What Is Rapid Rescoring

If youâre looking to gain approval for a source of credit, such as a mortgage or a new credit card, you may wish to do this. Rapid rescoring means that you wonât have to wait for the next round of routine updates, as it will be amended within a few days instead. This is a service that your credit lender requests on your behalf.

Some things you should consider before you submit a request for this are:

Tip #1: You arenât able to request a rapid rescore on your own.

Tip #2: A lender must request one on your behalf, and thereâs usually a fee for the service.

Tip #3: A rapid rescore canât fix previous mistakes or make negative information disappear.

When Companies Report Your Information

Credit bureaus dont have timing requirements for reporting information and the Fair Credit Reporting Act only requires creditors to provide accurate and timely information.

It may take up to a month for changed balance amounts to appear on your credit report. If you pay off a balance this month, it may not appear on your report until next month.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like youre:

- urgently seeking credit

- trying to live beyond your means

Read Also: Does Credit Karma Affect Credit Score

When Do Creditors Report To Credit Bureaus

Most creditors send information like a large purchase, opening a new credit card, applying for a mortgage, making a late payment, etc., to the bureaus once a month.

But not all creditors report to all bureaus, and they might report at different times during the day. Some credit card companies that handle millions of accounts may only send over information in batches, once or twice a month.

Thats one reason why moving the needle from poor to excellent credit wont happen overnight. Your score can move a bit in one day, but it can take a while to make a real change for the better.

When Do Creditors Report To Bureaus

So even though creditors arent required to report to credit bureaus, the majority of lenders will report information to the three main credit bureaus. So, when do they report this information?

Each credit provider has its own schedule of when they report to credit bureaus. Credit bureaus dont require the information to be reported at a specific date. But you can expect it to happen every 30 to 45 days. The exact dates will vary from lender to lender. Also, remember, the same information might not reach all credit bureaus at the same time. So, a lender could report your information to TransUnion this week, but it only reaches Equifax next week.

As a result, it is very typical for your credit score to be in constant flux. It can change within days or even hours as different lenders send information to the credit bureaus. Your credit score will also not be the same with each credit bureaus. Every new report a creditor makes to the bureaus could mean adjustments to your credit report and credit score.

Read Also: Does Having Multiple Credit Cards Affect Your Credit Rating

How To Get A Credit Report

Everyone in the U.S. can get up to six free credit reports per year through 2026 by visiting the Equifax website. This is in addition to one free annual credit report from each major bureauExperian, Equifax, and TransUnion.

You can reach them through:

| Company | |

| https://www.transunion.com/ | 833-395-6938 |

The good news is the major credit bureaus are offering free weekly credit reports during the pandemic. The offer will lapse on April 20, 2022.

Get your credit report from each of the three nationwide credit reporting agencies weekly at Annual Credit Report.

Other ways you can get a free credit report include:

- Adverse action notice. Suppose you get an unfavorable notice regarding your application for credit, employment, insurance, or other benefits. This notice will include the name, address, and phone number of the credit bureau, and you can request your free report from them.

- Note: You must ask for your report within 60 days of getting the notice

- If you’re unemployed and plan to look for a job within 60 days.

- In case you’re on public assistance, like welfare.

- If you receive an inaccurate report because of identity theft or another fraud.

- If your credit file has a fraud alert.

How Often Your Credit Score Updates

Credit scores continually go up and down as information on your gets updated. New balance amounts, bill payments and account openings are only a few factors that appear on your credit report and influence your credit score.

You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any one of your creditors sends information to any of the three main Experian, Equifax and TransUnion your score may refresh.

That means your creditor may send updated information to Experian today, then Equifax next week, and TransUnion the following, which creates variations in your credit score.

Taking a look at my recent credit score updates through *Experian Boost, my score changed four times in October. The fluctuations were due to a new auto loan being reported on my credit report, as well as changes in my credit card balances.

Your credit score may also fluctuate when you check different credit score services that work with different credit bureaus. As stated above, the credit bureaus may receive information at varying times throughout the month, so if you check your scores with Experian and TransUnion today, they may differ if one has info the other doesn’t.

Other reasons for credit score differences include the credit scoring model used and errors on your credit report.

You May Like: Does An Overdraft Improve Your Credit Rating

Build A Credit History If Needed

A low credit score doesnt always mean you have bad credit. It can just mean you have thin credit. In other words, you havent demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If thats the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Dont overspend, or use this as an excuse to take out loans you dont need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.

What Factors Influence Your Credit Score

There are many things that can influence your credit score, including your payment history, the amount of debt you have, the length of your credit history, and more.

Your payment history is one of the most important factors in your credit score. This includes whether you make your payments on time, and if you have any missed or late payments. The amount of debt you have is also a factor. This includes both how much debt you have and what kind of debt you have. The types of debt that can impact your score include revolving debt and installment debt . The length of your credit history is also a factor, as is the type of credit accounts you have.

Other factors that can influence your score include things like having a high utilization rate on your credit cards , or having recently applied for new credit accounts.

Also Check: How Often Is My Credit Score Updated

How Soon Will Your Credit Score Improve

Unfortunately, theres no way to predict how soon your will go up or by how much. We do know that it will take at least the amount of time it takes the business to update your credit report. Some businesses send credit report updates daily, others monthly. It can take up to several weeks for a change to appear on your credit report.

Once your credit report is updated with positive information, theres no guarantee your credit score will go up right away or that it will increase enough to make a difference with an application. Your credit score could remain the sameor you could even see your depending on the significance of the change and the other information on your credit report.

The only thing you can do is watch your credit score to see how it changes and continue making the right credit moves. If youre concerned about inaccurate reporting on your credit score or simply want to keep a closer eye on it you could use a .

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Recommended Reading: Paypal Credit Report To Credit Bureaus

Read Also: When Will Items Be Removed From Credit Report

Tips For Improving Credit Score After Paying Off Debt

While paying off your credit card debt is important, what matters more is on-time payments and your utilization rate. Many times, borrowers will ignore these factors, thinking that clearing up their debt as quickly as possible is the key to a stellar score. But there are a few other methods to consider:

- Be strategic with the order in which you pay off your debts. Personal loans and credit cards often have higher interest rates than mortgages, car loans and student loans. Paying off those first not only helps keep your credit utilization in check, but will also save you money in interest. You can also use a debt paydown calculator to help .

- Check your credit utilization. If youve paid off your debt and your credit score went down, look at just how much of your credit you are using. If its above 30 percent, you might consider charging less each month. If that isnt an option, you could speak with your issuer about increasing your credit limit. Both of those should help increase your credit score.

- Open another credit card. While opening accounts could temporarily lower your score due to hard credit checks, opening a new card could increase your total available credit and spread your charging among several cards.

Read Also: How To Get Things Removed From Credit Report

Check Your Credit Report

The bottom line to it all is information. To pick up on problems and learn whats going well, you must see your credit report. Every consumer can do that annually at no cost make your request at www.AnnualCreditReport.com but Griffin said fewer than half of the eligible people take advantage of that.

Thats a huge concern, Griffin said. We want people to be educated and know their course. You cant do anything about your credit report unless you know whats in it. Its all part of the education process. Information is powerful and people need to know how to get the right information.

6 Minute Read

Recommended Reading: Does Checking Your Credit Score On Credit Karma Lower It

How Long Does It Take For Credit Score To Go Up

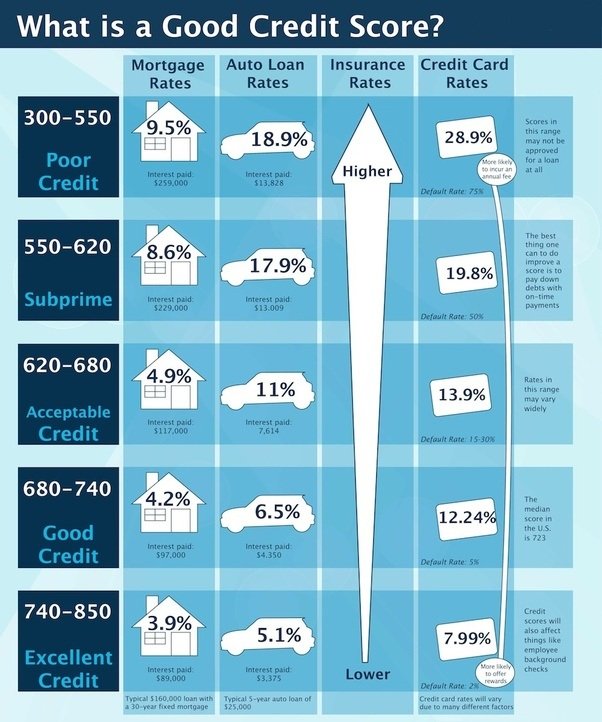

First off, whats considered a good score versus a poor one? Here are some general parameters:

- Perfect credit score: 850

- Good credit score: 700 to 759

- Fair score: 650 to 699

- Low score: 649 and below

While the score required varies by area and type of loan, lenders will generally look for a score of 660 or higher before they will grant a mortgage. If youre hoping to boost your credit score fast, here are some actions you can take.

How Often Does Transunion Update Consumer Credit Reports

TransUnion will typically update their consumer credit reports when they receive new information from a credit reporting agency. Most agencies will send new data every month or at least every 45 days. So, from the TransUnion standpoint, credit reports are typically updating as soon as information arrives. The confusing part is that different information is sent on different days and frequencies by the reporting agencies. Due to this inconsistent send, it may be possible to see multiple credit report updates within a single week, or no updates for some weeks at a time depending on the depth and complexity of ones credit. Credit scores are typically updated in sequence as a credit report updates.

Dont Miss:

Also Check: Will Getting A Credit Card Improve My Credit Rating

How Often Do Credit Reports Update

Credit reports are updated when creditors avail new information to the nationwide credit reporting agencies Experian, Equifax, and TransUnion for your accounts. If you want to keep track of your credit report progress, here’s how long you’ll need to wait for your credit report to update. It’s estimated to be once every month, or at least every 45 days.

Understanding how long it takes for a credit bureau to update can help you plan when to apply for credit and the optimal time to make a payment to boosting your score.

Your credit score isn’t included in the free weekly reports, but they can help you understand your credit score movements.

Note: Alternatively, you could consider a paid subscription to any major bureaus. It’ll give you access to daily credit reports. The score will refresh and alert you when there are changes to your accounts, helping you better track essential account changes.

How Is A Credit Score Calculated

Your credit score is a three-digit number thats based on the information in your credit report. Lenders use your credit score to help them decide whether to give you a loan and how much interest to charge you.

A higher score means youre more likely to get approved for a loan and qualify for the lowest interest rates. A lower score could mean you have to pay higher interest rates and might not be approved for a loan at all.

Your credit score is calculated by a credit bureau, such as Experian®, based on the information in your credit report. This information includes:-Your Payment History: Do you pay your bills on time?-Your Credit Utilization: How much of your available credit are you using?-The Length of Your Credit History: How long have you been using credit?-Your Credit Mix: Do you have different types of accounts, such as revolving and installment loans?-Hard Inquiries: Have you applied for new credit recently?

You May Like: Do Late Payments On Closed Accounts Affect Credit Score

Not Every Lender Reports On The Same Cycle

The answer to your question depends on the lender who is reporting the information to the credit bureaus. The typical credit reporting cycle is 90 days, or quarterly so even if they update your record within 14 days, it is likely that it will not show up on your credit report until the next cycle . There is quite a bit of information on Bills.com regarding

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Don’t Miss: What Is A Perfect Credit Score

Did You Know Its Not Just The Score That Counts

Lenders will look at your credit score when dealing with an application for credit. But their lending decision wont be made on the score alone. They will scrutinise the whole report to get an overall picture of the kind of borrower they are considering.

This is a good reason for making sure you have actioned a financial disassociation from any ex-partners you may have held a mortgage or any other kind of credit with.

Read Also: Which Credit Score Is Used Most

How Can I Get My Credit Re

If youre trying to raise your credit score a few points to get approved for a loan or to qualify for a better interest rate, your mortgage lender might be able to pay a fee for a rapid re-score that updates your credit report in two or three days. But only if theres proof of a credit report error or youre able to pay off an account right way and need the balance to reflect on your credit report.

Also Check: How To Access Credit Report

Dispute Inaccurate Information On Your Credit Reports

Sometimes, your credit score might suffer because something wound up on your credit reports that shouldnt have been there. Of course, you wont know unless you check them.

Under normal circumstances, consumers are entitled by federal law to one free credit report every year from each of the credit bureaus Equifax, Experian and TransUnion accessible through annualcreditreport.com. However, during the coronavirus pandemic, the bureaus are allowing consumers to access their reports weekly through April 2021.

If you spot legitimate, incorrect information while reviewing your reports, such as accounts that arent yours, a name mix-up with another person or incorrectly reported payments, you can file a dispute. The Consumer Financial Protection Bureau, a federal agency responsible for protecting consumers and offering financial education, provides dispute instructions for each bureau.

Its worth taking a look at your reports, even if you have no reason to suspect there might be a problem. According to a report from the Consumer Financial Protection Bureau, 68% of credit or consumer reporting complaints received by the bureau in 2020 dealt with incorrect information on peoples credit reports.

How much will this action impact your credit score?

Whether your credit score changes and how much it changes depends on what you are disputing.