Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Meaning And Impact Of Cibil Score

Your CIBIL credit score represents your credit repayment behaviour and reflects your creditworthiness. The credit score is determined by various factors such as credit history, timeliness in loan repayment and credit card bills payment, frequency of loan application, loan rejection, and various other factors. It is a three-digit number which gives the lender an idea of your creditworthiness and financial stability. CIBIL score determines your ability to repay the loan on time. It helps them to assess the risk involved in offering credit card or loan and evaluating whether the applications must be approved or not. A low CIBIL score not only minimises your chances of getting a loan and credit card, but also increases the rate of interest for the loan. On the other hand, a good credit score helps you get a loan application processed quickly.

Capital One Venture Rewards Credit Card

Another leading travel rewards credit card is the Capital One Venture Rewards Credit Card. You earn 2x miles on all purchases. So if you buy groceries, pay for a movie, or book a flight with your Venture Rewards Card, youll earn 2x miles. You also earn 5x miles on hotels and rental cars booked through Capital One Travel, where youll get Capital Ones best prices on thousands of trip options.

You can also redeem Venture miles for past travel purchases or booking future trips. Another redemption option is airline point transfers.

Another card benefit you might enjoy is a fee credit for Global Entry or TSA PreCheck. This is a good option for those people who have a 740 credit score.

New Capital One Venture Rewards Credit Card cardholders can earn 60,000 miles after spending $3,000 on purchases in the first 3 months.

Frequent flyer mile chasers should consider The Platinum Card® from American Express.

If youre not loyal to a certain airline or need free checked bags, this is for you. You can also transfer your Membership Rewards® points earned with the Platinum Card to airline partners like British Airways, Delta, JetBlue, Emirates, and Etihad.

Cardholders earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year, and earn 5x Membership Rewards® Points on prepaid hotels booked with American Express Travel.

Recommended Reading: What Credit Score Do You Need For An Apple Card

Is 520 A Good Credit Score

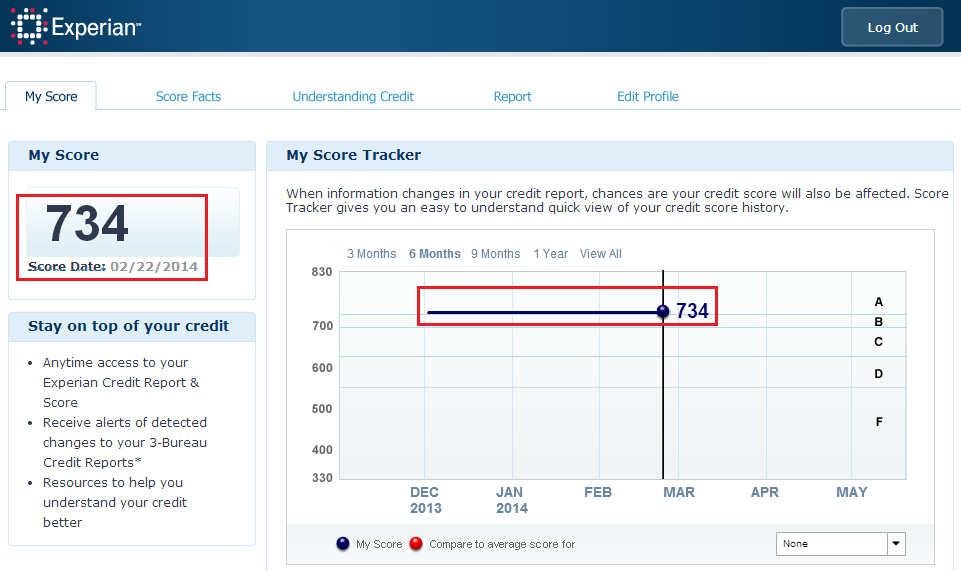

If youre checking your credit score on Experian or TransUnion, a credit score of 520 is categorised as Very Poor. This means most mortgage lenders wont offer you a mortgage. so we recommend working with a specialist mortgage broker to help. Get in touch and we can help with that.

If youre checking on Equifax, 520 is categorised as being Excellent. That means you shouldnt struggle to get a mortgage offer.

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

Read Also: Syncb/ntwk

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

Us Bank Cash+ Visa Signature Card

Recommended Score:752

- New Cardmember bonus: $150 after you spend $500 in eligible net purchases in the first 90 days of account opening.

- 5% cash back on your first $2,000 in eligible net purchases each quarter on the combined two categories you choose.

- 2% cash back on your choice of one everyday category, like gas stations or grocery stores.

- 1% cash back on all other eligible net purchases.

- No limit on total cash back earned.

- 0% Intro APR* on balance transfers for 12 billing cycles. After that, a variable APR, currently 13.99-23.99%.

- No annual fee*

- Great Offer for Customers of U.S. Bank, a 2018 World’s Most Ethical Company® – Ethisphere Institute, February 2018

Recommended Score:690 to 850

- Earn 1.5% unlimited cash back on card purchases every time you make a payment

- Combine the flexibility of a card with the low cost and predictability of a loan

- $0 fees – $0 annual fee, $0 activation fees, $0 maintenance fees

- No touch payments with contactless technology built in

- See if you qualify in minutes without hurting your credit score

- Access to a virtual card while you wait for your card to arrive in the mail

- Great for large purchases with predictable payments you can budget for

- Mobile app to access your account anytime, anywhere

- Enjoy peace of mind with $0 Fraud liability

Recommended Score:660 to 780

You May Like: What Credit Score Do I Need For Ashley Furniture

Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

- To check your credit history and past record

- To see whether you are capable of repaying debts

- To review your credit balance and understand the risk level of your profile

- To judge whether you qualify for the loan

- To decide on the loan amount to offer you and interest rate applicable

Tips On How To Build Good Credit

If your credit score isnt where you want it to be, dont worry. There are many small changes you can make that will help you build your score over time. Here are a few of our tips:

- Take out new credit. Taking on new credit, like car payments , and making those payments on time will help you build credit.

- Automate your payments. You wont miss payments if they happen automatically! Save yourself the hassle and keep them automated.

- Pay your credit card balance in full. The less money you have on your credit card, the better. If you pay off your bill in full each month, youll avoid interest fees and build credit.

- Have more available credit than used credit. Especially when it comes to credit cards, try to use less than half the credit you have available. If you can keep your balance under half, itll give your score a boost.

- Borrow what you can afford. Try not to live beyond your means. Borrowing what you can afford means you should have the funds to pay it back and maintain good credit.

Download our guide Repairing and Rebuilding Your Credit Score to learn more about your credit score, how it works and how you can rebuild it if its not where youd like it to be.

Read Also: Credit Score Needed For Les Schwab Account

Credit Score Mortgage Rate: What Kind Of Rates Can You Get

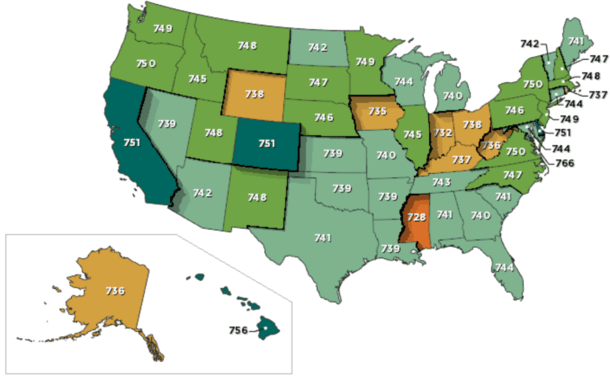

With a 750 credit score, you might qualify for the lowest mortgage rates which can help you save thousands of dollars over the life of your loan.

Edited byChris JenningsUpdated January 4, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When youre looking for a mortgage, the lender will usually pull your credit score as part of the approval process.

Most consumer credit scores range from 300 to 850 with 850 being the highest score but you dont need the best score possible to qualify for the lowest mortgage rates. A 750 credit score is generally considered excellent and can help you secure good loan terms.

Heres what you need to know about credit scores of 750 or higher:

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not go over your credit cards or bank accounts limit.

Also Check: Does Carmax Pre Approval Affect Credit

What Is Your Credit Score Why Is It Important

Your credit score may be defined as a rating that reflects your creditworthiness. Think of your as a batting average. If your batting average is above 50, then it means that you have a consistent scoring record of 50, and you are a good player. Similarly, when your credit score is high, it shows that you have borrowed and repaid credit responsibly in the past.

Your credit score is important because it showcases how dependable or risky you are as a borrower. Thus, it directly impacts how eligible you are for a loan, what the lender will offer you as a loan amount, and the rate of interest you will be charged. Your credit score allows lenders to judge the potential risk in lending you money. Your credit score is critical when it comes to unsecured or collateral-free loans and can affect your eligibility for personal loans to a great extent.

While you as an individual have a score, even businesses are given credit scores. For a business, the CIBIL score impacts how creditworthy a lender will find the company. A business credit score could also impact its ability to attract investment.

Additional Read: Save 45% on personal loan EMI

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Also Check: Which Credit Bureau Do Apartments Use

How To Check Your Cibil Score

Check your CIBIL score for free with Bajaj FinservIf you are wondering where to check your CIBIL score, you can do it easily by visiting the credit information companys website. Usually, you will need to pay a small fee to check your score. To get unlimited access to your credit score and report you can pay Rs.550 for 1 month or Rs.1,200 for a year at the CIBIL MyScore page. You can also check your CIBIL Score for free on a one-time basis here.

How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most dependable or reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get personal loan on bad CIBIL score

Also Check: Does Opensky Report To Credit Bureaus

How To Get A 745 Credit Score

While theres no sure-fire way to achieve an exact credit score, theres plenty you can do to build and maintain your credit within a range. Most importantly, youll want to practice healthy credit habits.

Even with so many different credit scores out there thanks to different scoring models and different credit bureau data some general principles apply. Most credit scores take into account at least five main credit factors.

Heres a breakdown of each factor and how it can affect your overall credit.

Shield Your Credit Score From Fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

Nearly 158 million Social Security numbers were exposed in 2017, an increase of more than eight times the number in 2016.

Recommended Reading: Why Is My Credit Karma Score Higher

We Make Mortgages Possible

Over 50% of mortgages for people who are self-employed or have bad credit arent available directly to you. Theyre only available through specialist brokers. Using our platform guarantees youll be matched with a broker who has a proven track record of making mortgages possible for people like you. Less processing, more understanding.

The Best Credit Cards To Have With A 740 Credit Score In 2022

You have worked hard to improve your score to get a better rewards credit card. These cards offer better purchase rewards and better card benefits than starter .

In some cases, you might qualify for these cards with a 720 credit score. But, your approval odds are better with a 740 credit score or higher.

Its also possible to receive an instant approval decision. Or, you may qualify for a higher credit limit. Either way, you likely have a number of options available.

Heres a preview of what a 740 credit score can get you:

- Chase Sapphire Preferred® Card

- Southwest Rapid Rewards® Priority Credit Card

Recommended Reading: What Collection Agency Does Usaa Use

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.