Getting Collectors To Remove Negative Information

Because creditors are not required to report information to a credit reporting agency, when you negotiate a debt settlement, ask to have any negative information about the debt removed from your credit files. The collection agency might tell you that they can’t make that decisiononly the original creditor can remove the information. Ask for the name and phone number of the person with the original creditor who has the authority to make this decision.

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

How To Get Something Removed From Your Credit Report

Categories

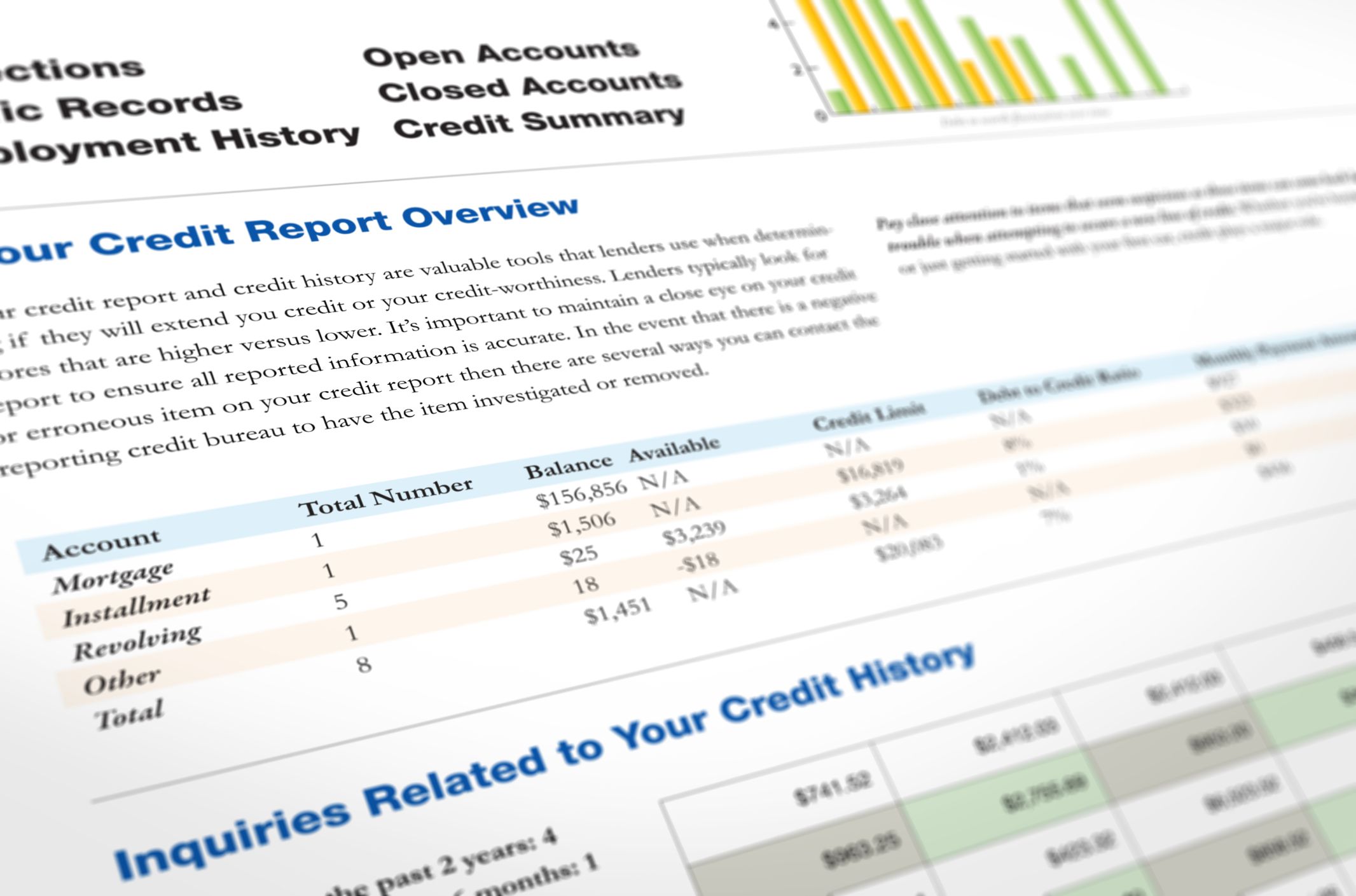

When it comes to the health of your finances, one of the most important things to have is a clean . After all, its often one of the first things that a bank, credit union, or alternative lender will examine when you apply for a new credit product, such as a personal loan, a line of credit, vehicle financing, or a mortgage.

Unfortunately, negative information on your report can lead to your application being denied, especially if you arent aware of it the information is wrong. To learn more about how credit report errors can affect your credit and how to get inaccurate information removed, keep reading.

Read Also: Does Paypal Credit Help Credit Score

When Can I Dispute A Negative Student Loan Entry On My Credit Report

If you believe that the negative student loan entry in your credit history was reported incorrectly, you can dispute this entry as part of your rights under the Fair Credit Reporting Act. There are instances when your student loan might have been mistakenly placed in default so you can dispute this. Doing so will improve your credit score.

Here are some scenarios that allows you to dispute the student loan placed in default on your credit report:

Scenario 1: You are current in all your payments

If you have been religiously paying your student loan debts but it was still reported as delinquent or in default, you can file a dispute to have this corrected. You have to gather payment records as evidence that all your payments have been made on time.

Scenario 2: You are still in school

If you are still in school, your student loan cannot be placed in default. What you need to do is to ask your school for a record of attendance and show this to your lender as proof that you are still attending school so they can correct the default status on your credit report.

Review Your Credit Reports

Once you pull your credit reports, comb through each one and check that the information listed is accurate. Review the following factors:

- Personal information, such as the name and address listed on your account

- Account information, such as balances, credit limit, payment history and current status

- Bankruptcy and collection data, such as if any of your accounts were marked past due for over 30 days and sent to a collection agency

Recommended Reading: Attcidls

Which Credit Report Errors Should You Dispute

The most concerning errors are those that could hurt your scores or suggest identity theft. Those include:

-

Wrong account status .

-

Negative information that’s too old to be reported most derogatory marks on your credit must be removed after seven years.

-

An ex-spouse incorrectly listed on a loan or credit card.

-

Wrong account numbers or accounts that arent yours.

-

Inaccurate credit limits or loan balances.

-

Accounts you don’t recognize.

If you suspect your identity has been stolen, follow the steps to report identity theft.

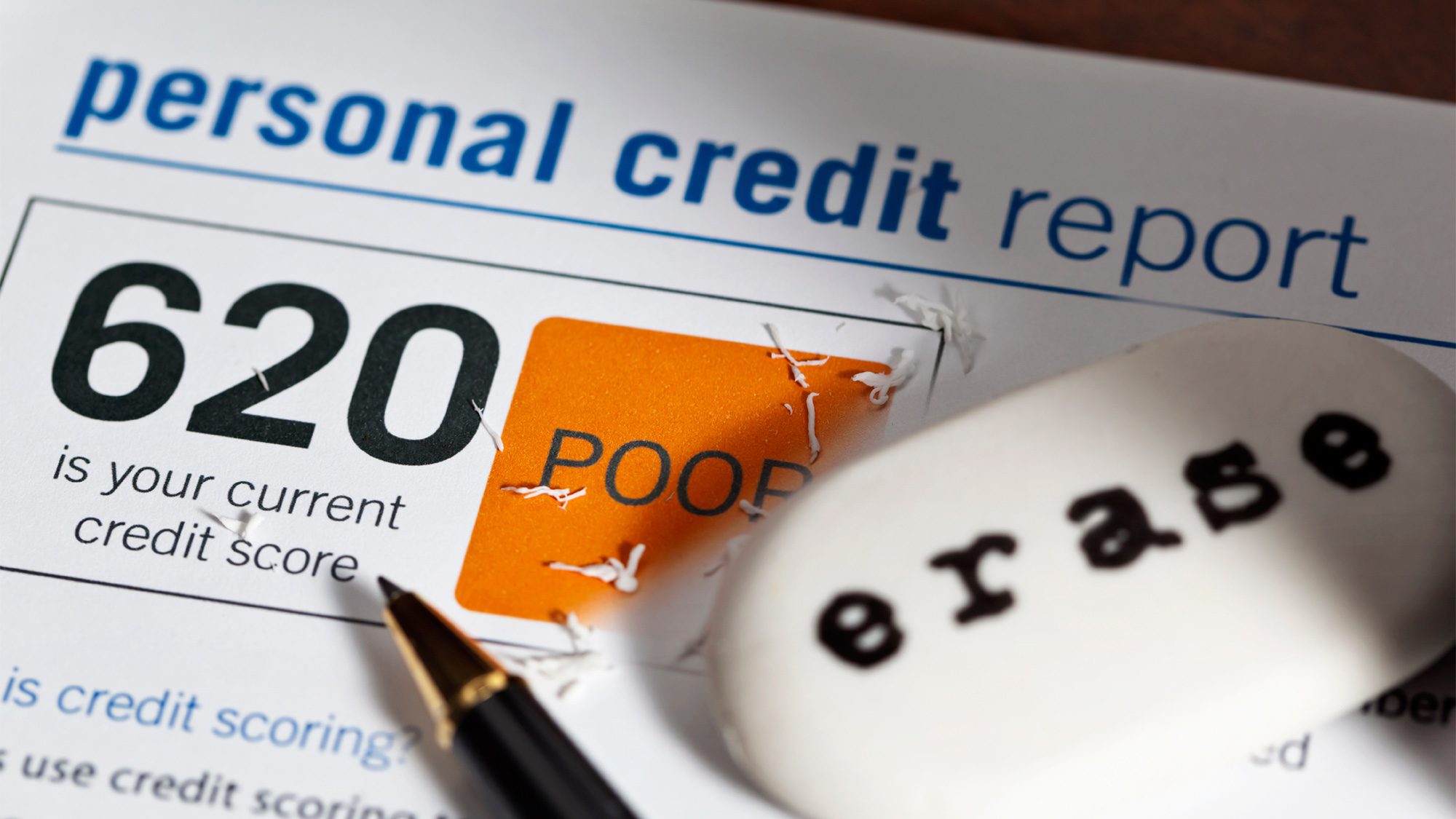

How Much Will Your Score Improve If You Remove Negative Items

It depends on two major factors: the length of your experience using credit and how serious the negative item was.

A long credit history will have less of an impact from a single negative item being reported. But a serious negative event like a charge-off will indicate that you are now a high-risk borrower and cause you to lose more points despite a long credit history. For those with a short credit history, also called a thin file, almost any negative item will cause a sizable drop in score. The higher the thin score to begin with, the bigger the drop.

But in credit scoring, sometimes just a few points are all you need to move into a higher tier. Those points could make a huge difference in real dollars on your next loan or whether or not you are approved for your next . So, how can you remove items that shouldnt be there?

You May Like: Who Is Syncb/ppc

How Long Do Negative Items Stay On Your Credit Report

It depends on what the item is, but most will fall off after seven years. Yes, I said seven years. I know thats a long time. Its even longer for a chapter 7 bankruptcy, which takes 10 years to fall off.

But before you hang your head in despair, you should know that the impact of negative items to your score will lessen before those seven years are up as long as you dont mess up again. This lessening can start in a matter of months for a minor mishap like a 30-day late notation to more than a year for a really serious issue like a charge-off or a bankruptcy.

How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

Here’s how to dispute credit report errors and have them removed in four steps.

Read Also: What Credit Score Does Carmax Use

Dumb Ways To Get Rid Of Negative Credit Report Items

Although the ideas above dont work, theyre not bad for you they just wont accomplish what you set out to do. But there are a few other things that you can do that are truly dumb either because theyll waste your money or break the law.

- Pay a company to remove a negative item that can be verified. If you legitimately incurred a negative item and it can be verified, then it cant be legally removed. Any company that tells you they can remove accurate items is a ! Theyre probably going to take your money and run

- Pay someone to help you set up a new credit profile. Other scammers tell you that you just have to start a new credit report. You use a different Social Security number or Employer Identification Number to start a new credit report. This is illegal and you can be criminally prosecuted for Social Security fraud!

Option : Credit Repair

This is the most common and usually best way to get negative items removed from your credit report. Here is how it works:

- If you believe an item cant be verified, you can dispute it with the credit bureau that issued the report.

- The credit bureau has 30 days to verify the information.

- If it cant be verified then it must be removed.

This is a process known as . Its usually used when you find mistakes on your credit report, like a missed payment that you made on time. Since creditors cant verify erroneous information, its the best way to get rid of negative items in your credit report that shouldnt be there.

However, in addition to removing mistakes, it can also be useful for get rid of re-sold collection accounts. Charged-off debts can change hands many times, from one debt buyer to the next. These portfolios of bad debt often include incomplete account information. As a result, the collector cant verify the original debt. This means with the help of a good , you may be able to have these accounts removed.

Looking for a way to remove negative items from your credit report? Connect with a Debt.com accredited credit repair service now!

Read Also: Does Lending Club Affect Your Credit Score

Review Your Credit Report

After youve picked up a free copy of your credit reports, you need to review to see which items are hurting your credit scores.

This step is crucial because youll be notating errors and negatives in your report that need to be rectified and possibly removed. Pay close attention to the account information included and highlight any issues.

Its also very important to make sure the item you are disputing is actually negative. You do not want to be disputing accounts that have a positive impact on your credit score.

If Your Credit Reports Contain Errors Or Outdated Information Heres How To Dispute Those Items With The Credit Reporting Bureaus

By Amy Loftsgordon, Attorney

A “credit report” is a detailed record of how you’ve managed your credit over time. Credit reporting agencies, like Equifax, Experian, and TransUnion, collect data from creditors, lenders, and public records to produce the reports. The agencies then sell the reports to current and prospective creditors, and anyone else with a legitimate business need for the information. For example, lenders use credit reportsor the that results from the data in itto help them decide whether to grant you credit and, if so, under what terms. The better your credit report, the more likely your credit request will be granted, and the lower your interest rate will be. Many landlords, employers, and insurance companies will also consider your credit history when making a decision.

So, your credit report is either a valuable asset or a liability, depending on its contents. The Fair Credit Reporting Act requires credit reporting agencies to adopt reasonable procedures for gathering, maintaining, and distributing information. It also sets accuracy standards for creditors that provide data to agencies. Even with these safeguards, credit reports often have errors and inaccuracies.

In this article, you’ll learn:

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Will My Credit Score Improve If I Pay The Charge

Some collection agencies may try to convince you paying off the full amount of your charge-off will restore your FICO score. This is not true. A paid charge-off will definitely look better to lenders who take the time to do manual underwriting, but it will have a minimal effect on your credit score. Also, paying off the charge-off wont automatically delete the entry from your credit report. Paying it off will not remove the charge-off from your account, either.

Can Debt Collectors Remove Negative Information From My Reports

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms. Therefore, it’s just as important for them to see your negative credit history as your positive history.

If you discover, however, that negative information is still on your credit reports after seven years and you have paid off the amount as agreed, you should immediately file a dispute.

You can dispute the negative information sooner if it appears on your credit reports multiple times. You can also dispute the information if it’s a result of fraud or identity theft. It’s important to report the fraud or identity theft immediately to the three nationwide credit bureaus so that you can get your financial life back on track.

Be warned that there are many companies that claim they can have negative information removed from your credit reports for a fee. However, neither you nor a third party can get negative but accurate information removed.

Also Check: Does Speedy Cash Report To Credit Bureaus

How To Remove Negative Information From Your Credit Report

As long as the information is accurate and verifiable, the credit reporting agencies will maintain it for the aforementioned timeframes. If, however, you have information on your report that you believe is incorrect, whether it’s positive or negative, then you have the right to dispute the information and have it corrected or removed from your credit reports.

The most efficient way to file a dispute is to contact the credit reporting agencies directly. And while Equifax and TransUnion have their own processes for consumers to dispute their credit reports, Experian makes available three dispute methods: You can do it over the telephone, via U.S. mail or online.

How Do You Get Something Removed From Your Credit Report After 7 Years

In theory, debts should be automatically removed from your credit report once they reach their legal expiration . If you see debts on your credit report that are older than that, youll want to contact both the creditor and the credit bureau by mail requesting a return receipt. In your letter, include all documentation about the debt, including any inaccuracies.

Don’t Miss: What Credit Score Does Carmax Use

Benefits Of Cleaning Up Your Credit Report

After you clean up your credit report, you may benefit from a variety of perks. For starters, you won’t have errors on your credit file, which can strengthen your credit history. Plus you may see a rise in your credit score if you removed negative information and/or paid off debt.

Paying off credit card debt, whether it’s through a balance transfer or personal loan, can also save you money on interest charges. This can allow you to use the extra money you would’ve paid on interest for an emergency fund or high-yield savings account.

Having a clean credit report and good credit score can also help increase your approval odds for credit cards, loans and mortgages, as well as your ability to qualify for the best interest rates.

Don’t miss:

Will My Credit Score Increase If A Collection Account Is Removed

Since payment history accounts for 35% of your FICO score, your score might build if a collection account is removed. However, how much it increases will depend on other items listed in your credit report. For example, if this negative account is the only one listed on your credit report, removing it could boost your score more than if you had several other collection accounts on your report.

Recommended Reading: Is 626 A Good Credit Score

How To Get Your Free Credit Report

Getting your credit report is easy, especially if you havent used AnnualCreditReport.com yet. You can use this service to pull your credit reports from all 3 of the major credit agencies/bureaus quickly and easily, and for free.

The law states that all consumers are entitled to 1 free credit report from each of the major credit reporting bureaus each year.

If youve used up your annual credit report and you feel that you need to pull a fresh report, then you can use any of the credit bureaus websites to pull your report.

Most offer credit reports from all 3 bureaus, too. Other services, such as MyFICO.com , offer 3 reports as well. It doesnt matter where you get them, just be sure to have a recent report just in case theres anything new that pops up, and its always good to know your current credit scores .

There are a few ways you can go about this.

1. File Complaints with the Consumer Financial Protection Bureau

2. Write dispute letters to the CRAs.

Ask The Creditor To Remove It

![Steps To Build Your Credit Score [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/steps-to-build-your-credit-score-infographic-all.jpeg)

Creditors and other furnishers who report information also have the power to correct or withdraw it. This is sometimes referred to as “re-aging” the account. You can ask creditors to stop reporting something that is accurate but negative because of extenuating circumstances, and sometimes they will agree. For example, if you have always paid your credit card bill on time but then accidentally missed a payment when you were in the hospital or traveling, your issuer may be willing to stop reporting the slip-up. Or you might be able to persuade a medical provider who failed to properly bill you to pull an account back from collections.

Keep in mind that creditors and collection agencies aren’t supposed to remove negative items just because you agree to pay them. So you’ll want to have a persuasive argument as to why they should work with you.

In addition to asking the company that furnished information to the credit reporting agency to make an exception for you, you also have the right under the Fair Credit Reporting Act to dispute an item directly with that furnisher. Simply send them a letter using the contact information found on your credit report. Generally they have 30 days to investigate and get back to you, or the information must be removed.

Read Also: Does Paypal Report To Credit Bureaus