How Credit Repair Works

Category: Credit 1. Credit Repair Companies: How Do They Work? | Credit Karma May 7, 2021 Credit repair companies often promise to help remove negative items from your credit reports, which could help improve your credit scores, A credit repair company works on your behalf to remove this information

How Long Does A Bankruptcy Stay On Your Credit Report

The amount of time a bankruptcy stays on your credit report is determined by the type of bankruptcy you filed for.

- A Chapter 7 bankruptcy will be removed from your credit report automatically in 10 years because, in this case, none of the debt is repaid.

- A Chapter 13 bankruptcy is cleared in 7 years since the debt is partially repaid.

What Happens After Bankruptcy

Its almost certainly going to be hard to get any kind of loan or credit once you have a bankruptcy on your record.

However, here are some things you can do in order to start the process of rebuilding your credit.

It wont happen overnight. Therefore, its important to understand that its going to take time.

There is an old riddle you may have heard: How do you eat an elephant? One bite at a time.

Recommended Reading: Is 626 A Good Credit Score

What Can The Debtor Do If A Creditor Attempts To Collect A Discharged Debt After The Case Is Concluded

If a creditor attempts collection efforts on a discharged debt, the debtor can file a motion with the court, reporting the action and asking that the case be reopened to address the matter. The bankruptcy court will often do so to ensure that the discharge is not violated. The discharge constitutes a permanent statutory injunction prohibiting creditors from taking any action, including the filing of a lawsuit, designed to collect a discharged debt. A creditor can be sanctioned by the court for violating the discharge injunction. The normal sanction for violating the discharge injunction is civil contempt, which is often punishable by a fine.

May An Employer Terminate A Debtor’s Employment Solely Because The Person Was A Debtor Or Failed To Pay A Discharged Debt

The law provides express prohibitions against discriminatory treatment of debtors by both governmental units and private employers. A governmental unit or private employer may not discriminate against a person solely because the person was a debtor, was insolvent before or during the case, or has not paid a debt that was discharged in the case. The law prohibits the following forms of governmental discrimination: terminating an employee discriminating with respect to hiring or denying, revoking, suspending, or declining to renew a license, franchise, or similar privilege. A private employer may not discriminate with respect to employment if the discrimination is based solely upon the bankruptcy filing.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What You Can Expect

After a bankruptcy, you can expect your credit score to be well below 640. Credit scores can range anywhere from 300 to 850, with anything above 700 considered low risk. To begin the process of improving your credit score, check your credit report after the bankruptcy falls off. The closer to 300 it is, the more work you will have to do to approach 700. Actively work to boost your score for six months, then assess how much it has improved. Use that figure to guide your expectations for future improvement. For example, if you find that your score increased 30 points after six months of diligent debt management, you might set a goal of increasing it another 30 points in the next six months. This can give you a target towards which to work, although the exact improvement in any given period is never guaranteed.

Can The Discharge Be Revoked

The court may revoke a discharge under certain circumstances. For example, a trustee, creditor, or the U.S. trustee may request that the court revoke the debtor’s discharge in a chapter 7 case based on allegations that the debtor: obtained the discharge fraudulently failed to disclose the fact that he or she acquired or became entitled to acquire property that would constitute property of the bankruptcy estate committed one of several acts of impropriety described in section 727 of the Bankruptcy Code or failed to explain any misstatements discovered in an audit of the case or fails to provide documents or information requested in an audit of the case. Typically, a request to revoke the debtor’s discharge must be filed within one year of the discharge or, in some cases, before the date that the case is closed. The court will decide whether such allegations are true and, if so, whether to revoke the discharge.

In chapter 11, 12, and 13 cases, if confirmation of a plan or the discharge is obtained through fraud, the court can revoke the order of confirmation or discharge.

You May Like: Syncb Ppc Closed

Speak To An Experienced Gadsden Alabama Bankruptcy Attorney Today

This article is intended to be helpful and informative. But even common legal matters can become complex and stressful. A qualified bankruptcy lawyer can address your particular legal needs, explain the law, and represent you in court. Take the first step now and contact Dani Bone & Sam Bone to discuss your specific legal situation at .

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

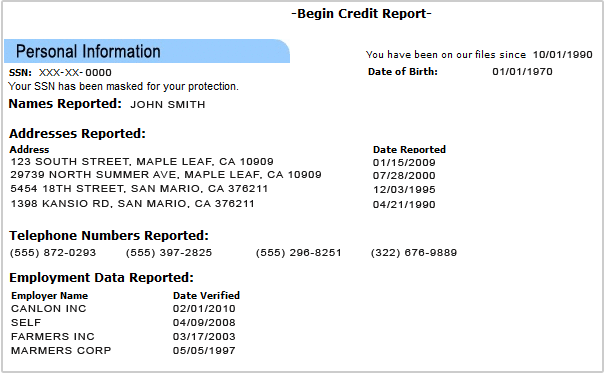

Review Your Credit Reports

Monitoring your credit report is a good practice because it can help you catch and fix credit reporting errors. After going through bankruptcy, you should review your credit reports from all three credit bureausExperian, Equifax and Transunion. Due to Covid-19, you can view your credit reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

While reviewing your reports, check to see if all accounts that were discharged after completing bankruptcy are listed on your account with a zero balance and indicate that theyve been discharged because of it. Also, make sure that each account listed belongs to you and shows the correct payment status and open and closed dates.

If you spot an error while reviewing your credit reports, dispute it with each credit bureau that includes it by sending a dispute letter by mail, filing an online dispute or contacting the reporting agency by phone.

Read Also: Experian Temporary Unlock

Is It Even Possible To Get A Bankruptcy Removed From Your Credit Report

We want to be upfront and transparent: its very hard to get a bankruptcy removed from your credit report. If all information is accurate and complete, it is not possible to remove a bankruptcy from your credit report. But if the bankruptcy entry contains any inaccurate or incomplete information, it may be possible to have it removed.

Buying A Car Or House After Chapter 7 Bankruptcy

Many people are surprised to learn that filing bankruptcy won’t derail a car purchase or homeownership for long. If the bankruptcy helps clean up your credit faster than you’d be able to do on your ownas it does for many without the means to pay off outstanding debtsyour dream might be closer than you imagine. Specifically, if you take steps to rebuild your credit, it’s possible to get relatively reasonable interest rates when buying a new car within one to two years after bankruptcy. Securing a home loan within four years is well within reachand some people start the home purchasing process in as few as two.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

You May Like: How Personal Responsibility Affects Credit Report

When Does The Discharge Occur

The timing of the discharge varies, depending on the chapter under which the case is filed. In a chapter 7 case, for example, the court usually grants the discharge promptly on expiration of the time fixed for filing a complaint objecting to discharge and the time fixed for filing a motion to dismiss the case for substantial abuse . Typically, this occurs about four months after the date the debtor files the petition with the clerk of the bankruptcy court. In individual chapter 11 cases, and in cases under chapter 12 and 13 , the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan. Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing. The court may deny an individual debtor’s discharge in a chapter 7 or 13 case if the debtor fails to complete “an instructional course concerning financial management.” The Bankruptcy Code provides limited exceptions to the “financial management” requirement if the U.S. trustee or bankruptcy administrator determines there are inadequate educational programs available, or if the debtor is disabled or incapacitated or on active military duty in a combat zone.

Obtaining Credit In A Chapter 13 Bankruptcy

Obtaining new credit while making repayments in Chapter 13 is difficult. The court generally frowns on it. On the one hand, your credit report wont matter so much if you cant get new credit. On the other hand, sometimes you really need a line of credit. For instance, if your car or a major appliance breaks down, youll need to replace it. When this happens, the courts and the bankruptcy trustee understand that securing this line of credit can actually save your Chapter 13 from being dismissed by the court.

Also Check: Does Paypal Credit Report To Credit Bureaus

You Can Improve Your Credit After Bankruptcy

Dont give up after youve filed for bankruptcyyou can improve your credit score. But be patient, because it could take some time. If you want a little extra help, sign up for our free , or consider ExtraCredit. Restore It, a feature on ExtraCredit, gives you an exclusive discount to one of the leaders in credit repair. They can help you work to get your score where you want it to be after youve filed for bankruptcy.

Donât Miss: How To Access Bankruptcy Court Filings

Learn How Long Chapter 7 Bankruptcy Will Stay On Your Credit Report

By Carron Nicks

Most people file a bankruptcy case when they need to put financial problems behind them and get a fresh start. Part of that fresh start often involves improving a credit score, and filers can take positive steps by paying bills on time and keeping credit balances low. Even so, it can take up to ten years for the bankruptcy to fall off your credit report, depending on the bankruptcy chapter that you file.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

How Long Does Chapter 13 Stay On Your Credit Report

How long is a bankruptcy on your credit report? As weve said before, Chapter 13 bankruptcy goes easier on the filer, and credit reporting outcomes are no different. Unlike the ten years associated with a Chapter 7 bankruptcy filing, a Chapter 13 bankruptcy filing is removed from your credit report seven years after filing. This is lighter treatment due to partial repayment of the debts included in the Chapter 13 bankruptcy.

Also, the individual debts are usually paid off in some portion through a court-created and court-ordered repayment plan that stretches from three to five years. Therefore, individual debts may begin to come off your credit report during those three to five years.

By Carron Nicks

Most people file a bankruptcy case when they need to put financial problems behind them and get a fresh start. Part of that fresh start often involves improving a credit score, and filers can take positive steps by paying bills on time and keeping credit balances low. Even so, it can take up to ten years for the bankruptcy to fall off your credit report, depending on the bankruptcy chapter that you file.

How Long Does A Bankruptcy Stay On My Credit Report

There are differences in severity between a Chapter 7 and a Chapter 13 bankruptcy. According to the Fair Credit Reporting Act , a Chapter 7 bankruptcy can remain on your credit history for up to 10 years from the filing date and a Chapter 13 bankruptcy can remain for a maximum of 7 years.

The FCRA states only the legal maximum amount of time bankruptcies can appear on your report and not the minimum. This means a bankruptcy can be removed earlier than the legal maximum, but it must be proven that it is misreported, unsubstantiated or otherwise found inaccurate. A bankruptcy cannot be removed simply because you do not want it there.

Recommended Reading: How To Get Credit Report With Itin Number

Learn How To Rebuild Your Credit After Chapter 7 Bankruptcy

Updated By Cara O’Neill, Attorney

Everyone wants to remain debt free after discharging credit card balances, medical bills, and other qualifying debt in Chapter 7 bankruptcy. Enjoy your fresh financial start for years to come by following these tips:

- stay within a budget

- monitor your credit report for errors, and

- learn how to purchase a new car or home relatively shortly after bankruptcy.

If you take control of your finances now, you can be one of the many who prosper following Chapter 7 bankruptcy.

How Can The Debtor Obtain Another Copy Of The Discharge Order

If the debtor loses or misplaces the discharge order, another copy can be obtained by contacting the clerk of the bankruptcy court that entered the order. The clerk will charge a fee for searching the court records and there will be additional fees for making and certifying copies. If the case has been closed and archived there will also be a retrieval fee, and obtaining the copy will take longer.

The discharge order may be available electronically. The PACER system provides the public with electronic access to selected case information through a personal computer located in many clerk’s offices. The debtor can also access PACER. Users must set up an account to acquire access to PACER, and must pay a per-page fee to download and copy documents filed electronically.

Read Also: Does Opensky Report To Credit Bureaus

Accounts Included In Bankruptcy

The accounts included in your bankruptcy filing will also have status notations for filing.

- During your filing, account statuses will note included in bankruptcy

- After discharge, the status will change to discharged in bankruptcy and the balance show $0

These statuses and accounts remain on your credit report for seven years from the date that each account became delinquent. So, even if the bankruptcy record remains for ten years, the accounts included will drop off your report after seven.

How Soon Will My Credit Score Improve After Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, JD | Last updated June 30, 2021

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range if you work to rebuild your credit. Achieving a good , very good , or excellent credit score will take much longer.

Many people are afraid of what bankruptcy will do to their credit score. Bankruptcy does hurt credit scores for a time, but so does accumulating debt. In fact, for many, bankruptcy is the only way they can become debt free and allow their credit score to improve. If you are ready to file for bankruptcy, contact a lawyer near you.

Also Check: Is Chase Credit Score Accurate

How Long Does Chapter 7 Stay On Your Credit Report

How long will bankruptcy stay on your credit report? If you file a Chapter 7 bankruptcy, youll probably have to wait the full ten years the maximum timeframe for record of the bankruptcy filing itself to disappear from your credit report.

Individual debts included in the bankruptcy, however, may disappear sooner. You can look for these in your credit reports from one of the three bureaus Experian, Equifax or Transunion all of whom are legally required to provide you a copy of your credit report upon request under the Fair Credit Reporting Act . These agencies can tell you what your credit score is after bankruptcy.

Looking closely at the data on the reports, your individual debts may be listed as included in bankruptcy or discharged with a zero balance. In a Chapter 7 bankruptcy, the debts should fall off the sooner of either seven years from the date delinquency on each account began, or seven years from the date you filed for bankruptcy.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Hereâs an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Also Check: What Can They Take In Bankruptcy

Don’t Miss: Does Zzounds Report To Credit Bureau