Difference Between Soft And Hard Credit Inquiries

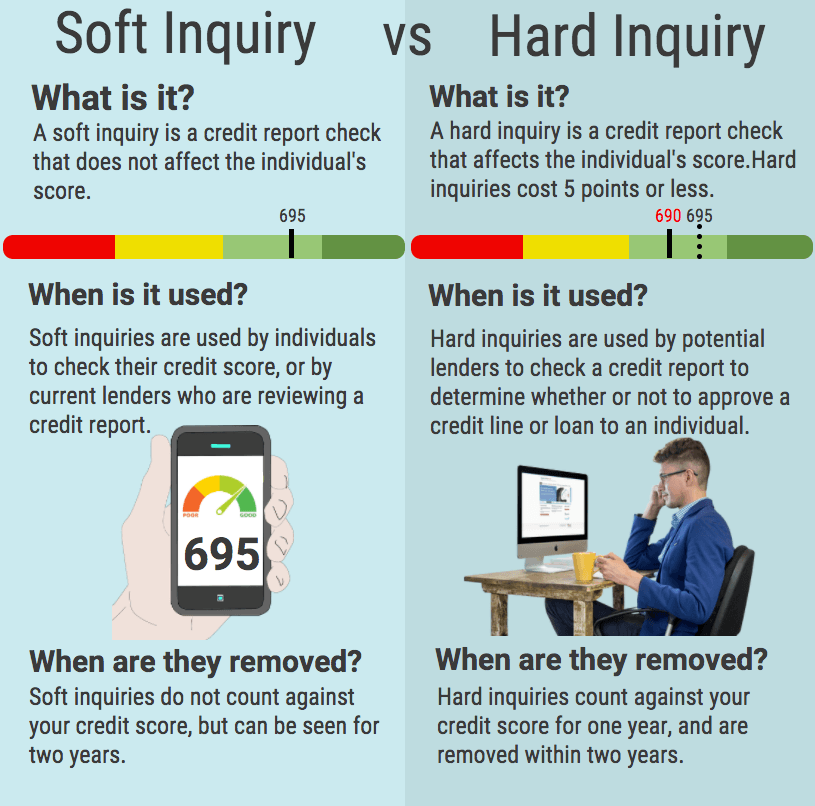

Soft credit inquiries dont affect your credit score, but hard inquiries can cause your score to lower.

Edited byAshley HarrisonUpdated October 13, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Lenders use a soft credit check or hard credit check to determine your creditworthiness.

Hard inquiries appear when youve given someone permission to check your credit report in order to process a credit or loan application these can also lower your score. Soft credit inquiries dont harm your credit score but do involve someone checking your score.

In this post:

Whats A Soft Credit Inquiry

According to the Consumer Financial Protection Bureau , a soft checkâalso known as a soft inquiryâis a review of your credit file and existing accounts. Soft inquiries donât impact your credit scores.

Examples of Soft Credit Inquiries

- Viewing your own credit reports and scores.

- Opening a bank account.

- Pre-qualified or pre-approved credit card offers.

How Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry can shave up to 5 points off your FICO score. However, with the most-used FICO model, all inquiries within a 45-day period are considered as one inquiry when you are rate shopping, such as for mortgage, student and auto loans. Older FICO models and VantageScore, FICO’s competitor, also group inquiries for rate shopping, but into a 14-day period. A VantageScore spokesman said a hard inquiry can shave up to 10 points off a VantageScore.

Most lenders or card issuers will pull a credit report from just one of the three major credit bureaus Equifax, Experian or TransUnion. So the inquiry will show up on only one of your credit reports. The exception is for a mortgage, when all three credit bureaus are usually checked.

It is smart to limit hard inquiries. Before you apply for credit, check to be as certain as you can that you are likely to be approved so you don’t lose score points without getting the approval you seek. Avoid applying for credit on impulse. Consider whether a discount or bonus you are hoping to receive is worth the potential ding to your credit score. If you have excellent credit, a few points may not be a big deal. However, if you have borderline credit quality, think twice.

Also Check: 8773922016

How Does It Affect Your Credit Score

Hard inquiries can negatively affect your credit score because it indicates that you have trouble making your debt payments. If you have missed several bill payments, lenders might assume you are likely to do the same again in the near future. It could result in your loan application being denied or your interest rates being increased. A hard inquiry occurs when a lender requests your credit report from the credit bureau to obtain the information it needs. Those inquiries appear on your credit report, and you may find yourself ineligible for new credit cards or loans.

Carefully Plan Your Hard Inquiries

Dont start applying for credit until youre serious about it, then you can stick to this time frame.

If you are shopping around, youll start to have separate hard inquiries stack up on your credit reports when they are spread out over time. It always helps to have a financial goal with a deadline so you can plan your inquiries in advance.

If youre not applying for too many types of credit at the same time, then you probably wont have to worry about disputing inquiries you can just leave them alone.

However, if you have several different types of inquiries, you may want to consider disputing them because they can add up as lost points. And if your credit score is borderline between two scoring categories, then every few points can make a difference.

Also Check: Annual Credit Report Itin

How To Minimize The Impact Of Hard Credit Inquiries

If you want to minimize the impact of hard credit inquiries, try to avoid applying for a lot of new credit all at once. That way, your credit report doesnt bear the burden of multiple credit card applications and the associated hard credit pulls.

If youre taking out a car loan or a mortgage, try to condense your credit shopping into a short time period.

The best way to minimize impact is to shop around in a short period of time, no more than 45 days, explains Ulzheimer.

The credit bureaus often track this type of rate shopping as a single credit inquiry, which will do less damage to your credit score.

That said, Ulzheimer advises consumers to not worry too much about whether inquiries will impact their credit.

I wouldnt worry at all about inquiries. They are the least impactful of all scored attributes, so there are plenty of other things that are considerably more important to worry about.

High credit card balances and missed credit card payments, for example, have a much larger effect on your credit score.

S You Can Take To Manage Your Hard Inquiries

Although a hard inquiry can have a negative impact on your credit report, the final effect is relatively small, at least until you apply for new credit multiple times. There are a few ways to better manage your hard credit inquiries, for example:

- Apply Within a Short Timeframe Its not always a great idea to apply for too much new credit. However, if you really need to, its best if you dont space out your applications too much. Actually, if you apply multiple times within a short window, a credit bureau may count them as a single hard inquiry.

- Limit How Many Credit Products You Apply For If you want to reduce the damage that hard inquiries can do to your credit score, one of the simplest solutions is to limit the amount of times you apply for credit in the first place. Do lots of research beforehand and only apply for credit products that you truly need.

- Check Your Credit Report Regularly Its possible that a new credit inquiry was placed on your credit report by accident or as a result of identity fraud. So, its smart to check both versions of your report for mistakes or discrepancies at least once a year. If you find one, file a dispute claim with the credit bureau right away.

Read Also: Removing Child Support From Credit Report

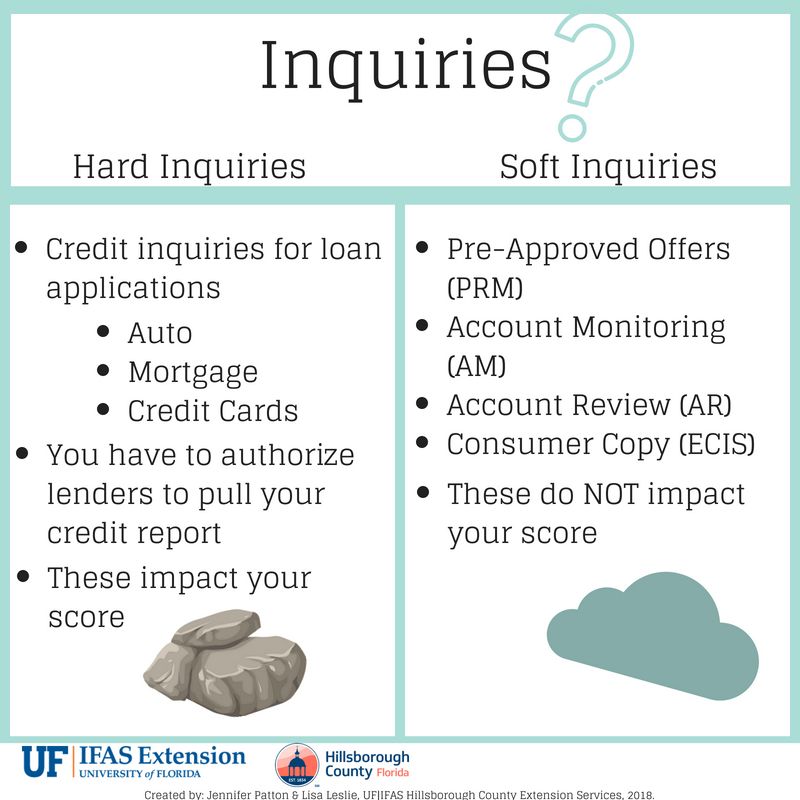

What Exactly Is A Hard Inquiry

In the credit world, when you apply for credit, the lender will pull your credit, which is referred to as a hard inquiry.

Its simply an evaluation of your credit by a potential lender.

A lender reviews your credit anytime you apply for a mortgage or auto loan.

Basically, if youve requested a business to review your credit for lending, then its going to be referred to as a hard inquiry.

How Often Should You Check Your Credit Report

Since all Canadians can request one free credit report a year from each credit reporting bureaus, once a year is a good place to start . For the average consumer, reviewing your credit report once a year should help you keep track of your accounts and make sure that there arent any issues. For anyone looking to make serious financial changes or who are currently experiencing financial problems, it may be in your best interest to check your credit report every 6 months.

Don’t Miss: Does Opensky Report To Credit Bureaus

Dispute An Unauthorized Or Inaccurate Hard Inquiry

Remember, if you did request the credit inquiry because you were applying for a loan, then you cant dispute it with the agencies.

But if something looks suspicious, then lets take action.

If you find you could have a case of identity theft youre dealing with, then you will need to file a police report.

You would need the information from your police report to help you dispute the unauthorized inquiry.

If you think this is a case of a mistake in reporting, then you can work directly with each bureau.

File A Dispute with Each Credit Bureau

Since you receive three different credit reports, youll need to dispute the inquiry with each corresponding bureau.

When A Credit Card Provider Or Lender Sees A Hard Inquiry On Your Credit Report This Is What They Assume

If you use the VantageScore method to create credit scores, hard inquiries are inthe less significant category. They make up only 10% of the FICO score. They play a significant role in credit card lenders and issuers assessing the risk you pose.

Lenders look at their credit reports to assess your creditworthiness. If, however, you have many requests regarding the credit record, that could indicate that youre in financial trouble and stand a higher likelihood of receiving credit soon.

Statistically, people who have more than six inquiries in the credit report are eight times more likely to declare bankruptcy than those with no queries to the credit records, according to FICO.

While these queries could be risky, lenders will look at other factors like your income and your payment history before deciding whether or not they will approve.

Recommended Reading: Does Lending Club Show On Credit Report

How Many Credit Checks Are Too Many

If you have a good credit score, the effects on your score could be minimal, especially if you’ve been keeping your balances low. But if you have a poor credit score and a high amount of unpaid balances, those credit inquiries may lead to application rejections and an even lower credit score.

To minimize the impact of opening up a new card account, try lowering your current debt first, to help bolster your credit score ahead of your application.

The Difference Between Soft Inquiries And Hard Inquiries

The most notable difference between a soft credit inquiry and hard inquiries is that a soft inquiry does not affect your credit score. A soft inquiry happens when youre pre-approved for something, usually a credit card. Soft inquiries may also be run by insurance companies, but they wont affect credit scores or show up on credit reports.

Other instances where soft inquiries occur include:

Youre trying to rent an apartment, and the landlord wants to make sure youre a creditworthy tenant. Sometimes, however, these inquiries can fall into the category of a hard credit inquiry, so make sure you find out before giving a potential landlord or property management company permission to delve into your finances.

Youve applied for a job, and your future employer wants a rough idea of your financial health.

You sign up for a credit tracking app, or your bank includes your FICO score in your account dashboard.

A creditor you currently have an account with checks your credit to ensure that youre still a good credit risk. If not, they may cancel your account or adjust your interest rate. Credit card companies are notorious for checking their customers credit reports.

Read Also: Does Paypal Credit Report To The Credit Bureaus 2019

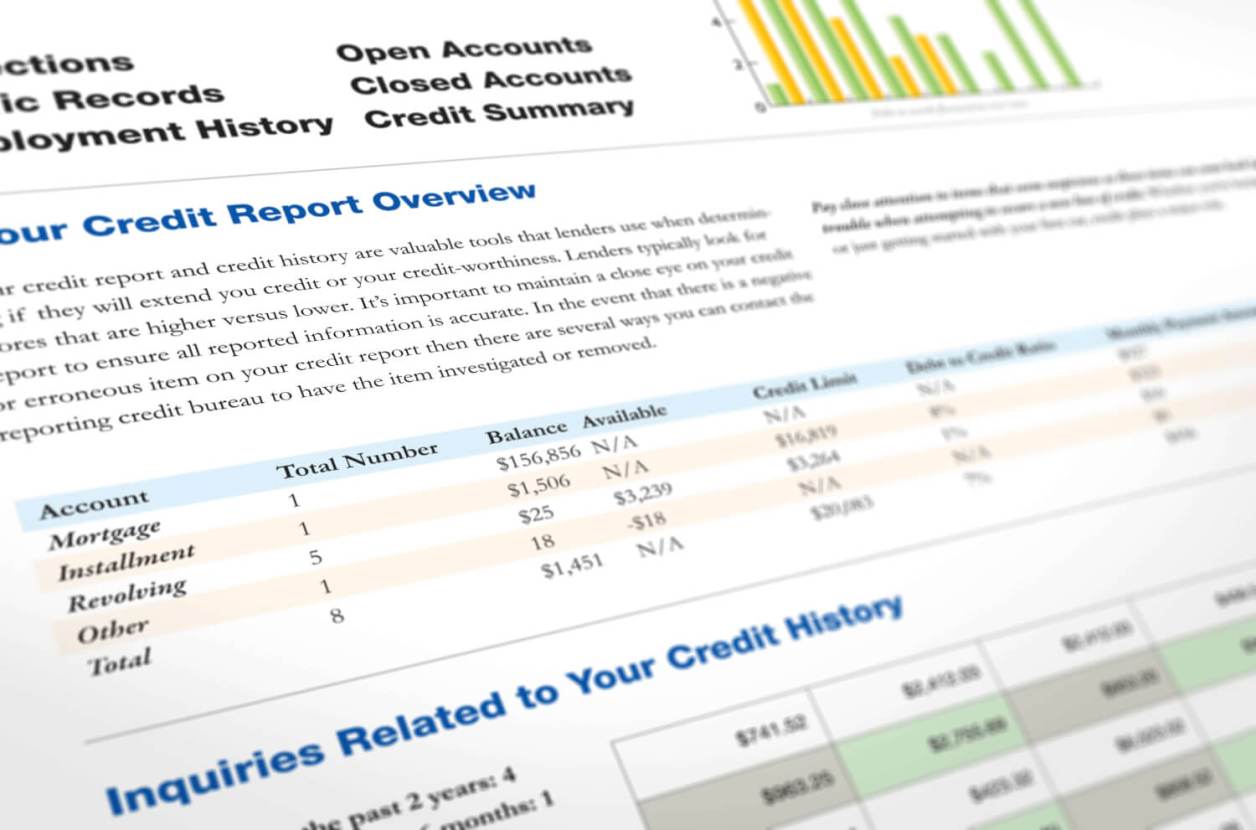

Check Your Credit Report

You can check your own credit report for free every year at AnnualCreditReport.com. When you look over your report, youll be able to see if any hard credit checks occurred recently.

When reviewing your credit report, check to see if there are any errors or credit inquiries you didnt authorize. These could be a sign of identity theft. You can dispute credit errors with individual credit bureaus like Experian, TransUnion, or Equifax.

If you find any inquiries on your report that you didnt authorize, you can submit a complaint with The Consumer Financial Protection Bureau about a financial product or service that used your information without your permission.

How Do Hard Inquiries Affect Your Credit Score

Hard inquiries have a negative impact on your credit score, in the short term at least. While a hard inquiry will stay on your credit report for two years, it will usually only impact your credit for a few months. Too many hard inquiries in a short time could make it look like you’re seeking loans and credit cards that you may not be able to pay back.

There are many factors that contribute to your credit score, however. The most important are payment historywhich accounts for 35% of your FICO® Scoreand credit utilization, or the amount of available credit you’re using, which makes up 30%. Applications for new credit account for just 10% of your score, according to FICO, so a hard inquiry won’t necessarily make a major impact.

There are times when a hard inquiry is unavoidable, such as when you’re applying for a mortgage or an auto loan. In these cases the credit bureaus recognize that you might submit applications to multiple lenders for one loan to compare rates.

As a result, you generally won’t be penalized for several inquiries appearing on your credit report for one loan type if they’re made within a 14- to 45-day period. On the other hand, applying for multiple credit cards and a personal loan in one week may be a red flag that you’re seeking credit you can’t afford. These will not be treated as one inquiry.

You May Like: What Credit Score Do You Need For Affirm

How Can You Reduce The Number Of Difficult Queries You Have

Although they cause small drops in credit scores, Hard inquiries arent a problem to be kept. However, its an excellent idea to be aware of methods to cut down on the number of inquiries appearing on the credit report.

IPASS Select has compiled some general guidelines to keep you at the top of your queries:

- Dont submit multiple credit applications for credit cards at an unrelated time. Most experts advise making one application for credit cards every six months.

- It is important to make sure you make an application for credit cards that are beneficial to you.

- Before investing to make a purchase, it is recommended that you verify your credit scores . The majority of card issuers provide this at no cost, and it can be obtained through apps such as The Scorecard Credit Scorecard and Chases Credit Journey .

- Do some investigation using the tools to determine whether you are eligible before applying for a credit card. These tools could aid you in determining your likelihood of being approved for the credit card without affecting your credit.

Next Stepscheck Your Credit Score & Report Regularly

Its a good idea to check your credit score at least once per quarter and your credit report once per year to check for errors. Free credit report websites can be a handy source to notify you about any new inquiries on your report. Signing up with one of these sites can help you receive any new updates about your credit reports in real-time.

Read Also: Does Lending Club Hurt Your Credit

Examples Of Hard Credit Inquiries

Hard inquiries typically result from applying for a loan or line of credit. Credit card issuers and lenders that let you prequalify for offers may perform a hard credit check when you move forward with an application. Some lenders dont let you check your offers with a soft inquiry. Youll have to decide whether its worth applying and allowing a hard inquiry to be reflected on your credit reportwhich can stay on your credit report even if your application is denied.

Review Your Credit Reports For Free

Your first step in reviewing hard inquiries is to pull your own credit reports.

But dont worry, you wont be dinged for checking your credit because as a consumer you are entitled to a free report annually from each of the credit bureaus.

The three credit agencies are Equifax, Experian and TransUnion. But you can also visit MyFICO for obtaining your reports and your credit score.

Its tempting to not look at your credit too often, but trust me, knowledge is power!

Youre not only evaluating your current score, but youre confirming if the hard inquiries listed are legitimate.

Recommended Reading: Paypal Credit Credit Bureau

How Are Hard Inquiries Different From Soft Ones

There are two types of credit inquiries, hard and soft. Soft inquiries are the ones that do not affect your credit score, while hard inquiries can lower it. Even though you probably have received a number of soft inquiries over the past 6 months, only up to 2 of them will be reported on your credit reports and they will not harm your credit score at all.

In order to better understand the difference between hard and soft inquiries, its best to use the following example. If you have applied for a credit card and were declined, this type of inquiry can be considered as a hard inquiry since it affects your credit score, but only negatively. However, if you have received a number of promotional offers in the mail or emails without applying for any credit cards or loans, those are considered soft inquiries.

Removing hard inquiries from your credit report is an essential step to take in order to get the highest possible FICO score. We hope that this article gave you some helpful tips and tricks that will help you avoid lower scores by removing some hard inquiries on your account.

The views/opinions expressed in these comments are solely those of the author and do not represent those of Island Echo. House rules on commenting must be followed at all times.

If you have a news story that you think we should know about, then get in touch.

Telephone: 01983 898288

You can also now send us Anonymous Tip-Offs.

Useful Links

Cookie Consent

Privacy Overview

Combining Multiple Inquiries For Credit Cards

The shopping around logic that combines multiple inquiries for auto, mortgage, and student loans is not designed to work for credit cards.

With installment loans, even though you may be approved for the loan, you still have the option of choosing whether or not you want to accept the loan and take delivery of the money. You will probably not open all the accounts, so multiple inquiries can be collapsed into one.

Sometimes, however, if you apply for multiple credit cards with the same issuer in a short period of time, you may only end up with one inquiry on some or all of your credit reports. This is not because the issuer is combining the inquiries and only pulling your credit once. Instead, the credit bureaus see that you have multiple inquiries that look exactly the same, because theyre from the same issuer on the same day. Since the credit bureaus want to avoid duplicate information and the inquiries look identical, they may only count one of them.

You May Like: Does Paypal Credit Report To Credit Bureaus