Southwest Rapid Rewards Plus Credit Card: Best For Southwest Rewards

Why we picked it: This cards Southwest-related rewards are sky high. Youll earn 2X points on Southwest purchases 2X points on local transit and commuting and 2X points on internet, cable, phone and select streaming services. All other purchases will earn 1X point including the first $10,000 of balance transfers made in the first 90 days of your original account opening date. Plus, if you earn 125,000 points in a year youll score one of the most coveted perks in all of travel rewards: the Southwest Companion Pass®. This pass lets you bring a companion with you on any Southwest flight you purchase with cash or points for up to the next two years for free .

Pros: The card features a sign-up bonus of 40,000 bonus points after you spend $1,000 on purchases in the first three months your account is open. Also, the Southwest Rapid Rewards Plus has no blackout dates and no seat restrictions.

Cons: You can find more generous bonuses with this cards big brother, the Southwest Rapid Rewards® Premier Credit Card. Also, theres an annual fee of $69 that isnt waived the first year.

Who should apply? Frequent flyers with Southwest or someone looking to get started on earning airline rewards are a good fit for this card.

Who should skip? Being a Southwest-centric card, there arent many uses for it if you dont travel often. If you dont frequently wanna get away, youll be better served by a different travel rewards credit card.

Simplii Financial Cash Back Visa Card

- 19.99% on purchases, 22.99% on cash advances.

- Rewards Rate0.5%-10%10% intro offer. 4% at restaurants, bars and coffee shops, 1.5% on gas, groceries, drugstores and pre-authorized payments, and 0.5% on everything else.

- Intro OfferUp to $500Earn 10% bonus cash back at restaurants and bars in your first four months .

- Our TakeWhy we like itThe $0-annual-fee Simplii Financial Cash Back Visa Card earns bonus cash-back on the purchases you make almost every day.Pros

- New cardmembers can earn a 9.99% introductory annual interest on purchases for the first six months.

Cons

- The 0.5% base rate isnt exactly impressive, but it only applies after you hit the annual spending limits of bonus categories.

- It only includes purchase security and extended protection insurance.

Our pick for bonus rewards on travel

First Progress Platinum Prestige Mastercard Secured Credit Card

- Receive Your Card More Quickly with New Expedited Processing Option

- No Credit History or Minimum Credit Score Required for Approval

- Quick and Complete Online Application No credit inquiry required!

- Includes Free Real-Time Access to Your Credit Score and Ongoing Credit Monitoring powered by Experian

- Full-Feature Platinum Mastercard® Secured Credit Card Try our new Mobile App for Android users!

- Good for Car Rental, Hotels Anywhere Credit Cards Are Accepted!

- Monthly Reporting to all 3 Major Credit Bureaus to Establish Credit History

- Just Pay Off Your Balance and Receive Your Deposit Back at Any Time

- 24/7 Online Access to Your Account

- Nationwide Program though not yet available in NY, IA, AR, or WI ** See Card Terms.

- Get a fresh start! A discharged bankruptcy still in your credit bureau file will not cause you to be declined.

Recommended Reading: What Credit Score Do You Need For An Apple Card

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

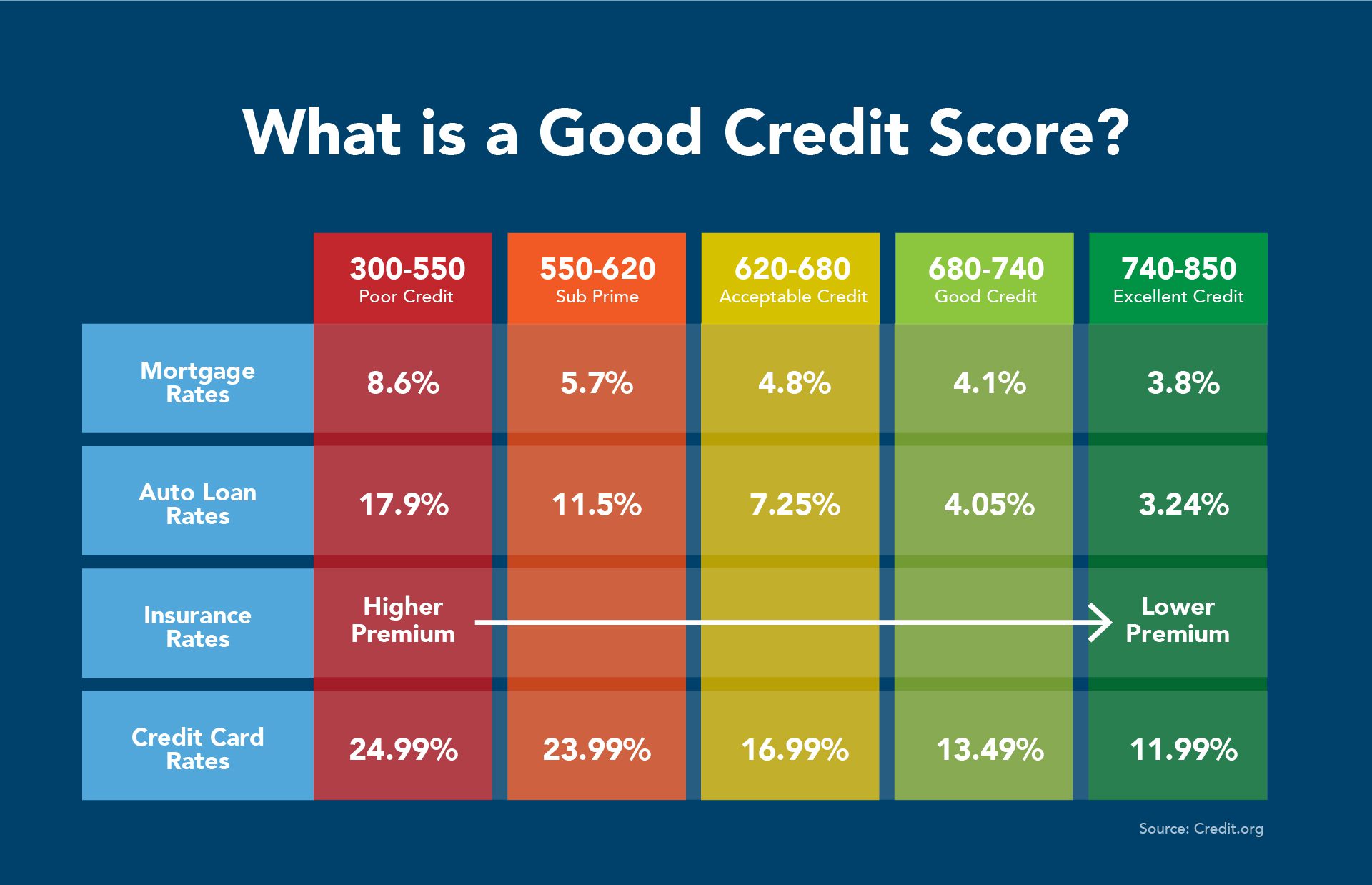

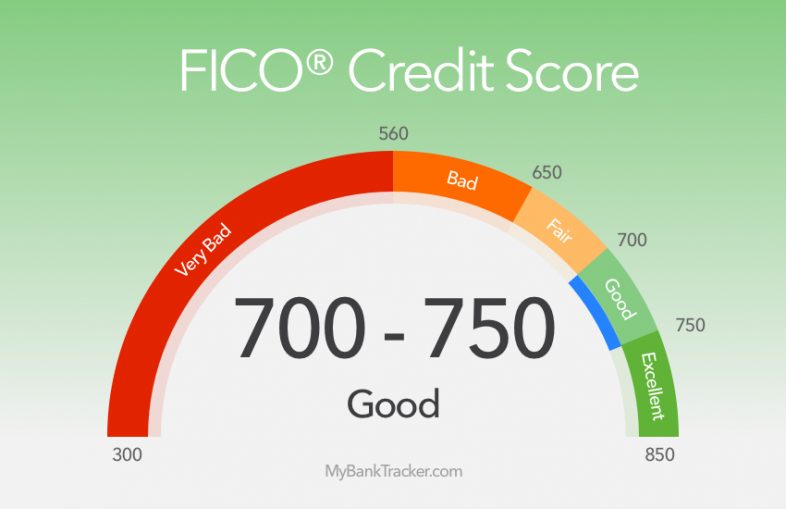

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

What Makes Up Your Credit Score If You Have No Credit Cards

Consolidated Credits FInanical Education Director April Lewis-Parks explains how credit scoring models apply when a consumer doesnt use credit cards. Learn what impacts your credit score besides the plastic in your wallet.

Hi, Im April Lewis-Parks, Director of Education at Consolidated Credit. And we have a consumer question today, and it is, Can I have a credit score without having a credit card?And the answer is yes. If you have any type of financing whatsoever ever extended to you, you probably have a credit score. But that doesnt mean a credit card. If you have a car loan, a mortgage, student loans you certainly have a credit score. And theres probably three, because theres three credit reports and then theres FICO.So you should always check your credit score even if you dont have any credit cards.

Don’t Miss: What Company Is Syncb Ppc

What Is A Fico Score

Many aspects of life are affected by credit ratings. They may:

- Determine whether a lender approves a new loan.

- Influence your interest rates and fees on the loan.

- Be reviewed by employers before they offer you a new job.

- Be used by landlords when deciding whether to rent to you.

- Determine your student loan eligibility, including most private loans.

- Be reviewed by insurance companies when you apply for many types of insurance, including car or homeowners insurance.

Home Trust Secured Visa *

The Home Trust Secured Visa stands out because its a secured credit card with no annual fee . To open an account, you need to make a $500 deposit. And while the interest rate is standard at 19.99%, this wont kick in unless you carry a balanceand if youre looking to build your credit, you should aim for that not to happen. As with other secured credit cards, you can improve your credit score by making payments on time, and preferably in full. Note: If you dont use your card at least once a year, theres a $12 inactivity fee, so make to charge at least one purchase to the card annually.

- Annual Fee: $0

You May Like: When Does Usaa Report To Credit Bureaus

Research Methodology: How We Choose The Best Cards For Fair Credit

Methodology: We analyzed 161 credit cards in the average credit range to identify the top products in the class. Core criteria we considered in our evaluation include:

- : When building a credit score, its vital to have a card that regularly reports your payment habits and has flexibility with your credit limit. We looked for credit cards with perks that help bolster your credit history and make it easy to track your credit score.

- Base rewards program: Does the card provide any ways to earn rewards? Not all cards in the fair credit range do, but some options provide strong cash back earnings, attainable sign-up bonuses and rewards across several spend categories.

- Affordability: Does the card feature an annual fee? Additionally, are there any extra fees you need to watch out for? How high are the interest rates if you were to carry a balance? In other words, we considered how costly a card can be.

- Additional benefits: Some cards offer introductory 0% APR periods on purchases/balance transfers to help protect cardholders from tedious costs. Other protective benefits, like zero fraud risk, prequalification and many more, were also weighed during our analysis.

Find Your Perfect Credit Card In Under 60 Seconds

Tell us a bit about yourself

Answer some questions so we can personalize our recommendations – this won’t impact your credit score

Check your eligibility

We confirm your eligibility with our partner, TransUnion. This will be a âsoft credit checkâ which you can see but lenders cannot

Find your perfect matches

Also Check: Tri Merge

Simplycash Preferred Card From American Express

- 19.99% on purchases, 21.99% on cash advances.

- Rewards Rate2%-10%10% cash back for the first four months, then earn unlimited 2% cash rewards on purchases.

- Intro OfferUp to $400Earn 10% cash back on purchases for the first 4 months . New cardmembers only.

- Our TakeWhy we like itA high flat rewards rate of 2% makes it easy to earn cash back on every purchase no need to keep track of bonus categories, spending limits or tiered and rotating structures.Pros

- An unlimited 2% cash-back earn rate is among the highest we evaluated.

- You can earn up to $400 in the first four months.

Cons

- Other cards on this list offer a higher cash-back rate on specific spending categories and might be a better fit if youre comfortable keeping track of tiered rewards structures.

Our pick for a premium Aeroplan credit card with unlimited rewards

Avant Credit Card: Best For No Foreign Transaction Fee

Why we picked it: Compared to many credit-building cards, the Avant Credit Card offers a relatively high credit limit to start and requires no security deposit.

Pros: This card allows potential applicants to check if theyre preapproved without dinging their credit. The application process is quick and applicants generally receive a decision in as little as 60 seconds.

Cons: This card offers no rewards and is generally short on perks beyond its lack of a foreign transaction fee.

Who should apply? This card could be a match for credit-builders looking to boost their score without putting cash down for a security deposit. Travelers will like its lack of foreign transaction fees.

Who should skip? Someone hoping to earn rewards will be disappointed by this cards lack of a rewards program. Those who tend to carry a balance should be mindful of the high APR .

Read Also: Does Affirm Check Credit Score

Chase Freedom Student Credit Card: Best For No Credit History

Why we picked it: Chases first credit card for college students rewards responsible spending: For the first five years, cardholders receive a $20 bonus after each account anniversary year if their account is in good standing . Plus, theres no annual fee.

Pros: The Chase Freedom Student credit card lets students earn rewards: 1% cash back on every purchase. Plus, theres a sign-up bonus: Cardholders earn $50 after making their first purchase with the card in the first three months. They also receive 5% total cash back on Lyft rides through March 2022 and a complimentary three-month subscription to DashPass, DoorDashs subscription service that provides free deliveries on eligible orders over $12. You must activate this benefit by Dec. 31, 2021, and after three months, youll be automatically enrolled in DashPass at 50% off for the next nine months.

Cons: Depending on their spending habits, students could arguably earn more over time with other cards in this category. For instance, the Journey Student Rewards from Capital One offers 1% cash back on general purchases but also lets cardholders earn a 25% bonus when they pay on time . Learn more about the best student credit cards.

Who should apply? This cards great credit-building tools and college-friendly rewards opportunities make it an ideal starter card for students.

Read our Chase Freedom® Student credit card review.

How Old Do You Have To Be To Get A Credit Card

You have to be at least 18 years old to get a credit card in the U.S. The law requires those who apply to have a source of income to demonstrate that they can pay back any amount they might charge to a card. But, sometimes those younger than that can be added as an authorized user on a parent or trusted adults credit card. Some issuers have a minimum age requirement to be an authorized user, others do not.

Don’t Miss: Usaa Credit Monitoring Experian

What Is A Good Fico Score

What is a good credit FICO score? The Fair Isaac Corporation developed FICO scoring models to provide an industry standard for creditworthiness that would work for both lenders and consumers. FICO utilizes software that analyzes a credit report to generate your credit score. Credit reports come from companies that work with you, such as your mortgage provider, your utility company, even landlords.

Your FICO score is a three-digit number based on the information in your credit reports. Lenders commonly use FICO credit scores to determine how likely you are to repay a loan. FICO measures:

A between 740 to 799 is generally considered good, according to FICO, and a score of 800 or above is considered excellent. The average FICO score in the U.S. rose to 714 in 2021, growing four points, making it the fourth consecutive year scores went up, according to Experian.

FICOs score ranges are as follows:

- Excellent credit: 800-850

- Fair/poor: 580-669

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Which Credit Bureau Does Paypal Use

Best No Foreign Transaction Fee Credit Cards

One of just two credit cards from Canadaâs big banks to waive its foreign transaction fees , the Scotiabank Passport Visa Infinite also offers impressive lounge access benefits and is issued by Visa so itâs more widely accepted when travelling outside of North America.

In terms of everyday rewards, the Scotiabank Passport Visa Infinite will earn you two Scotia Rewards points for every dollar you spend on eligible grocery stores, dining, entertainment , and daily transit purchases . For all your other purchases, youâll get one point per dollar. As a new Scotiabank cardholder, you can also earn up to 30,000 bonus points when you make at least $1,000 in everyday purchases within the first three months and another 10,000 points when you spend at least $40,000 on the card annually. 1 Scotia Rewards point is worth $0.01 when redeemed for flights on any airline.

Why we like it:

The cardâs lack of foreign transaction fees is the cherry on top of a number of perks including a $300 travel points bonus and Priority Pass membership with six free visits per year to over 1,200 lounges worldwide. As with other Visa Infinite cards, cardholders have access to the Visa Infinite Luxury Hotel Collection and Visa Infinite Dining Series.

Additional perks:

Oakstone Gold Secured Mastercard

- No minimum credit score requirements! We invite all credit types to apply! No processing or application fees!

- Includes Free Real-Time Access to Your Credit Score and Ongoing Credit Monitoring powered by Experian

- Helps strengthen your credit with responsible card use. Reports to three national bureaus

- Fast, easy application process. Choose your credit line and open your Personal Savings Deposit Account to secure your line.

- Nationwide Program though not yet available in NY, IA, AR, or WI

- Get a fresh start! A discharged bankruptcy still in your credit bureau file will not cause you to be declined.

- See website for additional Oakstone Gold Secured Mastercard® details

| $49 |

Also Check: Ccb Ppc Credit Inquiry

Understanding Your Credit Score

Credit scores range from 300 to 850 and help lenders assess levels of risk associated with borrowers. Every lender is different, and are not the only thing they consider, but anything 800 or higher is considered excellent, 740799 is considered very good, and 670739 is considered average. Borrowers with scores below 700 are more likely to be denied credit, and the lower the score, the higher interest rate is likely to be. Scores in the high-500s to mid-600s might still be approved for some credit cards with low limits and very high interest rates. However, once scores go south of 600, approval for an unsecured credit card is unlikely.

Two formulasFICO and VantageScore 3.0are used to calculate, but they both emphasize the same things. Payment history and credit utilization are most important, followed by the average age of your credit accounts. Also considered but less important are the number of inquiries into your credit and the mix of different types of credit. Credit utilization is the key factor to watch with a credit card.

Help improve your credit by always paying your credit card bill on time and never carry a balance greater than 30% of your spending limit. Keeping at least 70% of your available credit unused shows that you can handle your finances responsibly, which could boost your credit score.