How To Unfreeze Credit With Transunion

For unfreezing your TransUnion credit report online, you may need to sign up for a new TransUnion account with a username and password. You no longer need a PIN.

You can lift a TransUnion credit freeze for one to 30 days, beginning on a start date you pick. You can lift the freeze for a specific time period or for certain creditors for whom you can create an access code to be used during a limited time. This differs from Experians single-use code because it can give multiple creditors access to your file during the time window.

Contact info:TransUnion TransUnion LLC, P.O. Box 2000, Chester, PA 19016, 888-909-8872.

When To Unfreeze Your Credit Report

Unfreezing your credit reportalso known as thawing in the credit industryis a temporary lift of the freeze for a specific period of time. This allows you to make your applications in the short window before your credit freezes again automatically. Permanently removing the credit freeze is known as lifting the credit freeze. Youll have to specifically request to add the credit freeze again if you want to protect your credit against unauthorized .

Here are a few instances where you should temporarily or permanently unfreeze your credit report.

Since you cant predict which of your credit reports a business might check, you should unfreeze all three. Make sure you allow enough time to complete your application process before freezing your credit reports again.

Each Of The Major Credit Bureaus Is Slightly Different

Heres a guide to unfreeze your credit with Equifax, Experian and TransUnion. The three major credit bureaus are all different. So, you have to unfreeze your credit with each bureau individually.

Note: If your credit issuer lets you know which credit bureau they are going to use, then you can choose to thaw just that one.

The first big difference is with Experian. According to the bureau you need to create a personal identification number, or PIN, to unfreeze your Experian credit report.

TransUnion and Equifax, however, now require you to set up online accounts to freeze or unfreeze your credit reports with them.

Also Note: If your account was previously frozen and you were issued an Experian PIN, the bureau will direct you to establish a password-protected account. This account will let you manage your freeze within their portal.

Recommended Reading: Credit Inquiries Fall Off

A Credit Freeze Can Help Protect Against Identity Theft

Protecting your credit is important since your can impact your financial life in many ways. A credit freeze is a security measure you might consider if you want to prevent unauthorized people from accessing your credit file. Freezing and unfreezing your credit is a relatively simple process, but it helps to understand how it works to know when it’s the right move.

Which Fraud Alert Is Right For You

Fraud Alert

Extended Fraud Alert

Active Duty Alert

Place when youre concerned about identity theft. It makes it harder for someone to open a new credit account in your name. Its free and lasts 1 year.

Place when youve had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. Its free and lasts 7 years.

Place when youre on active military duty. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 2 years. Its free and lasts 1 year.

What to do if your information is exposed in a data breach

Don’t Miss: How Long Do Evictions Stay On Credit Report

Sample Letter To Get Hard Inquiries Removed From Your Credit Report

If youâre going to dispute an error on your credit report, itâs best to write a letter to the credit reporting agencies. Though many bureaus have online forms, they often include forced arbitration forms, which will prevent you from filing a lawsuit over the dispute, something you may ultimately need to do.

Writing a letter may feel overwhelming. However, the Consumer Financial Protection Bureau and the Federal Trade Commission both provide a sample cover letter and a template of the information that the dispute letter needs to include. Your letter should contain the following info:

Information that identifies you:

-

The number from the account

-

You should number each item that you want corrected

-

The dates that the dispute occurred

-

Explain each inaccuracy

-

The company that has the information in dispute

Finally, make sure you include a summary or list of the documents you submitted to support your claim.

How To Temporarily Or Permanently Lift The Freeze

The freeze generally remains in place until you choose to lift or “thaw” it. When you place a credit freeze on your file, you’ll receive a personal identification number or password that you can use to:

- permanently lift the freeze or

- temporarily lift the freeze for a specific party or amount of time.

Under federal law, the bureau must lift the security freeze not later than:

- one hour after receiving the request, if you make the request by toll-free telephone or secure electronic means, or

- three business days after receiving the request, if you make the request by mail. .

Don’t Miss: When Does Capital One Report To Credit

Difference Between A Credit Freeze And A Credit Lock

A credit freeze is different from a credit lock or fraud alert. A credit lock is a paid service provided by the credit bureaus that enables you to lock your own credit. A fraud alert warns lenders that they should verify your identity before extending credit since you suspect that your identity has been compromised. They will be able to access your credit report after confirming your identity with you. While this will prevent someone from opening a new account in your name, you will still have to monitor your existing accounts to make sure there are no spurious charges.

How To Lock Your Credit Report At Transunion

TransUnions credit lock program is called TrueIdentity, and its also free. Like with Equifax, you can lock and unlock your credit quickly on a smartphone or computer. The program also gives you access to your TransUnion® credit report, free monitoring alerts and up to $25,000 in identity theft insurance. TransUnion also has a premium product, called Credit Lock Plus, that allows you to lock your credit reports with both TransUnion and Equifax but it costs $19.95 a month. You can sign up for the free TrueIdentity program on TransUnions website.

Read Also: Bestbuy/cbna

The Timing Of A Credit Freeze

A credit freeze, sometimes known as a security freeze, stays in place until you contact the credit bureau that issued the freeze and ask for it to be lifted. While it can take one business day for a credit freeze to take effect, the credit bureaus are required to lift it within one hour if you make your request by phone or online. If you ask for a credit freeze to be reversed by mail, it can take up to three business days once the credit bureau receives the notice.

Thanks to a law passed in 2018, it’s totally free to freeze or unfreeze your credit reports.

What Is A Judgment

If you default on your debt and dont try to make good on it with the creditor , they may take it to court. If the court rules in their favor, they bring a judgment against you. Like a collection, its a negative hit to your credit.

Today, judgments dont show on your . While they are public record, the National Consumer Assistance Plan made it illegal to report judgments on credit reports in most situations.

Don’t Miss: Goverment Free Credit Score

How To Unfreeze Credit

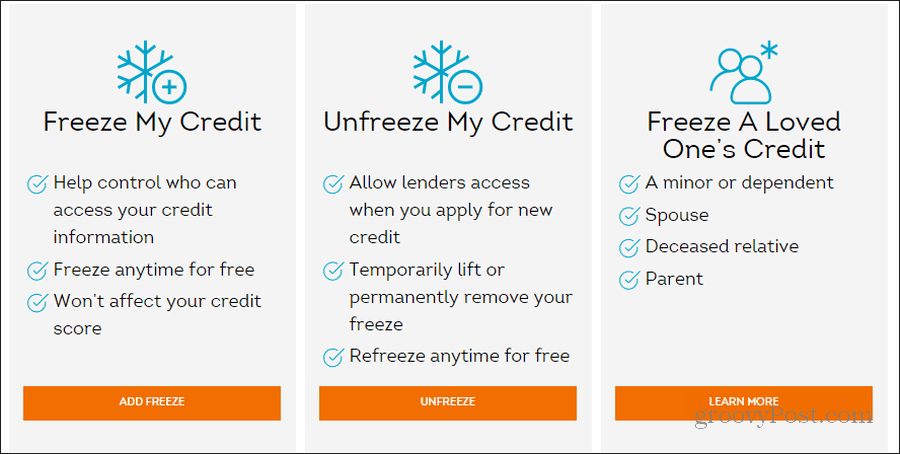

Unfreezing credit, sometimes called thawing, can be done on a temporary or permanent basis.

Itâs free to unfreeze your credit, but the process is different at each bureau. Hereâs what they say:

- Equifax: You can manage and unfreeze your account in multiple ways. But it might make sense to use the same method you used to place the freeze. You can , call 888-298-0045 or use the same form to submit a request through the mail.

- Experian: Make sure you have the PIN you were given when you placed your freeze. Itâs crucial whether youâre removing a freeze online or over the phone . If you donât remember your PIN, youâll have to go through the verification process again. You can also submit through the mail, but youâll need to provide the same information and documents used to freeze your credit.

- TransUnion: The bureau says that the simplest way to remove a freeze is to do it online. You may also be able to do it over the phone or through the mail. You can call TransUnion at 888-909-8872 to find out more.

You May Like: How To Remove Repossession From Credit Report

How To Unfreeze Your Credit Reports

In most states, a credit report freeze is in place until you request it be removed. You have two options for removing a credit freeze: either a temporary lift or removing it altogether. If you have a specific reason for removing a credit freeze, like those mentioned above, a temporary lift may be the smarter option.

The credit bureaus have three days to remove a freeze after youve submitted your request, and it may cost money to have a freeze temporarily thawed . With each credit reporting agency, the process differs slightly.

Don’t Miss: Does Paypal Report To Credit Bureau

Send A Pay For Delete Letter To Your Creditor

Your credit score suffers when your credit report contains derogatory information . You can negotiate an items removal with a debt collector by using a pay for delete letter. It may not work, but its certainly worth a try since it is a legal request.

The gist of a pay for delete letter is an offer: Youll pay some or all of the amount you owe, after which the collector will remove the derogatory item from your credit report. Thats a win-win, as an item hurting your credit score is removed, and your collector receives at least some of the money you owe.

Procedurally, you should first request a debt validation letter from the collector verifying it has accurate information about your debt. You can request the letter within 30 days of the initial contact from the collector. If the letter reports accurate debt , you can then follow up within the next 30 days with a pay for delete letter.

However, if you dont recognize or agree with the debt in question, you can request the collector to prove you legally owe the money. If it cannot provide proof, it must drop its collection account request. This wont automatically remove the item from your credit report, but you can request that as part of the dispute.

You dont have to reinvent the format for your verification request letter or a pay for delete letter. Youll find many sample templates on the internet that are freely available or sell for a nominal price.

Remember To Stay Patient

This could turn into a long process, but it will be well worth it for the majority of Americans. Having great credit is not always easy, especially if you started out with a rough past and made mistakes along the way. But it can be even tougher if you have erroneous or inaccurate information listed under your credit file.

Getting rid of this information will allow you to boost your score and erase a lot of bad history on your accounts. Youll suddenly see yourself getting approved for just about anything you want once you finally get the CRAs to remove these marks.

Stay positive and stay patient. You will soon see a credit score increase which will give you more access to credit and better credit lines.

Ready to mail? Here are addresses:

Experian

If you have disputed items that did not get removed and know they are inaccurate, you can use the 609 Dispute Letter Template.

Don’t Miss: What Is Serious Delinquency On Credit Report

How To Put In A Credit Freeze

You can request a credit freeze through Equifax, TransUnion and Experian either online, by phone or in written communication. Be prepared with your personal information, such as your Social Security number and address. The credit bureau will provide you with a personal identification number or password for this transaction. While requesting a freeze either online or over the phone should go into effect in as little as an hour, it can take three days after a credit bureau receives your written communication for it to be done.

Ask For Court Validation

Any inaccurate information on your credit report must be removed according to the Fair Credit Reporting Act. If a court cant validate your judgment, its inaccurate information, and the credit bureau must remove it.

To obtain court validation, send a request in writing to the court that entered the judgment. Include your identifying information and the court case number.

Send your letter via certified mail so you can track it. If the court does not or cant validate the case, write to the credit bureaus and ask them to delete the information.

You May Like: What Credit Bureau Does Uplift Use

What Is A Credit Report Freeze

Each time you apply for credit of some sort, the creditor will pull a credit report against you to get an accurate picture of your credit history. They want to know what your FICO score is and if you have a bad or good habit of paying all your bills on time. When the credit check is made, it can hit one or all three primary credit bureaus .

When your credit reports are unfrozen, anyone with access to your personal information can request credit on your behalf. This is primarily how identity theft occurs a bad actor pretends to be you and applies for a new source of credit like a credit card. Because they have all of your personal information, including Name, Address, Social Security Number, and mailing address, the three credit bureaus will review your credit file and approve the credit request based on your current rating.

However, if you have a in place with all three credit bureaus, no new requests for credit will be approved, even if they have all of your private information. The good news is, setting up a credit freeze is free. Just follow the steps below for all three major credit bureaus.

Why Would I Lift A Credit Freeze

The process of enacting a credit freeze on your credit file involves the creation of a unique personal identification number with each of the three major credit bureaus. This PIN can be used to temporarily lift or permanently unfreeze a credit freeze when a new, legitimate application for credit is submitted.

Because credit decisions cannot be made without a full review of your credit report and history, you may want to lift a credit freeze when you are applying for a new credit card, personal loan, mortgage or line-of-credit.

Once the application is approved, you can reinstate the credit freeze if you deem it necessary.

You May Like: Check Credit Score Without Social Security Number

Freeze Your Credit With Experian Equifax And Transunion

Youll need to contact each of the three major credit reporting agencies individually to freeze your credit with them. You can do this online, via the phone, or through the U.S. mail.

The quickest and easiest way to freeze your credit is online. Heres how:

- Date of birth

- Social Security Number

You will also likely be asked some questions about prior places of residence and credit accounts you may have or have had in the past. This is all to ensure that you are actually the one requesting the freeze.

Read Also: Is 739 A Good Credit Score

What Do I Do If I Think I Have Been A Victim Of Identity Theft

If you think you’ve been a victim of fraud or identity theft, contact one of the nationwide credit reporting companies and place a fraud alert in your credit report.

You can contact the three nationwide credit reporting companies, Equifax

| TransUnion Fraud Victim Assistance Department,P.O. Box 2000, Chester, PA 19016 |

A fraud alert requires creditors who check your credit report to take steps to verify your identity before opening a new account, issuing an additional card, or increasing the credit limit on an existing account based on a consumer’s request. When you place a fraud alert on your at one of the nationwide credit reporting companies, it must notify the others.

There are two main types of fraud alerts: initial fraud alerts and extended alerts.

Initial fraud alerts

To file an identity theft report, you must file either a police report or a report with a government agency such as the Federal Trade Commission.

When you place an initial fraud alert in your file, you’re entitled to order one free copy of your credit report from each of the nationwide credit reporting companies. These free reports do not count as your free annual report from each credit reporting company.

Extended alerts

You can place an extended alert on your credit report after your identity has been stolen and you file an identity theft report.

Security freezes

Special help for servicemembers

Also Check: Protectmyid Deluxe Reviews