How Long Does It Take For Your Credit Score To Go Back Up After Closing A Credit Card

Your credit score is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working

Your credit score is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

Find Help For Outstanding Debt

Sometimes debt can get away from you. If you’re being sued for outstanding debt, there’s help. SoloSuit can help you respond to a lawsuit and get the justice you deserve. But act quickly. You only have 14 to 35 days to respond. , and we’ll help you by filing it on your behalf.

To learn more about how to respond to a debt collection lawsuit, check out this video:

Average Credit Score After First 6 Months

Every person is different, and the average credit score after working on credit repair can vary among individuals. Everything from the initial score, what is causing the score to drop, and what you do to fix the low score can determine how much your credit score can rise after six months. On average, those who work diligently can raise their credit score as much as 100 points within the first six months.

Read Also: Is 640 A Good Credit Score

How Long Does A Chapter 7 Stay On Your Credit Report

Chapter 7s can stay on your credit reports for up to ten years from the date you filed. Currently, civil judgments do not appear on your credit reports at all. Yet this change was due to a settlement the credit bureaus made . The FCRA still allows judgments to remain on credit reports for seven years from the filing date.

What Is The Maximum Time It Will Take For Your Score To Improve

Black marks can stay on your credit report for up to 7 years . This means that a damaged credit score will take a maximum of 710 years to fully recover, provided you dont incur any more negative items in the intervening time.

In practice, your credit score will improve more quickly than that because the effect that negative items have on your credit score diminishes over time. As the table above shows, in many cases, you can expect your score to recover within 23 years.

Read Also: When Do Closed Accounts Fall Off Your Credit Report

Is 700 A Good Credit Score

FICO credit scores, the industry standard for sizing up credit risk, range from 300 to a perfect 850with 670 to 739 labeled good, 740-799 very good and 800 to 850 exceptional. A 700 score places you right in the middle of the good range, but still slightly below the average credit score of 711.

Three Ways To Eliminate Collections Accounts From Your Credit Score

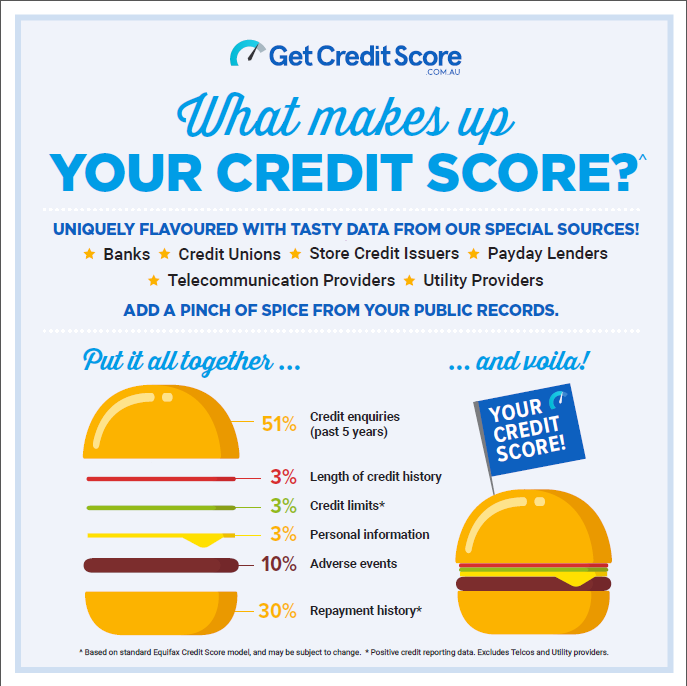

First, you must obtain credit reports from each of the three leading credit reporting agencies: Equifax, Experian, and TransUnion. Notify only one or two of the bureaus about the collections. You may attempt various methods to delete collections from your account, some of which will be more successful than others. Well go through each of these possibilities in detail below.

However, do keep in mind that the outcomes of various strategies differ and that not every customer will see the same results. But it is always worth looking into as your credit score can increase as a consequence.

Also Check: How To Get A Copy Of Credit Report

Ways To Improve Your Credit Score

Your credit score is important. It is used by lenders to determine whether or not youre a good candidate for a loan. A high credit score means youre a low-risk borrower, which could lead to a lower interest rate on a loan. There are a few things you can do to improve your credit score, and well go over them in this article.

Six Ways To Raise Your Credit Score By 40 Points

Raising your credit score by 40 points can make a big difference. Imagine that you buy a house for $305,000. You put down 20%, which means your mortgage loan totals $244,000 . With a credit score of 685, you’ll qualify for an APR of 4.546%, spending $203,000 in interest over the course of a 30-year loan.

But if you bump your credit score up to 725, you’ll qualify for an APR of 4.369% and spend $194,000 in interest, a difference of $9,000. That saves you $300 a year over a 30-year term, enough to supplement your summer vacation savings.

Here are six ways to quickly raise your credit score by 40 points:

Read Also: Is 570 A Bad Credit Score

Benefits Of Paying Off Collections

Though your will not automatically improve when you pay off your collections, there are certain benefits to it:

- For overdue medical or credit card payments, you avoid a debt collection suit.

- You dont have to pay the debt collectors interest costs. Debt collectors acquire and sell accounts all the time, and they can keep charging you fees and interest on accounts they have bought.

- Your credit record may show settled or paid in full. Lenders who consider your credit history and your credit score may be positively impacted by these labels. An individual who repays a significantly overdue account compared to someone who does not demonstrates greater financial discipline and stability.

- Take advantage of the new FICO® Score methodology. Although FICO 9 is being phased in gradually, most lenders will ultimately utilize it. Medical bills are given less weight in this approach, while paid accounts in collections are wholly ignored.

Why Did My Credit Score Drop After Collection Account Removed

The most common reasons credit scores drop after paying off debt are a decrease in the average age of your accounts, a change in the types of credit you have, or an increase in your overall utilization. It’s important to note, however, that credit score drops from paying off debt are usually temporary.

Also Check: How To Add Rent To Your Credit Report

Work With A Credit Repair Agency

If youre not able to raise your credit score on your own, you may want to consider working with a credit repair agency like or Lexington Law. These companies can help you dispute errors on your credit report, negotiate with creditors to remove negative items and develop a plan to improve your credit.

Just be sure to do your research before choosing a credit repair agency. There are a lot of scams out there, so you want to make sure youre working with a reputable company. You can check out the Better Business Bureau website to see if there have been any complaints filed against the company.

Dispute Inaccurate Information On Your Credit Reports

Sometimes, your credit score might suffer because something wound up on your credit reports that shouldnt have been there. Of course, you wont know unless you check them.

Under normal circumstances, consumers are entitled by federal law to one free credit report every year from each of the credit bureaus Equifax, Experian and TransUnion accessible through annualcreditreport.com. However, during the coronavirus pandemic, the bureaus are allowing consumers to access their reports weekly through April 2021.

If you spot legitimate, incorrect information while reviewing your reports, such as accounts that arent yours, a name mix-up with another person or incorrectly reported payments, you can file a dispute. The Consumer Financial Protection Bureau, a federal agency responsible for protecting consumers and offering financial education, provides dispute instructions for each bureau.

Its worth taking a look at your reports, even if you have no reason to suspect there might be a problem. According to a report from the Consumer Financial Protection Bureau, 68% of credit or consumer reporting complaints received by the bureau in 2020 dealt with incorrect information on peoples credit reports.

How much will this action impact your credit score?

Whether your credit score changes and how much it changes depends on what you are disputing.

Don’t Miss: What Credit Report Does Rooms To Go Pull

How Long Does It Take To Build Credit From Nothing

Exactly how long it takes to build credit is different for everyone. And it can depend on what your credit scores are now, as well as how youâre managing your debt.

If youâve never had credit of any kind, there are several ways you can begin to build a credit history. This could include applying or being approved for a credit card or even a loan. And according to Bankrate.com, you can get a FICO® score calculated in about six months. It may take even less time to get a VantageScore®.

Experian®, one of the three major credit bureaus in the U.S., explains that âyouâll need to have an open and active account for three to six months before a credit score can be calculated.â

Although it can take months to build a good credit score, it can take far less time to undo all your hard work. For instance, negative factors like late payments may stay on your for years and could negatively impact your scores. The Consumer Financial Protection Bureau says some types of bankruptcy filings can stay on your credit reports for up to 10 years.

The good news: If you start developing healthy credit habits now, the negative impacts to your credit scores may begin to diminish over time.

Keep The Accounts That You Already Have

One mistake that people often make is to close their credit accounts after paying off their balances. Its common for those with a secured credit card or one with an annual fee.

Unfortunately, doing so can come back to bite you. When you close a credit account, you have less open accounts on your credit report. Many lenders will turn down your credit application if you dont have enough open accounts in your name.

Also, closed accounts dont contribute to the length of your credit history. So your average credit history length could go down if you close your oldest accounts.

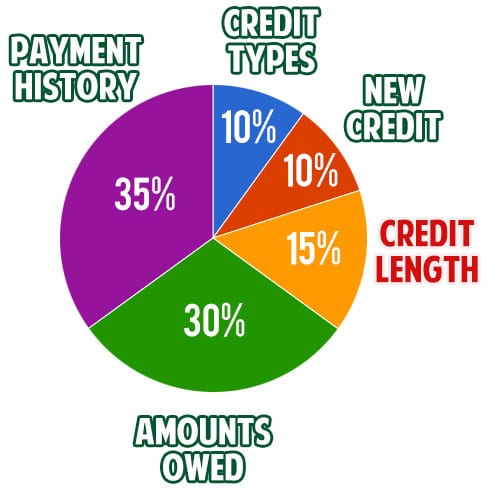

Since length of credit history is a credit score factor, it could decrease your credit score immediately.

If you have a secured credit card, its sometimes possible to get your deposit back without closing the account. Your credit card company might allow you to roll over into an unsecured card after six months to a year of good behavior.

If they dont offer the upgrade after a year or so, you can reach out and request one. If youre successful, theyll refund the deposit without closing the account. They may also increase your available credit, which will help your credit utilization. Double win!

As for cards with an annual fee, its up to you to decide whether theyre worth the cost. If you still use it and can accrue enough in rewards to cover the fee, its probably worth keeping.

Also Check: How To Fix Credit Report

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Become An Authorized User

If a relative or friend has a credit card account with a high credit limit and a good history of on-time payments, ask to be added as an . That adds the account to your credit reports, so its credit limit can help your utilization. Also called “,” authorized user status allows you to benefit from the primary user’s positive payment history. The account holder doesnt have to let you use the card or even give you the account number for your credit to improve.

Make sure the account reports to all three major credit bureaus to get the best effect most credit cards do.

Impact: Potentially high, especially if you are a credit newbie with a thin credit file. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization.

Time commitment: Low to medium. You’ll need to have a conversation with the accountholder you’re asking for this favor, and agree on whether you will have access to the card and account or simply be listed as an authorized user.

How fast it could work: Fast. As soon as you’re added and that credit account reports to the bureaus, the account can benefit your profile.

You May Like: How To Pay Off Bad Debt On Your Credit Report

May You Have Multiple Late Payments

If your credit report score has dropped because of multiple late payments, it is time to sit down, create a budget, and start making payments on time. Setting up automatic payments can also help pay bills on time. Paying bills on time accounts for 60 to 70 percent of your credit score. If you start paying all debts on time, you may see an improvement in your score as soon as a few billing cycles.

How To Get Your Credit Score To 800

A credit score in the 800s is a remarkable milestone. Although it will take time, its completely possible to achieve. Heres how to get started:

- Pay all of your bills on time.

- Never max out your credit cards.

- Dont apply for every credit card you see.

An 800 credit score is a great goal but itll likely take many years to reach this elite status as credit scores factor account ages into the score. As your average account age grows, so can your credit score.

Also Check: What’s A Low Credit Score

Review Your Credit Report

One of the most effective ways to improve your credit is to review your credit report and dispute inaccurate information. , and you could have accounts on your credit report that dont belong to you. If there are errors with derogatory marks, such as missed payments, and you successfully dispute them, you could improve your score in a relatively short time.

Typically, you can view your credit reports for free once per year at AnnualCreditReport.com the only federally-authorized site for free credit reports. However, the bureaus have made credit reports available on a weekly basis through April 2022 due to the COVID-19 pandemic.

How Can I Improve My Score Now

What can you do while youre waiting? Plenty.

- Pay all subsequent bills on time. A student loan account, for example, may return to good standing after twelve consecutive on-time payments.

- Settle small debts. See if the collection agency will agree to take the debt off your credit report once its paid in full.

- Request your report from each of the three bureaus . See if any debts are more than seven years old. If so, send a letter to the credit bureau requesting that the expired debt be removed. Know and cite your rights under the Fair Credit Reporting Act.

- Dispute debts that you dont owe . Start with old debts. The older a debt is, the harder it is to verify.

- Preserve your credit history. If youre closing accounts, start with the newer ones, or dont close them at all. Older accounts indicate a longer credit history, which is better for your report.

Most importantly, be proactive. Dont wait seven years to work on building good credit! Your planning should start now.

Don’t Miss: What Does Dt Mean On Credit Report

How Long It Takes To Raise Your Score

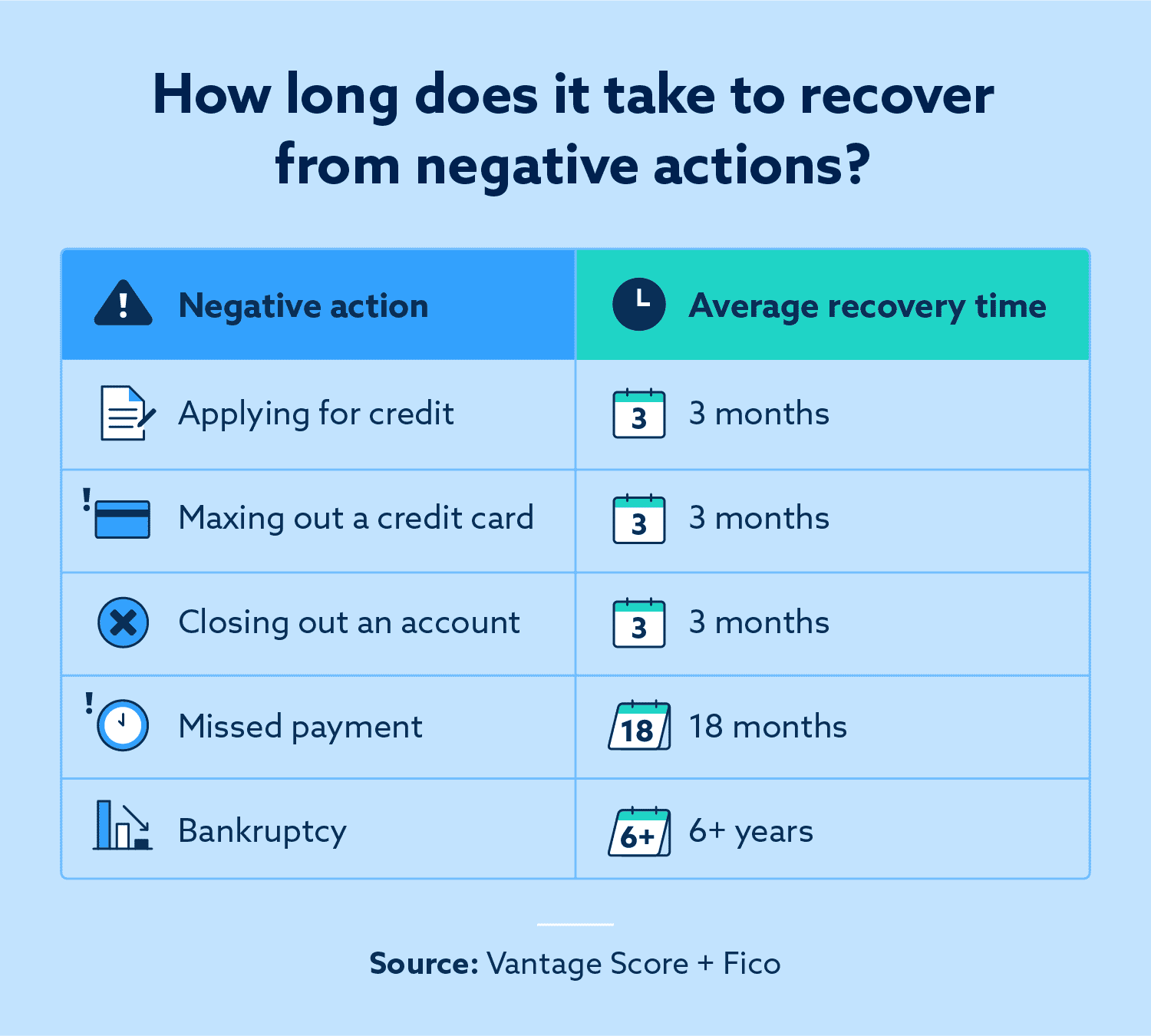

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

Pay Credit Card Balances Strategically

The portion of your credit limits you’re using at any given time is called your . A good guideline: Use less than 30% of your limit on any card, and lower is better. The highest scorers use less than 7%.

You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that’s what is used in calculating your score. A simple way to do that is to pay down the balance before the billing cycle ends or to pay several times throughout the month to always keep your balance low.

Impact: Highly influential. Your credit utilization is the second-biggest factor in your credit score the biggest factor is paying on time.

Time commitment: Low to medium. Set calendar reminders to log in and make payments. You may also be able to add alerts on your credit card accounts to let you know when your balance hits a set amount.

How fast it could work: Fast. As soon as your credit card reports a lower balance to the credit bureaus, that lower utilization will be used in calculating your score.

You May Like: Will A 2 Day Late Payment Affect Credit Score