Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

What Do Apartment Background Checks Look For

A background check for an apartment can include a national criminal background check, credit report, eviction history, and employment history. Specific landlords or property managers may choose to run one or all of these screenings and applicants will need to give signed consent to have a background check performed.

Learning Your Credit Scores Shouldnt Be The End Of Your Credit Evaluation

Your credit reports from the three major consumer credit bureaus can help shed light on your credit history by showing information like why you may have been turned down for credit, how negative information may affect your credit, and whether someone tried to fraudulently apply for credit under your name.

Equifax, Experian and TransUnion issue separate credit reports, which may contain information about your credit activity, payment history and the status of your credit accounts based on reporting from creditors and other sources.

So why are these reports important? Because credit card issuers and lenders pull and review them to help determine things like whether youre a credit risk, what interest rate theyll offer you, and the amount of your credit limit. Your credit reports may also be reviewed when youre renting an apartment or purchasing insurance.

With so much information, where do you even start when it comes to reading your credit reports? Lets take a look.

If you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. You can also notify the creditor that reported the information and request that it send an update to the credit bureau.

Also Check: Is 524 A Good Credit Score

How To Use This Report

If you are applying as a tenant for a residential property, ask the management company for the name of consumer reporting company it will be using to screen you.

Contact the screener to fact-check your information and dispute it as needed. If a landlord refuses to rent to you or charges you more because of something in a background check, be sure to know your rights.

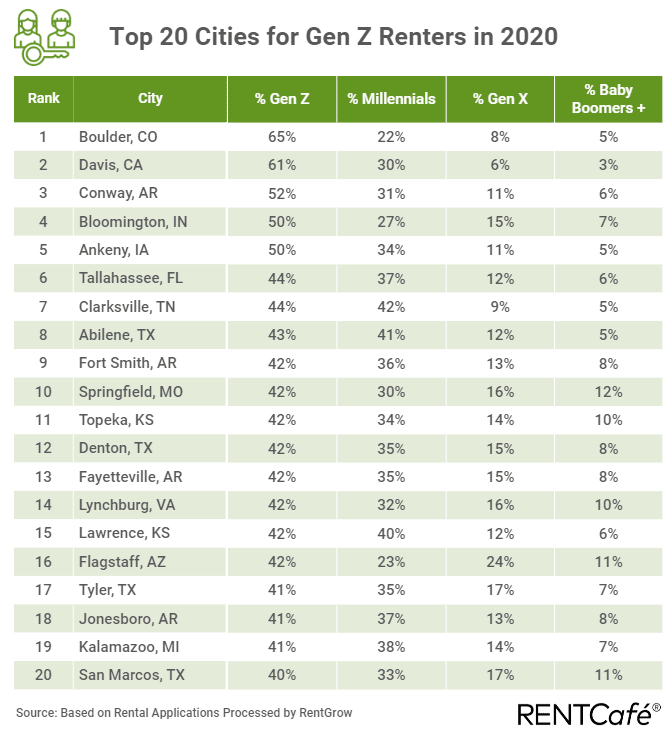

File A Dispute With Rentgrow And The Bureaus

Your first step when a questionable inquiry is added to your report is to dispute it.

Both RentGrow and the credit bureaus should help you get the inaccurate entry off your report.

Hard credit inquiries can impact any one of your credit scores, or all three of them.

As such, you need to dispute the inquiry with every credit bureau that is displaying the entry from RentGrow on their reports.

The Fair Credit Reporting Act requires the credit bureaus to investigate disputes in a timely manner.

They have 30 days to look into a dispute once you file it.

If they find that its fraudulent or inaccurate, theyll remove it from your report.

You can submit a letter, report the dispute online, or call the bureaus to start the investigation.

In addition to disputing the entry with the bureaus, you should contact RentGrow.

The agency encourages individuals with erroneous entries to contact their Consumer Relations Team at 800-898-1351.

RentGrow should be able to give you helpful information about the application that triggered the inquiry, helping you to determine whether a reporting error or identity theft is to blame.

Read Also: Does Having A Mortgage Help Credit Score

Different Credit Check Different Schedules

A credit check is slightly different from a full background check, and the time that it takes to have a credit check returned is often dependent on your prospective tenant. Some landlords dont mind having the tenant involved, while others prefer to have quicker turnaround times. Youll want to factor this into your decision-making when ordering a credit check.

We offer a simple credit check, and youll have your report within the hour during business hours. That is because these reports require zero tenant involvement.

We also offer SmartMove reports, which oftentimes are labeled as instant tenant screening reports. There truly are no instant services because tenant involvement can slow down the process.

With our SmartMove reports, youll provide the tenant applicants email address and then they are asked a series of questions to verify their identity.

If your tenant applicant does this within 10 minutes, youll have an instant report within 15 minutes delivered to your inbox. If your tenant applicant takes five days to respond, then your report will be turned around in five days.

The SmartMove Report also includes an option to add-on income verification where landlords can verify the income of non-traditional earners and self-employed applicants. With the income verification service, landlords will receive an annual net income summary, average monthly net income, and the amount in any current accounts that the tenant connected.

Can Freezing Your Credit Hurt Or Help Your Score

A freeze doesnt do anything to your score, per se.

It only makes sure that fraudsters wont access your report or open new accounts in your name.

If you need to curb the impulsive behavior of applying for new credit cards, then freezing your credit might also help you kick the habit and help you focus on paying down your balances.

In this sense, it might help your score.

Also Check: How Long Does A Delinquency Stay On Your Credit Report

How Long Does Yardi Screening Take

Yardi Breeze features an optional, built-in prospect screening service. This program takes less than 60 seconds to complete a background check, credit check and eviction check. Resident screening doesnt have to be a long, difficult process. Its actually a great way to build trust in your rental community.

What Information Does Rentgrow By Yardi Systems Check

RentGrow provides all the information to check on a potential tenant.

RentGrow uses information that is provided by one or more credit bureaus and might also contain information provided by other screening agencies. RentGrow generates reports which may include but are not limited to the following:

- Civil or criminal records

Read Also: Will Paying Off Credit Cards Increase My Score

Can I Sue Rentgrow By Yardi For Tenant Screening Errors

You have the right to sue background check companies for damaging errors. If you were denied and apartment or home, or your lease terms were changed due to errors on your RentGrow tenant screening report, get a free case review.

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

Recommended Reading: How Long For Credit Score To Update

Rentgrow Has Received Many Complaints And Bad Reviews

The Better Business Bureau gives RentGrow an A+ rating, but 112 consumers rate the company at 1.04/5 stars. As of 2022, RentGrow has received 242 complaints on its BBB profile in a three-year period. The bulk of the complaints are centered around poor customer service and providing inaccurate information on rental inquiries.

Google reviews for RentGrow come in at 1.1/5 stars, with many consumers reporting the same type of problems above. Inaccurate information, slow responses to disputes, along with unhelpful or rude customer service make RentGrow an unpopular tenant screening company.

Let’s take a look at a real complaint against RentGrow.

This company inaccurately reported my credit information to an apartment I was applying to – leading to my denial . I contacted them, and once they learned on the phone that I wanted to file a dispute of their report on my credit information – they hung up.You cannot file a dispute on their dispute portal online. You cannot print out a print copy of their dispute form to email to them. They will not respond to my emails, and now I have lost out on an apartment for which I should have been approved .

What Information You Need From A Tenant To Run A Credit Check

To run a credit check on a tenant applicant, you will need to gather some of their personal information and enter it into the desired reporting system. Specifically, you will need the following from the prospective tenant:

- Social Security number or ITIN

Without this information, you will not be able to run a full credit check on the applicant. Inquiries on credit are limited to those who have the correct information and permission to do these checks. This is because hard inquiries on credit can cause credit scores to change, and it would be unfair to consumers to allow these inquiries without permission.

Suppose you are worried about collecting this information directly from a tenant or you have tenants who are weary of sharing personal information directly. In that case, it might be in your best interest to sign up with a tenant screening service. Reliable services will allow you to email the applicant and then they can enter their information directly.

Not only is this more secure, but it also allows you to have the tenant pay for their screening cost directly rather than needing to collect the money yourself. Many landlords find this to be a more favorable way to run credit checks for that reason.

If youre ready to learn more about tenant screening today, dont hesitate to take advantage of the great tenant screening packages we have available at RentPrep right now!

Read Also: What Is The Lowest Credit Score To Buy A House

Are There Any Alternatives To Freezing Your Credit

You can try and lock your credit cards if you suspect that someone is using them.

This will require you to call each one of your credit card companies and requesting a stop on them, which can be time-consuming if you have many.

This also means that you will not be able to use any of your credit cards.

However, if someone has your social security number, along with other personal identifiers, it will not prevent them from applying for loans, etc.

Another popular method is using a credit-monitoring service.

There are countless third-party services like Credit Karma, Identity Force, myFICO, etc. The credit-reporting agencies themselves also offer credit-monitoring services.

What Does Conditional Approval Mean For An Apartment

What does conditionally approved mean when applying for an apartment? Conditional approval means that subject to verification of information that they already have, something will be approved. For example: You told them you do not have a felony record. You told them you have never been evicted before.

Recommended Reading: How Long Does It Take To Build A Credit Score

What Do Apartments Check For In Rental History

What do apartments look for in rental history? In most cases, apartment managers and landlords look for several key elements on rental history reports. These elements include your previous residences, whether you have been evicted in the past, previous rental rates, and details about your income and credit history.

How To Dispute The Information In Your Report

If you find information in your consumer report that you believe is inaccurate or incomplete, you have the legal right to dispute the reports content with the consumer reporting company and the company that shared the information to the reporting company, such as your lender. Under the FCRA, companies must conduct free of charge a reasonable investigation of your dispute. The company that has provided the incorrect information must correct the error, and notify all of the consumer reporting companies to whom it provided the inaccurate information.

Recommended Reading: Will Applying For A Credit Card Hurt My Credit Score

Rentgrow Complaints Cases And Lawsuits

The following are RentGrow complaints and cases recently filed by the consumer law firm, Francis Mailman Soumilas, P.C.. In the cases below, inaccurate criminal history was on the RentGrow reports that resulted in the denial or delay of renting apartments for these consumers.If you have experienced any of the following, you too may have a case. Call us at 1-877-735-8600 for a free case evaluation.

Anthony Boyd v. RentGrow. C.D. Il Anthony Boyd was denied housing because of an inaccurate RentGrow tenant screening report. Specifically, the RentGrow report contained a civil judgement that does not belong to Mr. Boyd. RentGrow mis-matched Mr. Boyd with someone with a similar first and last name thus creating the inaccurate report.

Shawn Kelly v. RentGrow. Middle District of North Carolina RentGrow, Inc. prepared and sold a consumer report about Mr. Kelly that included a criminal record that had been expunged in 2017. As a result, Mr. Kelly was unable to rent an apartment.

Jeremiah Dauer v. RentGrow. District of Arizona RentGrow, Inc. prepared and sold a consumer report about Mr. Dauer that included a criminal record that had been expunged in 2017. As a result, Mr. Dauer was unable to rent an apartment

How Long Do Credit Checks Last

You can keep the credit report that you received about a tenant until you have made your decision. Then, you must destroy the records according to the rules of the FTC because this is a confidential consumer report.

If you have taken adverse action and denied an applicant based on their credit report, remember that you must alert them as to exactly why they received a rejection and how they can get a copy of the report within 60 days of your decision. Their copy of the report would come directly from the service provider, so you are still responsible for destroying your own copy of said report.

Also Check: Is 818 A Good Credit Score

What Is A Credit Check

A credit check, also known as a credit inquiry, is a report run by landlords to determine specific parts of an applicants credit history. The report may show the prospective tenants exact credit score, a credit score range, or another interpretation of some of the applicants financial history.

The type of credit score given usually depends on the tenant screening package being used by the landlord and the type of permission given by the tenant to check this information.

More detailed credit checks will give the exact FICO score. Less detailed reports will use credit scoring models to take the information in the credit report into account and generate a pass/fail score for landlords to view.

The credit check that you use as part of your credit screening criteria may vary depending on what type of unit you are renting out. Think about what type of information you need to make the best decision about whether or not to rent to a tenant.

What Is Experian Boost

Experian Boost is a feature that can help you boost your FICO® Score when you add on-time payments through the platform for utility, telecom, video streaming services and more. Boost now includes rent, which can be added along with your other payments.

To use Experian Boost, simply connect your bank accounts or credit cards that you use to pay bills to your Experian account. Boost searches your payment data looking for eligible payments. You’ll verify any payments you want to add, and then sit back and wait for your .

Experian Boost is a first-of-its-kind feature that gives consumers the control to add information to their and potentially raise their score in just minutes. As a completely free feature, Boost makes it easy for consumers to get credit for positive financial habits without extra cost or time commitment.

Also Check: Does Closing A Credit Card Hurt Your Score

I Have A Question Re The Letter Below Is It Saying I Did

Hello. My name is ***** ***** I have been a licensed attorney for over 24 years and hope to be of assistance. Please be advised that this website is for information purposes only and I cannot formally represent customers of this website or perform actual legal services on your behalf. I know your question is important and Im working on typing an answer to your question now. The site will offer you a premium service charge phone call and I would be more than happy to assist you via telephone if that would be easier for you. Sometimes responses and replies take time, and we ask you to be courteous and patient to allow the expert to type your answers to you and also to others.

I would be more than happy to assist you with your legal questions. I am sorry to hear about your issue with this apartment letter. I know that can be stressful and difficult to experience. It appears the letter is saying you are “conditionally” approved for the apartment. The reason you are not fully approved is a lack of credit history. It appears they have additional conditions that you would need to meet financially in order to get the apartment.

Did you have a ?

That is odd. They make it seem like you have no credit at all. I would recommend requesting the tenant screening report. Maybe it was a mistake.

Ok. Once you get it let me know if you have any follow up questions. I would be more than happy to assist you further.

Ways To Improve Your Credit Score

There are many ways to continue improving your credit on top of using Experian Boost. These include making positive changes to your credit use as well as trying out some new credit moves. Try these five ways to improve your credit score.

Don’t Miss: How To Dispute A Name On Your Credit Report