What Other Free Tools Does Credit Karma Offer

Free credit reportsOn Credit Karma, you can check your free credit reports from Equifax and TransUnion. And as with your credit scores, you can check your free credit reports as often as you like.

Free credit monitoringCredit Karmas free credit-monitoring service can alert you to important changes on your Equifax and TransUnion credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can sniff out any suspicious activity.

Mobile appThe allows you to check your credit scores on the go. The app also features tools ranging from the newRelief Roadmap to opt-in push notifications that help alert you to potential changes on your Equifax or TransUnion credit reports.

Enter Your Personal Information

Once youre on the correct website, click on the button near the top of the page or bottom left that says, Request your free credit reports. Afterward, click on the button with the same words below the line that reads, Fill out a form. Finally, complete the form by entering your name, birthdate, current address and Social Security number .

If you havent lived at your current address for at least two years, youll have to enter your previous address, too.

Why Should You Check Your Credit Report

Mistakes happen. In fact, a study finds that 34% of consumers have at least one error on their credit report. These errors can affect your ability to get approved or cause you to pay higher rates when you are approved. The only way to verify that your credit report contains the right information is to review the information on an ongoing basis.

Recommended Reading: Can Medical Bills Affect Your Credit Score

Best For Improving Credit: Creditwise

-

Only offers TransUnion report access

-

Sign-up required

You can check your TransUnion credit report and credit score through CreditWise, a credit report and credit score tool from Capital One. Credit Wise is available for free, even for those who arent Capital One customers. Signing up is simple and easy. You wont have to enter any credit card information, theres no trial subscription to cancel, and your credit information is updated weekly. You can access Credit Wise online or use the mobile app to keep up with your credit score.

Best Ways To Build Credit

Fortunately, there are a range of options to help you establish credit and build your credit score. You can:

- get a secured credit card

- be added as an authorized user to a loved ones credit card, or even

- take out a credit-builder loan .

To offer more in-depth guidance on how to establish and build credit, weve put together some of our best credit-building tips below.

You May Like: How To See Derogatory Marks On Credit Report

How To Get A Free Credit Score

There are dozens of free credit score services available that offer your free FICO Score or VantageScore. Here are some popular free credit score resources.

Information about the Capital One Secured Mastercard has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

*Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

For rates and fees of the Discover it® Secured Credit Card, click here.

For rates and fees of the Discover it® Balance Transfer, click here.

here to view the Cardholder Agreement for the OpenSky® Secured Visa® Credit Card.

Editorial Note:

Free Credit Score And So Much More

Get more than a free credit score with NerdWallet.

Get to know your credit score.

FAQs

Is my credit score really free?

How can I check my credit score? How often does it change?

Is it secure? Can I check my credit score without hurting it?

Where does NerdWallet get my score?

Get your free credit score.

By NerdWallet, reviewed by Liz Weston. Updated July 1, 2022.

What goes into my free credit score and what doesn’t?

Payment history:Age of credit history:Applications:Type of credit:

What is my credit score and why does it matter?

What can I do with my credit?

How are credit scores and credit reports different? What are the three credit bureaus?

What is a good credit score? What are the credit score ranges?

Excellent credit:Good credit: Fair credit: Bad credit:

How can I build my credit score?

Pay all your bills, not just credit cards, on time.Use no more than 30% of your credit limit on any cardKeep accounts open and active when possibleAvoid opening too many new accounts at once.Check your credit reports

What if I’m just starting out?

Recommended Reading: How To Get Old Delinquencies Off Credit Report

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Whats The Difference Between A Credit Score And A Credit Report

Your credit report is a record detailing all of your credit history, while your credit score is a numerical score that is calculated based on the information in your credit report. To use an analogy, if your credit report is a report card detailing all your past assignments, your credit score is your final grade in a class.

One important thing to know is that you can dispute information on your credit report, but you cant dispute your credit score. If you notice any errors or inconsistencies on your credit report, you should report them to the credit bureaus immediately to avoid any negative effects on your credit score. Conversely, if you notice a sudden drop in your credit score, you should check your credit report to discover why and report any potential mistakes.

Another thing to remember is that youre legally entitled to a free copy of your credit report annually, but theres no such law regarding your credit score. Most credit card companies and banks provide credit score updates for free.

You May Like: How To Remove Closed Accounts From Credit Report

Request Credit Reports & Answer Any Security Questions

After you fill out the form, you can request your credit reports from the three major credit bureaus. Youll likely be asked to answer some security questions to verify your identity. For example, you may be asked when you were born or information about past accounts you may have owned. In addition, you may be asked to provide your phone number to receive a one-time password.

Understanding Your Credit Score

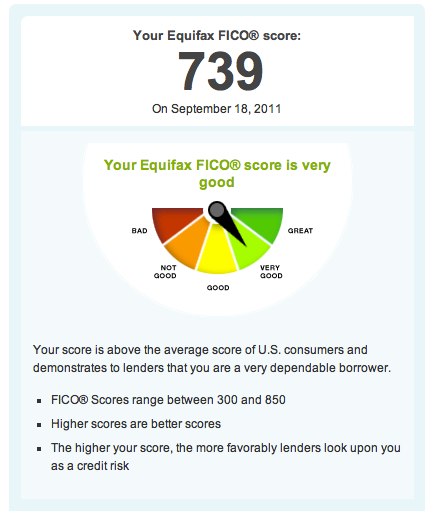

When you receive your credit score, keep in mind that there are numerous credit scoring models, and you likely have multiple credit scores. Your credit score may vary depending on the site or bureau.

FICO and VantageScore are two widely used scoring models, but these scores break down even further. According to Debt.com, there are at least 16 different FICO credit scores and many of them are industry-specific.

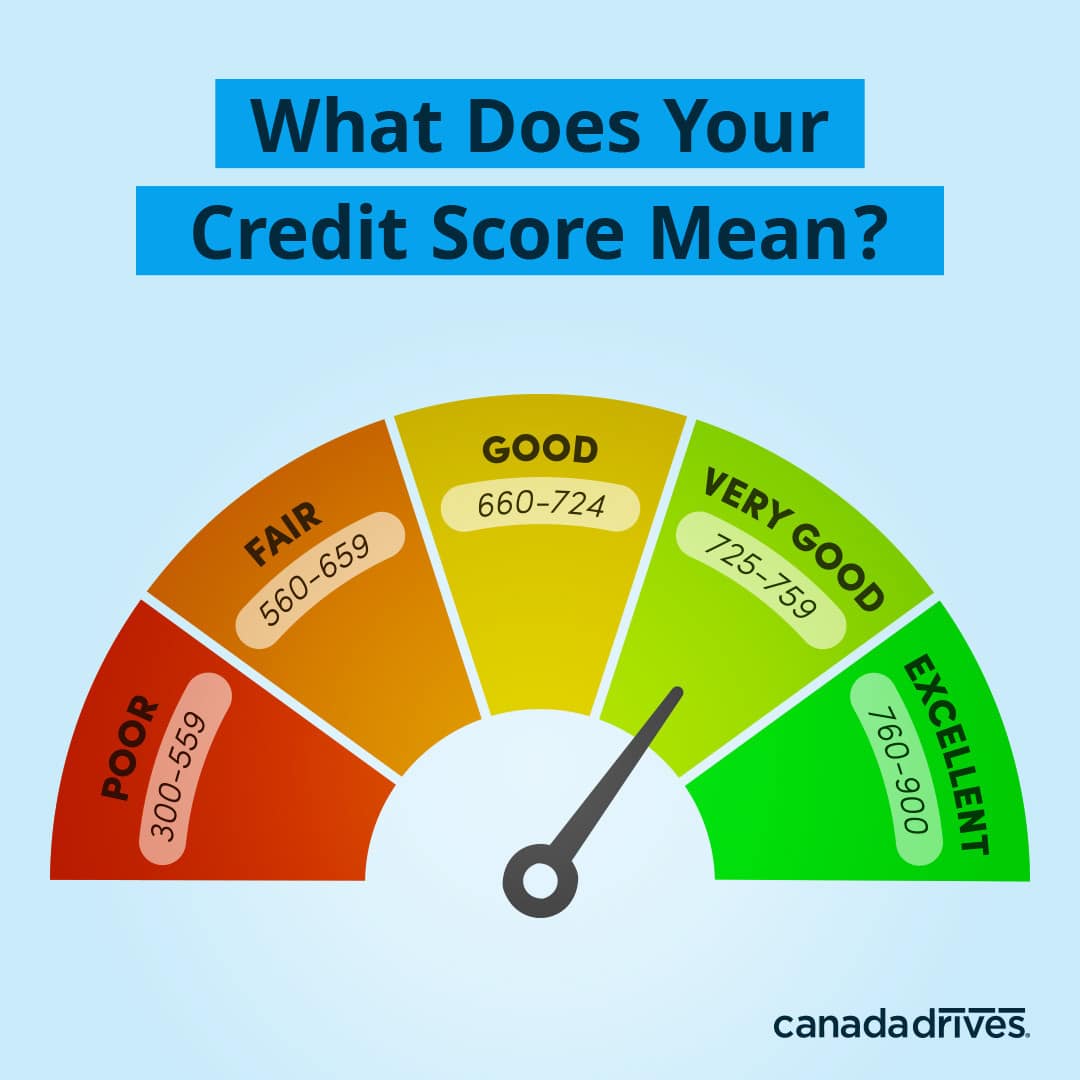

Try not to pay too much attention to the exact credit score number. Instead, focus on the credit range your score falls in, as that lets you know where your credit stands and if it is poor, fair, good, very good or exceptional.

A good FICO score is between 670 and 739, while a good VantageScore falls between 720 to 780. Conversely, a FICO credit score is considered fair or bad if it falls below 670. Along these lines, a VantageScore between 658 and 719 is fair, and scores of 600 or lower are considered either poor or very poor. Here’s a breakdown to better compare the two:

You May Like: What Credit Score Do Mortgage Lenders Use

How Can I Build My Credit Fast

Since your credit impacts so many aspects of your life, its normal to feel a sense of urgency to build credit. However, building credit is usually a hurry-up-and-wait situation. Your credit score is a way to show lenders that youre trustworthy, and that trust takes time to build.

If youre smart with your credit minimizing its usage, making payments on time, keeping your accounts open, and eventually having different types of credit then your score will grow. This can take some time and patience is key.

Its Been Awhile Since You Checked

Youre entitled to a free copy of your credit report once a year from each of the three major credit reporting bureausEquifax, Experian and TransUnion. You can access these reports by going to AnnualCreditReport.com. Remember, your credit report wont show your credit score. If youd like to find out your score, you can do that for a fee at myfico.com. Its a good idea to stay on top of your credit, even if you dont plan to borrow money. If you find issues with fraudulent accounts or inaccurate information, clearing them up can be time-consuming. So its better to start the process now than miss out on a great new apartment or job opportunity down the road.

Read Also: Will Medical Debt Be Removed From Credit Report

Why You Should Check Your Credit Often

Even though some consumers worry about checking their credit frequently, its actually a smart practice. There are two reasons for this:

- Youll always have an accurate idea of what your credit score is.

- Youll be aware of any changes to your credit right away.

Its important to know your credit score in case you ever need to apply for something that requires a credit check. Lets say you want to get one of the best credit cards. Those almost always require good to excellent credit, and if you dont have that, youd be wasting your time applying.

Because your credit score can change at any time, you should get into the habit of checking yours regularly. If your score shows a significant drop, youll want to know about it as soon as possible so you can verify its not due to false information and work on repairing it.

Dont Miss: Which Credit Card Companies Report Authorized Users

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: How To Dispute Collections On Credit Report

What Affects My Credit Scores

It’s important to understand the factors that go into determining your credit scores so you know how to improve them if necessary. For the FICO® Score, the credit score version you will receive through Experian, there are five main factors that impact your score. They are all weighted differently:

When you receive your credit score, you should also get some guidelines on your score profile and why your score ranks where it does. This will include information on what’s hurting it and what’s helping your score, as in the image below:

These guidelines will help you figure out what you need to do to maintain a good FICO® Score, and what you need to do to improve it. For example, if bad payment history is one of the reasons your FICO® Score is on the lower side, you should focus on paying your bills on time. Consider automating your payments so you never miss them again.

How Do I Run A Credit Check Without Hurting My Credit

Some places may charge you to check or monitor your credit. But you donât have to pay to use . You can use it to access your TransUnion credit report and weekly VantageScore 3.0 credit score for free anytimeâwithout negatively impacting your score.

You can even see the potential impacts of financial decisions on your credit score before you make them, with the CreditWise Simulator.

Also Check: Why Does Credit Karma Show A Higher Score

How To Check Credit Score

The easiest method for checking your credit score is requesting one from Equifax. When you apply for your credit report, well need some of your details. These details can include your drivers licence, passport, and Medicare cards. Well require you to complete a 100-point identity check . After all the required documents have been sent and accepted, well process your report and send it to you. After receiving your report, you can read through it and check that everything is accurate according to your records. The report will detail your credit dealings and give you a score from 0 to 1,200. The higher the number on your report, the better your credit rating. You can request your credit score online every three months or within 90 days of having a loan application denied.

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Recommended Reading: How To Win A Dispute On Credit Report

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Does Checking My Credit Score Or Report Hurt My Credit Score

Checking your own credit score or pulling your credit report will never hurt your score. Ill repeat that for the people in the back: never!

There are two types of credit score checks: hard and soft.

Hard inquiries occur when you apply for a new credit account and a lender checks your credit score. They appear on your credit report and stay there for two years.

Too many hard inquiries at once might cost you a few points, but even they are nowhere near as impactful as your payment history or credit utilization. Dont worry about them too much.

Soft inquiries are the ones you initiate when you pull your score from a website or credit card company like those I mentioned above. They dont show up on your report, and they will never damage your credit score. Feel free to use them to your hearts content!

To continue learning about credit, see the following articles in the series:

You May Like: What Kind Of Credit Score To Buy A Car

Youve Seen Something Suspicious

If youve gotten a collection call for someone else, received information in the mail about a credit card you didnt open, or gotten a notice from the IRS that doesnt seem to apply to you, those are all signs your credit may have been compromised. A look at your report can determine whether theres fraudulent activity in your name.

How Is Your Credit Score Calculated

Your credit score is calculated by credit reporting agencies such as Veda, Australias largest.

Although these agencies score in different ways , in general the higher the number, the more likely you are to have your request for credit accepted.

To calculate your score, credit reporting agencies look at:

- Your debt , including any problems youve experienced repaying that debt

- Loans youve taken out for household, personal or family reasons or to buy, refinance or renovate a property or as a guarantor for someone

- Your credit cards and store cards

- Your current credit limit

- Accounts youve opened and/or closed

They will also check if you have a court writ or default judgment against you and look out for any history of bankruptcy.

You May Like: Is 684 A Good Credit Score