How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

The 6 Best Free Credit Reports Of 2022

- Best for Credit Monitoring:

- Best for Single Bureau Access:

- Best for Improving Credit:

- Best for Daily Updates: WalletHub

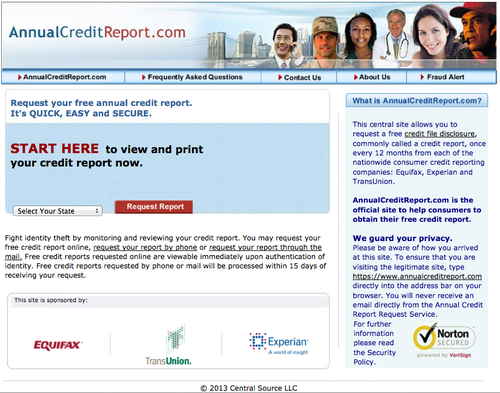

In 2003, a Federal law passed granting every consumer the right to a free report from all credit reporting agencies each year. AnnualCreditReport.com is the centralized site that allows every consumer to access their free credit report granted by Federal law.

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus Equifax, Experian, and TransUnion at no cost. You can obtain one free credit report every 12 months through AnnualCreditReport.com, without signing up, creating an account, or entering your credit card information. Alternatively, you can call 1-877-322-8228 to order your legally free credit report.

Credit reports are available as a PDF download or you can request to have your credit reports mailed to you. The downside is that you receive your full credit report, which hasnt been formatted for user-friendliness. Depending on the length of your credit history and the number of accounts youve had, your credit reports can be dozens of pages each. You wont receive a credit score with your credit report from AnnualCreditReport.com.

How To Get 3 Free Credit Reports Annually

Its a good idea to keep an eye on your credit score regularly. By law you are allowed to get a credit report from each of the 3 major agencies throughout a calendar year. Spreading out the time when you pull each one will help you detect fraud or problems with your credit report more frequently than just once annually.

Pick 3 months during the year you intend to review your report. Lets say January, May, and September for example. One day each of those months, go to annualcreditreport.com and choose one agency to pull a report from. So in January, you could pull your TransUnion report in May you could pull your Experian report and in September you could pull your Equifax report.

However, If you intend to only check your reports once a year, then it’s a good idea to pull all 3 at once.

Also Check: Walmart Affirm Apply

What Makes My Credit Score Go Up Or Down

A credit score is based on information in your credit report. Some factors include how much money you owe, how long you’ve owed it, how many new accounts you have, how often you miss or are late with payments, and what type of credit accounts you have. Changes in any of those factors may cause a score to go up or down.

Top Sites For Free Credit Reports

Though some websites use the term free liberally, there are actually more places than ever to get a truly no-cost credit report. These include:

- WalletHub

- Experian

Rather than making money directly from consumers, these firms either collect advertising revenue or charge their lending partners a fee when they get a new customer through the site.

If youre waiting for a catch, here it is: The numerical rating that these sites provide isnt the FICO score that most banks rely on to make lending decisions. Rather, they give you a VantageScore, created in collaboration with the top three credit bureaus: Experian, Equifax, and TransUnion. It uses the same basic information from your credit reports but employs a somewhat different mathematical formula to compute the score.

Thats not to say VantageScores arent valuable. Theyre still useful for tracking overall trends in your credit and generally offer an approximation of what lenders use.

You May Like: Usaa Credit Monitoring Experian

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Also Check: Credit Score Needed For Sapphire Preferred

Best For Improving Credit: Creditwise

You can check your TransUnion credit report and credit score through CreditWise, a credit report and credit score tool from Capital One. Credit Wise is available for free, even for those who arent Capital One customers. Sign up is simple and easy. You wont have to enter any credit card information, theres no trial subscription to cancel, and your credit information is updated weekly. You can access Credit Wise online or use the mobile app to keep up with your credit score.

How Can You Dispute Your Credit Report

Some credit report sites offer assistance disputing credit reporting errors or guidance after identity theft.

- Missed payments: Missed payments reported in error can have a negative effect on a credit report. Some credit bureaus help consumers file a dispute.

- Fraud: Credit reporting companies can help consumers monitor their credit and resolve fraudulent charges on their accounts.

- General errors: It’s possible to find general errors on a credit report that can lower ones credit score. Consumers can enlist the credit reporting companies to investigate the errors.

Also Check: Does Affirm Do A Hard Credit Check

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

What Is The Difference Between Equifax Consumer Services Llc And Equifax Canada Co

ECS and ECC are separate Equifax companies that operate in different physical locations and provide different products and services.

ECS is located in the United States and it obtains information from ECC to create and deliver credit monitoring products directly to Canadian consumers for a fee. The credit monitoring products offered by ECS can help you monitor your Equifax credit report and also help you protect your identity.

ECC is located in Canada and is a registered Canadian credit reporting agency that is regulated by federal and provincial authorities that govern privacy and credit reporting legislation. This means that ECC maintains a database of credit information provided by credit grantors and other sources so that a credit report and related products can be compiled and delivered to the recipients that you have provided consent to and/or who are authorized by law to receive them. ECS is one of these authorized recipients when you purchase a product from them. In order to deliver your product to you, ECS securely collects and stores your credit report and/or an Equifax credit score from ECC.

ECC does not offer any credit monitoring products to consumers. However, as a Canadian consumer, you can receive a free Equifax credit report and Equifax credit score from ECC by visiting one of our consumer centres in person during operating hours, by submitting a request for delivery by mail, or online.

Don’t Miss: Unlock Experian Account

How To Get Your Free Credit Report

Get a hold of your free credit report to see what exactly creditors and employers can see about your financial history.

Tim Fries is the cofounder of The Tokenist. He has a B. Sc. in Mechanical Engineering from the University of Michigan, and an MBA from the University …

Meet Shane. Shane first starting working with The Tokenist in September of 2018 and has happily stuck around ever since. Originally from Maine, …

All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Thinking about getting a loan but noticed a change in your credit score recently? Maybe you want to figure out why, or maybe you just want to check that theres no inaccurate information on there mistakes do happen.

Typically, you are entitled to a free credit report from one of the three major credit bureaus every 12 months. Normally, accessing a credit report any more than this will cost you.

What Is A Credit Report

When you make a payment on a credit card or loan, the business that gave you the loan or credit keeps a record of how much and often you pay, as well as the credit limits and loan balances. Those businesses and other sources may report your credit, loan and payment history to one or more credit reporting companies. The credit reporting companies each combine the information they receive about your different credit, loan and payment activities into a credit report. The credit reporting companies prepare credit reports for people in the U.S. Since not all businesses report to all three credit reporting companies, the information on your credit reports may vary.

A credit report is an organized list of the information related to your credit activity. Credit reports may include:

- A list of businesses that have given you credit or loans

- The total amount for each loan or credit limit for each credit card

- How often you paid your credit or loans on time, and the amount you paid

- Any missed or late payments as well as bad debts

- A list of businesses that have obtained your report within a certain time period

- Your current and former names, address and/or employers

- Any bankruptcies or other public record information

Under Federal law, you are entitled to receive one free copy of your credit report from each credit reporting company every 12 months. For more information visit the Consumer Financial Protection Bureau’s website.

You May Like: Rental Kharma Complaints

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Recommended Reading: Is Opensky Reliable

How To Get Your Free Annual Credit Report Online

You can access your annual credit report by filling out a credit report request form online at AnnualCreditReport.com. AnnualCreditReport.com is the only federally authorized source for free credit reports. You can use it to view all three of your credit reports for free once a year. Heres how to use the site to access your annual credit reports:

- Visit AnnualCreditReport.com. Double-check the spelling of the website youre on and ensure that youre visiting the legitimate AnnualCreditReport.com. Scammers and identity thieves create fake credit report request sites to harvest data. If the URL isn’t spelled correctly, don’t enter any of your personal information.

- Request your free credit report. Click on the red button titled Request your credit reports.

- Enter your personal information. Youll need to enter some personal information and answer a few security questions to confirm your identity. Double-check that all the information you entered is correct before you continue.

- Request your reports. Once you confirm your identity, you can choose which credit reports to view. You might want to look at all three at once or stagger your requests throughout the year.

Requesting your credit reports online is the only way to instantly view your reports. Phone and mail requests typically take 2 3 weeks to arrive.

How To Access Your Free Credit Reports

To access your free credit reports, visit AnnualCreditReport.com. Youll need to answer some questions to prove your identity in order to see your reports. If you have difficulty accessing your report online, you can also request it by phone or postal mail. You can choose to access your report for any of the three credit bureaus or all three at once.

These reports dont show a credit score but instead provide a thorough history of your financial activities, including payments history and balances for credit cards, mortgages, and car, personal, or student loans.

When you access your report, make sure all the information is correct. If youve paid at least the minimum on time each month, your accounts should be listed as being in good standing. If you have past-due payments or an account in collections, this will also be noted on your report.

Also Check: Does Snap Report To Credit Bureaus

Why Check Your Credit Reports For Free

A lot of people think that checking their credit score once in a while or just a short period before they apply for credit is enough to get by, and many others dont even think that far. The truth is that youre bound to miss a lot if you dont review at least one of your credit reports on a regular basis. Thats problematic because what you dont know about your credit can and will cost you.

Why Its So Important To Check Your Credit Report Periodically

Its important to check your credit reports periodically to make sure everything is accurate and that there are no mistakes. Credit bureaus can make errors, so you want to make sure they have everything right.

Your credit reports are also the best way to check for any unauthorized financial activity. You may not even realize someone has gotten their hands on your information until you find an unauthorized bill or account in your name on your credit report.

Identity theft and other mistakes can really throw your financial life into disarray, so its crucial that you keep up with your reports.

Your include all the details on your credit accounts, both current and closed. The reports track payments and other information for every loan, credit card and any other line of credit you have.

Your , on the other hand, is a number based on your credit history and activity.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Is A Fraud Alert

Identity theft is a serious issue that can be detrimental to ones credit. Many credit reporting companies offer with fraud alert services to quickly inform consumers of potential threats to their credit profile.

- Fee: Depending on the credit report company, there may be an additional fee for the fraud alert, or it may be included in a credit management package.

- Unusual charges: Some credit monitoring services will alert consumers if an out-of-character charge appears on their account.

- Account freezing: Some credit report companies assist consumers in freezing their credit at the credit bureaus. This prevents unknown individuals from opening accounts in the customers name.