Mix And Match Methods Of Borrowing

The algorithms that calculate credit scores love diversity, meaning they smile when they see you paying on a mortgage, car loan, student loan and credit card. What that says to them is that you can multi-task when bill paying time rolls around each month.

Members of the 800 Club, naturally, take it a step further. They average nine open accounts, which does wonders for not just the methods of borrowing, but also helps the credit utilization category immensely.

In most cases, the extra accounts are credit cards and here is how that helps.

As demonstrated above, if you rely on just one credit card to pay for all your expenses, your credit utilization likely is going to 50%-75% or higher. The credit score algorithms dont care that you pay that off every month. They want the credit utilization under 30%.

So add three more cards to your wallet, each with $5,000 limits on them and suddenly your credit utilization is up to $20,000. If you spend the same amount with cards that month, your utilization drops dramatically, probably under 20%.

Not all of us are comfortable carrying that much credit in our pocket so be careful with this one.

What’s The Fastest Way To Boost My Credit Score

Generally, the best answer for how to build credit fast is to improve your utilization ratio. You can do this by paying down credit card debt. You can also decrease your utilization rate by asking your credit card issuer for higher credit card limits.

If you’re building credit for the first time, being an authorized user is usually the fastest way to boost your credit score. Old accounts with positive payment histories are best for building credit as an authorized user.

Be Consistent With Your Payments

Paying your bills on time is probably the single most important thing you can do for your credit score. And this doesnt just apply to your loans and credit card payments!

Many different types of businesses can report delinquent payments to credit bureaus, including cell phone carriers and utility companies.

Read Also: Does Paypal Credit Report To Credit Bureaus

Dispute Errorseven The Small Ones

Your first step: Order a copy of all three credit reports from the major players Equifax, TransUnion, and Experian. You can order one free copy per year from each credit bureau through AnnualCreditReport.com. Order your reports, print a copy, and start reviewing.

Look for the big errors first, things like accounts that dont belong to you, paid balances that are showing as unpaid, and credit limits that are reported incorrectly. Highlight each one of these errors and then dispute them with the credit bureau. You can file a dispute online through each of the credit bureaus websites:

- Experian: Dispute Your Credit Report Online

- TransUnion: Initiate a Dispute on Your Credit Profile

After I disputed the big stuff, my financial adviser told me not to sweat the small things like credit inquires or incorrect dates. I didnt listen. Instead, I disputed everything, thinking every point mattered. If a creditor pulled my credit without my permission, I disputed it. If my credit card company reported my balance higher than it should have been six months ago, I disputed it. In total, I raised my credit score 88 points by disputing every little error.

By law, the credit bureaus must investigate valid claims and remove inaccurate information, but if you run into trouble, complain to the Consumer Financial Protection Bureau.

Best Cash Back Rewards Credit Card

Looking for a great cash back credit card thanks to your solid credit score? My favorite is the Chase Freedom Unlimited credit card. Given you know how to improve your credit score, its now time to reap the benefits!

Key Benefits

- Earn unlimited 1.5% cash back on all purchases

- No annual fee because annual fees are terrible

- 0% introductory APR on purchases for 15 months

- Get a $200 bonus after you spend $500 in the first 3 months

- Redeem cash back with no minimums

- Rewards dont expire as long as your account is open

Also Check: Sync Ppc Credit Card

Tips To Get A High Credit Score

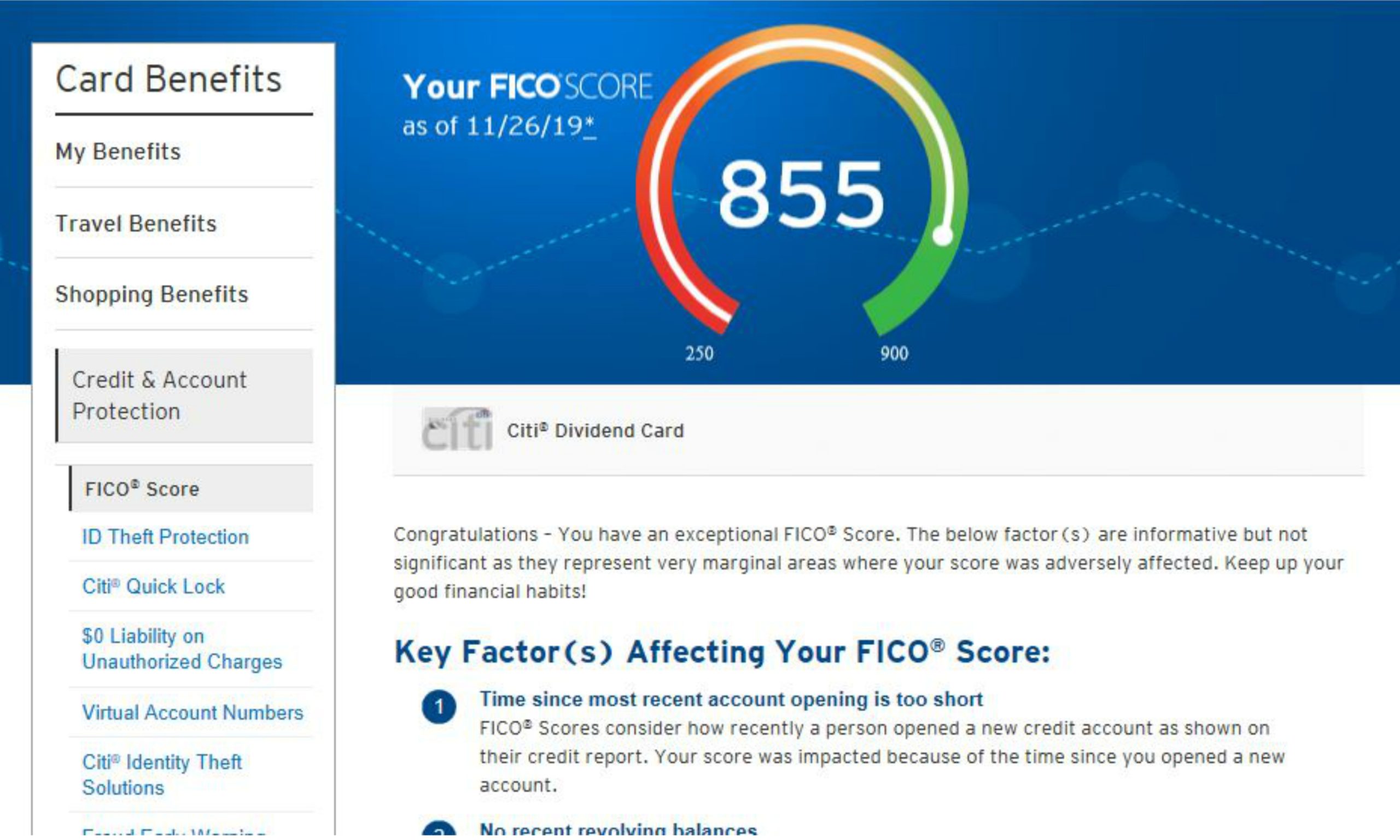

For years, its been widely reported that fewer than one percent of American adults have a FICO credit score of 850.

So, how did Stevens and Ulzheimer climb to the top of the credit-score mountain? Both of them say it was a slow trek that was aided by responsible handling of debt.

Ulzheimer says some of the control over your credit rests with you, while some of the control is out of your hands.

Just like a professor who grades your college coursework, credit-scoring models grade you on your credit activity. So while you might think you deserve a perfect score, the professor or in this case, the credit-scoring model has the final say over your grade.

How do you improve your credit?

Theres no quick fix. Improving your credit health takes time, but the most important behaviors can be summed up as this: Pay your bills on time and reduce the amount you owe. It also helps to check your credit reports regularly and dispute any errors you see, such as a collections account that hasnt been removed from your reports after seven years from the original delinquency date.

Based on the experiences of Stevens and Ulzheimer, what follows are some things you can do to aim for the FICO 850 mark .

Keep in mind, though, that their circumstances are unique, and what theyve done to achieve a FICO 850 score might not work for you.

Heres the advice they gave:

How To Get Your Credit Score To 800 Or Higher: Complete Guide

Do you know your credit score? The three major credit bureaus, Equifax, Equestrian, and TransUnion, compile information from credit reporting agencies to calculate your credit score.

Our credit score determines our level of creditworthiness. When we want to take on debt, such as a car loan, mortgage, or a credit card facility, lenders look at your credit score to assess their risk in loaning you money.

If you have a credit score under 500, the chances of you obtaining any credit facility are slim. If a lender does decide to take a chance on you, then the facility will undoubtedly come with unfavorable terms, such as high-interest rates. This strategy helps banks to discourage you from taking on debt that you cant afford to repay.

However, if you have a credit score over 750, then lenders view you as a prime customer, offering you the best APR rates, and rewards programs to encourage you to use the facility. People who have a credit score of 800 or more are in the best financial position to apply for new credit facilities. Banks see these clients as low-risk, and they are willing to open any credit facility the customer requires.

So, how do you get your credit score over 800? Follow this brief guide of tips to help you reach the upper-echelon of creditworthiness.

Also Check: When Do Things Fall Off Your Credit Report

Report Your Monthly Bills To A Credit Bureau

Thanks to tools like * and Experian Boost, you can report certain bills to a credit bureau to help you improve your credit with payments youre already making. With CreditBoost, renters can report their on-time rent payments directly to TransUnion to help build their FICO 9, FICO XD, and VantageScore credit scores with ease.

For a small fee of $3.95/per reported month, you can easily report past and future rent payments to one of the three main credit bureaus to help get you that much closer to your goal of attaining an 800 credit score. All you have to do is invite your landlord to Avail to set up your account. Then, once youre ready to make a payment, you can turn on CreditBoost to start contributing to your credit immediately.

Optimize Your Credit Utilization Ratio

If you already have one or more credit cards, this could be the biggest move to make if you want to get to 800+. Its the second most important factor that affects your credit score, since it accounts for about 30% of your score. You can change it quickly, and it has a major impact if you get it right.

Ideally, you want a credit utilization ratio of below 10%.

First, if you carry a credit card balance from month to month, pay that off asap. The interest rates are horrendous and its negatively impacting your credit utilization ratio.

Second, if you have two cards that each have, say, a $7,500 credit limit, and you have $6,000 in debt on one card and only $1,000 in debt on the other card , then try to balance them out. Pay down the higher debt one first, so that none of your individual cards have a very high credit utilization ratio.

Third, even if you do pay off your credit card balance each month, your payment timing might be unfairly hurting you. Credit card issuers usually report your credit information to the credit rating agencies once per month, around the end of your billing cycle. But what if you just paid for a major $3,500 car repair on your $5,000 limit card right before they report your credit utilization? Theyll say you have a 70% credit utilization ratio, which is bad, even though you always pay your card off every month.

There are two main ways to fix that:

Read Also: Does Paypal Credit Report To Credit Bureaus

Plan To Resume Paying Loans

If you’ve taken advantage of relief measures passed in the Coronavirus Aid, Relief and Economic Security Act, such as student loan or mortgage forbearance, you may be preparing to resume those payments. Contact your lender to make sure you understand any modified repayment terms, and review your budget to determine whether the resumed payments will stretch you financially. Consider cutting your expenses or earning extra income through a side job to ensure you can make all of your loan payments on time and in full.

Now You Qualify For The Lowest Interest Rates And Best Credit Cards

Thomas J. Catalano is a CFP and Registered Investment Adviser with the state of South Carolina. He is a CFP, registered investment advisor, and he owns his own financial advisory firm. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If youve earned an 800-plus credit scorewell done. That demonstrates to lenders that you are an exceptional borrower and puts you well above the average score of U.S. consumers. In addition to bragging rights, an 800-plus credit score can qualify you for better offers and faster approvals when you apply for new credit. Heres what you need to know to make the most of that 800-plus credit score.

Read Also: What Is Syncb Ntwk On Credit Report

How To Improve Credit Utilization Ratio

These five tactics can help you improve your credit utilization ratio if you believe it is lowering your credit score.

1. Pay off your debts. Paying more than the minimum on your credit cards each month will help you pay off your debt. Consider making two or more credit card payments per month even minor extra payments will help you pay off your debt faster and keep your utilization ratio low throughout the billing cycle.

2. Use a personal loan to refinance credit card debt. Credit card debt can be refinanced with a personal loan in a variety of ways. For starters, combining numerous credit card balances into a single loan will minimize the amount of interest you pay over time, allowing you to put more money toward principal and pay off the debt sooner.

Second, many consumers find it easier to keep track of one monthly loan payment rather than several credit card installments. Finally, your credit usage ratio decreases if you keep your credit cards active after shifting the debt to a personal loan.

3. Request for a higher credit limit. You can also lower your credit use ratio by requesting an increase in the credit limit on one of your cards. According to CreditCards.com, 89 percent of consumers who request a higher credit limit receive one. 4 Lets imagine you have a $8,000 balance on a card with a $10,000 credit limit. Increase your credit limit from $10,000 to $15,000, and your credit usage ratio will drop from 80% to 53%.

Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

You May Like: Remove Items From Credit Report After 7 Years

Check Your Credit Report

The best advice I can give for people starting to look into this is to sign up for a FREE credit monitoring service. It used to be that this was almost impossible to get and would often cost money, but today there are services that are free and easy to use.

Ive used , they are not paying to say this. Ive used them for years, Ive recommended them to all my family members. Its 100% free, I just log in every few months and just go over the reports to make sure everything is looking good.

Ill put a link in the description, sign up asap, you dont need a credit card, they make their money by recommending you products that you might find useful, but they are not annoying about it, which is nice.

Have A Credit History

You not only want a good record of paying your bills and credit cards on time, you also want a long history of doing so. The older your credit accounts are, the better your credit score will be. You want to have credit accounts that have been open for 10 years or more.

Length of credit history accounts for 15% of a credit score, and closing old accounts can affect your credit score, Ross says.

Don’t Miss: What Is Attcidls On My Credit Report

What Happens If You Have A 800 Credit Score

If you already own a home and dont ever borrow money or use credit cards , then actually NOTHING happens.

All an 800 score means is that you do borrow money frequently and you do an excellent job of repaying it. Believe it or not, if you paid cash for your house and never borrowed money, your credit score would actually be 0.

A credit score is not a measure of wealth or even a measure of financial performance. It is a measure of how much and how well you borrow money.

Now if you do borrow money responsibly, the biggest impact an 800 credit score will have for you will be on lower interest rates on credit cards or bank loans or mortgage rates.

If you already have credit cards, though, you will likely have to ask them for lower rates as they arent likely to just lower them automatically.

How Long It Takes To Raise Your Score

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

Recommended Reading: When Does Usaa Report To Credit Bureaus

Add Yourself As An Authorised Member

This trick is not very well known by many people but can help you raise your credit score to 800 in snaps.

Add yourself as an authorized member to your familys credit card your credit reports are automatically backed by that credit cards historical reports when you do so. If you are getting an authorization on your sisters card who has a credit score of 800 and you are having a credit score of 750 and around, there is a high chance that you get to the score of 800 when you get clubbed.

This does not limit the range of credit scores, but it is always better to get authorization on higher credit scores.

How To Increase Credit Score To 800 And Above

A good credit score opens up a lot of possibilities for you.

You can get the greatest credit cards and the lowest interest rates on any loans you take out by shopping around. If you apply for a mortgage without a good credit score, youll waste a lot of money.

It can even help you acquire a job or find nice housing because employers and landlords examine it frequently. Its the financial industrys best guess about your level of responsibility, and it has consequences that go beyond money.

With these top 10 tips, we will teach you how to increase credit score to 800 and above!

Read Also: Credit Score Needed For Les Schwab Account