Work With An Experienced Real Estate Agent

Hire an expirenced real estate agent to help you through the home buying process. Some first-time buyers believe they can save some money by not hiring a real estate agent. This couldnt be farther from the truth. You may end up paying for items that are usually paid for by the seller.

It would be best if you also never used the sellers agent. The sellers realtor works for the seller and will always have their best interest in mind, not yours. You should hire your own real estate agent. You can ask friends or family members for a recommendation or find one on websites like Trulia or Realtor.com.

Avoid Applying For New Credit

Virtually every time you apply for credit, the lender runs a hard inquiry on your credit report. In most cases, you’ll see your credit score drop by five points or fewer with one inquiry, if at all. But if you have multiple inquiries in a short period, it could have a compounding effect and lower your credit score even more.

Also, adding new credit increases your DTI, which is a crucial factor for mortgage lenders.

Getting The Loan You Want

As weve mentioned, the first step to getting the loan you want is to know your current credit standing and what you need in order to qualify. If you already qualify great. If not, there are steps that you can take to help improve your credit.

We spoke to Credit Sesame member, Mark, to find out more about how he got a mortgage, and why he ultimately chose the type of mortgage that he did. Heres what he had to say:

Recommended Reading: How To Get Inquiries Off Your Credit

How Much House Can I Afford With An Fha Loan

With a FHA loan, your debt-to-income limits are typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirements are met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

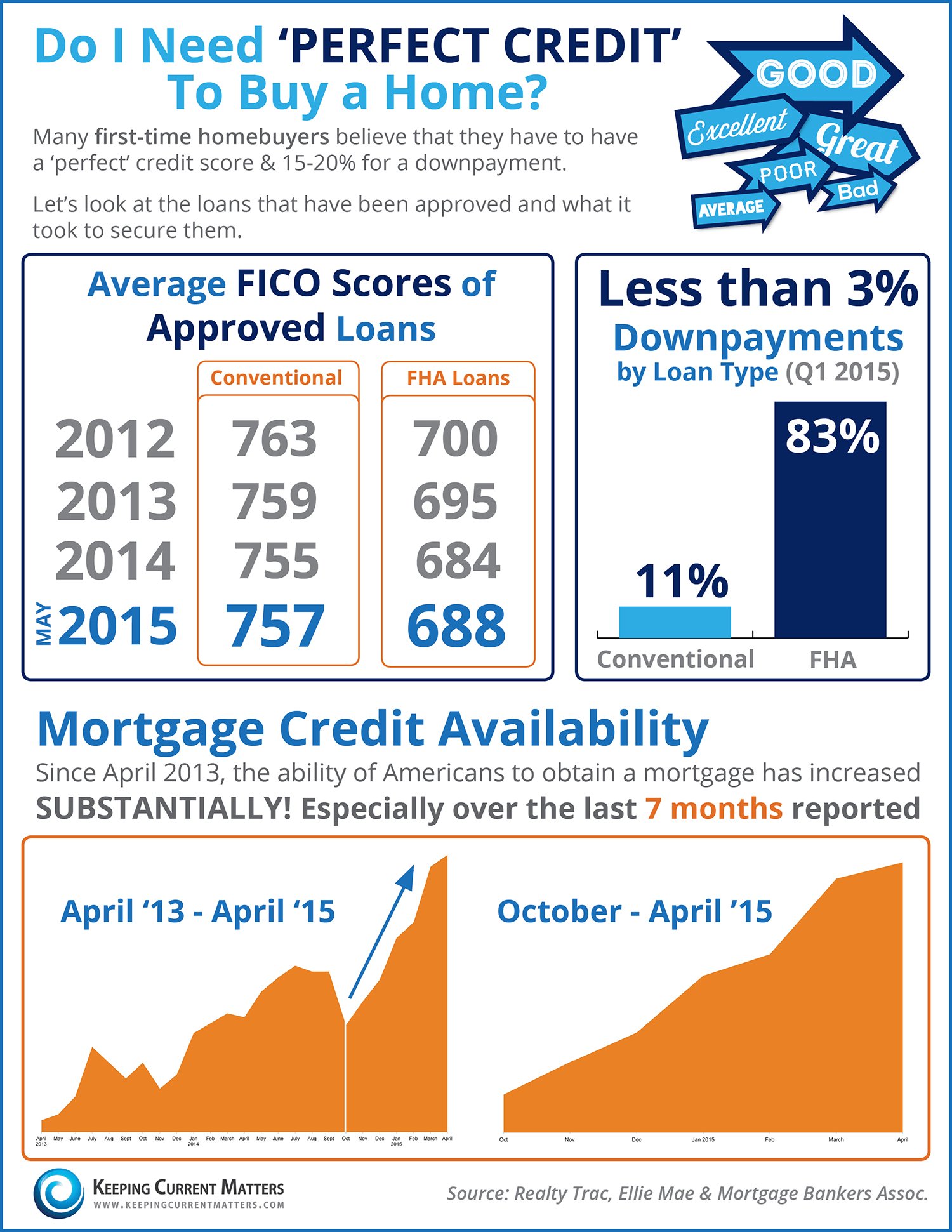

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

You May Like: When Do Things Fall Off Your Credit Report

A Review Of Credit Karma Members Shows The Average Vantagescore 30 Credit Score Across The Us For Those Who Opened Any Type Of Mortgage Tradeline In The Past Two Years Is 717

Looking at VantageScore 3.0 credit scores from TransUnion for tens of millions of Credit Karma members who had a mortgage tradeline open on their credit report in the past two years, we also studied the average VantageScore 3.0 credit score among homebuyers state by state.

Our findings: Average credit scores ranged from 683 to 739 . The range of scores was even wider when broken down by city.

How Hard Is It To Buy A House

There are some minimum score requirements that banks use in order to determine if the applicant is financially able to take on a large mortgage. To understand how firm these requirements are, its helpful to have a basic understanding of how the mortgage industry works.

Some lenders arent interested in keeping your mortgage. There are two reasons why your lender may sell your loan to another lender to free up capital and/or to make money. Lenders who need to free up capital, do so in order to provide loans to other consumers. The other reason is when a lender sells a mortgage they can make money in interest, origination fees, and even selling it for a commission. Your loan being sold is not necessarily a bad thing, but it is something that you, the mortgagee should be aware of. Everyone has different standards for acceptance after all, they dont want bad mortgages. This is where minimum score requirements come into place.

Heres a quick look at the minimum credit score requirements for the various types of mortgages.

Minimum Credit Score Requirements for Mortgages Types

| Mortgage Types | |

|---|---|

| 580 and a 3.5% deposit | |

| FHA 203K Loan | |

| VA | 620+ |

Of course, these are just the minimum requirements and dont necessarily mean automatic approval. Lets take a closer look at how many people were denied a mortgage, by credit score range, to give you a better idea of how difficult it can be to qualify for a home loan:

Mortgage Denial Rates

| 93% | 91% |

The main benefits include:

You May Like: What Credit Report Does Comenity Bank Pull

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history, and help lenders assess your financial health. Home buyers with lower credit scores are typically assigned a higher interest rate.

Getting Preapproved For A Mortgage

You can look at general requirements to buy a house on your own, and figure out if you might qualify based on your finances.

But your mortgage lender gets the final say. So when youre ready to get serious about buying, your first step is to get preapproved for a mortgage.

Some home buyers make the mistake of shopping for a property before meeting with a lender. But with a preapproval, youll know what you can afford before starting the process.

This way, you only look at houses within your price range. Plus, a preapproval letter indicates that youre a serious buyer. In which case, a seller will give more consideration to your offer.

When getting preapproved for a mortgage, contact at least three mortgage lenders to compare interest rates and terms.

Home buyers can often lower their monthly payment and save thousands just by shopping around and lowering their rate.

Read Next

Read Also: How To Remove Repossession From Credit Report

The Minimum Credit Score You Need For A Mortgage Loan

The national median price of a home in the United States is $266,200, according to Zillow. Most people don’t have that amount in cash. So, in order to buy property, you’ll likely need a loan.

To get the best interest rate on a mortgage loan, borrowers should have a credit score of 760 or greater, which is considered “good” on FICO’s scale. But the minimum requirement varies depending on the loan type. Although some loans accept “poor” scores as low as 500, the baseline needed for most is 620.

Here are the minimum score requirements for five mortgage loans, based on FICO data.

- Jumbo loan: Most lenders prefer at least a 680A jumbo loan exceeds the maximum loan limit set by the Federal Housing Finance Agency. It’s used for properties that are too expensive for conventional loans. Jumbo loans are not guaranteed by a government agency, like the U.S. Department of Veteran Affairs, or by the government-sponsored Fannie Mae or Freddie Mac.These loans can be secured through a private lender, but lenders consider them risky since they aren’t federally backed, meaning the financier isn’t protected if the borrower defaults. The required down payment varies.

- USDA loan: Most lenders prefer at least a 640The U.S. Department of Agriculture insures for low- to moderate-income homebuyers. The USDA does not set a minimum credit score requirement and does not require a down payment.

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan, depend on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.

Don’t Miss: What Credit Score Is Needed To Buy A Car At Carmax

How Is A Credit Score Calculated

- Your debt repayment history.

- Types of credit applied for and how often.

- How long your accounts have been open.

- How much of your available credit youre using.

- Whether there is any history of you not honouring a debt obligation that resulted in bankruptcy or a judgment against you.

The credit bureaus wont only be looking at your repayments history. Theyll be able to access your employment history and income as well and calculate your credit score according to a complex formula.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Recommended Reading: How To Remove Repossession From Credit Report

How Credit Scores Affect Mortgage Interest Rates

Your credit score can have a major impact on the overall cost of your loan. Each day, FICO publishes data that shows how your credit score could affect your interest rate and payment. Below is a snapshot of the monthly cost of a $200,000, 30-year fixed-rate mortgage in August 2021:

| 4.161% | $973 |

That’s an interest variance of over 1.5% and a $177 difference in monthly payment from the 620 to 639 credit score range to the 760+ range.

Those differences can really add up over time. According to the Consumer Financial Protection Bureau , a $200,000 home with a 4.00% interest rate costs $61,670 more overall over 30 years than a mortgage with a 2.25% interest rate.

Finding The Right Lender

Finding the right bad credit mortgage lender may seem like a difficult task, but it doesnt need to be. Loans Canada can help you compare and connect with a licensed lender who can meet your unique needs.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 4/5 based on 27 votes.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Should You Check Your Credit Report And Score Before Looking For Houses

Yes, its definitely a good idea to check your credit report and credit rating before you apply for a mortgage. With your credit report and score in hand, you can:

- Correct any inaccurate information or errors in your report before you apply

- Anticipate your likelihood of approval as well as your interest rate

- See where you can improve your overall creditworthiness before buying

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Also Check: How To Unlock My Experian Credit Report

What Kind Of Credit Report And Score Do Lenders Use

There are several versions of your credit score, depending on who issues the score and the lending industry .

To offset their risk and ensure that theyre getting the most accurate picture of a mortgage borrower, most lenders will use whats called a tri-merge credit report showing credit details from multiple credit bureaus.

Instead, they may use a residential mortgage credit report, which may include other details about your financial life, such as rental history or public records. These reports reveal the borrowers credit details from multiple bureausTransUnion, Experian, or Equifaxor all three.

In many cases, the credit score you see as a consumerpossibly through your bank or credit card companyis different from what a potential mortgage lender would see.

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

Don’t Miss: When Does Usaa Report To Credit Bureaus

How To Improve Your Score Before Applying For A Mortgage

If your credit isnt where youd like it to be to get you access to the lowest interest rates and best terms, there are a few tactics you can use to improve it before you apply for a mortgage:

- Monitor your credit report. Keeping a close eye on your credit helps you more easily and quickly spot errors and gauge whether youre heading in the right direction.

- Save up for a large down payment. If your credit score is less than perfect, putting more money down can trim your loan amount, ultimately saving you unnecessary interest.

- Hold off on other credit. Each time a potential lender runs your credit report, your credit score dips. Wait until your mortgage is approved before applying for your next credit card or loan.

- Lower your credit utilisation ratio. Pay off as much debt as you can to lower your debt-to-income ratio and ultimately improve your score.

- Pay your bills on time. To assure future creditors that youll repay what you borrow, build a history of on-time payments.

- Hire a credit repair service. If youre feeling stuck, call in professionals to get back on your feet.