What Credit Score Do You Need To Buya House

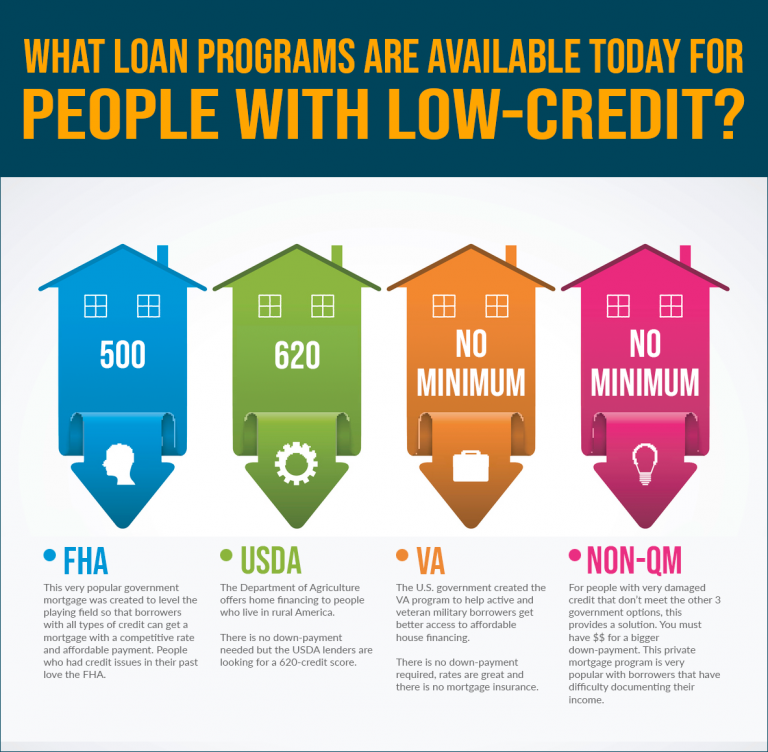

You dont need perfect or even good credit to buy a house. In fact, the minimum credit score to get a mortgage is 580 which is considered only fair.

Remember, mortgage lenders dont look at your credit score in a vacuum.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to get away with a low credit score.

The downside to lower credit is that youll pay a higher interest rate. But many buyers with low scores choose to buy now and refinance for a better rate when their credit improves later on.

What Makes Up Your Credit Score

The FICO credit score takes into account the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score ismade up of the following:

- Payment history: 35% of your total score

- Total amounts owed: 30% of your total score

- Length of credit history: 15% of your total score

- New credit: 10% of your total score

- Type of credit in use: 10% of your total score

Based on this formula,the largest part of your credit score is derived from your payment history, andthe amount of debt you carry versus the amount of credit available to you.These two elements account for 65% of your FICO score.

To put yourself in thebest position to qualify for a mortgage, focus on these areas first. Payyour bills on-time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilizationratio compares the total amount of credit available to you against your currentbalances try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

Want To Buy A House Heres The Credit Score Youll Need To Do It

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Your credit score plays a major role in your ability to secure a mortgage loan. Not only does it impact your initial qualification for a loan, but it also influences your interest rate, down payment requirements, and other terms of your mortgage.

Are you considering buying a house, and making sure your credit is ready? Heres what you need to know.

Don’t Miss: Financing At Carmax

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan, depend on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.

What Score Is Needed To Buy A House In California

There is no standard “cut-off” point used in the mortgage industry for credit ratings. This is one common misunderstanding. The truth is that different lenders have different standards , different business models and different risk appetites. So the credit score required to buy a home in California would depend partly on who you work with.

In general terms emphasis on the word “generally” mortgage firms prefer to see a score of 600 or higher for approval of loans. That number, however, is not set in stone. It is just a phenomenon in the industry. So don’t be discouraged by dropping below that point. Either way please contact us. We’ll gladly review your financial situation to see if you are a good candidate for a home loan from California.

Here too, the type of home loan you use plays a role. For example , home loans from the Federal Housing Administration require a minimum score of 580, if the borrower wishes to take advantage of the 3.5 percent down payment option. Credit score requirements tend to be a bit higher for conventional mortgage loans, because there is no government insurance.

As described above, when assessing loan applications, the borrowers prefer to look at the big picture. Every lending scenario is different, because it is different for every borrower. So a low credit score may not necessarily be a deal-breaker by itself. Having said that, a higher credit score would usually increase a borrower ‘s chances of qualifying for a California home loan.

Read Also: Check Credit Score With Itin Number

Improving Your Credit Score

Theres a lot that goes into determining your credit score, including your repayment history, the total balances on your accounts, how long youve had those accounts, and the number of times youve applied for credit in the last year. Improving in any of these areas can help increase your score.

You can:

- Pay down your existing debts and credit card balances

- Resolve any credit issues or collections

- Avoid opening new accounts or loans

- Pay your bills on time, every time

You should also pull your credit report and check for any inaccuracies you might see. If you find any, file a dispute with the reporting credit bureau, and include the appropriate documentation. Correcting these inaccuracies could give your score a boost.

Order Copies Of Your Credit Report

Get started by ordering copies of your credit report. This way you can get an idea of everything a lender would see when reviewing your loan application.

First, check to make sure that all the information is 100% accurate. From there, look at where there are weaknesses on your report. Is the amount of debt you owe really high?

You May Like: Does Capital One Report Authorized Users To The Credit Bureaus

Lenders Might See A Lower Credit Score Than You Do

Perhaps you monitor your credit with free credit score apps from the major credit bureaus, so you know exactly what youre working with when you apply for a mortgage.

But then you talk to a mortgage loan officer, and they tell you theyre seeing a lower score than you thought you had.

In fact, this happens pretty often.

Most people arent aware that they have dozens of credit scores. And the score you see from your bank or credit reporting service is just one of them.

Its common for your mortgage credit score to be lower than the score you see on other platforms. This is because lenders use a tougher scoring model.

Its also pretty common for your mortgage credit score to be lower than the score you see on other platforms.

Thats because mortgage lenders often use a tougher credit scoring model. A home loan is a lot of money, and lenders want to be extra sure youll be able to pay it back.

So, if your score is a little lower than you thought, dont be surprised.

Also, dont be discouraged! Youre still likely to qualify for most loans with a score slightly below 700. And there are plenty of ways to raise your score a few points, then try for a mortgage again.

Does Paying Your Noncredit

Can you add to your credit history by calling other providerslike your wireless provider or utility companyand asking them to report your payment history to your credit report? It sounds like a pretty good idea, but its one thats still in its infancy.

Each of the major credit-reporting agencies is making some changes to include more bill payments, albeit slowly. In general, though, most of the time, these types of payments only appear on credit reports when they are delinquent, Gallegos says.

The light at the end of this credit score tunnel is that in early 2019, you will be able to add utility and telecom payment histories to your credit score by signing up for a free credit platform called Experian Boost. To register for early access, you can submit your info and it will be added to your credit report and credit score as soon as this option is available.

So, this last credit move probably wont improve your credit score right now, but there are still plenty of things you can do to kick-start your credit score makeover. So what are you waiting for?

You May Like: Repo On Credit Report

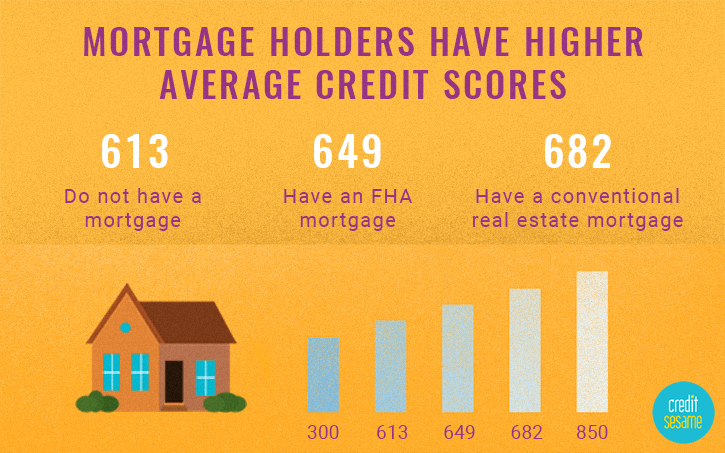

Mortgage And Credit Score Statistics

- 786 is the median credit score in the U.S. for those taking out a mortgage, according to Q2 2021 Federal Reserve Bank of New York data.

- Minnesota, New Hampshire and Vermont are home to those with the highest average credit scores in the country, while Mississippi, Louisiana and Alabama are home to those with the lowest, VantageScore reports.

- The average mortgage debt is $229,242, according to 2021 data from Experian. Generation X borrowers have the highest average mortgage debt, at $259,100.

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history, and help lenders assess your financial health. Home buyers with lower credit scores are typically assigned a higher interest rate.

You May Like: Minimum Credit Score For Carmax

Being Able To Pay Closing Costs

There are a number of fees associated with a home mortgage, and you could be in for a rude financial awakening if you dont know what to expect in advance.

Although closing costs vary from lender to lender and from state to state, borrowers pay for the appraisal, credit report, attorney/closing agent fees, recording fees, and processing/underwriting fees, Alcorn says, adding that closing costs are usually 1% of the loan amount.

However, the fees could account for as much as 3%, and lenders must provide borrowers with a comprehensive good faith estimate of the fees you may incur on a specific type of loan.

Ways To Help Strengthen Credit Scores To Buy A House

If your credit scores need work before you buy a house, consider these ways to help improve your scores:

- Make on-time payments. FICO and VantageScore both say your track record of making on-time paymentsâyour payment historyâcan be a significant factor in determining your credit rating. You could use email reminders or calendar alerts to remind yourself. And setting up automatic payments can ensure you donât miss a payment due date.

- Pay more than the minimum. Making only your comes with a cost: interest charges. And interest can add up and cost you more money in the long run. Interest can even make it harder to pay off debt. So consider this from the CFPB: âPaying off your balance each month can help you get the best scores.â

- Keep your balances low. The CFPB recommends that you not spend more than 30% of your available credit. A low âa measure of how much of your available credit youâre usingâcould be a sign that youâre using your credit responsibly and not overspending. And that could help you improve your score.

- Apply only for the credit you need. As the CFPB explains, âCredit scoring formulas look at your recent credit activity as a signal of your need for credit. If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

Also Check: Trueidentity Credit Freeze

Average Credit Score By State

The credit health of Americans varies across states. Minnesota has the highest average credit score, 724, followed by New Hampshire and Vermont , according to VantageScore data from December 2021. Mississippi , Louisiana and Alabama have the lowest average scores.

The Northeast and Pacific Northwest tend to have higher credit scores overall, while the Deep South has some of the lowest scores.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Donât Miss: 830 Credit Score Mortgage Rate

Read Also: When Do Late Payments Fall Off Credit Report

Whats The Average Credit Score For People With Mortgages In Your State

While its common for mortgage lenders to look at FICO scores in their application review process, we turned to Credit Karmas vast collection of VantageScore 3.0 data to get a broad picture of the credit health of people getting mortgages.

Below, you can see the average TransUnion VantageScore 3.0 credit score of homeowners in each state who recently opened a mortgage.

In general, people in the Northeast or on the West Coast who got mortgages had VantageScore 3.0 credit scores averaging 720 or above on the higher end of the spectrum.

On the flip side, the Gulf Coast, Midwest and Southern coastal states tended to have some of the weakest average credit scores .

| State |

|---|

Maximize Your Credit Score In Other Areas

In addition to your payment history and credit utilization ratio, the other factors that influence your credit score are as follows:

Learning about the major factors that affect your credit score puts you in a better position to earn and keep a good credit rating.

With length of credit history, the older the average age of the accounts on your credit report, the better. If you have a young credit file, you may have to be patient and wait for it to grow older over time. Yet a loved one whos willing to add you as an on an older credit card might be able to speed the process along for you as well.

As far as credit mix is concerned, having a variety of account types on your credit report can work in your favor. If you only have credit cards open, you might want to consider opening an installment loan . And if you only have installment accounts open, you might want to add some revolving credit cards to your report instead.

Finally, the new credit component of your credit score refers to how often you apply for and open new accounts. Too many credit applications in a short period of time might damage your credit score . At the same time, you never have to worry about checking your own credit report. Personal credit checks dont damage your score.

You May Like: How To Remove Hard Inquiries From Credit Report Fast

What Is A Good Credit Score For Buying A House

So far we’ve only discussed the minimum credit score that a mortgage lender will consider. But what type of credit score could qualify you for the best rates? FICO breaks its credit scores into five ranges:

|

FICO Credit Score Ranges |

| 800 and above | Exceptional |

Aiming to get your credit score in the “Good” range would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the “Very Good” range .

It’s important to point out that your credit score isn’t the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause the loan to fall through.

Using Credit For Home

Buying a house involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card < em> after< /em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.

You May Like: 623 Credit Score Credit Card