Credit Karma Vs Credit Sesame

What are the differences between Credit Karma vs. Credit Sesame? Credit Karma uses two of the top three credit reporting agencies while Credit Sesame only uses one of the top three credit reporting agencies. In general, you are going to receive a more accurate score from Credit Karma than you will from Credit Sesame making it the preferred credit monitoring service.

Aside from the fact Credit Karma’s score will be more accurate than Credit Sesame it’s important to note that Credit Karma also goes far and beyond what Credit Sesame offers. Identity monitoring alerts are one of the larger offerings Credit Karma brings to the table to ensure your identity is safe and your information is protected. They also offer programs through their partners that offer additional benefits as well such as free tax preparation, automobile values, and any DMV information or recall information.

Final Thoughts on The Accuracy of Credit Karma:

Hi there! I’m Ryan Fitzgerald, a REALTOR in Raleigh-Durham, NC and the owner of Raleigh Realty. Chances are you and I share a similar passion, Real Estate! I also have a passion for building businesses, working out, inspiring others, technology, sports, and people. Connect with me on and !

6 Responses to “How Accurate is Credit Karma? 9 Takeaways”

Jeffrey Johnson wrote:

Posted on Monday, August 24th, 2020 at 4:54pm.

Posted on Thursday, September 17th, 2020 at 2:53pm.

Robert L Godwin Jr wrote:

Posted on Sunday, January 10th, 2021 at 11:01am.

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO. FICO stands for Fair Isaac Corporation, the biggest competitor in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

VantageScore and FICO are both software programs that calculate credit ratings based on consumers’ spending and payment history. FICO is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer , Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most frequently used base model and which of its many versions is used.

The key point is that your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

Are Free Credit Reports Worth It

Purchasing your credit reports can get expensive, especially if you need to review your credit report multiple times a year. Accessing a free credit report allows you to stay on top of your credit without the hefty price tag. Plus, you can use more than one free credit report service at a time for a comprehensive look at your credit across all three major credit bureaus.

Recommended Reading: Are Credit Cards Good For Credit Rating

How Do Medical Collections Affect Credit Scores

Multiple factors are commonly used in calculating credit scores, including credit card utilization, payment history and age of credit history.

Your payment history is the most important factor that goes into determining your credit scores. So just like any other collection account that shows up on your credit reports, medical collection accounts can have a negative impact on your credit scores if they go unaddressed.

But its possible for a medical collection to affect your credit scores differently than other types of collections. Some scoring models give less weight to outstanding medical debts than other types of collection accounts. And some credit-scoring models will disregard unpaid medical bills if you originally owed less than $100.

Breaking Down Fico And Vantagescore

When most people think about their credit score, whether they know it or not, they are thinking about FICO. The Fair Isaac Corporation introduced FICO credit scores for consumers back in 1989, and since then the company has worked diligently to keep up with consumer behaviors and how those impact the FICO scoring calculations. Up until a decade ago, FICO was the only consumer credit score used by the three major credit reporting agencies, as well as the only score used by lenders and financial institutions.

In recent years, VantageScore has taken on the challenge of competing with FICO for its place at the top of the consumer credit scoring chain. By partnering with the three credit bureaus, VantageScore is able to use similar information and scoring models as FICO to generate individual credit scores. However, there are differences between FICO and VantageScore that consumers should be aware of.

First, it is important to understand that both the FICO and VantageScore methods draw from the same consumer information: payment history, credit usage, recent inquiries, length of credit, and type of credit. However, these details are gathered in different ways.

You May Like: Does Removing Hard Inquiries Increase Credit Score

Hard Inquiries Vs Soft Inquiries

Hard inquiries occur when people apply for a mortgage, auto, student, business, or personal loan, or for a credit card. They also occur when someone requests a credit limit increase. While one or two hard inquiries a year may hardly dent credit scores, six or more hard inquiries at once can cause harm.

Soft inquiries, on the other hand, pivot around investigations, such as credit checks made by businesses who offer goods or services, employer background checks, getting pre-approved for offers, and checking personal credit scores. Soft inquiries can also be inquiries made by businesses with whom people already have accounts. Most of these inquiries are not lending decisions. Theyre considered promotional and conditional, and therefore, wont affect the person’s score. Soft inquiries can be done without the persons permission and may, or may not, be reported on the credit report, depending on the credit bureau.

Other activities, such as applying to rent an apartment or car, getting a cable or internet account, having your identity verified by a financial institution, such as a credit union or stock brokerage, or opening a checking account may result in a hard or soft inquirythis depends on the credit card bureau or type of institution that instigates the inquiry. Credit Karma requests the information on its members behalf, so it is a soft inquiry and therefore does not lower the member’s credit score.

You Know Staying On Top Of Your Credit Is Important But How Often Should You Check Your Credit Reports

The answer depends on your situation, but the Consumer Financial Protection Bureau recommends checking your credit reports at least once a year, as well as under specific circumstances, including

- Before you take out a loan for a major purchase, such as a car or home

- Before you apply for a new job, as many employers check your credit

- To reduce your risk of identity theft

Freddie Huynh, vice president of credit risk with Freedom Financial Asset Management and former senior data scientist at FICO, advises getting and reviewing your credit reports annually.

If youre about to make a big purchase that requires a loan, it may be helpful to check reports a few months before so there are no surprises, he says.

Surprises, such as mistakes on your credit reports showing a late payment that didnt occur, could result in your credit scores being lower than they otherwise would be. Checking your reports helps you identify incorrect information, which you can then dispute with the credit bureaus. If the error is on your TransUnion® credit report, you can use the feature to help rid your report of the error.

Dont Miss: Does Opensky Report To Credit Bureaus

Recommended Reading: How Long Do Late Payments Stay On Your Credit Report

Once People See That Credit Karma Offers Access To Your Credit Scores For Free They Usually Follow Up With Questions Like Is Credit Karma Accurate Or Whats The Catch

Whether its your first time visiting Credit Karma or youve been a member for years, you might want some more insight into where Credit Karma gets your credit scores and why you should trust a company that claims to offer something for free.

Heres the short answer: The and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

This means a couple of things:

- The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating. This, by the way, is one of the reasons why we ask for your Social Security number and other personal information in order to create a Credit Karma account so that we can match you up to what the bureaus have on file for you.

- We dont gather information from creditors, and creditors dont report information directly to Credit Karma.

Understandably, you may still have some questions about how Credit Karma gets your credit scores and why your scores from Credit Karma might look different from scores you got somewhere else.

Well dig into some of those questions below. Well also explain how Credit Karma can offer free credit reports from TransUnion and Equifax along with your free credit scores from each of those credit bureaus.

Theres Inaccurate Or Outdated Information On Credit Report

If the incorrect account information is more than a month old, this could indicate that your credit report contains inaccurate or outdated information about your credit history.

In this case, we recommend viewing the full credit report in question, reviewing it carefully, and disputing any errors you see directly with the credit bureau.

Recommended Reading: How To Clean Credit Report

Can I Trust Credit Karma

Q: Im trying to increase my credit score ahead of applying for a large loan, so Im considering signing up for Credit Karma to track my score. How accurate are the credit scores it shares? Is there anything I need to be aware of before signing up for this service?

A: Credit Karma is a legitimate company however, for a variety of reasons, its scores may vary greatly from the number your lender will share with you when it checks your credit. We have answers to all your questions about Credit Karma.

What is Credit Karma?

How does Credit Karma calculate my score?

How do other lenders calculate my score?

How does Diamond Valley decide if Im eligible for a loan?

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Don’t Miss: How To Remove Chapter 13 From Credit Report

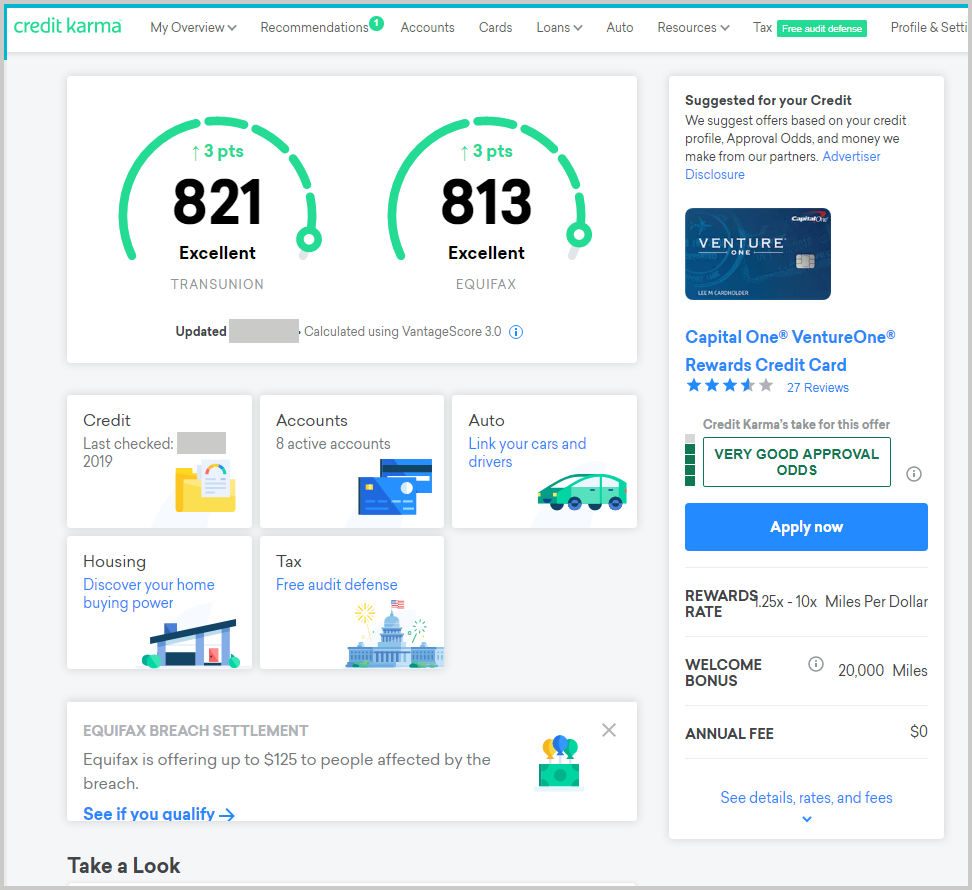

The Credit Karma Dashboard

When you log in to your free Credit Karma account, youll arrive at your financial dashboard. From here, you can view high-level credit information and drill down on your Credit.

The top of the page shows your credit score. Youll see the VantageScore 3.0 credit score as reported by both TransUnion and Equifax. And youll find the date when your score was last updated. Click either score, and youll jump to your Credit Health Report .

When you scroll down, youll see a block of icons that let you navigate Credit Karma. Click to access your Credit Health Report, view your financial accounts, or access some of Credit Karmas services for taxes, auto loans, home loans, and savings accounts.

Read Also: How To Remove Repossession From Credit Report

Does Credit Karma Use Fico

No. However, the credit score Credit Karma provides will be similar to your FICO score. The scores and credit report information on Credit Karma come from TransUnion and Equifax, two of the three major credit bureaus. Your scores can be refreshed as often as daily for TransUnion and weekly for Equifax, with a limited number of members getting daily Equifax score checks at this time.

Also Check: How Long Does A Hard Inquiry Affect Your Credit Score

Is Credit Karma Accurate

Though the FICO score is arguably the best-known credit score , many people aren’t aware that FICO doesnt actually collect information. FICO is a model used to create a score by looking at your files from the three major .

Credit Karma’s VantageScore follows much the same process, except that its scoring model was actually created by the credit bureaus. Although VantageScore is less known to the public, it claims to score 30 million more people than any other model. One advantage is that it scores people with little , otherwise known as having a thin credit file. If you’re young or have recently come to live in the U.S., that could be an important factor.

The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those credit bureaus.

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

Address:80 River St., STE #3C-2, Hoboken, NJ,07030

Recommended Reading: How To Get My Credit Score Up

Why Credit Karma Won’t Hurt Your Score

Credit Karma checks your FICO score on your behalf and therefore conducts soft inquiries. Soft inquiries differ from hard inquiries in that they leave your credit scores untouched. Multiple hard inquiries done in a short period of time can knock off as much as five points per inquiry and can stay on the record for upward of two years.

Credit bureaus tend to deduct points, particularly if the person has a short or only a few accounts. Credit bureaus interpret multiple hard inquiries as showing that the person may be a high-risk borrower. The bureaus suspect that the person may be desperate for credit or was unable to get the credit needed from other creditors. MyFICO reports that people with multiple hard inquiries are eight times more likely to declare bankruptcy than other people with no bankruptcies on their reports.

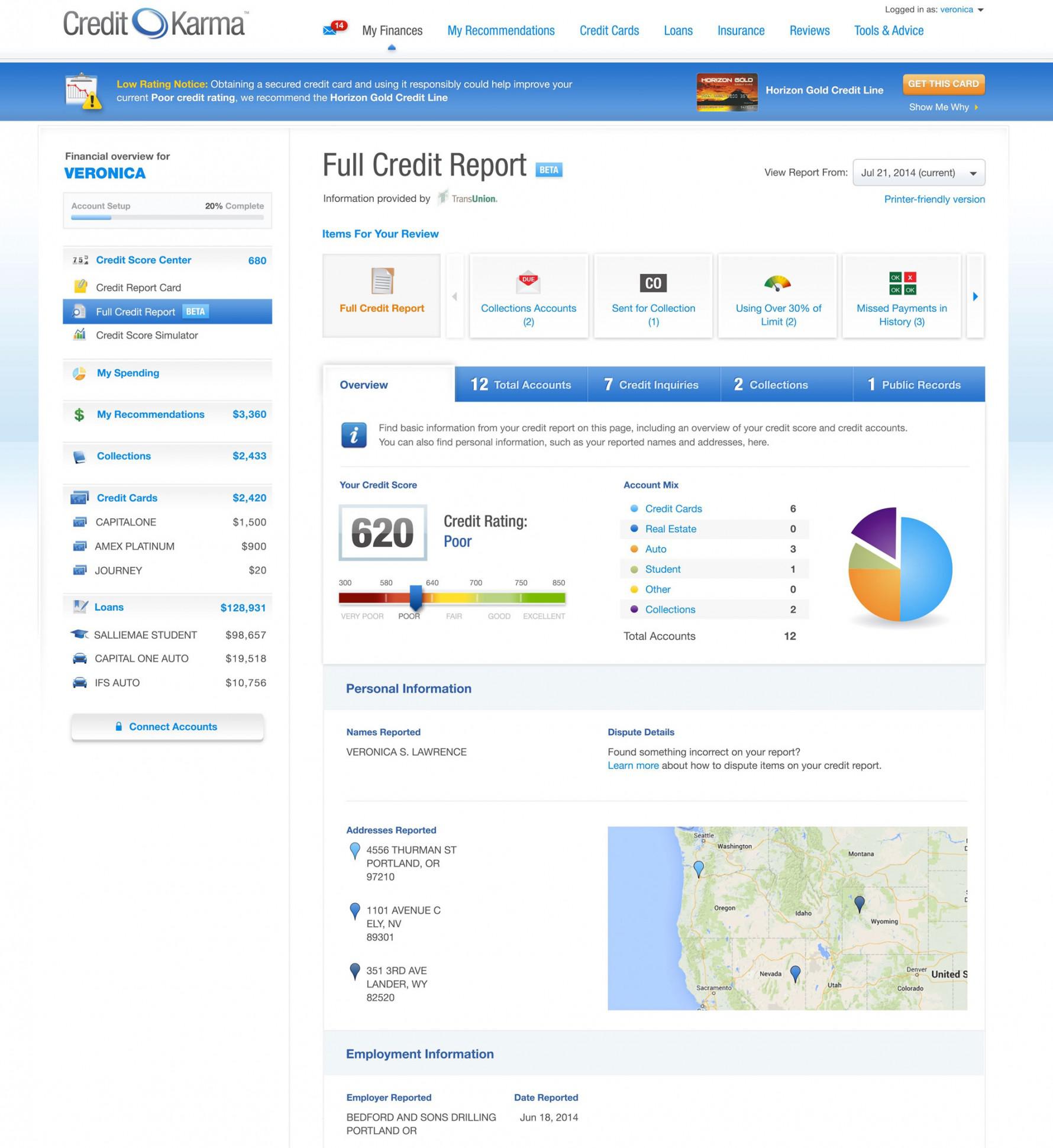

Now On Credit Karma: Full Credit Reports

For years, has taken pride in providing free credit scores, credit monitoring and valuable educational resources. Now, were excited to introduce full credit reports to our family of features.

The Features

This new product isnt simply a data dump. Instead, its a carefully crafted resource for your credit health. Here are a few of the highlights of Credit Karmas full credit reports.

1. Always available, always free

Like everything on Credit Karma, your full credit report will always be available and always be free. Gone are the days of paying for credit reports. Forget about only getting your reports once a year. Instead, access your full TransUnion information anytime and always enjoy the liberty of printing out a hard copy for your records.

2. Information put in context

3. Key aspects highlighted

Your credit report will come with filters that point to areas that might deserve your attention. If one of your accounts has been reported as closed, if youve missed a payment or even if a new personal address has been added to your report, youll receive helpful notifications that will get to the heart of the change as well as tips on potential actions you could take.

4. A complete library of previous reports

Awesome! How do I get my report?

If youre already registered for Credit Karma, all you have to do is log in to get access to your latest credit report. For those who havent registered already, nows the time! and start collecting your full credit reports today.

Read Also: How Often Does Wells Fargo Report To The Credit Bureaus