What Is A Credit Score

A credit score is a number between 300 and 850 that is used to represent a persons creditworthiness. Typically, the higher the score, the better your chances of qualifying for a loan at a good interest rate.

Your credit report shows specific information about your loans and credit cards, which influences your credit score. Youre able to see both your full credit report and score with Rocket Homes®.

Why Do Landlords Run Credit Checks

Finn Simpson, from Belle Property in Dee Why, said credit checks empower property managers to make the best decisions for their landlords.

A poor credit check likely signifies that the tenant is not good at keeping financial commitments. If this is the case, wed rather not appoint them as tenants, as it may mean the landlord will be out of pocket, plus its a headache for the agent to keep chasing money from the tenant, he said.

Diane Bukowski, managing director of eezirent, an online tool for self-managing landlords, said searching national tenancy databases is the most important piece of risk minimisation a landlord can do.

Its not difficult for a person who is blacklisted or has other financial issues in their past to conceal this on the standard rental application, she said.

Relying on your gut instinct wont count for much when the rent is unpaid and the property is damaged things a landlord might have learned at the application stage.

A Spouse’s Credit Report

Although a married couple might have joint accounts, their credit scores remain separate. If you have joint accounts, you’re equally responsible for debts. Unless your spouse is applying for the auto loan as a joint borrower or co-borrower on the loan, the dealer won’t need to check her credit. When you apply together for an auto loan, both incomes are taken into consideration. If one spouse has better credit than the other, a joint application could result in a higher interest rate than if the spouse with the higher score applied alone.

Recommended Reading: Hutton Chase Reports To Credit Bureaus

But When It Comes To Your Future As A Tenant Its Always Best To Be Prepared For What To Expect When It Comes To Your Rental History

Just what is rental history? Its essentially information on your past rental arrangements, which includes the likes of former addresses, late rent payments and evictions, as well as criminal history, your credit score and other data to help a landlord judge whether or not youre a good fit as a tenant.

And thats the value of pulling a rental history report yourself well before you apply for residency in that dream apartment complex youve been eyeing. After all, your would-be landlord will certainly be pulling your rental history report to judge your liability as a tenant wouldnt you rather be prepared for the information it reveals now rather than when your landlord sees it? That way, not only can you see for yourself if there are any negative items on your report, but you can also take measures to have certain ones removed.

Yes, a rental history report is key. Essentially, it is to renting what your credit score is to getting financing for a loan. If your rental report is positive, youll likely be approved no problem for your apartment lease. But if there are a lot of negative marks on your report, your application may be denied.

This all circles back to the question at hand how to find your rental history.

Heres a closer look:

How do Apartments Check Rental History?

How Can I Find My Rental History?

I Pulled My Report and Theres a Lot of Negatives on it What Can I Do?

Next Post

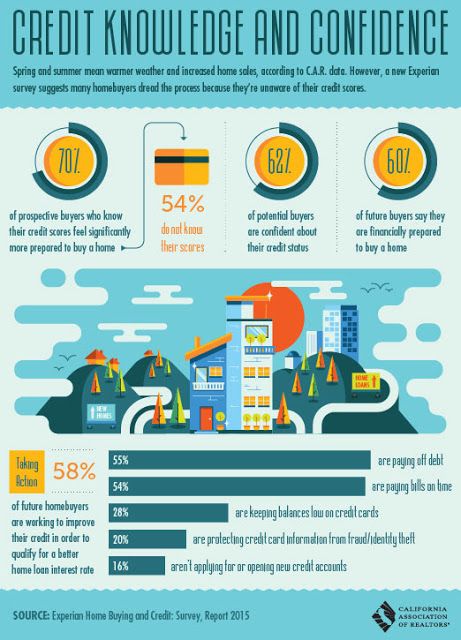

How Does Credit Score Affect Your Interest Rate

The interest rate you receive on a home loan is largely tied to your credit score. Generally, borrowers with higher scores qualify for lower mortgage rates, which can save them thousands of dollars over the life of a mortgage. Its a good idea to compare how varying .

Every lender will have a different formula for setting your interest rate, but even a small difference on your credit score can help you save substantially. For example, bumping your score from 660 to 700 may help you shave $61 off your monthly payment on a $300,000 mortgage. Thats a difference of $21,960 over a 30-year mortgage term.

Recommended Reading: Does Paypal Report To The Credit Bureau

Not Budgeting For Expenses Youll Incur After Purchasing A Home

Buying a home is a huge expense by itself but the costs dont end there. Homebuyers should set aside money not only for common housing expenses, such as utilities, but also for possible repairs and upgrades that come with owning a home. Youll also have to pay property taxes, and, depending on your housing type, you may incur homeowners or condo association fees.

Homebuying is a complex process with a lot of room for error, but keeping an eye on these common mistakes can help you get through the process with as few hiccups as possible.

You Can Get A Free Credit Report In A Few Other Situations Too

Under the FCRA, you’re also entitled to a free credit report if youve been turned down for a product or service based on information in your credit report , youre unemployed and you plan to look for a job soon, you receive welfare or government assistance, or youve been a victim of fraud or identity theft.

In these situations, you will only receive a free copy of the credit report that was used in that specific credit decision.

Recommended Reading: Credit Score With Itin Number

What Is A Soft Pull

A soft inquiry, on the other hand, does not appear on your credit report and does not affect your score at all. Soft pulls generally occur when you check your credit score or you give someone like a potential employer permission to review your credit report. Generally speaking, a soft pull wont result in someone receiving your full credit profile and score. Instead, he or she might get an estimated score based on the information requested or may get limited information pertaining to just one area of your report.

These credit checks are not tied directly to a credit application of any kind, which is why they arent recorded in your report and do not affect your credit score.

What Do Underwriters Look On Credit Report Besides Credit Scores

This Article Is About What Do Underwriters Look On Credit Report Besides Credit Scores

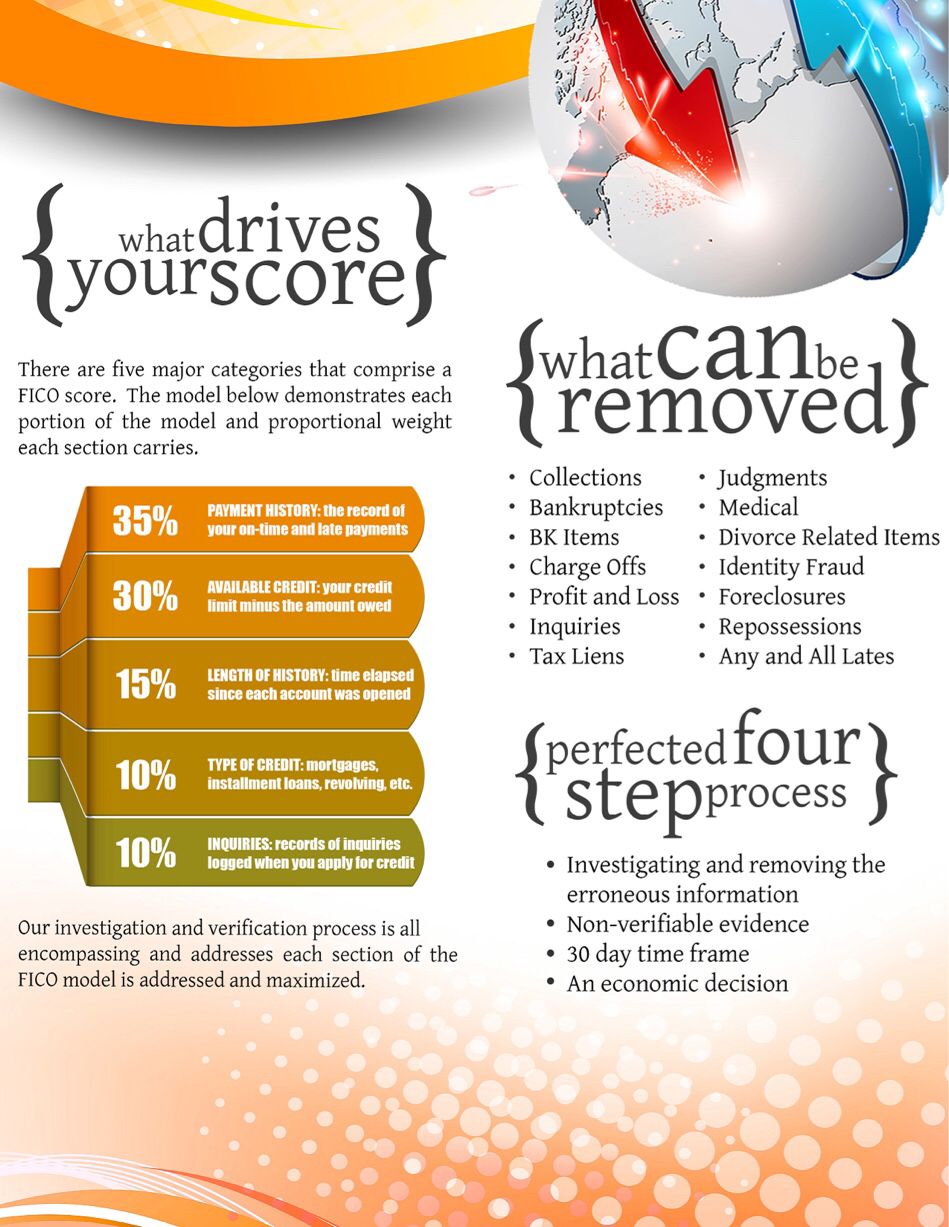

is the biggest factor in determining mortgage rates. Credit scores also determines whether or not borrowers qualify for certain mortgage loan programs. However, just meeting the minimum credit score requirement is not a ticket to mortgage approval.

Below Are Things What Do Underwriters Look On Credit Report?

- Look at qualified income

- The borrowers ability to repay the new mortgage payment

- Is the employment and income likely to continue for the next three years

- The borrowers overall payment history with special emphasis with payment history in the past 12 to 24 months

- Outstanding Collections/Charged Off Accounts and rebuilt and reestablished credit after period of derogatory credit period

- Overall payment history

- Periods of derogatory credit

- If the borrower has a prior bankruptcy and/or foreclosure, has the borrower rebuilt and reestablished their credit

- Late payments after bankruptcy and/or foreclosure

- Reserves and compensating factors

Recommended Reading: Shopify Capital Eligibility Review Changed

How Does My Credit Affect My Ability To Get A Mortgage

Your credit score is one of the many factors that determine if you qualify to get a mortgage and at what interest rates. Lenders look at your credit score, income, debt levels and several other factors when theyre deciding if they will lend you money.

Its important to understand your credit score and the factors that influence it as you start searching for a home. This will help you understand what you might qualify for and give you time to improve your credit before applying for a mortgage if you need to.

Selling Agent And Credit Report Uses

Selling agents do not need the credit reports of the listing parties. Like buying agents, selling agents also need information from a lender. Some buyers may try to begin with a prequalification, which provides an estimate of buying power but may not require the purchaser to create a hard credit inquiry.

It is the selling agents job to know the difference between a prequalification and a full mortgage pre approval, which means the purchasers credit report, as well as assets, have been vetted by a lender.

You May Like: Opensky Locked Account

How Do Hard Pulls Affect Your Credit Score

Hard pulls on your credit report signal that you are looking to open a line of credit. The more inquiries you have in a short period of time, the more creditors might assume you are in financial distress and therefore at a higher risk for delinquencies. Both the FICO and VantageScore credit scoring models factor in recent credit behavior, including new inquiries. This can affect your score in two ways.

When you apply for a new account, you may notice a slight dip in your score because of the hard pull. This is almost always temporary and should only affect your score by a few points at most. However, if you have opened a lot of new credit accounts recently, that could potentially affect your score longer term. Hard inquiries can stay on your credit report for up to two years, which means thats how long they can potentially affect your score. Hard pulls also factor into your Chase 5/24eligibility.

Related: What is a good credit score?

You Have The Right To A Timely Credit Report

Certain negative information can only remain on your credit report for a certain length of time. For most negative accounts, that time limit is seven years. But, bankruptcy can stay on your credit report for up to 10 years depending on the type of bankruptcy you file. If negative information remains on your credit report after the time limit, you can use a credit report dispute to remove it.

Read Also: Comenity Bank Credit Score

Monitor Your Credit Reports

Each year, youre entitled to one free credit report from each of the Big Three credit bureaus Experian, Equifax, and Transunion. And in light of the pandemic, you can view your report for free weekly through April 2021. It can pay off big time to get those reports and read them carefully, according to Karra Kingston, a New York bankruptcy lawyer. Why? Because even credit bureaus make mistakes, and a mistake on your credit report could cost you a mortgage. You should always be up-to-date on what has changed and why something has changed, Kingston says.

The bureaus make it possible to fix errors in your reports with online forms you can fill out and submit. There are also a number of for-profit companies that will monitor your credit and alert you if there are significant changes, but in most cases, youll be able to do this monitoring yourself for free.

Go Big And Bold With Your Images And Copy

Whatever type of media you use in reports, make it sizable and stylish. Develop the copy for your report first, then use that content to determine what visuals to include. For instance, if you write about the results of a survey you sent out to leads and clients, produce charts or graphs that detail your findings, or even record a short video of yourself broadcasting your thoughts regarding the results. Written and visual elements go hand in hand â similar to your real estate branding components â meaning regardless of which you create first, the latter content type should relate closely to the former.

Recommended Reading: When Does Usaa Report To Credit Bureaus

What You Can Do

If you are concerned about potential problems popping up in the renters credit check, you can find out what information is in it. You are entitled to one free copy per year from each of the three credit bureaus. Look carefully at all of the information. Many credit reports contain errors. If you spot mistakes, you can dispute them via the credit agencys website. For negative information, you can submit a statement explaining the circumstances, which will be added to your report, so your landlord will see the real deal.

Once you get a rental home or apartment, maintain a good payment pattern and ask your landlord to report this information to help your credit. On the other hand, If you know you will have a problem making the rent on time in the near future, you can opt-out of this reporting until youve passed that point and gotten back on track.

Learn Why Landlords And Property Managers Often Run Credit Checks On Potential Tenantsand Ways To Help Improve Your Score

Your credit scores can be important when youâre looking to rent an apartment. Thatâs because the landlord or property manager may pull your credit as part of the screening process. Your credit history can show them how youâve managed money in the past and help them determine whether you might be a responsible tenant.

A credit score in the 600s typically places you in either the âfairâ or âgoodâ credit score range and could be a starting point for some landlords and property managers. Meeting their minimum requirements doesnât necessarily guarantee approval. But knowing what they look for could help you position yourself as a great rental candidate.

Don’t Miss: Navy Federal Checking Line Of Credit – Myfico

Hire A Designer To Develop Graphics

First and foremost, consider hiring a professional graphic designer to make your data, audience information, and other report details look organized and snazzy. This certainly isnât a viable option for every agent â particularly ones just starting their real estate careers â but once youâve made some money on the job, consider investing in an experienced designer or design firm to make your reports and other real estate marketing collateral shine.

Things You Shouldn’t Do When Waiting To Close A Real Estate Sale

- Do not touch your credit report. Don’t even look at it. You could make a harmless inquiry and end up delaying your closing. If you have any problems with your credit report, wait to address them until the home buying process is complete.

- Do not establish new credit. Cash-back cards offered out of the blue to you? Delete those emails, shred the reply forms, or wait until after your transaction has closed to accept new credit.

- Do not close any credit accounts. Even if you realize that you never use a certain credit card, for example, feel free to cut it up, but don’t cancel that line of credit while you are waiting to close the purchase of your home.

- Do not increase the credit limits on your cards. Anything that is worth buying with a credit card is worth waiting for. If you get an offer in the mail, don’t respond to it.

- Do not buy anything with a credit card or put an item on layaway. This is extremely important, and it will probably be difficultbut it’s worth the effort. Yes, you may need a washer and dryer, as well as other furniture and appliances, but wait until you close to order anything. Even if a salesperson says they’ll write it up and hold it for you, there’s a chance it could be entered into the computer by mistake, which could delay your closing. It’s best not to take the chance.

At the time of writing, Elizabeth Weintraub, CalBRE #00697006, is a Broker-Associate at Lyon Real Estate in Sacramento, California.

Read Also: Does Capital One Report Authorized Users To The Credit Bureaus

Quick Tips For Improving Your Credit Score

A surefire way to increase your chances of renting with a low credit score is to improve it. That said, it’s not something that you can do overnight.

This is especially true for those with a long-standing history of non-payment or late payments of debts. It can take years to fully repair a credit score. However, all hope is not lost.

There are some things that you can do in the short term to improve your credit score. Here are some quick tips to raise your credit score.

- Don’t Close Old Cards: This is often the biggest mistake that people make when trying to improve their credit score. Though you may have older cards that you simply do not use, it’s better to keep them open. Older cards contribute to the average age of your credit. So, the older your accounts are, the better.

- Pay What You Can…Often: It’s unlikely that you’ll be able to pay all your debts off at once. Paying as much as you can in small increments and meeting the minimum monthly payment for each of your cards is essential.

- If youre able to successfully negotiate a higher credit limit with your card issuer, the percentage of credit used can go down significantly. As this is an important factor in your credit score, it can be the one change you need!

- Increase Your Credit: Another counterintuitive method for improving your credit score, diversifying your credit can improve your score. A mix of loans and credit cards are ideal. Even opening another credit card can have a positive impact!

What If My Prospective Tenant Doesnt Have Any Credit

An applicant without a credit history doesnt have to be automatically ruled out of your applicant pool, as they may not be a bad choice. A credit check is a basic but essential part of your screening process as a landlord, so you should do your due diligence. In the absence of credit history, youll need to dig more heavily into an applicants financial background to verify tenant identity, income, employment, and rental history. For example, you might want to ensure that the potential tenant can pay and afford the rent by asking for recent pay stubs, W2s, and a letter from his or her current employer. Its also a good idea to contact former landlords and employers directly to ensure that your new tenant has a history of paying rent on time.

Pro-tip: In the absence of credit history, you might also consider requiring a larger security deposit or advanced payment of rent. However, youll need to outline these criteria in your initial screening requirements and indicate this within the terms of your rental agreement.

If an applicant doesnt have credit, then you may also choose to offer a co-signing option .

If your tenant proves to be consistent and regularly makes timely rent payments, then you may agree to take the cosigner off the lease at some point in the future.

You May Like: Does Acima Report To Credit Bureaus