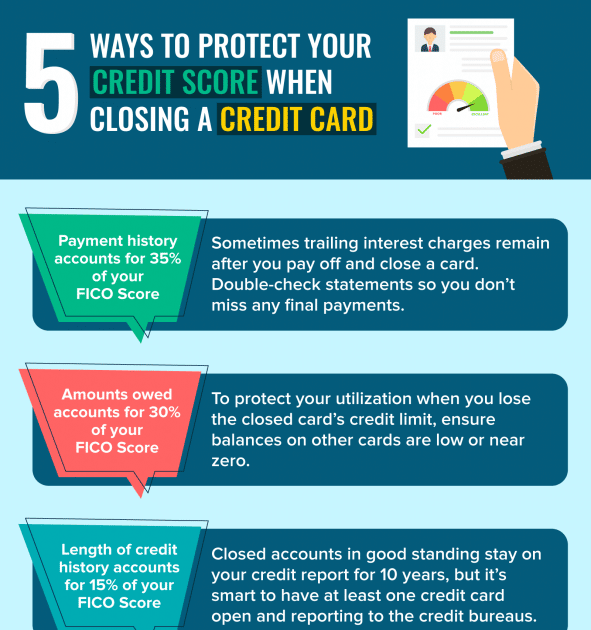

Increased Credit Utilization Ratio

Closing a credit card with the highest credit limit could hurt the most. If you do not know, your credit utilization ratio comprises 30 percent of your FICO credit score. The credit utilization ratio is the amount of debt you have compared to your available credit. For example, if you have a $500 balance on a card with a $2000 limit, your utilization ratio is 25 percent. That is within the acceptable range.

When you close a card, you lose the available credit, increasing your utilization ratio and lowering your credit score. If you aim for a high credit score, experts recommend maintaining a 30 percent or less credit utilization ratio. Account-holders with the highest credit scores usually use less than 10 percent only. It is noteworthy that a high credit utilization ratio indicates that you are using more of your available credit than you should. It could raise a red flag to lenders about your creditworthiness.

Boost Your Financial Standing With Current

One of the best ways to keep your credit score high is to make regular and timely payments to your credit cards. Current can help you do that with the ability to earn 4.00% APY on the money in your Savings Pods up to $6,000 and getting your paycheck up to two days faster with direct deposit. The more money you have in hand to pay your bills, the better equipped you are to make on-time payments that look great on your credit report.

We also offer the ability to earn points on purchases that are redeemable for cash back when you use your Current debit card, which is a great way to avoid paying high interest rates for purchases made on a credit card as well as the issue of managing multiple credit card accounts. Check it out now.

See If You Need To Redeem Your Rewards

Rewards sometimes expire after your card account is closed, so check your programs terms to see if you need to use your rewards before canceling. If youre having trouble getting out of debt and have rewards, you might be able to redeem them toward a statement credit to help you pay off your balance.

You May Like: What Is The Highest Credit Score You Can Achieve

Write A Letter For Your Records

To cover all your bases, it can be a good idea to have a form of written proof that you requested the account be closed and when you closed it. Because your credit score is so important and hard to build, having written proof leaves little room for error that could have negative repercussions. You may even enclose a check for the last payment on the card. Send the letter via certified mail or request a receipt to prove that the bank received it.

Ways To Safely Close Your Credit Card

Closing a credit card may seem simple enough. But before you break out the scissors to snip your card in two, here are some things to consider:

- Pay down your balance first. While you can close a credit card with an active balance, you may want to consider paying down your balance first. Even if you close your account, youâre still responsible for any remaining balance, interest and fees that might be charged. Plus, paying down your balance first will help keep your credit utilization under control. And that can help minimize impacts on your credit scores.

- Double-check your payoff amount. In some cases, the payoff amount for your card may be more than just the statement balance because of fees and interest. Be sure you check with your credit card issuer to confirm what you owe.

- Get confirmation of your cancellation. With some credit card companies, you can simply sign in to your account to close it. Or you may be able to call your card issuer to make the request. Either way, consider getting confirmation in writing. That way, you have a permanent record in case anything gets called into question.

- Check your credit report. After closing your card, you might also want to check your credit report. You can get free copies of your credit reports with credit scores from all three major credit bureausâvisit AnnualCreditReport.com to learn how.

If you still have questions about closing your account, check your cardholder agreement for more details.

Read Also: What Credit Score To Get Best Mortgage Rate

Closing An Unused Credit Card Without Hurting Your Score

Depending on your situation, you may be able to close an unused without impacting your credit score. For example, if you have multiple credit cards with the same issuer, they may let you transfer your balance from a closed card over to your remaining card.

Consider this hypothetical: You have two credit cards with the same issuer, one with no annual fee and a $3,000 credit limit, and one with an annual fee and a $5,000 credit limit. You want to close the card with the annual fee to save money. You can request that your issuer transfer the $5,000 credit limit to your other card before closing the account. That way you end up with a single credit card with an $8,000 limit.

Transferring your credit limit to another card conserves your total available credit, which keeps your utilization rate the same. So long as the card you close isnt one of your oldest accounts, this can help your credit score remain the same after you close an unused credit card.

That being said, if the main reason youre thinking of closing an unused credit card is the annual fee, you may have other options. First, try negotiating with your issuer to waive the annual fee. Depending on how long youve had the account and how much the issuer wants to keep your business you may get a waived or reduced annual fee.

Ways To Improve Credit Scores

Having a credit card can be very useful and helpful when building credit scores. Lenders consider your creditworthiness on your credit and payment history, credit accounts, new accounts, and credit utilization.

There are plenty of ways that will help you achieve your score goals. The most significant ones include:

Read Also: How To Report Bad Credit To Equifax

What Should Your Credit Score Be To Finance A Car

The higher your credit score, the better the rate youll get for any loan. A credit score above 660 will typically allow you to qualify for an auto loan without a hassle. A credit score of 760 and above will typically allow you to qualify for auto maker special financing that can offer low-APR loans and rebates.

You Want To Upgrade To A Rewards Card

If you’re planning to close an account because you want to upgrade to a different card, ask the issuer to transfer your account to the new card instead. Balance transfers don’t usually incur direct changes to your credit score, but opening a new card may. This could be an increase or decrease in score depending on the circumstance and other factors in your credit history.

Don’t Miss: How To Get Credit Report Without Social Security Number

Why You Might Want To Close Your Credit Card

If there is a risk of lowering your credit score, why might someone decide to close their credit card rather than just keep it open? Here are a few reasons why it might be worth it to take the credit score hit and close the card:

- High annual fee: If you have a credit card with a high annual fee and you can manage by using only cards that have no or low annual fees, it might be worth it to your budget to save that money and close the account.

- High interest rate: Similarly, if you tend to carry balances on your credit cards, you have a card that has a very high interest rate, and you can manage with using cards that have lower interest rates, it makes sense to close the credit card.

- Rare use: If you rarely use a credit card to the point that you may even forget that you have it or misplace it, it is better to close the account than lose track of the details.

- Too many open cards: If you have a high number of credit cards, it may make sense to simplify your finances and close credit cards you dont want or need.

- Too much unused debt:If you have multiple credit cards with high credit availability, it may be differently damaging to your credit score.

Your Credit Score Could Drop If Your Bank Account Isnt In Good Standing

Some blemishes in your bank account history could affect your credit. For example, if you close an account while the balance is negative or a bank closes your account because its overdrawn for an extended period, the negative balance could go to a third-party collection agency. That could lead to your credit report being marred.

If the bank sends this outstanding debt to a collection agency, it could be reported to any of the three credit bureaus, Marguerita Cheng, certified financial planner and CEO of Blue Ocean Global Wealth in Gaithersburg, Maryland, said in an email. Collections can trigger a drop in your credit score.

Recommended Reading: Does Capital One Report Credit Limit

The Impact Of Opening Or Closing A Credit Card

Its one of the most common questions Ive been asked in more than a decade of talking about for a living: How does closing or opening a card affect my credit?

The short answer is that it depends. Whether youre talking about VantageScores or FICO Scores, credit scores are incredibly complex, nuanced tools with myriad factors helping to determine how they move. These factors include the length of your credit history, the total number of loans youve taken out over time and how many different types of credit youve had, whether your balances and utilization are trending higher or lower and many, many more.

VantageScore and FICO formulas generally emphasize the same actions and traits, though they weigh them somewhat differently. For example, VantageScores formula states that your total credit usage your balance compared to your available credit is the most important piece of the formula, while FICO says your payment history is.

Researchers used VantageScores in creating this report.

While it may be impossible to predict the exact impact of a card opening or closure on a specific individual, data can help people better understand what they might expect. That was the goal of this report.

On average, a users VantageScore credit score fell by 6 points in the month after they opened a credit card and increased by 2 points in the month after they closed a credit card.

How To Safely Close Your Bank Account

In case you are planning to close your existing bank account and do not want it to affect your credit score, the first thing you should ensure is to clear off the negative balance, if any. Further, if you cannot afford to repay the amount, talk with the financial institution and request them to make the necessary arrangements for the repayment.

You should not think that the negative balance will not be reported just because you have moved to another financial institution. You will have to take necessary actions to repay the outstanding checks, auto drafts, or pending transactions even after the bank account has been closed. In such a case, the former financial institution will notify the person via mail regarding the outstanding balance.

Recommended Reading: Does Cancelling Credit Card Affect Credit Score

Why Hasnt My Score Changed After Paying Off Credit Cards

Your score wont get an immediate update once you pay off credit cards. That can be a disappointment when youve put a lot of effort into cutting down your balance. But all other things being equal, you will likely see an improvement in a relatively short period of time.

The credit scoring models may not update your credit score immediately so that they can also take note of whether youve simultaneously taken on more debt, which would also be reflected in your credit score. All in all, allow for at least one to two months after paying off a balance for your credit score to be recalculated.

Also Check: Carmax Approve Bad Credit

How To Safely Close A Credit Card

If you believe closing your credit card account is the best move for you, its important to take certain steps to ensure the cancellation goes smoothly. Lets go through those steps now:

Since closing your card will inevitably hurt your credit score, its best to follow up by taking steps to improve your credit.

Read Also: Do Insurance Companies Report To Credit Bureaus

Check Your Credit Before Closing An Account

Closing a credit card account can make sense in certain circumstances, but it’s important to understand that it can adversely affect your credit score. Before your close your account, consider taking a look at your to see where you stand and make sure that closing the account won’t leave you with a credit history that’s too thin or too new. While the negative effects of closing a credit card account are usually temporary, it might be worth keeping a long-standing account open if you’re able to.

When Canceling A Credit Card Makes Sense

There are a few situations in which it may make sense to cancel a credit card. For example, if:

- The card has a high annual fee and the benefits aren’t worth it to you

- The interest rate on the card is high and you need to carry a balance

- You are struggling to manage your debt load and are having trouble resisting the temptation of living beyond your means with the card

- You want to get rid of a bare-bones card, like a student card or secured card, in exchange for a regular or rewards card

Also Check: How Long Does A Judgement Stay On Your Credit Report

When Closing Your Credit Card Makes Sense

While closing your credit card could negatively affect your credit score, there are instances where it may make sense.

- Your card has an expensive annual fee: It may not be worth carrying a card with a steep annual fee, especially if you aren’t using the rewards.

- The card carries a high interest rate: It’s understandable if you want to cancel a credit card with a high interest rate. But keep in mind, you can avoid paying interest altogether by paying off your balance each month or by not using the card at all.

- You’re going through a divorce or separation: Closing a joint credit card with your spouse or partner after a breakup may be a logical choice. Doing so could help keep your finances separate and avoid any surprise purchases on the card from your ex.

- Your card leads to overspending: If you have a habit of maxing out your credit card, closing your account could help you gain control over your spending.

- Your card doesn’t match your spending habits: You may get more value and maximize your rewards earnings by switching to a card whose benefits align better with your spending habits.

Through Credit Card Utilization Ratio

The first way that canceling a credit card affects your credit score is by lowering your credit card utilization ratio. Your utilization ratio is the total amount of available credit that youre actually using. If you have a credit card with a $10,000 limit and you regularly spend $5,000 on that card each month, youd have a utilization ratio of 50% .

Having a low utilization ratio is generally considered a positive factor in determining your credit score.Lenders prefer when youre not using all of your available credit, since doing so can be an indicator of financial distress. When you cancel a credit card, you lower the total amount of your available credit line, which will generally raise your credit card utilization ratio.

Recommended: What is the Average Credit Card Limit

You May Like: How To Build Up Credit Score

How To Close A Credit Card

All you have to do to close a credit card is pay off any outstanding balance and close the card online. You will need to call the phone number on the back of the card to ensure that you have no interest payments or other charges remaining and that the account was indeed closed. Then, check in with your credit report in the next few months to make sure that the card is showing as closed and that there are no other issues, such as new charges or missing payments.

After that, all you need to do is destroy all the cards you have for the account and update any bill payments that you have set up to charge to the card automatically, if applicable.

How To Cancel A Credit Card Without Dinging Your Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Don’t Miss: How To Improve Payment History On Credit Report

Is It Bad To Close A Credit Card

Closing a credit card can negatively impact your credit utilization ratio, which may lower your credit score. However, borrowers should take a broader perspective when making the decision to close an account. There can be positive outcomes to canceling a card, such as avoiding an annual fee or preventing unnecessary, impulse purchases.