Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

How Do Errors Impact Your Credit Score

Your is calculated using different models such as VantageScore and FICO, the two most widely used credit-scoring models. Each model has its proprietary metrics and criteria. However, both use data from the major credit reporting agencies to generate your score.

Both scoring models also consider similar factors when calculating your score. These include your total credit usage and length of credit history, for example. But your payment history is the most important factor when determining your credit score.

Your payment history alone makes up around 35% of your FICO score and 42% of your VantageScore 4.0. Since payment history is so significant, a single inaccurate late payment could impact your score considerably. According to FICO, if your report has a 90-day missed payment, your score could drop by as much as 180 points.

How To Remove Negative Items From Your Credit Report Yourself

First, it’s important to know your rights when it comes to your credit history. Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the bureaus find that the information you disputed doesnt belong in your record or is outdated, they are obligated to remove it.

Common credit report errors include payments mistakenly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number or identifying information.

Bear in mind that correct information cannot be removed from your credit report for at least seven years. So, if your score is low due to down because of accurate negative information, youll need to repair your credit over time by making payments on time and decreasing your overall amount of debt.

Here are some tips to help you repair your credit history:

You May Like: What Is Elan Financial Services On My Credit Report

Make Sure Your Disputes Are Legitimate

Be sure you dont do anything to make the credit bureaus think your credit report disputes are frivolous. Dont dispute everything on your credit report and do not send all your disputes at once. If you dispute the same item more than once, you should give a different reason for each dispute so the credit bureau doesnt think youre sending duplicates. The credit bureau has the right to reject your dispute if you don’t have solid evidence.

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Recommended Reading: Does Debt Consolidation Hurt Your Credit Score

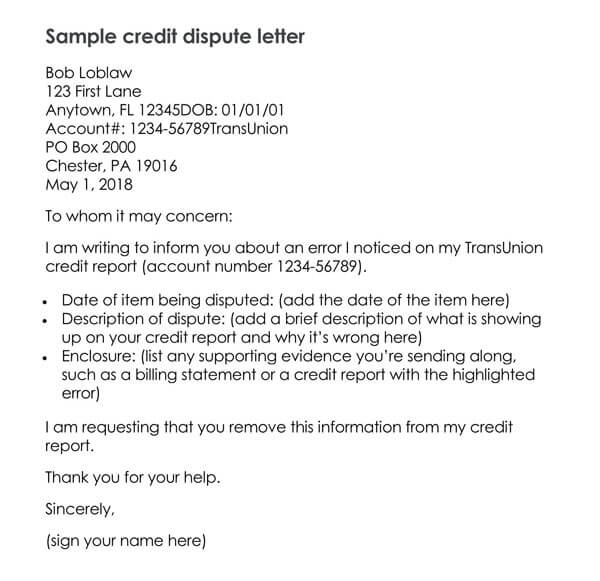

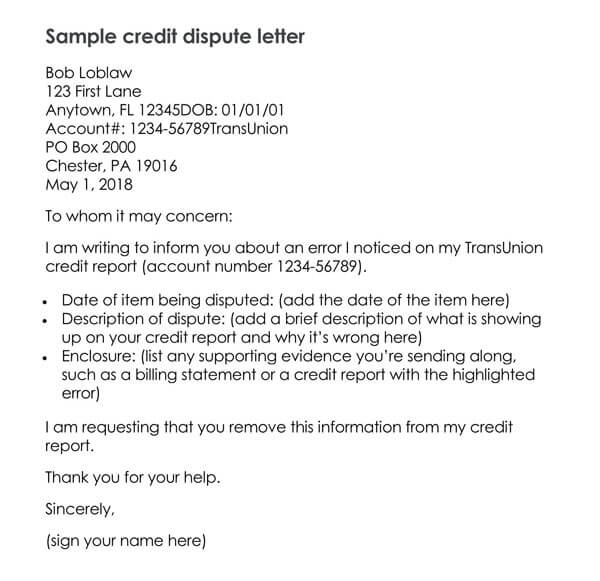

What Is A Credit Report Dispute Letter

Consumers can dispute a credit report. It is their free right provided by the Consumer Credit Protection Act. Credit agencies have thirty days to provide a formal response to your letter of dispute. An additional fifteen days can be added to the timeline if additional evidence is presented. The Credit Report Dispute Letter should identify specific items on the report which are in error. The item may have been paid, reported incorrectly, or is more than seven years old. The three bureaus are required under federal law to provide credit reports free of charge to residents of the United States.

How Do I Correct Or Dispute Information On My Equifax Credit Report

If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly. This is especially helpful if the information involves your name or address. Updating your personal information with lenders and creditors can help ensure the information reported to the three nationwide credit bureausEquifax, Experian and TransUnion is correct.If you need to dispute information with the credit bureaus, the fastest way to do so is online. Youll need to file a dispute separately with each credit bureau. You can file a dispute on the following sites:

- Equifax: www.myequifax.com. New users will first need to create an account. Existing users can log in using their current credentials.

Also Check: How To Keep A Good Credit Score

Do You Have A Right To Have All The Information Removed From Your Credit Report

Yeah, under the Fair Credit Reporting Act credit bureaus in any creditors or collectors nice report correct and accurate information about you and your credit report. In situations where another person’s information is on your account, this law may have been violated. Just because you have a similar social security number, name, date of birth, or other identification information doesn’t mean you get credit reports mixed with someone else. That’s just not fair and the law doesn’t allow it.

Common Mistakes That Cause Credit Report Errors

To begin, it’s important to know if the person responsible for the error is you. Often, a person may have applied for credit under different names . Make sure you’re consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person with a similar name. Likewise, apply the same consistency and care with things like your Social Security number and address.

Or it could be a case of what you didn’t put in your report. If you were denied credit because of an “insufficient credit file” or “no credit file,” it may be because your credit file doesn’t reflect all your credit accounts. Though most national department store and all-purpose bank credit card accounts will be included in your file, not all creditors voluntarily supply information to the credit bureaus, nor are they required to report consumer credit information to credit bureaus.

If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different creditor who does report regularly to credit bureaus.

Other common errors to look for:

Read Also: Does It Hurt To Check Your Credit Score

When Is It Necessary To Dispute A Name

If your credit reports list accounts that belong or belonged to you and are under names you no longer use, it’s probably not necessary to file a dispute to correct them. One exception, though, is if you’ve informed a current creditor about a name change, and it’s reflected in their communications with you but your credit reports aren’t updated after several months. If this were to happen, you may want to submit a dispute with the credit bureaus to bring the reports current.

But sometimes names you’ve used could be connected with account information that isn’t yoursand that’s when it becomes important to dispute the information. This isn’t a common occurrence, but it can happen accidentally or under suspicious circumstances, such as identity theft.

You’re particularly at risk if:

- You share a name with a parent or childparticularly if neither of you uses a suffix with your name.

- Your name is fairly common, and someone who shares your name also shares your date of birtha situation that’s atypical, but also not as rare as you might think.

Accidental mixture of your credit data with those of another person who shares your name creates what’s known in the industry as a “mixed credit file,” or mixed credit report. A mixed credit file distorts your credit history and can lead to erroneous credit score calculations.

Filing With The Information Provider

Also Check: What If My Credit Score Goes Up Before Closing

Look For Inaccurate Information On Your Credit Reports

If you havent already, request your credit reports from the major credit reporting bureaus: Experian, TransUnion, and Equifax. Youre entitled to one free report from each bureau once per year . You can access all three reports online at AnnualCreditReport.com or call 200-6020 to request hard copies. Some sites like this are scams, but AnnualCreditReport.com is a safe website that is federally authorized to provide free credit reports.

Next, carefully review each report for errors and take note of which credit bureaus have reported inaccurate information.

Fixing Credit Report Errors

To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

Keep in mind that all three of the credit bureaus now accept the filing of disputes online, with Experian now only accepting online submissions.

Find out how to initiate a dispute online.

Begin by telling the credit bureau what information you believe is inaccurate. Credit bureaus must investigate the item in question-usually within 30 days-unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your communication should:

- Clearly identify each disputed item in your report.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may also want to enclose a copy of your report with the items in question circled. Your communication may look something like this sample.

If mailing a letter, send it by certified mail, return receipt requested, so you can document that the credit bureau did, in fact, receive your correspondence. Also, keep copies of your dispute letter and enclosures. If you want help disputing mistakes on your credit report, myFICO can help you write a free letter in minutes.

You May Like: Do Bank Accounts Affect Credit Score

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Why Does My Credit Report Show Variations Of My Name

It’s not uncommon for your credit report to list your accounts under multiple versions of your name.

Your accounts may reflect different variations of your name that you used on credit applicationsSuzanne Smith, Sue Smith and Suzanne A. Smith, for instance.

If you’ve ever changed your name , past versions of your name also may be reflected in your credit reports. That’s especially true of accounts that are no longer active: A student loan or car loan you paid off before you got married will be listed under your unmarried name, for instance, and will stay that way even after you marry.

With open accounts, when you inform creditors of a name change, your new name should eventually be reflected in your credit reports. It may take a few months, however, for each creditor to update all three national , and then for the bureaus to post the changes to your credit report.

If you have a hyphenated last name , it may appear on your credit reports in its correct form as two words or as a single word without a hyphen . The way it appears reflects the way lenders’ automated systems handle hyphens.

The national credit bureaus recognize that people may use different names at different times. As a result, your credit report from each bureau lists all the various names under which your accounts are listed. Credit reports are formatted differently at each bureau, but here’s an idea of what the name list looks like on an Experian credit report:

Read Also: Does Advance America Report To Credit Bureaus

Review Your Credit Reports For Errors

Your are based on information provided by companies to the three major credit bureausExperian, Equifax and Transunion. To identify which credit reports contain errors, you have to review each report separately. You can do this by visiting AnnualCreditReport.com. Due to Covid-19, you can view all three of your reports for free weekly through April 20, 2022.

If Youve Spotted An Error On One Of Your Credit Reports You Should Take Immediate Steps To Correct The Inaccuracy

Around 25% of U.S. consumers found errors that could affect their credit scores in one of their credit reports, according to a 2012 study by the Federal Trade Commission. The same study reported that one in five consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one report.

An error on your credit reports could lead to lower credit scores and impact your ability to open a new credit account or get a loan. Here are steps you can take to ask the credit bureaus to remove incorrect derogatory marks from your credit.

Also Check: How To Report Unpaid Bills To Credit Bureau

Gather Materials To Dispute Errors

Your goal is to make it as easy and quick as possible for investigators to confirm that your complaint is valid. Depending on the error, the things you gather to support your case could include:

-

Copies of credit card statements or loan documents

-

Copies of bank statements

-

Copies of birth or death certificates, or a divorce decree

-

If you’ve reported identity theft, include a copy of your FTC complaint or police report.

How Long Does Information Stay On Your Reports

The FCRA limits how long a credit reporting agency can report negative items in your credit report. Items that arent negative but are neutral or positive can be reported indefinitely. Review the rules below and then check your credit report for negative items that are too old to be reported.

No Negative Credit Reporting If You Make an Agreement Due to Coronavirus

Under the federal Coronavirus Aid, Relief, and Economic Security Act, if you make an agreement with a creditor to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or get any other assistance or relief because COVID-19 affected you, the creditor must report the account as current to the credit reporting agencies if you werent already delinquent.

Also Check: Is 552 A Good Credit Score

Dispute Your Credit Reports Errors

Under the Fair Credit Reporting Act, both the credit reporting bureau and the company that reports the information about you to the credit bureau are required to accept disputes from consumers and correct any inaccurate or incomplete information about you in that report.

The U.S. Federal Trade Commission recommends taking these actions:

- Tell the credit bureau, in writing, what information you think is inaccurate. The Federal Trade Commission provides a sample dispute letter that makes this step easier. The letter outlines what information to include, from presenting the facts to requesting that the error be removed or corrected.

- Include copies, not originals, of materials that support your position.

- Consider enclosing a copy of your credit report with the errors circled or highlighted.

- Send your letter by certified mail with return receipt requested to ensure the letter is delivered. Keep your post office receipt.

- Keep copies of everything you send.