Does Afterpay Charge Interest

One unique feature about Afterpay is that it does not charge interest. Zilch. Nada. Not even if you pay late .

In contrast, the average annual percentage rate for a credit card was 20.28% in April 2021, according to data collected by The Balance. The average rate for a 24-month personal loan was 9.46% APR as of March 2021, according to the Federal Reserve. With Afterpay, the APR is 0%.

However, you’ll need to be careful. One of the ways you can opt to pay your Afterpay installment plan is with a credit card. If you’re not paying off your credit card balance in full each month, you’re not really saving any money at all by using Afterpay. You’re just trading an interest-free installment plan for high-interest credit card debt, which defeats the whole purpose of Afterpay.

Close Unused/unnecessary Credit Cards

If you dont need a credit card, or if you have multiple credit cards, consider closing them before you apply for a home loan. Even if you have nothing owing on your credit card, the credit cards limit is still viewed as credit that is available to you, and this counts towards the amount of debt you have.

Also Check: How To Get Credit Report Without Social Security Number

Will Afterpay Affect Your Credit Scores

Join millions of Canadians who have already trusted Loans Canada

More and more merchants are offering Buy Now Pay Later services, allowing customers to split up their payments on larger purchases. Afterpay offers a financing option that allows consumers to make installment payments over time until the full purchase price is paid off, with no interest.

Sounds a bit like a mini loan, right? So, will your credit score be impacted if you chose Afterpay to pay for your purchase over installments rather than pay in full upfront?

Lets take a closer look at this innovative service to help you decide if its worth taking advantage of.

Recommended Reading: How To Report A Death To Credit Bureaus

Can Buy Now Pay Later Services Help You Build Credit

When included on a person’s credit report, BNPL loans can be beneficial for people with thin or young credit files who are looking to establish a credit history. A thin credit file consists of two or fewer lines of credit, while a young file means that the user’s credit history is no more than two years old. A lack of credit history may lead to a lower credit score. So, it can be difficult for people in these situations to qualify for credit cards or traditional loans.

That’s where BNPL services may help. The average user in the Equifax study saw an average FICO® Score increase of 13 points with the addition of on-time BNPL usage. For those with thin or young credit files, that number jumped up to 21 points.

There are also benefits for users who may need to improve their credit score due to missed payments or other negative information on their credit report. BNPL plans are typically easier to qualify for than other lines of credit. So, securing a BNPL loan and making on-time payments may help build a history of positive credit behavior.

How To Improve Your Credit Score Fast

- Pay off credit card balances strategically. The portion of your credit limit that you use at any given time is called your credit usage.

- Ask for higher credit limits. If your credit limit increases but your balance remains the same, you immediately decrease your total credit usage, which can improve your credit score.

- Become an authorized user.

Amazon afterpayWhat do companies have Afterpay?Quadpay Afterpay Splitit Sezzle Klarna Progressive Leasing Affirm Zebit ViaBill What stores take Amazon Pay?Currently, you can use Amazon Pay to shop online from tens of thousands of third-party vendors, including: Dyson and bedding distributors Parachute and shop at Amazon stores. You can also order products with Amazon Pay from devices with Alexa. Does Amazon have payment options?Acc

Dont Miss: Unlock Transunion Credit Lock

You May Like: What Does Fraud Alert Mean On Credit Report

Afterpay How To Use It

Are you looking for alternatives to credit cards? If youre looking for convenient ways to make your online payments or shop online, consider using Afterpay. Fans of buy now pay later plans will surely appreciate the options that this app has to offer.

The best part? You can use Afterpay even if you dont have the best credit rating. Using it also wont affect your credit score or financial history.

Lets take a closer look at how Afterpay works and what this payment platform has to offer.

Read Also: What Do Credit Rating Numbers Mean

What’s The Highest Afterpay Limit

Afterpay: For every transaction, you can make a maximum purchase of $1,500 and hold an outstanding account limit of $2,000. Your spending limits will be lowest upon opening your Afterpay account and remain restrictive within the first few months. Limits may also depend on the retailer you’re shopping with.

Read Also: How Often Does Your Credit Score Update

How Buy Now Pay Later Loans Through Affirm & Afterpay Can Decrease Your Credit Score

You might have seen the option to pay for things like furniture or home goods through things like Affirm, Klarna or Afterpay. These options typically show up underneath the price of an item youre looking to purchase online and will have a note that reads something like: Just $25 a month with Affirm or $40 this month with Afterpay. These are Buy Now, Pay Later, or BNPL loans, and you should approach them with caution since they can be a detriment to your credit in the long run.

Find: Affirm Personal Loans Review: No Hidden Fees, Potentially High APR

These loans work similarly to the old-fashioned layaway system. Instead of putting a lump sum on a credit card or paying for something with cash in full, you can spit up the cost of an item or several items with payments due every two weeks, or every month but in smaller amounts. These loans, also known as point-of-sale loans, often offer 0% interest for a particular period of time.

Not all BNPL loan providers report to credit rating agencies, but the most popular ones do. Affirm, for example, reports to credit bureaus, but not for all their loans. CNBC reports that Affirm does not report loans that are paying 0% interest for a period of three months or those loans with zero interest rates and four bi-weekly payments. In other words, if youre scheduled to be off their books soon, theyre not interested in reporting you to the credit bureaus.

People First Federal Credit Union

1. Online Application People First Federal Credit Union Its easy to become a member of People First FCU! There are some requirements you must meet in order to open your People First FCU account online. Welcome to People First Federal Credit Unions Online Loan Application! Before you begin, there

Recommended Reading: How Long Do Collections Stay On Your Credit Report

Using Afterpay In Stores

To use AfterPay in stores customers must download the application and sign up for free. Once an account is created and they are ready to purchase by tapping the “card” tab in the app which gives them access to a digital card which they can use to tap and pay. Scheduled repayments and amount will be visible within the AfterPay app, and customers can even set reminders in the settings menu so they aren’t hit with late fees.

They can also use an AfterPay card that allows customers to pay via AfterPay using their digital wallet. The AfterPay card can be set up through the AfterPay app.

Didnââ¬â¢t like what you bought in-store or online? If the retailer accepts returns and you have returns the order, you will be issued an AfterPay refund and the amount will be refunded to the source account. All AfterPay refunds are made in accordance with the refund or cancellation policies of the retailers. If there are any upcoming or scheduled payments, those will be canceled and any payments you have already will also be reversed.

And in case you are wondering what the maximum amount for AfterPay is, it depends on the retailer you are shopping from. When you open a new account on AfterPay, the AfterPay credit limit can be as low as $500 but if you keep repaying on time, the maximum limit can go up to $1,500 with an outstanding account limit of $2,000.

How To Use Buy Now Pay Later Safely

If you are going to use a Buy Now Pay Later service, choose one that doesnât report to the credit bureaus, like AfterPay.

Here are some things you should remember before you Buy Now and hopefully Pay Later:

ð Read the terms and conditions so you know what youâre signing up for

âï¸ Create a budget , so youâre not spending money you donât have

ð³ Set up auto-pay, so you donât miss a payment

â Wait a week before buying, so you donât make a decision you might regret

And always remember, if you canât afford to pay the full price now, you probably canât afford to pay the price later.

Also Check: What Does Age Your Credit Report Mean

How Is My Credit Rating Calculated

Your credit rating is calculated based on information such as:

- Your personal details. E.g. your age, your occupation, where you live

- The type of credit providers youve used in the past. E.g. bank, credit card provider, phone company, gas or electricity provider

- The amount of credit you accessed in the past. E.g. your credit card limit

- The number of credit or loan applications youve made, and whether they were successful or not

- Your usual repayment amounts and how timely youve made them

- How often you make repayments and whether you make them before the due date

- Any loans or credit card balances that are unpaid or overdue

- Any debt or personal insolvency agreements related to bankruptcy

Your credit rating is a dynamic metric. It can increase or decrease over time depending on the information held in your credit report.

Buy Now Pay Later And Credit Scores

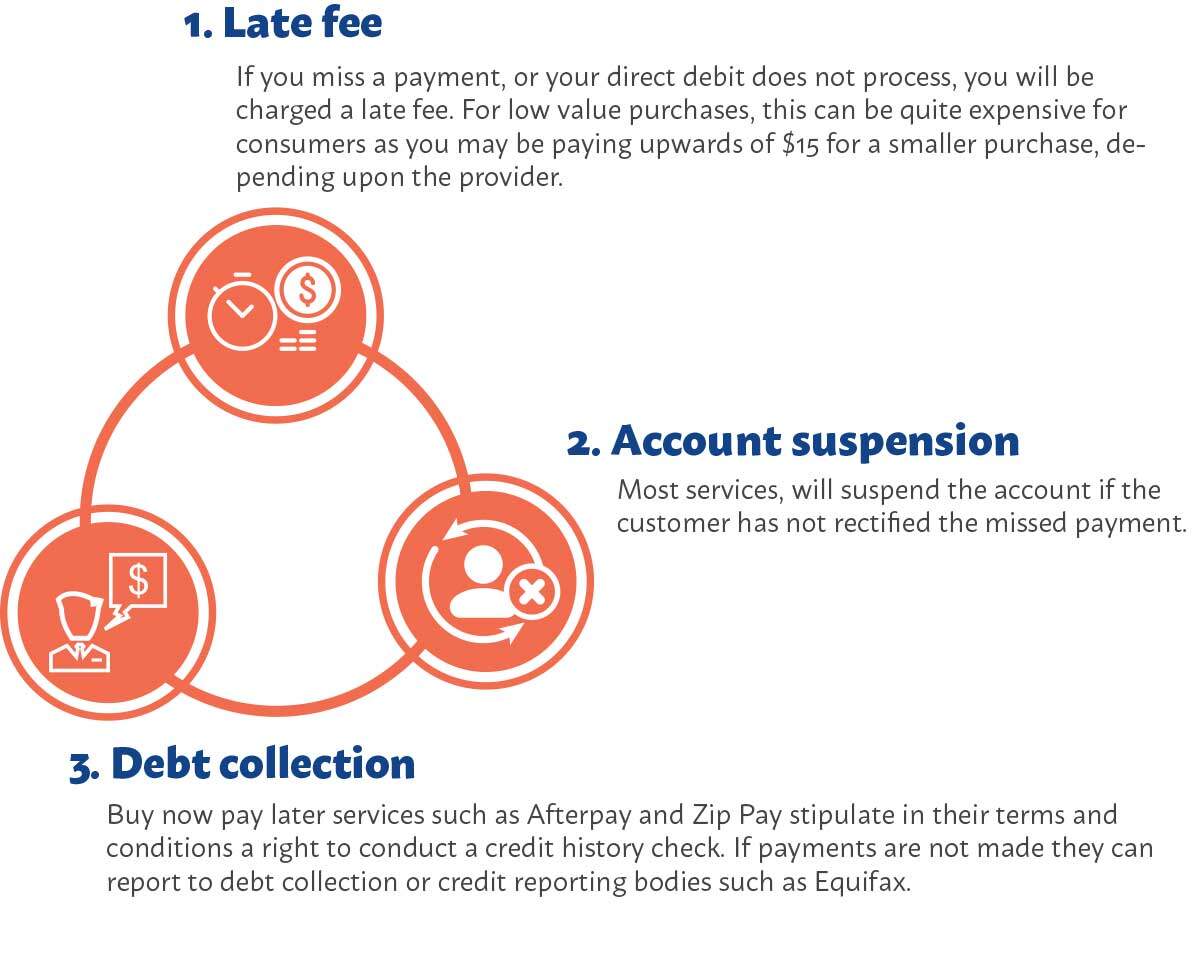

Most BNPL providers say they may perform a credit check on you. This could be done when you apply for an account, and some providers may also do this when you make a transaction to make sure you can make the repayments.

You can check your credit score for free

In addition to credit checks, most BNPL providers can also report negative activity on your account to credit reporting bodies. This includes missed payments, defaults and serious credit infringements. This can lower your credit score and will stay on your report for a period of time. For example, information about your repayment history will remain on your report for two years, defaults will stay for five years and serious credit infringements will remain for seven years.

Lets take a look at what the major BNPL providers policies are on credit checks and how using them could impact your credit score.

Recommended Reading: Can You Check Your Credit Score Without Affecting It

Can Using Afterpay Hurt Your Credit

Nope.

If you make a late payment to AfterPay, you will only be charged the late fee. You wonât also take a credit score hit.

On their website, they specifically say:

â…Afterpay Buy Now, Pay Later payments will not affect your credit score, as they are not reported to credit reporting agencies.â

AfterPay does run a soft credit check on their new joiners, but this does not affect your credit score in any way.

Afterpay Buy Now Pay Later: 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Also Check: How To Get 850 Credit Score

Affirm Vs Afterpay: Terms

Buy now, pay later financing is available from both Affirm and Afterpay. Affirm offers a variety of repayment terms and options, while Afterpay focuses only on pay-in-four lending to consumers, wherein the purchase price is divided into four equal payments.

With Affirm, you will be offered multiple payment terms to choose from at checkout. This gives you the ability to select the payment amount, interest rate, and term that works best for your budget. Some of these payment options are the pay-in-four that is common with BNPL apps, while others are longer terms up to 36 months. While credit limits vary by customer, the maximum loan amount is $17,500. Depending on which retailer you are shopping with, you may be required to pay a down payment.

Afterpay splits customer purchases into four smaller payments with its pay-in-four financing. The company does not have a minimum purchase requirement, but certain retailers may require you to spend a certain amount before this financing option is available. Your spending limit is determined by your personal profile, but it does not guarantee that your transaction will be approved at checkout. Like many pay-in-four programs, each transaction is individually underwritten for an instant credit decision.

Does Using Afterpay Help Your Credit Score

If you use Afterpay responsibly and make your payments on time, then Afterpay will neither help nor hinder your credit score because “positive” behaviour paying on time is also not reported to credit reporting bureaus.

This is in contrast to credit cards and most other loan repayments, where positive behaviour is reported and will help your credit score.

Also Check: Can You Remove Charge Off From Credit Report

Why Is My Afterpay Limit So Low

You may notice your spending limit decreases too this is because our system takes into account a range of different factors, including late payments, in deciding spending limits. … Note, if you are unable to make your Afterpay payments for an extended period of time, you may not be able to use our service indefinitely.

What Credit Score Do I Need To Buy A House With No Money Down

All you need is a credit score of 580 to get an FHA loan combined with a lower down payment. However, youll have to make up for it with a larger down payment if your credit score is lower than 580. You may be able to get a loan with a credit score as low as 500 points if you can bring a 10% down payment to closing.

You May Like: Is 781 A Good Credit Score

Is It Too Good To Be True

Afterpay is a buy-now-pay-later service that offers interest-free payment plans. Launched in 2015 in Australia, it debuted in the U.S. in 2018. Since then, it has become extraordinarily popular. Over 13 million people in the U.S. have used Afterpay, and the company sold $2 billion worth of products nationwide in November 2020, according to a December 2020 Afterpay press release.

However, just because the payments are interest-free doesn’t mean you wont have to pay any other costs. Learn more about how to use Afterpay and what to watch out for before choosing this option at checkout.

Is Afterpay Bad For My Credit Score

Lets get stuck into the next question is Afterpay bad for my credit score? Heres what Afterpay has to say about it:

Afterpay does not affect your credit score or credit rating. Your credit score can be impacted when somebody does a credit check on you or if you are reported as paying debts late at Afterpay, we never do credit checks or report late payments.

However, it is worth highlighting, that Afterpays Terms & Conditions do give it the authority to perform credit checks and also allow it to report any negative activity on your Afterpay Account to credit reporting agencies.

So what does this mean? In answer to the question is Afterpay bad for my credit score basically, Afterpay doesnt typically report your late payments or perform credit checks, but that doesnt mean it wont. Thats something to keep in mind when considering whether to start using Afterpay.

Other BNPL platforms, like Klarana, do perform a credit check when you use its services. Other platforms, like Zip, humm, Openpay and Payright all say they might perform a credit check, or that they reserve the right to perform a credit check, depending on the platform.

Want to know what is a good credit score? Heres an overview of how Equifax and Experian categorise their credit scores:

Also Check: How To Get A Copy Of Credit Report

How Do I Pay With Afterpay

In retail stores

To use Afterpay in store, download the Afterpay app on your smartphone and sign up for the service. Then, tap the Card button and follow the prompts to set up an Afterpay virtual card. The app will add the card to your Google Pay or Apple Pay Wallet where you can use your phone to complete the purchase in-store.

You can only use the in-store function at stores that accept Afterpay, so be sure to confirm through their online store directory first.

Online

To make an online purchase with Afterpay, open the app on your smartphone or online and browse through their affiliated stores. When you see the store you want, tap on it and shop online like you normally would.

Once you get to the checkout cart, select Afterpay as your payment option. If you dont have an account or payment method set up already, youll be able to instantly set one up and complete the purchase.

Read Also: How Often Do Companies Report To Credit Bureaus