How Long Does Chapter 11 Bankruptcy Stay On Your Credit Report

4.8/510 years7 years

People also ask, does a bankruptcy automatically come off?

The Two Types of BankruptcyIt takes 10 years for this type of bankruptcy to come off your credit report. The bankruptcy itself will automatically be deleted from your report seven years from its filing date.

Also Know, does Chapter 11 affect personal credit? If you are operating as an LLC or corporation, a business bankruptcy under Chapter 7 or 11 should not affect your personal credit. However, there are exceptions. Pay the debt on time and your will be fine. If it goes unpaid, or you miss payments, however, it can have an impact on your personal credit.

In this manner, how much will credit score increase after bankruptcy falls off?

The Truth: While bankruptcy may help you erase or pay off past debts, those accounts will not disappear from your report. All bankruptcy-related accounts will remain on your report and affect your for seven to ten years, although their impact will lessen over time.

Can Chapter 7 be removed from credit before 10 years?

Chapter 7 bankruptcy is deleted 10 years from the filing date because none of the debt is repaid. Individual accounts included in bankruptcy often are deleted from your history before the bankruptcy public record. Usually, a person declaring bankruptcy already is having serious difficulty paying their debts.

Can You Remove Bankruptcy From Your Credit Report

In most cases, no: You cannot remove a bankruptcy from your credit report. Remember, it will be removed automatically after seven or 10 years, depending on the type of bankruptcy you filed.

In the rare case that the bankruptcy was reported in error, you can get it removed. Its fast and easy to dispute your information with TransUnion. If you see a bankruptcy on your credit report that you didnt file, heres how to dispute your credit report.

You May Like: How To Get An Eviction Off Your Credit

Can Bankruptcy Be Removed From Your Credit Report Early

Unfortunately, itâs usually not possible to remove a bankruptcy filing from your credit report before 7 to 10 years have passed. After 7 to 10 years, depending on which type of bankruptcy you file, it will automatically fall off your report. The only scenario in which you could potentially remove a bankruptcy filing from your report sooner is if it were reported in error.

Don’t Miss: Will Checking Credit Score Lower It

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

How Long Does Bankruptcy Show On Your Credit Report

John E. PytteFeb. 23, 2021

It is true that a Chapter 7 or Chapter 13 bankruptcy will appear on your credit report for years, but that does not necessarily mean filing for bankruptcy is the wrong choice. It could be the only way you can get back on firm financial footing when you are struggling with debt.

In the 12 months leading up to March 31, 2020, the state of Georgia had the highest number of individuals filing for Chapter 13 bankruptcy in the nation. That was more than twice the number filed in California or New York during the same period. Despite the damage bankruptcy would do to their credit ratings, thousands of people decided it was the best way to get back on their feet financially.

If you are thinking about filing for bankruptcy, or if you have already filed and wonder how it will affect your future, you should talk to an experienced bankruptcy attorney.

At Pytte Law, I help clients in Savannah and Hinesville, Georgia, and the surrounding towns and counties consider their options. I provide answers about the long-term impact of bankruptcy and help people like you decide if itâs is right for you.

You May Like: How To Remove Charge Off From Credit Report

What Should I Look For

Remember that when you file bankruptcy, you must list all of your debts.

This means that every open credit account in existence at the time of filing should be marked as either included in bankruptcy, or as discharged in bankruptcy.

- Any account that you paid off prior to the bankruptcy should be listed as paid and closed

Without the bankruptcy, all of the delinquent and collections accounts would report to the bureaus every month that you had missed a payment.

This lowers your credit score every month.

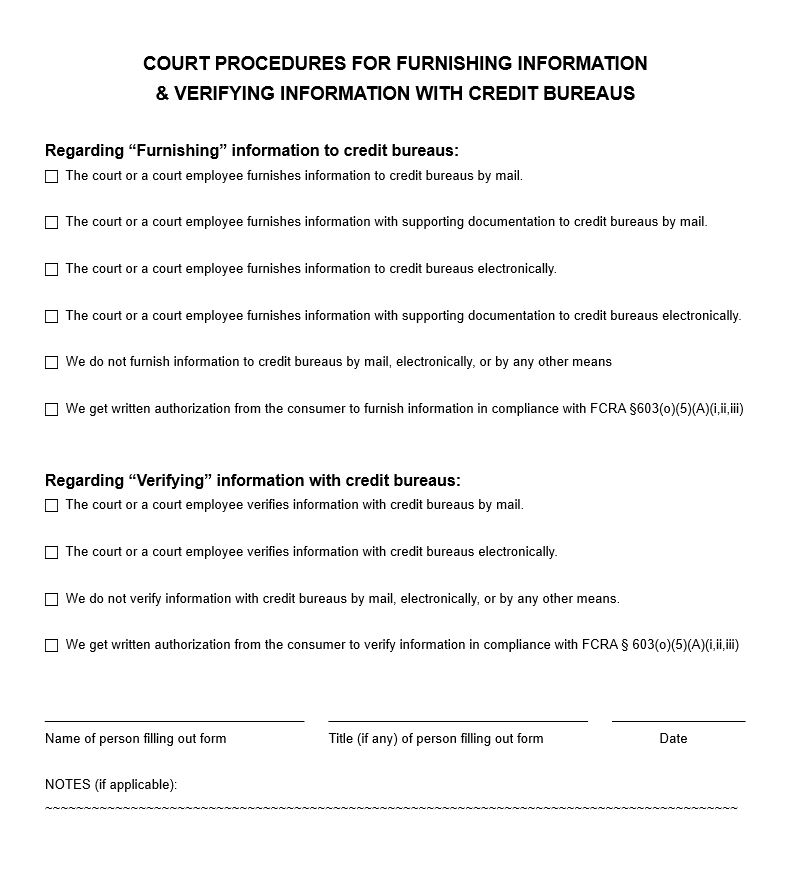

Do I Have To Get My Credit Report From All Three Cras

As there is no requirement under data protection law for lenders to report such data to all the CRAs, it is up to the lender to decide which CRA they wish to use, if any.

While we appreciate it is frustrating you may have to obtain three copies of your credit reference file. You may want to consider obtaining one report first as it could be that all accounts appear on there and you wont have to obtain the other two. You could ask your lenders which CRAs they use to help narrow this down. You may find that they all use one, or even all of, the CRAs.

You May Like: Does Affirm Show Up On Credit Report

You May Like: How To Add Rental History To Credit Report

Understanding Chapter 13 Credit Reporting

During a Chapter 13 bankruptcy the creditors are not required to report anything to the credit reporting agencies. Even though a debtor is making payments in their plan, those payments may not be reported to the credit reporting agencies.

On the other hand, some creditors will zero out the debtors balance after the bankruptcy filing. This, however, is not guaranteed. But whether or not a creditor zeros out a debtors balance will not impact the fact that they cannot attempt to collect on the debt while the debtor is in bankruptcy.

Lastly, your credit report is not entirely important at the moment. Generally speaking a debtor is not able to obtain new credit while in Chapter 13 bankruptcy without the permission of the bankruptcy trustee. Because of this their credit rating during bankruptcy is not as important as their credit rating after their bankruptcy discharge.

You May Like: Does Speedy Cash Check Your Credit

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

You May Like: Does Authorized User Affect Credit Score

How Can I Get A Copy Of My 1999 Credit Report

For example, if you suspect that someone opened credit card accounts in your name in 1999, that can help your representative find the report that you need. Request a copy of your current credit report. Here, you can see factors from the past seven years that affect your credit negatively, from collections to delinquent accounts.

Apply For An Unsecured Credit Card

Youll wait to do this for several years. But if youve improved your credit score over the years, you should apply for an unsecured credit card again.

This lets you continue to improve your credit score. Its also a much better deal than an unsecured credit card.

But dont apply for more than one credit card. If you get declined, wait at least six months before you apply for another one.

Also Check: Will Evictions Show On Credit Report

Also Check: Is 777 A Good Credit Score

How Can Bankruptcy Impact My Credit Score

Bankruptcy can severely hinder your chances of obtaining a loan, financing a mortgage, being approved for credit cards, or renting an apartment. Luckily, its impact on your credit score shrinks as time goes on.

On the surface, bankruptcy seems negative, but it can also serve as a fresh start for struggling individuals and businesses. Filing for bankruptcy means that the debts you canât repay are forgiven, and lenders still receive a certain amount of repayments through the liquidation of your assets.

How bankruptcy affects your credit score depends on the specific type of bankruptcy. That said, if an individual is filing for bankruptcy, they most likely have a bad credit score already.

Recommended Reading: Epiq Corporate Restructuring Letter

How To Build Your Credit After Bankruptcy

A bankruptcy is a devastating and life-altering event that can leave some serious emotional scars. But just because youve got bankruptcy or other negative info clouding up your credit history, it doesnt mean your life is over. You can come back from a bankruptcy, and it starts with dusting yourself off and learning from your mistakes. Here are some ways to help rebuild your financial stability after a bankruptcy.

Recommended Reading: Which Credit Report Is Used Most

How Can I Rebuild My Credit File After Bankruptcy

The good news is that bankruptcy isnât the end of the road financially. Here are some steps you can take in the short term:

- Order a copy of your statutory credit report to ensure your credit details are correct

- Add a short statement to your report explaining why you got into debt

- Register for the electoral roll at your current address

- Update all personal details on your credit profile

In the long term, itâs important to show lenders that you can borrow money responsibly. You can do this by using and repaying credit. But before you do so, you need to be 100% sure you can afford and meet the repayments.

- Consider credit designed for people with low credit ratings. This usually means low limits and high interest rates. You may be able to improve your rating by using this type of credit for small purchases and repaying the money in full and on time.

- Space out your applications. Each application for credit will leave a mark on your credit report, so aim to apply no more than once every three months.

- Check your eligibility before you apply for credit. Doing this can help you reduce your chances of being rejected and having to make multiple applications. You can see your eligibility for credit cards and personal loans when you create a free Experian account.

What Are The Consequences Of Bankruptcy

According to AFSA, bankruptcy can affect:

- your income, employment and business

- your ability to travel overseas

- your ability to get credit in the future

- your assets, such as your home if you own one

- some, but not all, of your debts

If you declare or are declared bankrupt, a trustee will manage your bankruptcy, and they will seek to ensure fair and reasonable outcomes for you and your creditors. The trustee may be able to claim and sell your assets and possessions, using the proceeds to repay money you owe. While a vehicle can be kept if its value is up to an indexed amount , a trustee can claim any houses or property you own as assets as part of proceedings.

Recommended Reading: How To Get Transunion Credit Report

Learn Positive Financial Habits

As time goes by after your bankruptcy and you begin to earn new forms of credit, make sure you dont fall back into the same habits that caused your problems. Only use credit for purchases you can afford to pay off, and try using a monthly budget to plan your spending. Also, work on building an emergency fund to cover three to six months of expenses so a random surprise bill or emergency wont cause your finances to spiral out of control.

How Long Does Bankruptcy Affect Me

There sure is a lot of misinformation out there about bankruptcy, how long it lasts and what the long term effects are. Just when I think I have heard it all, someone comes up with a new one, I heard you cant have a bank account for 10 years when youre bankrupt A person said that to me just last week.

So, how long does a bankruptcy affect you? There are three answers to that question:

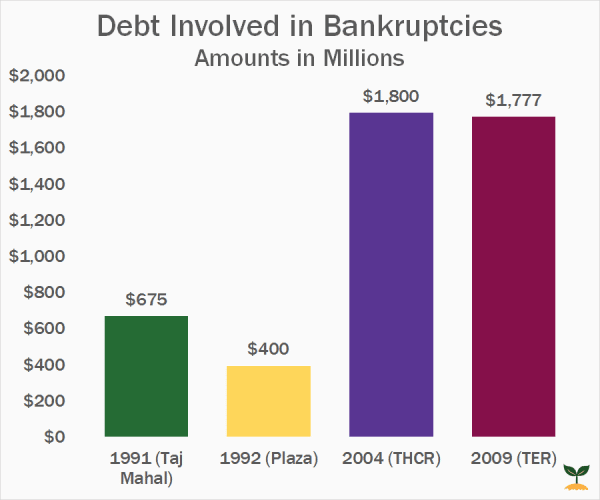

Dont Miss: Donald Trump Number Of Bankruptcies

Read Also: When Will Chapter 7 Be Removed From Credit Report

How To Improve Your Credit After Bankruptcy

You may be disappointed to know that bankruptcy can stay on your credit report for a decade, and that theres nothing you can do to make your bankruptcy disappear any sooner. However, there are still plenty of steps you can take to recover from a bankruptcy much faster than many people realize.

If you want to be able to get a mortgage, finance a car or get approved for a line of credit in the years following a bankruptcy, consider these tips:

After Six Years From The Date Of Discharge Start Checking

If your bankruptcy was discharged, and its been more than six years since it was discharged, submit your Certificate of Discharge. It may take them a few week to update your credit reports. I would allow at least a month, maybe more. Then request a new copy of your credit report and see if its still showing up. Better yet, when submitting your certificate of discharge, request that a new copy of your credit report be sent to you once all of the updates have been done. By mail, you should be able to get it for free. If you get it online, you get it instantly, but you have to pay for it .

If its only been slightly longer than six years since your bankruptcy was discharged, it may take a few more weeks or even months for it to drop off your credit report. But if you absolutely cant wait then call or send in a correction form to see if you can speed up the process.

Don’t Miss: What’s A Perfect Credit Score

Your Credit Report During Bankruptcy

How long will bankruptcy be on my credit report?

A bankruptcy will be on your credit report for anywhere between 7 to 10 years. Usually, a Chapter 7 bankruptcy is on your credit report for 10 years while a Chapter 13 bankruptcy is on your credit for 7 years. However, that does not mean your credit score will be hurt for 7 to 10 years. Instead, your credit score after filing a bankruptcy is usually damaged for about two years.

Does the bankruptcy come off my credit report 7 to 10 years after I file or after my bankruptcy is over?

Bankruptcy will be removed from your credit report 7 to 10 years after the date you file the bankruptcy, not the date it is discharged. I have clients who are always worried that a bankruptcy will be on their credit for 12 years if they file a Chapter 13 bankruptcy . Thats not the way it works. They look at the date the bankruptcy is filed.

How long does bankruptcy hurt my credit score?

Bankruptcy will typically hurt your credit score for two years from the date you file the bankruptcy. It will be on your credit report for 7 to 10 years but that doesnt mean it will actually hurt your FICO credit score for that entire period. Instead, you are looking at a negative impact for about two years. However, its not uncommon for someones credit score to improve much, much quicker than that.

How is my credit report impacted if I dont finish my bankruptcy?

How does a bankruptcy show up on my credit report?

Bankruptcy Affects High Credit Scores More Than Low Credit Scores

The higher your FICO score is before a bankruptcy filing, the more it will affect your credit rating:

| Score | |

| Note: Scores do not go lower than 300 | 130-150 points |

You will likely drop to a poor credit score no matter what score you started with. Your credit history already shows you filed for bankruptcy, but credit bureaus want to ensure you take steps to improve your bad credit before you take on more debt and new credit.

The sliding scale system will generally knock your credit points however much it takes to show you have poor credit. Your score may barely change if you already have bad credit . It is not common to see credit scores lower than 500 even after a bankruptcy filing.

Read Also: How Long Do Judgements Stay On Credit Report

How Long Will My Credit Score Be Hurt

Your credit score will likely be impacted by the bankruptcy for the first two or three years immediately following your bankruptcy filing. After that time, it is important for you to work on rebuilding your credit, even though the bankruptcy is still showing on your credit report. By working on rebuilding your credit while the bankruptcy is still showing, you are taking important steps to ensure your credit is not ruined for ten years. If you are in Chapter 13 bankruptcy, however, be sure to talk to your attorney before you incur any new credit or debt.

After two or three years following your bankruptcy filing, if you have been working on rebuilding your credit, you will begin to see your credit score increase again. It is important to remember that the bankruptcy is similar to a wound it will not heal overnight, and it takes diligence, time, and care to completely heal. Eventually, that wound will turn into a scar and can still be seen but is not painful. Just like after two or three years the bankruptcy will still be visible on your report but will not have a big impact on your actual FICO score. By caring for your credit and taking the necessary steps to rebuild it during the seven to ten years it is reflected on your credit report, you will ensure that the bankruptcy gives you a true clean slate and that it does not ruin your credit for ten years.

How can I rebuild my credit after bankruptcy?