How Often Is Your Credit Score Updated

Your credit scores are always based on an analysis of one of your credit reports. Rather than being updated at specific intervals, a credit score is created when you checks your credit report. New information could be added to your credit report at any time, which means the resulting score could change.

You may also see different scores if you’re checking credit reports from different credit bureaus, as it’s not uncommon for there to be differences between your credit reports. Or, even if you’re checking the same report at the exact same time, you could get different scores depending on which scoring model analyzes the report.

Resist Credit Inquiries Unless Absolutely Necessary

Make sure credit inquiries arent being made on your credit report on a regular basis. Soft credit checksthose in which you or a prospective landlord or employer look at your scoredont affect your credit score. But hard credit checks, like when you want to increase a credit limit or apply for a credit product or loan, always do. You can learn more about the difference between the two inquiries by reading our in-depth article on the effect of checking your credit score.

Some Canadians rack up cash back and rewards points by engaging in , a practice where applicants apply for credit cards to take advantage of sign-up bonuses offered in the first few months and then cancel these cards when the bonus period expires. But this practice is unkind to your credit score, as each time you apply for a new card it can take up to ten points off.

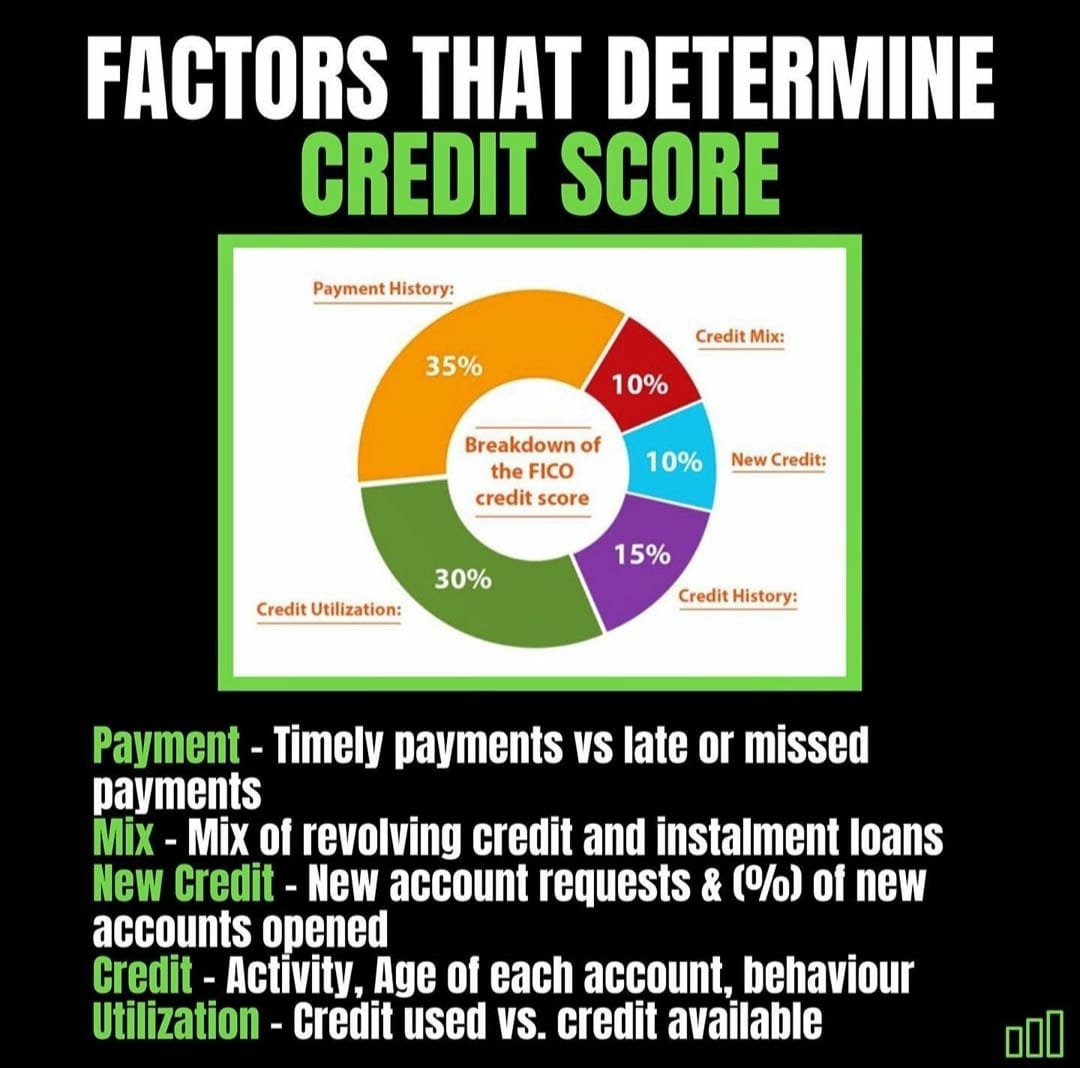

Top 5 Credit Score Factors

While the exact criteria used by each scoring model varies, here are the most common factors that affect your credit scores.

Recommended Reading: Do You Have A Credit Score Without A Credit Card

Debt Burden Or Amounts Owed

The specifics of your existing debt burden account for 30% of your credit score, including how much you owe in total, what types of loans you have and any other quantitative indicators about your overall debt and credit profile. As an indicator of your creditworthiness, how much you owe and how it’s broken up across different types of lending products acts as a signal about your capacity to manage your existing debt.

Example:

When it comes to how existing debt affects your credit score, less debt doesn’t necessarily have a more positive impact. That’s because the FICO calculation considers all components relative to each other, rather than taking each factor for face value.

For instance, let’s consider a credit profile of someone who has large amounts of debt but a long and spotless payment history. This might indicate that the person is financially well off and the debt burden is a signal that any additional loans might be obligations they can easily handle.

Take that same level of debt on a profile with a recent history of payment problems, and the higher quantitative factors should be a major red flag. This consumer may be having difficulties making ends meet and even a small amount of additional credit might be a risky proposition.

Which Scoring Version Is Used For A Mortgage And An Auto Loan

To help lenders make prudent decisions, the FICO® Score algorithm has been updated several times over the years. This is because we use credit much more often than we did several decades ago. As culture and consumer behavior evolves, the scoring model does as well. Although the most widely used version of the model is FICO® Score 8, this is not true of mortgages or auto loans. These types of loans often mean a very large amount of money is being requested, so earlier and more conservative versions of the algorithm are used. For example, for mortgages, Experian may use FICO® Score 2, and TransUnion may use FICO® Score 4.

Recommended Reading: Which Is The Best Credit Report To Check

Length Of Credit History

Responsibly managing credit accounts over a long period of time can help your credit scores. Credit scoring models may look at the age of your oldest account, newest account and the average age of all your accounts when factoring in credit history.

There’s no shortcut to building a lengthy credit history, although becoming an on an account that the primary user has had for a long time may help. If you decide to close a credit card account in good standing, it can remain on your credit report for up to 10 years, and could continue to help your credit scores during that time. However, closing an account reduces your overall available credit, which could have a negative effect on your scores.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Read Also: How To Get Free Credit Score

What Goes Into A Credit Score

Because some parts of your bill-paying history are more important than others, different pieces of your credit history are given different weights in calculating your credit score.

Even though the specific equation for coming up with your credit score is proprietary information owned by FICO, we do know what information is used to calculate your score.

| What Makes Up Your FICO Credit Score | |

|---|---|

| Payment history | |

| New credit | 10% |

Payment history: Lenders are most concerned about whether or not you pay your bills on time. The best indicator of this is how youve paid your bills in the past.

Late payments, charge-offs, debt collections, and bankruptcies all affect the payment history portion of your credit score. The better your history of paying debtssuch as loan payments or credit card billson time, the higher your credit score.

More recent delinquencies hurt your credit score more than those in the past.

Amounts owed: The amount of debt you have in comparison to your credit limits is known as . The more money you already owe, the less flexible your spending is, which makes it riskier for you to take on new debt, which lowers your credit score.

Keep your credit card balance at about 30% of your or less to improve your credit score.

Length of credit history: Having a longer credit history is favorable because it gives more information about your spending habits. A longer history of reliable borrowing means your score will be higher.

Types Of Credit In Use: 10%

The final thing the FICO formula considers in determining your credit score is whether you have a mix of different types of credit, such as credit cards, store accounts, installment loans, and mortgages. It also looks at how many total accounts you have. Since this is a small component of your score, don’t worry if you don’t have accounts in each of these categories, and don’t open new accounts just to increase your mix of credit types.

Recommended Reading: What Score Do You Need For Care Credit

What’s A Credit Limit

A credit limit is how much credit the credit card issuer provides to you, and the maximum amount you can borrow at any time. You can spend up to your credit limit before your transactions are declined or you begin to incur penalties.

When you use your credit card, you’re borrowing money against your credit limit to fund the transaction. Your account balance goes up, and your available credit goes down until you pay the bill.

For example, if you have a credit limit of $10,000 and you make a number of purchases totaling $2,000, your available credit becomes $8,000 with a statement balance of $2,000. After you pay the full $2,000 balance, your available credit once again becomes $10,000. A simple way to think about it is:

Your credit limit also accounts for any balance transfers you may initiate on your account, so if you have a credit limit of $10,000 and transfer a balance of $5,000 from another credit card, your available credit would then be $5,000 until you pay off the outstanding balance.

There are a number of other financial products aside from credit cards that feature credit limits, or credit lines. These include business lines of credit and home equity lines of credit .

Somewhat Important: Length Of Credit History

A variety of factors related to the length of your credit history can affect your credit, including the following:

- The age of your oldest account

- The age of your newest account

- The average age of your accounts

- Whether youve used an account recently

Opening new accounts could lower your average age of accounts, which may hurt your scores. But the hit to your scores could also be more than offset by lowering your utilization rate and increasing your total , making sure to make on-time payments to the new card and adding to your credit mix.

Closed accounts can stay on your credit reports for up to 10 years and increase the average age of your accounts during that time. But once the account drops off your credit reports, it could lower this factor, and hurt your scores. The impact could be more significant if the account was also your oldest account.

Read Also: What Credit Score Do You Need For Affirm

Increases Your Chances Of Improving Your Score And Qualifying For A Better Rate

When you understand how your credit score is calculated, you can take strategic steps to improve or build it over time. Several scoring websites allow users to simulate changes to their score based on factors such as on-time payments, extra payments, and new credit applications.

Suffice to say, this could save you thousands in the long run.

Also Check: What Day Does Capital One Report To Credit Bureaus

What To Look For When Checking Your Fico Score

Monitoring and checking your credit report regularly is a helpful way to keep track of your finances and keep an eye out on fraud. When checking your credit score and report, you’ll want to check for any errors that could potentially make you seem like an undesirable borrower. With so much information listed on your credit report, it can be overwhelming to figure out what you should focus on. Below are some things you should look for when checking your credit score.

Also Check: How To Check Your Credit Score For Free

How Your Credit Score Is Calculated

Learn what your credit score is based on and the many ways you can improve it.

Your credit score is one of the most important measures of your creditworthiness. For your FICO® Score, it’s a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. By understanding what impacts your credit score, you can take steps to improve it.

The 5 Biggest Factors That Affect Your Credit

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

A is a number that lenders use to determine the risk of loaning money to a given borrower.

Here are the five biggest things that affect your score, how they affect your credit, and what it means when you apply for a loan.

Don’t Miss: How To Boost Up Your Credit Score

What Happens If You Charge More Than Your Credit Limit

If you try to make a purchase over your credit limit, your card will likely be denied depending on if you have any over-limit protections in place.

Most credit issuers no longer have over-limit fees, however, and issuers can’t charge a fee for over-limit purchases without consent, following the CARD Act of 2009.

If you did opt in to over-limit protection, the purchase will go through, but you’ll incur a fee. Continued over-limit use could result in lower credit scores and increased interest rates, or the credit issuer could close your credit account entirely. Repercussions could also include a lower credit limit.

“Someone who is maxing out a credit card, or coming close, might have their credit limit reduced as a risk mitigation tactic, or the credit card company might give them an even higher credit limit in the hope that they’ll keep spending,” said Ted Rossman, a credit card industry analyst.

It’s important to keep an eye on how much you’re spending each month, and to stay up on all of your monthly payments to avoid overcharging and the headaches that come with it.

How To Improve Your Credit Score

Improving your credit score can be easy once you understand why your score is struggling. It may take time and effort, but developing responsible habits now can help you grow your score in the long run.

A good first step is to get a free copy of your credit report and score so you can understand what is in your credit file. Next, focus on what is bringing your score down and work toward improving these areas.

Here are some common steps you can take to increase your credit score.

Don’t Miss: How Many Points Does A Hard Inquiry Affect Credit Score

What Determines Your Credit Limit

How lenders determine your credit limit varies, but there are a few things that carry through regardless of the institution you’re asking to borrow from. The lender’s underwriting process — the process by which lenders decide how much to lend a borrower — is proprietary, meaning issuers don’t disclose exactly how it works, because it’s central to the issuer’s business model. It would be like if a restaurant revealed the secret ingredient of its best dish.That said, there are a number of factors that impact how large or small your line of credit will be, despite which lender you’re requesting the loan from. Credit score, payment history, credit history, income, debt-to-income ratio and the overall economy all likely contribute to a lender’s decision.

In the end, it comes down to your overall creditworthiness, or how financially attractive you are to a lender. The better your creditworthiness, the more favorable your terms will be, which typically means a higher credit limit and lower interest rate.

The Ultimate Guide To Credit Scores In Canada

What is a credit score? A credit score is a 3-digit number that allows lenders to determine a potential borrowers credit riskthe risk they run of not paying back their credit cards or loans. Canadians typically cannot borrow money or receive credit of any kind unless they have a solid credit score. Canadas two national credit bureaus, Equifax and TransUnion, create credit scores and credit reports based on the information they receive about each borrower from their lenders.

In This Article:

Also Check: How Much Credit Score Is Needed To Buy A House