Court Ruling On The Eviction And Posting Of Writ Of Restitution:

The ellis act is a state law which says that landlords have the unconditional right to evict tenants to go out of business. for an ellis eviction, the landlord must remove all of the units in the building from the rental market, i.e., the landlord must evict all the tenants and cannot single out one tenant and/or remove just one unit out of several from. The court could grant your request for an order of restitution after an occupancy hearing, a trial or a default. The good news is that an eviction judgment is not stated on a credit report but will appear on consumer reports.

Impact Of Eviction On Credit And Future Housing

House & Apartment

Having an eviction in your past can make it more difficult to find housing in the future.

Eviction is a legal process where a landlord removes a tenant for breaking their lease agreement. Breaking the lease agreement is called a breach. A breach can be because of nonpayment of rent, repeatedly late payment of rent, having too many people inside the residence, subleasing without permission, damaging the property, having pets where prohibited, or any other conduct that the lease does not allow.

To be evicted, you must first have an eviction hearing. The hearing will be at your local Justice of the Peace court. The judge must decide against you and in favor of your landlord before you can be evicted.

Always go to your hearing. If you do not attend, you almost always lose. If you lose, you will have to move out, pay any rent that you owe, and may have to pay court fees.

However, just having an eviction case can make it harder to find housing. This is true even if you win.

Do You Still Have To Pay Rent After Being Evicted

After a tenant is evicted from a property, the landlord can no longer charge them monthly rent. … This means that if you send out an eviction notice and the tenant agrees to leave, they will still owe you for the previous months of back rent, but they will not be responsible for any month’s of future rent.

Also Check: How To Check Credit Score With Chase

Next Steps For Removing Evictions From Your Credit Report If You Can’t Do It Yourself

There are only two things you can do if you can’t remove evictions from your credit report. You can give up and forget about maintaining a clean credit history or find someone to help you work it out. However, the last thing you want to do is give up when you can find help elsewhere. This is where DoNotPay comes in handy.

Effective Ways: How Do I Get An Eviction Off My Credit

Catch It Before It Hits Collections · Communicate with the property manager and let them know you wish to remove a blemish from your credit. · Pay them or work

Mar 3, 2021 Removing the civil judgment from your credit report requires gathering the documentation proving the expunged eviction or dismissal, sending a

Aug 4, 2020 · 1 answerYou can get an eviction off your credit report by waiting until 7 years have passed, at which point it will fall off naturally. If more than 7

Don’t Miss: Zzounds Payment Plan Denied

Who Can See If I Have An Eviction On My Record

Evictions first require the landlord to obtain a civil judgment against you. The civil judgment is recorded on your public record and can remain there forever if no action is taken to have it removed. Public records, as the name suggests, are available to the public. Pulling individual public records is impractical however, since credit reports contain a “Public Records” section, the civil judgment will often show up there. Also of note, even if seven years have passed and the eviction is gone from your public records, the civil judgment may still show up on your credit report.

Property Damaging And Misconduct

In the cases of misbehavior, damage caused to the rental property, or complaints by other tenants and neighbors, the best way to resolve the issue is to apologize and rectify your mistakes.

This can be done by offering to pay for fixing the damage, keeping your behavior in check, and abiding by the rules.

Don’t Miss: Does Sezzle Affect Credit Score

Do Bankruptcies Clear Evictions

Evictions are often caused by an individuals inability to pay rent or mortgage. But, if they are bankrupt they may be able to avoid eviction.

A bankruptcy can stop an eviction by stopping foreclosure proceedings a debtor goes through in order to keep their home. This is because the debtors property may become exempt from asset seizures. As well as, being exempt from seizure for use of back taxes or debts owed to the government.

Even if a person does not file for bankruptcy, but still has their home foreclosed upon, this may also prevent their eviction as it will no longer be under the control of the lender that initiated foreclosure proceedings.

Donât Miss: Keyword

What’s The Impact Of Eviction On Your Credit Report

Evictions can significantly bring down your credit score. For instance, your landlord can sue for late or unpaid rent in a small court and win the case. And, when that happens, you’ll have a civil judgment that negatively affects your credit history and stays on your record for seven years.

Eviction information may not appear on your credit report but can still be found in your rental history report. However, if your landlord sold an unpaid debt following your eviction to a collection agency, then it can still appear on your credit report in the form of a collection account.

You May Like: Coaf Credit

How To Know The Credit Score In Usa

Category: Credit 1. How Can I Check My Credit Scores? | Equifax® Youre entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus by visiting www.annualcreditreport.com.Credit Scores · Credit Score Range · Equifax Core Credit · FICO Score You can

How Much Will A Judgment Affect My Credit Score

When judgments show up on your credit reports, they can do severe damage to your score. A judgment in your credit history means that a lender had such a difficult time recovering their money from you that they had to go to court.

Judgments tell potential lenders that you can’t be trusted to pay them back. Any lender still willing to do business with you will do so knowing that you are a risky customer. Because of this, they will likely impose stringent terms and higher interest rates to any line of credit they offer you.

Also Check: Walmart Affirm Apply

Solve Your Problem With Evictions On Your Credit Report With The Help Of Donotpay

Removing evictions from a credit report can be daunting. The process is tedious, and it’s pretty easy to give up along the way. Sadly, an eviction in your credit report can get in the way when house hunting. This is the last experience you want to go through. The good news is DoNotPay has you covered.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Negotiate With The Collection Agency

If your previous landlord turned your debt to collection agencies, you should contact the respective agency regarding this. You can then negotiate with them and have the eviction information and collection account removed from your credit records.

Removing a collection from your credit report can be done by offering a pay-for-delete agreement to the agency. You can also clear up your past dues in exchange for the removal of negative remarks from your credit history.

Again, it would help if you asked everything in writing to save yourself from being cheated and have proof for future reference.

Recommended Reading: How To Unlock My Transunion Credit Report

Why Should You Dispute The Eviction On Your Credit Report

If you arent paying your bills on time, the eviction will show up on your credit report for 7 years, just like any other negative account. Suppose you are trying to get back into the housing market after being removed from ones rental property, where rent is paid monthly. In that case, an eviction will have a negative impact to any potential landlords on your ability to get back in because of all the previous debts that were left unpaid before being evicted from properties.

Having an account with late payment history can affect your ability to get back into credit-related matters such as applications for new lines of credit at local bank branches or even apartment rentals!

To avoid having issues with creditors down the road when applying for a mortgage loan and other types of loans, its important to take steps towards understanding how to dispute an eviction on ones credit report.

Suppose youve been served with a lawsuit and your landlord sends the account into collections. In that case, it will be even more important that you understand how to dispute an eviction on ones credit report as opposed to disputing an eviction alone!

Furthermore, it helps to understand your credit and do everything you can to increase your credit score. Make sure you run a credit check on yourself . In many cases you can get a free report at no charge.

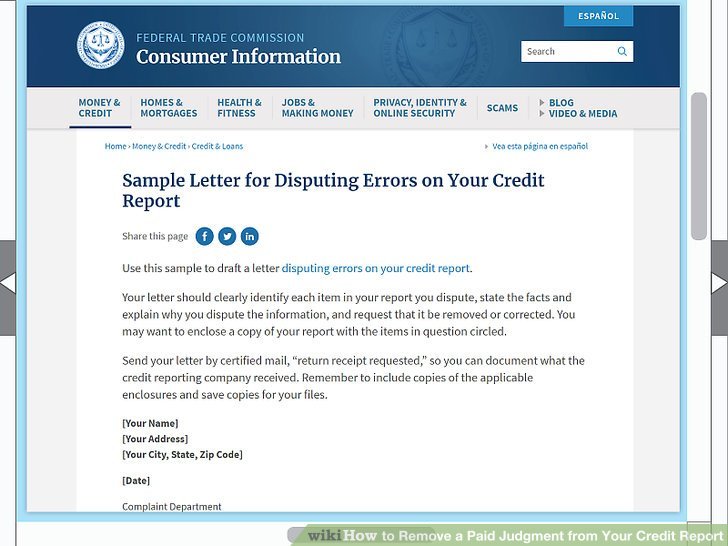

Challenging Errors On Reports

You’re in better shape if the reference to eviction is a mistake. For example, if the landlord incorrectly reported that he evicted you for unpaid rent, you have the right to get that corrected.

The Federal Trade Commission says you should contact the credit bureau in writing. Identify the item you object to, explain why it’s incorrect and attach copies of whatever documentation proves your case. The bureau has to respond in 30 days. Also contact the landlord or whoever provided the inaccurate information in writing with the same evidence and request a correction.

You May Like: Remove Transferred Student Loans From Credit Report

What Should I Do If A Creditor Tries To Sue Me

When a creditor tries to sue you, you’ll receive a court summons. Many people ignore the summons and don’t show up to court. If you’re not there to defend yourself, the judge usually issues a default judgment against you.

The judge may even order that your wages are garnished or place a lien on your property. If you show up, you can try to defend yourself. If you’re not sure what to do, then you can seek out an attorney for legal advice on how to handle the summons.

Can An Eviction Make It Harder For Me To Rent In The Future

Yes. Some landlords report to tenant screening services, like Experian’s RentBureau or TransUnion’s SmartMove. Even though your credit report may not read “eviction”, a check with one of these services will reveal your eviction record. If the screening service has incorrect information about your rental history, you should contact them to dispute the information. If someone rejects your lease application because of one of these rental reports, they must give you the name and contact information of the company that made the report.

An eviction will make it difficult to rent in the future. The best way to avoid an eviction is to pay your rent on time and comply with your lease.

Don’t Miss: Does Affirm Affect Credit Score

Other Places Where The Negative Information Is Reported

- Tenant screening reports: Rental history reports can be obtained through rental screening companies hired by potential landlords for tenant verification.

- Court records: This includes any information regarding judicial trials and judgments against the tenant. The information related to the eviction judgment appears in the public records section of the credit report.

- Rental background checks: This includes police verification of the tenants past eviction information and history, along with the data collected from the three major credit bureausTransUnion, Equifax, and Experian.

What Is An Eviction In Legal Terms

While the situations above describe reasons for a tenants removal from the property, eviction from a technical standpoint entails the landlord suing a renter for refusal to leave.

A few places allow landlords to employ self-help eviction tactics, like changing the locks on the property, but this is illegal in most places. If your landlord does this to you, make sure you check to see if this is legal. Otherwise, its time to contact the authorities.

Instead of locking you out, the landlord must usually go through the court system to file a lawsuit against you and obtain a writ of possession.

A law enforcement officer then posts the eviction notice on the property, giving a specific deadline of when it must be vacated. If the tenant is still there on the posted date, the law enforcement officer will physically remove the tenant and their belongings.

You May Like: How Long For Things To Fall Off Credit Report

Read Also: Syncb/ntwk

Ask For Professional Help

If you need legal advice in order to restore your good credit, I recommend hiring , a credit repair company.

Credit Saint is one of the an excellent with an A+ BBB rating for 13 years in a row.

This firm will charge you a monthly fee, but if anyone can get evidence of an eviction removed from your credit report, they can.

What Happens If You Get Evicted And What To Do

Apr 13, 2020 Hi there, thanks for your question. The best thing to do would be to check your credit reports if the eviction shows up on them. Usually, they

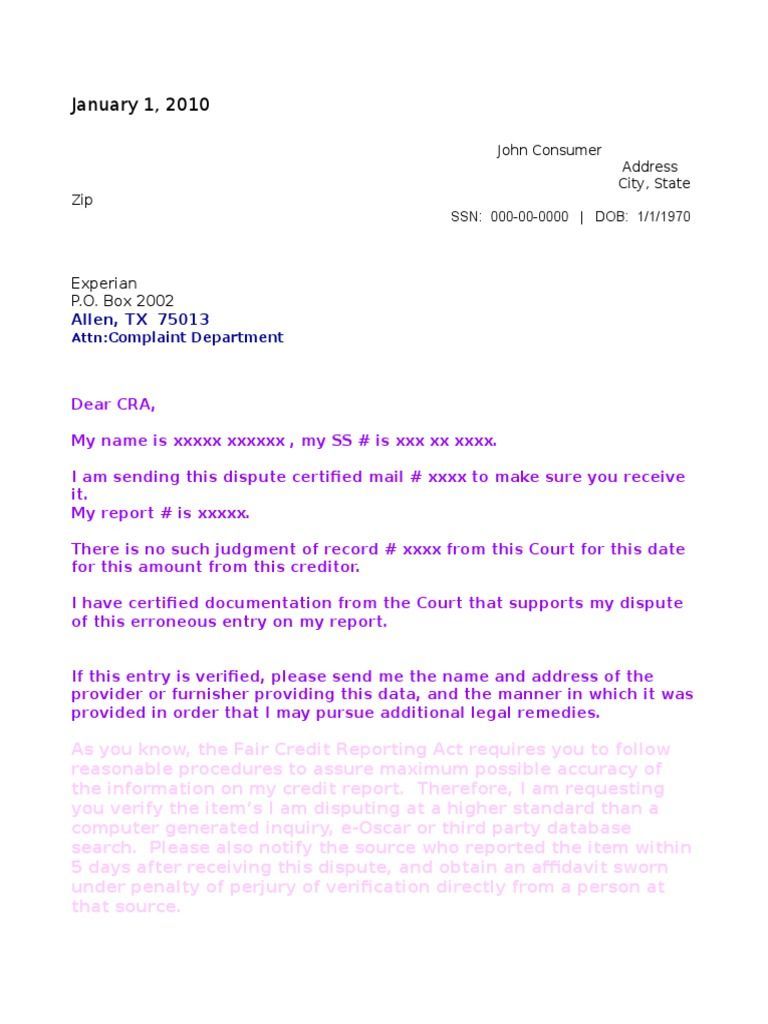

Write down a dispute letter to all the aforementioned credit bureaus and attach a letter explaining the circumstances, together with the notarized statement

Feb 19, 2021 your credit history. Learn how to get an eviction removed from your record. Evictions do not show up on a regular credit report.

Read Also: 819 Fico Score

Ask To Have Collections Removed From Your Credit Report

Even after you’ve paid or settled a debt, the collection activity may remain on your credit report. When you make payment in full or negotiate a settlement, ask the collection agency or property manager to request removal of the collection from your credit report. Be sure to get this agreement in writing. If the collection isn’t removed, the documentation will be helpful in filing a dispute with the credit bureau.

Avoid Eviction If You’re Able

Do your best to avoid eviction in the first place by being proactive and working with your property manager. But if you’ve already faced that stressful situation, knowing how to get an eviction off your record can empower you. It will take some effort, but in the end, you’ll be ready to find the perfect place to live.

Don’t Miss: How To Remove Evictions From Your Credit Report

How To Find Out If You Have An Eviction On Record

Eviction is a legal process a property manager can use to remove a tenant. The process creates a public record of the eviction. There are two places you can check to find if you have an eviction on your record: a tenant screening report and your credit report.

There are a variety of reasons people get evicted, but no matter why you were evicted, the record of your eviction will appear on tenant screening reports and background checks. You can request a copy of your report from a tenant screening agency. If you’re apartment hunting, ask the property manager what screening agency they use and start there.

Your credit report is different from a tenant screening report. Credit bureaus collect information on your debts and payment history. So let’s bust a common myth: the public record of your eviction won’t appear on your credit report. But if you were evicted for non-payment of rent or fees and you have outstanding debt, the property manager may turn your debt over to a collection agency. Collections activity will show up on your credit report within 30 to 60 days. You can request a free credit report from all three nationwide credit reporting agencies once every 12 months, so be sure to check yours regularly to keep track of your credit activity.

Judgments For Possession/warrants Of Removal

If a judgment for possession is entered, the landlord can take steps to have the tenant evicted. If the tenant does not leave the property, a special civil part court officer, not the landlord, will serve the tenant with a warrant of removal. When residential tenants are served with a warrant of removal , they must leave the property within three business days. If they do not, the landlord can ask the court officer to evict them unless they pay everything in full. If they do not, the special civil part officer can carry out the warrant of removal. The residential tenant can also pay the landlord everything in full up to three business days after an eviction in order to have their case dismissed.

Unlike residential tenants, business tenants must leave immediately when served with a warrant of removal.

After Judgment for Possession

There are still things that a tenant can do after the court date that could delay or prevent an eviction. The tenants must notify their landlord if they decide to pursue any of these actions with the court:

Tenants should contact the Special Civil Part Office as soon as possible to apply for any of the above.

Special COVID-19 Moratorium on Residential Evictions

Recommended Reading: Primary Cardholder’s Ssn (last 4) Wells Fargo