Does Amex Platinum Have To Be Paid In Full Each Month

The Platinum Card® from American Express was introduced as a charge card, meaning your balance was due in full every month. However, cardholders can now carry a balance on certain purchases with American Expresss Pay Over Time feature, which allows the card to function more like a traditional credit card.

How Many Authorized Users Can Be On A Credit Card

The number of authorized users that can be added on a credit card varies by issuer and card. For example, American Express allows four authorized users to be added to the American Express Everyday Preferred card. Chase allows up to 99 authorized users on an account for its business cards.

If no Social Security number is linked to an authorized user, the bank may not send over payment information to the credit bureaus.

Some Credit Cards For Bad Credit

Some credit card issuers take advantage of people with bad credit by offering them credit cards that charge outrageous fees and interest and dont help them build credit.

In general, try to avoid credit cards that charge fees to process your application or open your account. Also, stay away from cards that charge APRs higher than 30%.

Finally, double check with a credit card issuer before you apply to make sure it reports your account activity to all three credit bureaus. Most issuers that do will list that on their website. But dont be afraid to call if you cant find it anywhere.

Donât Miss: How To Get Credit Report With Itin Number

Don’t Miss: Will Paying Off Closed Accounts Help Credit Score

File A Request Online Via Your American Express Online Account

To begin, you need to log in to your account via the American Express website. The next step is to choose the card for which you want an increase. Navigate to “Account Services” and then to “Card Management.” This is where you will see the “Increase Your Credit Limit” option.

When you move past this stage, Amex asks you for your desired credit limit and your annual income . Once you submit your request, you might find out Amexs decision right away, or you might have to wait for a few days.

Use your American Express credit card regularly and responsibly because Amex might reject your request if you dont use your card often enough.

Would You Please Review Us

A review would mean a lot to us and takes less than 20 seconds. Let us know what you think. Thanks!

Advertising Disclosure

Some of our articles feature links to our partners, who compensate us when you click them. This may affect the products and services that we showcase in our articles and how we place and order them. It does not affect our evaluations of them, which our writers and editors create independently, without considering our relationships with our partners.

Editorial Standards

We promise to always deliver the best financial advice that we can. Thats our first priority, and we take it seriously.

To ensure that our articles and reviews are objective and unbiased, our writers and editors operate independently from our advertisers and affiliates. Our writers do not take FinanceJars relationship with its affiliates into consideration when writing their reviews and articles.

Everything we publish is as accurate and as complete as we can make it. All of our articles undergo several rounds of fact-checking before we publish them, and we do our best to keep them as no-nonsense and jargon-free as possible while still delivering the information that you need.

We know that taking financial advice from us requires a lot of trust on your part. Were grateful for that trust, and we wont abuse it.

How We Make Money

FinanceJar partners with other companies in the credit and finance industry, such as credit card issuers and credit repair companies.

Recommended Reading: Does Pre Approval Affect Credit Score

Sue Patterson Wallethub Analyst

@sweetsue11/27/20 This answer was first published on 11/27/20. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

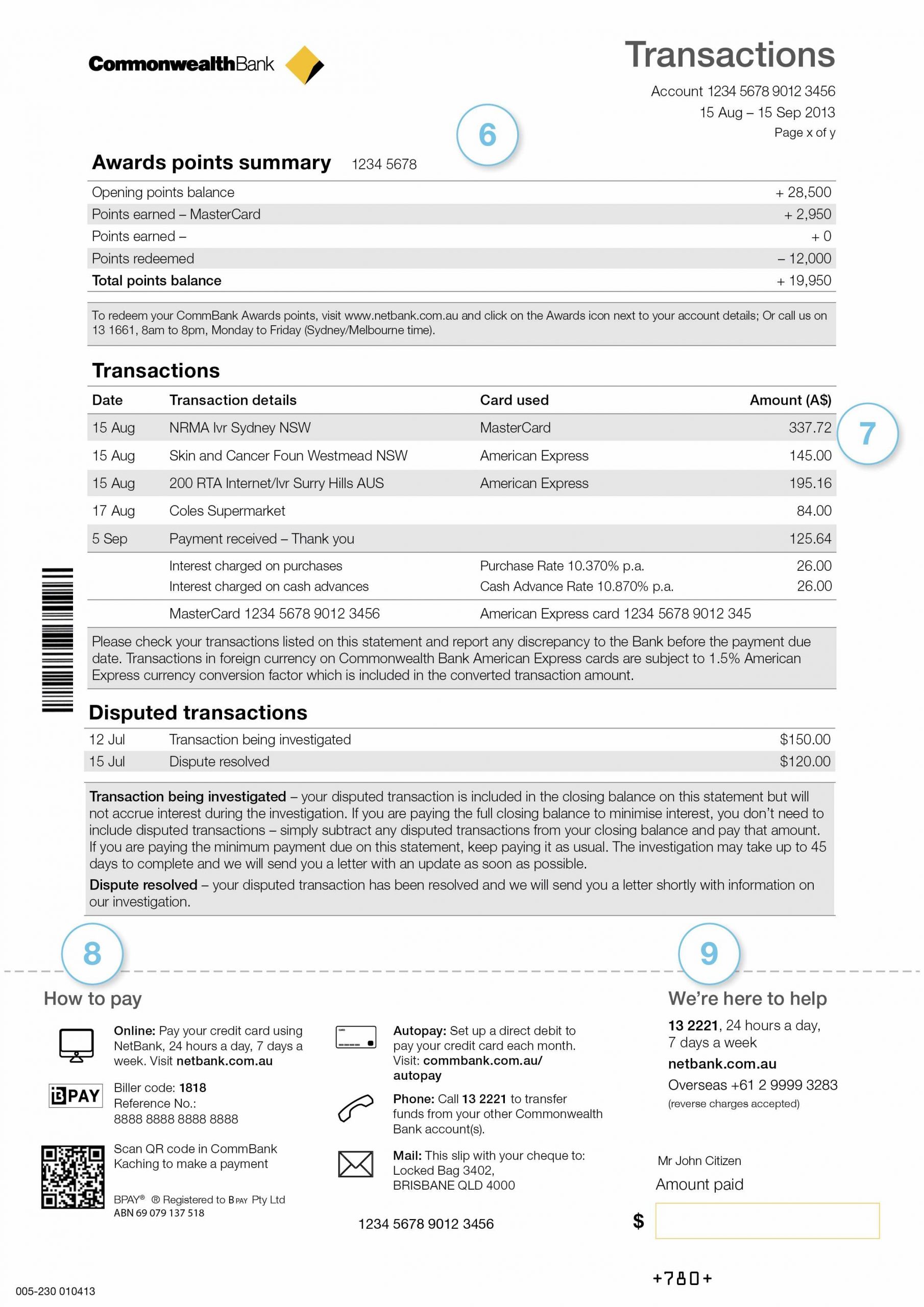

American Express reports to credit bureaus once per month, typically updating Experian, Equifax, and TransUnion within 5 days of a cards billing cycle ending. Since Amex billing cycles are usually based on the opening date of cardholders accounts, there is no set day on which American Express reports to credit bureaus.

For example, if someone opened an Amex credit card account on the 21st of October, then the end of the first billing cycle would fall around the 21st of November, one month after the opening date. In that case, Amex would report to the credit agencies sometime before the 26th.

Given that credit reporting happens on a different day for each Amex cardholder, its important to know when the end of your billing cycle and subsequent due date will be. If you just got a new Amex card, keep in mind that it might take one or two billing cycles for the new card to appear on a credit report. So, dont worry if your American Express credit card doesnt show up right away.

When do credit bureaus update?

Since credit scores are a direct result of the information on your credit report, they’re also updated when the new data is in the system.

Best Business Credit Cards That Dont Report To Personal Credit For 2021

Jordan is a financial analyst with over two years of experience in the mortgage industry. He brings his expertise to Fit Small Businesss and bank account content.

This article is part of a larger series on Best Small Business Credit Cards.

Editors note: This is a recurring post with regularly updated card details.

Business credit cards issued by banks that dont report card activity to your personal credit wont impact your personal credit score. You can use these cards as you normally would to earn introductory rewards, access cheap financing, and keep your business expenses separated. While all the cards listed in this article still require a personal credit check and personal guarantee, your personal credit score wont be damaged by ongoing business activity.

The best business credit cards that dont report to personal credit are:

- Wells Fargo Business Platinum Credit Card: Best overall for earning rewards and accessing an introductory 0% annual percentage rate period

- Wells Fargo Business Secured Credit Card: Best for boosting poor business credit scores

Don’t Miss: What’s My Business Credit Score

Amex Blue Business Plus Vs Chase Ink Business Unlimited Credit Card

The Chase Ink Business Unlimited® credit card has a very generous welcome bonus: New cardholders can earn $750 bonus cash back after they spend $7,500 in the first three months of card membership. The Ink Business Unlimited offers 1.5% cash back on all purchases.

While you can earn a better rewards rate with the Blue Business Plus, the Chase Ink Business Unlimited has a better welcome bonus. Its worth doing to the math to see which one will help earn you more rewards. Lets say you spend $50,000 in the first year of card membership. Including the current welcome offers, you will earn the following rewards:

Amex Blue Business Plus: 115,000 Membership Rewards points

Ink Business Unlimited Credit Card: $1,500 in cash back

The overall value tilt goes to the Amex Blue Business Plus depending on how you redeem your rewards. However, if you dont want to hassle with points values, there is nothing wrong with choosing a cash-back card.

The Chase Ink Business Unlimited has similar benefits to the Blue Business Plus, including rental car insurance and free employee cards. So while both of these cards deliver great value, the Chase Ink wins the welcome offer battle, while the Amex Blue Business Plus may deliver better value over the long run.

About American Express Credit Guide

What information can I find on MyCredit Guide?

MyCredit Guide provides your VantageScore® credit score by TransUnion®, refreshed weekly upon login. MyCredit Guide also includes a range of information and tools to help you understand your credit score better and plan for the future. Some of the features include:

- Score Factors impacting your score

- Up to 12 months of score history

- Detailed TransUnion credit report

- Email alerts about critical changes to your TransUnion credit report information to help you identify potential fraud

- Score simulator to help you assess the possible impact of financial choices before you make them

How often is the credit score in MyCredit Guide updated?

Your VantageScore credit score is updated weekly, upon login.

What are the Score Factors impacting my VantageScore credit score?

The Score Factors impacting your VantageScore credit score tell you what information from your TransUnion credit report is impacting the calculation of your score. These are some key factors that could affect your credit score:

- Your history of making payments on time

- How old your credit accounts are

- How much credit you are using

- Recent inquiries for credit

- Recently opened new credit or loan accounts

- How much credit you have available

What is the Credit Score Simulator?

Please note the results of Credit Score Simulator are estimated and dont necessarily show the exact results a given behavior will have on your score.

How accurate is the Credit Score Simulator?

Don’t Miss: What Is A Good Credit Score For A Mortgage

American Express Credit Cards With Authorized Users

| Card name |

|---|

|

Which American Express card is the best for adding an authorized user?

The Amex Platinum Card is undoubtedly the best card for adding authorized users because authorized users get to use the cards perks.

One would think the Amex Gold card is also one of the best cards for authorized users, but unfortunately, they wont get to use any additional perks.

Re: Amex Business Card Reports To Business Credit Reports

wrote:

I was for some reason under the impression that American Express didnt report their business cards to the business credit bureau unless you default or something.

I know they dont report to personal credit reports, which is great, but for some reason I had it in my head that my Chase Ink card reports to my business reports, but my AMEX SimplyCash does not and remember being kinda bummed about that

I just got my busienss credit report and the AMEX card is being reported on thereany idea what is going on with that? Or was I just totally mis-remembering from the time when I originally got the card, or maybe some bad info?

Amex reports to business bureaus but NOT personal reports unless you default. It is a business card going to help build your business credit so what is the problem? Dont you want it reporting to business?

Well I just though they didnt report at all unless you default. Thought it might be a new thing they are doing or something. Who said there is a problem? Im saying this is a good thing! Definitely want all that good history reporting!

I thought you didnt want it to report to the business report thats why I asked what the problem was

You May Like: How Can You Get A Credit Report

When Does A Late Credit Card Payment Show Up On Credit Reports

Reading time: 2 minutes

Highlights:

- Even a single late or missed payment may impact credit reports and credit scores

- Late payments generally wont end up on your credit reports for at least 30 days after you miss the payment

- Late fees may quickly be applied after the payment due date

If you are facing financial hardship because of a job loss or furlough, and having trouble paying credit card bills on time or if you just missed the due date by accident you may want to know when a late payment will appear on your credit reports, and if there is any kind of grace period.

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally wont end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

If youre only a few days or a couple of weeks late on the payment, and you make the full late payment before that 30 days is up, lenders and creditors may not report it to the credit bureaus as a late payment. Keep in mind, if you arent able to make the full payment, and only make a partial payment, it generally will be reported as late.

Heres how the process generally works:

On the account closing date, your statement or bill is generated.

A third date is the reporting date, which is usually the date your account information is reported to the nationwide .

What Are Charge Cards Used For

Charge cards can be used for both everyday spending and making big-ticket purchases, such as electronics, appliances and jewelry. Depending on your creditworthiness, spending patterns, payment history and financial resources, this might mean a spending limit that’s double or triple that of a traditional credit card.

As a general rule, cardmembers tend to have few issues when using their charge cards for predictable, everyday spending. But to avoid your card being declined, there are ways to double check that your card will be approved for big purchases, trips or business expenses ahead of time. This will save you the hassle and help you plan accordingly.

If you’re unsure if a purchase will be approved on your charge card, consider calling or messaging your card issuer to inquire about the size of that expense. And if you have an Amex card, there’s a tool available online or via the Amex app that allows you to check your purchasing power.

Also Check: How To Remove Old Student Loans From Credit Report

What Our Research Means For You

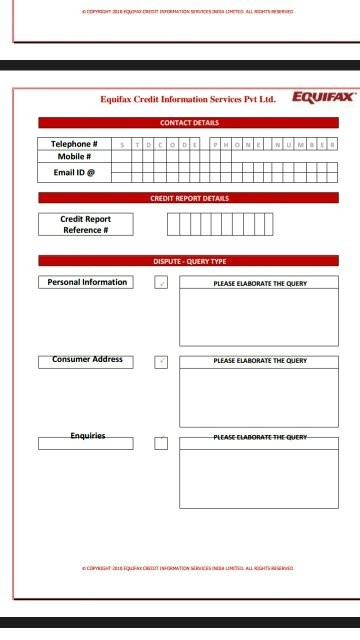

The goal of this article is to help you identify the credit report that is most likely to affect your chances of getting a credit card from American Express. Given that Experian is used for almost every American Express application, that is the report you should focus on.

Ideally, anything you do to improve your score with one bureau will improve it at all three. However, focusing on one, especially if there are errors, can make things easier.

How To Apply For An American Express Business Credit Card

Once you determine which of the American Express small business credit cards you want to apply for, youll start the application process online. Be ready to provide:

- Your companys legal business name, business address, and phone number

- Type of industry your business is in

- Company structure

- Number of years your company has been in business

- Number of employees

- Federal Tax ID, or Social Security number

Don’t Miss: How To Get A Credit Report From Credit Karma

When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

How We Evaluated Business Credit Cards That Dont Report To Personal Credit

When deciding on the best options for this list, we considered business credit cards that dont report ongoing activity to your personal credit as the most important feature. Although these cards protect your personal credit scores, its also important to consider cards that offer the most benefit for your business. So, we also reviewed cards with great rewards, card perks, and low fees that also help you build business credit.

Read Also: How To Get Your Free Credit Report From Experian

Also Check: Is 684 A Good Credit Score

Understanding The Fine Print

Understanding the fees and charges associated with the American Express Hilton Honors Business Card will give you a better idea if getting it is worth it or not.

- Card Feature

- Rewards Rate on Online Shopping3x

- Rewards Rate on TV, Phone, Internet Services6x

- Rewards Rate on Air Travel6x

Show more

-

Regular APR

This card charges a high variable APR of 15.74%24.74%, making it unsuitable to carry a balance every month as youll accrue high interest charges.

-

Annual Fee

The annual fee of this card is $95, which may be worth paying depending on how you use its rewards program.

-

Cash Advance Fee

On every cash advance, youll pay either $5 or 3% of the total amount, whichever is greater.

You can find this information on your credit card issuers website, mobile app or the maintained by the Consumer Financial Protection Bureau.