unsecured credit card, though, a secured card is much easier to get in general. You have to secure it with a deposittypically in the amount of the credit limit. For example, if you put down a $250 security deposit, your initial credit limit is $250.

You build credit by using the card and paying the bill on time each month. Make sure you opt for a credit card that reports to all three of the bureaus to maximize the benefits to your credit history. Usually after a certain number of timely payments, you get your security deposit back and may even be eligible for an increase in credit limit.;

Two options you might consider are the OpenSky Secured Visa and UNITY Visa Secured card.

OpenSky® Secured Visa® Credit Card

Rates and FeesSnapshot of Card Features

Card Details +