Reduce Your Credit Utilization Ratio

Several factors determine your credit score. Your credit utilization ratio is an influential metric because it is part of a factor that makes up 30% of your score. Credit utilization is simply how much credit you are using divided by the total amount of credit you have access to.

If you charged $10,000 to your credit cards and your total credit limit is $50,000, your utilization is 20%. Credit bureaus use your statement balance in this calculation, so you have utilization even if you pay off your balances in full each month.

A general rule of thumb is to use up to a maximum of 30% of your credit card limit. Many experts suggest keeping it below 10%, if possible. Most credit cards report your credit utilization once a month to the credit bureaus. In many cases, your most recent statement balance is the number that goes onto your credit report.

Here are three ways to keep your credit card utilization ratio below 30%:

- Only charge essential purchases like gas and groceriesor those that earn bonus points

- Split your purchases between multiple credit cards

- For large one-time purchases, make extra payments during the billing cycle

If you wont be making an extra payment each month, you can simply pay cash on purchases that would push your balance above the 30% threshold. If youre going to make additional payments, schedule them to post before the end of the billing cycle. This way your balance on your statement is lower.

Wallethacks.com

Pay Down Your Balance

According to Fair Isaac Corp., aka FICO, the company that calculates one of the most widely used credit scores, 30% of your FICO score is based on the amount you owe.

However, its not simply how much you owe thats important. Its how much you owe compared with how much credit you have, a ratio known as your credit utilization rate.

For example, if you have a $10,000 credit limit and a $5,000 balance, your credit utilization is 50%. If youve maxed out that $10,000 limit, your utilization is 100%.

There are many theories on the ideal credit utilization rate, but Experian suggests its best to have a rate of less than 30%. In other words, you should never have more than $3,000 charged at any time if you have a $10,000 limit.

If your credit utilization rate is high, paying down your balances is a quick way to lower that rate and thus boost your score. For more ideas on tackling debt, read 8 Surefire Ways to Get Rid of Debt ASAP.

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

Recommended Reading: Can A Repossession Be Removed From Credit Report

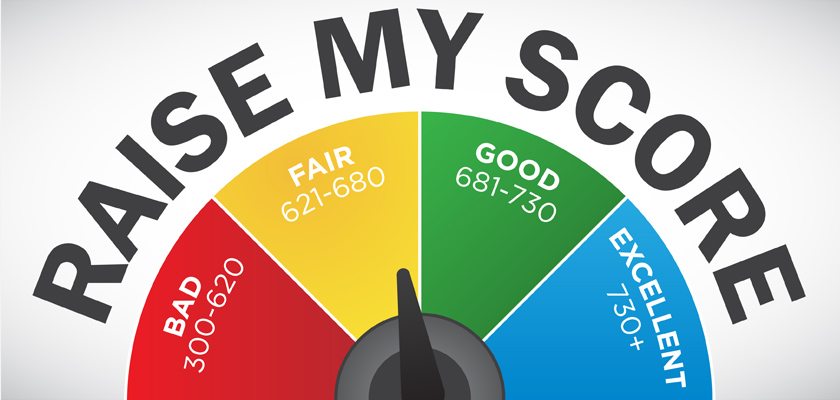

What Is A Good Credit Score How To Improve Your Credit Score

Lets face it, tackling finances is always a difficult job, whether its personal or business finance. Any business growth plans need funding, and for that, we require loans from financial institutions. Now, to be eligible for borrowing such business loans, you need to understand where you stand as a borrower.

One of the easiest ways to know your creditworthiness is by looking at your credit score. A gives banks and other lenders a general insight into the reliability of you as a borrower. If your credit score is good, then you are more likely to get your loan approved as compared to someone who has a bad credit score.

How Long Do Derogatory Marks Stay On Your Credit Report

No ones perfect, and thats very clear when youre dealing with credit scores and credit reports. Your credit report is a history of how youve handled credit in the past. If youve made mistakes, such as late or missed payments, those will stay on your credit report for a long time. But just how long depends on the type of derogatory mark:

- Late payments: Because lenders usually report to the bureaus every 30 to 45 days , you may have a small window of time after missing a payment to make it up before it appears on your report. But once a late payment is on your report, it will stay for seven years from the original delinquency date.

- Collection accounts: If you have an account that is sent to collections, the account will remain on your credit report until seven years after your initial missed payment that led to the account ending up in collections.

- Bankruptcies: Depending on the type of bankruptcy you declared, it will remain on your credit report for seven to 10 years.

- Other negatives: Other derogatory marks, such as repossession, will typically stay on your credit report for seven years from the date of the first payment you missed.

Read Also: Does Paypal Report To Credit Bureaus

Set Up Automatic Payments

Making all of your payments on time is crucial. If you miss payments, thats going to damage your credit score severely and very quickly and its going to take some time to recover, says Rod Griffin, senior director of consumer education and awareness with Experian. Late payments remain on the credit report for seven years from the date of the missed payment and can drag down scores for that entire time, he explains.

To reduce the risk of forgetting a payment until after its due, set up automatic payments linked to your bank account. As an added bonus, some student loan and personal loan lenders offer rate discounts if you enroll with AutoPay, lowering your interest rate.

Use A Loan To Consolidate Credit Card Debt

Credit utilization ratios only consider the balances and limits on revolving credit accountscredit cards and lines of credit. If you use a personal loan to pay down credit card balances, you’re moving the debt from a revolving account to an installment account. The primary motivation for consolidating credit card debt is to lower your interest rate or monthly payment. But now you know why consolidating credit card debt could also help your credit scores.

Don’t Miss: How To Get Credit Report With Itin Number

In Summary: Tips To Improve Your Credit Score

Fix Credit Report Errors

Sometimes, banks make reporting errors that hurt your credit score. Even if you havent missed a payment, many consumers overlook the benefits of a periodic credit report review.

Reviewing your credit report is free and only takes a few minutes. You can request free credit reports from Equifax TRU weekly through April 2021.

If you find an error, you will need to file a dispute with the credit bureau. No error is too small to dispute. Ive disputed incorrect phone numbers, which are correctly in minutes, which led me to discover unauthorized accounts .

If the error affected your score, you should see a pretty quick change once the credit bureau corrects the error.

Also Check: Does Afterpay Affect Credit Score

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Also Check: What Is Cbcinnovis On My Credit Report

The Importance Of Staying On Top Of Your Credit

One of the most important aspects of building a good credit score is consistency. To achieve and maintain a good score, you need to develop good credit habits and stick with them. Remember, building credit is a long-term endeavor and it’s important to always stay on top of what and how things can impact your score.

As you build your credit, understanding the factors that go into score calculations will allow you to monitor your behavior and ensure everything you do it’s helping, not hurting your score. Here are some of the key attributes of your credit scores and areas to watch as you build your credit.

Information on your credit report that can influence your credit scores includes:

- Payment history

- Types of credit accounts you have open

- How long you’ve been using credit

- Your debt balances

Have A Variety Of Credit Accounts

While you should only borrow money when necessary, having a variety of credit accounts can demonstrate you can manage credit responsibly. You might have one credit card, a home mortgage and a car loan. Each type of account can benefit your credit score differently.

Loans that you repay in full can remain on your credit report for up to ten years. You can have an easier time qualifying for a similar loan in addition to having a higher credit score.

Don’t Miss: How Personal Responsibility Can Affect Your Credit Report

Ask For A Credit Limit Increase

If youve been regularly making required payments on your credit card, you may want to try asking the credit card company for a credit limit increase. You wouldnt necessarily want to do this to finance a purchase you otherwise wouldnt have been able to make. But if your monthly balance is relatively steady, you could decrease your utilization rate by increasing your credit limit.

For those who may not know, the is the amount of credit available to you that youre actually using. Its basically your balance divided by your credit limit. So, if you increase your credit limit and keep the balance the same, the utilization rate will be lower. And that can translate into how to improve your credit score.

Avoid New Credit Card Purchases

New purchases will raise your a ratio of your credit card balances to their respective credit limits that makes up 30% of your credit score. You can calculate it by dividing what you owe by your credit limit. The higher your balances are, the higher your is, and the more your credit score may be negatively affected.

Under the FICO score model, it’s best to keep your credit utilization rate below 30%. That is, you should maintain a balance of no more than $3,000 on a credit card with a limit of $10,000. To meet that 30% target, pay cash for purchases instead of putting them on your credit card to minimize the impact on your credit utilization rate. Even better, avoid the purchase completely.

Also Check: 778 Fico Score

Make Payments Throughout The Month

You don’t have to wait until your bill is due to make a payment. Pay early. If you’ve put a big expense on your card, this helps keep your credit utilization low and improve your credit score.

A good credit utilization rate never exceeds 30%, and the lower it is, the better, so if you have a credit limit of $10,000, you should never use more than $3,000 at a time.

If you have to put a big expense on your card, go ahead and make a payment even a partial payment quickly so that your credit utilization doesn’t ding your credit score.

Start A New Credit History

One strategy some people use to improve their payment history is to take out a credit card that is easier to qualify for, like a gas station or store card, and consistently pay off the balance each month. The good behavior can slowly put you in a better financial position. But be careful this strategy doesn’t backfire on you: you don’t want to take out new cards if you think you will be tempted to rack up more debt.

Also Check: Do Authorized Users Build Credit Capital One

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

Read Also: How To Dispute Repossession On Credit Report

Tips For Lowering Your Credit Utilization

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit utilization is simply the portion of your available credit you use, expressed as a percentage. It is the total of balances on all your credit cards divided by the total of all your credit limits. This number is a big factor in your credit score the less available credit you use, the better it is for your score.

Paying your balances on time and in full every month is the best way to keep your score intact or build it. On the other hand, using a larger portion of your credit limit could do damage.

But if a financial crisis means you have to lean on credit cards, take heart: once you’re able to lower your utilization.

These tactics can help you keep your utilization low.

What Makes Up Your Credit Score

First, its important to understand the factors that go into your score and who decides on your score. Lets take a closer look at where your credit score comes from.

Your credit score is a report of how youve used credit in the past and lets companies like lenders and credit card issues predict how much risk they would be taking loaning you money. Your report shows if youve ever missed credit card payments, the types of loans youve taken out and if you have filed for bankruptcy in the past.

There are three major credit reporting bureaus: Experian, Equifax, and TransUnion. These companies collect, store and organize the data on your credit reports. Then they each issue you a credit score from the information contained in your report. Credit scores are important because they allow creditors to see a snapshot of your credit history without spending hours reading your whole report.

There are a few different methods that credit reporting bureaus can use to calculate your score. The score that most lenders look at is the FICO model. The factors that go into your credit score include:

You May Like: How To Remove Repos From Credit Report