Check Your Credit Report Regularly

A frequent check of your credit report helps you ensure it is accurate, and up to date, and helps you spot errors. You can sign in to Equifax and TransUnion to request a free copy of your credit report every 12 months without impacting your credit score. In addition, if you spot any incorrect information, you can file a dispute to correct your Equifax report or correct your TransUnion report.

Build A Good Credit Mix Over Time

The different types of credit accounts under your name for your credit score. If you have both revolving credit and installment credit, your credit score will increase by a few points.

You can build and maintain a good credit score even if you only have credit cards, so if you dont have much of a credit mix you dont need to worry about it.

This doesnt mean going out and getting a student loan, car loan, and a mortgage all at the same time Instead, youll want to take on different types of debt one at a time, while having various types of debt within 7 years.

A Perfect Score Is Not Necessary

This post from Credit Sesame reports that a perfect credit score is not necessary when your score falls in the range of excellent. Thats because lenders generally base their credit decisions using ranges, rather than specific scores. Having a credit score of 850 is a great goal that may not be realistic only a small fraction of people under 30 have a FICO score above 780, they point out.

My comment: I applied for a mortgage when my score was in the mid-700s and got the best rate the bank had to offer. Of course, theres multiple other factors affecting your mortgage rate. But other things being equal, my score didnt need to be at the absolute top of the range to get me the best deal.

Lenders want your business. So once your credit score hits 750+, youll likely have access to the same deal as if your score were 850.

Also Check: How To Check Credit Rating Of Individual

Learn About The Highest Credit Score And Just How Perfect Your Credit Score Needs To Be

If youâve ever wondered what the highest credit score you can have is, itâs 850. Thatâs at the top end of the most common FICO® and VantageScore® credit scores. And these two companies provide some of the most popular in America.

But do you need a perfect credit score? Not necessarily. According to credit bureau Experian娉s research, a score above 760 could qualify you for the best interest rates.

What Qualifies As A Perfect Credit Score

Pinning down a perfect credit score ultimately depends on which scoring model you use.

FICO scores, which are issued by the Fair Isaac Corporation, range from 300 to 850, with 850 being the highest score you can attain.

According to Fair Isaacs internal data, approximately 19.9% of the population has a FICO score in the 800 to 850 range.

At the other end of the spectrum, just under 5% of consumers have a score of 499 or less.

The majority of Americans, 58.1% to be precise, have scores ranging from 600 to 800.

Overall, the national average FICO score comes in at 695, which according to Fair Isaac is an all-time high since the company began tracking it.

So how are FICO scores calculated? While Fair Isaac doesnt disclose a specific formula to the public, its common knowledge that the following five factors play a part in how your score adds up:

Don’t Miss: How Long Do Inquiries Affect Credit Score

What Is A Perfect Credit Score

What does it mean to have perfect credit? If your credit score is 850, you have the highest credit score possible in both the FICO and the VantageScore credit scoring systems.

However, the FICO credit scoring system considers all credit scores over 800 to be exceptional. While trying to get a perfect credit score might be a fun game, you can get all of the advantages associated with perfect credit simply by getting your credit score over 800. Once your credit score passes 800, theres little you can do to actually make your credit score even higher, besides keeping your credit utilization low and waiting for the length of your credit history to improve.

Is It Possible To Get A Credit Score Of 850

Its possible to achieve an 850 FICO® Score. However, its very difficult to get your score this high. An 850 credit score means that you have nearly perfect credit management. Very few people actually hold a perfect 850 credit score. Consumers with this score are incredibly unlikely to default on their loan obligations. If you can achieve an 850 credit score, youll have access to nearly any type of loan or card.

No lender will expect you to have an 850 credit score, no matter what youre applying for. Its possible to buy a home, go back to school and get a personal loan even if you have less-than-ideal credit. However, if youre still determined to make it into the perfect credit club, you can use these tips to start your journey toward an 850-point score.

Read Also: Is Discover Credit Score Accurate

Do Not Open New Credit Too Frequently

While people with perfect credit scores have more credit card accounts than average, they donât open new accounts frequently. In fact, only 10% of them had one or more inquiries in the past year, and about one-quarter had opened one or more credit accounts in the past year.

Opening or applying for too many new lines of credit in a short period of time can negatively impact your credit score. Every application counts as a âhardâ credit inquiry For this reason, consider opening new lines of credit only when absolutely necessary and beneficial to your financial goals.

However, you donât need to worry about soft inquiries, such as checking your own credit, allowing prospective employers to do so if youâre applying for a job or checks by credit card issuers seeking to preapprove you in an effort to get your business. Soft inquiries do not deduct any points from your credit score.

What Is The Highest Credit Score Possible

As we know, a credit score is a 3-digit number that signifies your creditworthiness, so it can range between 300 to 900.

900 is the highest credit score possible ever, but the funny fact is that no one has ever gotten that kind of score, or if anyone did, there is a very slight chance that they would be able to maintain it.

Interestingly, FICO says that the best-known range of credit score is 300-850 and 850 is considered as the maximum credit score, but now you must be thinking that earlier I said that 900 is the maximum score possible.

Heres the thing, it is possible to have a score of 900 but depends on what kind of industry you are in. Like scores for credit cards or auto loans can range between 250-900 but for normal people, it ranges from 300 to 900.

Read Also: When Does Usaa Report To Credit Agencies

Reduce Credit Card Debt

Having high credit limits helps you build a better credit score as long as you keep your debt low. Even though individuals with perfect credit scores had an average of 6.4 credit cards, more than average scorers, they had less credit card debt. Perfect scorers had an average credit card debt of $3,025 compared with the national average of $6,445 â over twice as much debt as individuals with perfect credit scores.

Reducing your credit card debt while keeping accounts open may give you a better credit utilization rating, which accounts for 20% to 30% of your credit score, depending on the model., You can try a number of ways to reduce your debt.

- Budget carefully.

- Pay beyond the minimum balance on your credit cards.

- Explore the debt avalanche method: Apply more money to debt with the highest interest rates while paying the minimum amount on lower-interest accounts.

- Use the debt snowball strategy. Pay off the smallest debt first, then roll the money you were paying on that into the next-smallest debt while continuing to make minimum payments on the rest.

What Do Credit Score High Achievers Have In Common And What Can We Learn From The Credit Behavioral Characteristics In These Populations

Scoring Solutions

Some of the more frequent credit score related questions people ask are around the subject of a perfect FICO® Score:

- What is the perfect FICO® Score?

- How can I get a perfect FICO® Score?

- Does anyone have a perfect FICO® Score?

- Whats the typical credit profile of someone who has a perfect FICO® Score?

FICO® Scores are a sequence of three-digit numbers ranging from 300-850*. Each lender determines the score cutoff they require to approve a request for credit and to help them set the terms of the credit being extended. Typically, most lenders do not require an individual to have the highest credit score possible to secure the best loan features. Instead, they set a high-end cutoff where those applicants scoring above that cutoff qualify as a good credit score and get these most favorable terms.

In other words, dont sweat it if you are only an 800 as most lenders are likely to treat you the same if you score in the 800-850 range because your risk of not paying as agreed is very low in these highest FICO® Score ranges.

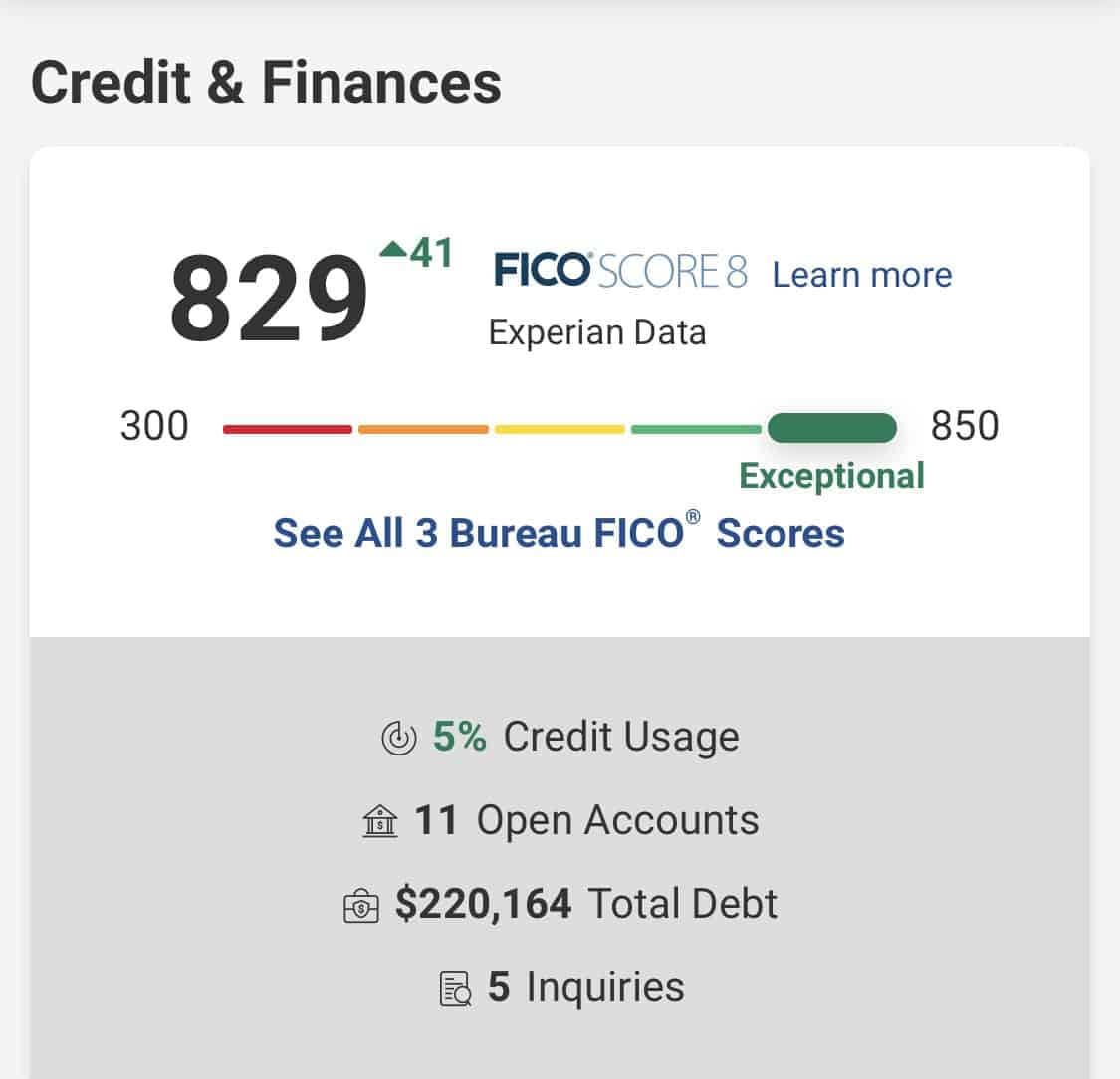

The percent of the population with an 850 credit score is relatively small, but has been increasing. As of April 2019, about 1.6% of the U.S. scorable population had an 850 FICO® Score. That compares to 0.98% in April 2014 and 0.85% in April 2009. This slight uptick is not surprising as we have been seeing the average FICO® Score on the national population increasing as time since the great recession ages.

Don’t Miss: How To Have A Perfect Credit Score

Make All Your Payments On Time

Dont miss payments. Your payment history is the most important part of your FICO credit score. If you are unable to afford a payment, call your lender and let them know of the situation to see if theyre able to work something out with you. This is a much better option than simply ignoring it!

Missing a credit card payment can have serious negative effects on your credit score, especially if you dont make up the missed payment as quickly as possible.

For student loans, you can often get your payments put into forbearance, giving you some breathing room during difficult financial times.

Stay Away From Negative Items

An article on Credit Karma reports the results of an interview with people who achieved an 850 credit score. One of their findings is that in order to get a perfect score, nothing negative can show up on your credit report. They discuss late payments as one example, mentioning that you cant have late payments on your credit card.

My comment: I remember one instance in the past when Id completely forgotten about my credit card bill. It was a silly mistake: Id switched phones and forgot to set a new bill payment alert. My credit score fell by about 25 points because of it. I believe it took 3 to 4 months for it to go back to 850.

Absent that lone slip off, I havent had any other negative items on my credit report for a long while.

Read Also: What Credit Report Does Mortgage Companies Use

The Secret To Getting An 850 Credit Score

Who wants an 800 credit score or higher?! We all do, right?

But is it really possible? Yes, not only is it possible, Ive done it! I used to have terrible credit and now my scores are all over 800!

Its definitely possible to have a credit score over 800, but its not common! Only 21% of the population has a credit score of 800 or more. AND only one percent of the population has that perfect score of 850

So what is the secret to getting a perfect 850 credit score?

A great place to start is considering what people with super high credit scores have in common.

They all have

- Between four and six credit cards which are revolving accounts

- At least one installment line – like a mortgage or auto loan thats in good standing

- Around 30 years of credit use

- No late payments or other serious account errors for at least the past seven years

- Very few credit inquiries. No more than 3 inquiries in a six-month period

- No derogatory notations like collections, bankruptcies, liens, judgments, etc. They are clean as a whistle.

- And the debt levels on their credit accounts are at less than 30% of their overall credit limit

You can tell from this list that you dont get there overnight.

BUT the important thing I want you to know is that, while it IS possible to have an 850 credit score, its not necessary to have an 850 credit score. Even improving your credit score to 700 can make a big difference.

So lets dive in!

Heres why this is important:

Were starting again soon, so

Benefits Of A High Credit Score

Credit scores range from 300 to 850. Since its the highest credit score, 850 is considered a perfect score. An 850 credit score is difficult to achieve, but not impossible. And while it would feel pretty great to be able to say that you have a perfect credit score, you dont need to achieve it to reap the benefits of a high credit score. These benefits include:

- More favorable loan terms

- Lower interest rates, which can save you money

- A better chance of qualifying for loans and credit cards

The reason higher scores come with these benefits is because a high credit score shows a lender that youre good at handling your debt and are a responsible borrower. Lenders are able to offer better terms because youre seen as less of a risk.

Recommended Reading: Do Storage Units Report To Credit

More Tips On How To Get An 850 Credit Score

In addition to optimizing each of the above five categories that factor into your credit score, it is also important to regularly check for errors on your credit report and dispute any inaccurate information both with the as well as with the lenders who furnish the data to the bureaus.

In addition, those with very high credit scores rarely have serious delinquencies or public records on their credit reports, such as bankruptcies or liens. Obviously, this will be easy to avoid if you follow all of the suggestions above, but if you have a history of bad credit in your past, it could take up to 7-10 years to recover enough to get an 850 credit score.

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

Recommended Reading: Is 570 A Good Credit Score

Dont Cancel Old Cards

Some credit card holders think that they should cancel their old credit cards to get that last push toward a perfect score. After all, more cards mean more opportunities to overspend right?

The truth is that closing old lines of credit can harm your credit score. When you close a credit line, you give yourself access to less credit and automatically raise your utilization. For example, imagine that you have a couple of credit cards and they each have a $1,000 limit. You put $300 on one card each month your total utilization is 15% . You dont use one of the cards at all, so you decide to close it. Even if you still spend $300 a month, your utilization is now 30% because you only have $1,000 of available credit.

Is a certain card tempting you to overspend? Keep it in a locked safe or desk drawer instead of closing it to maintain your score.

Pay Your Bills On Time All Of Them

Paying your bills on time can improve your credit score and get you closer to an 800+ credit score. Its common knowledge that not paying bills can hurt your credit score, but paying them late can eventually hurt also.

I think a lot of people dont really understand that there isnt a bill thats really too small, says Thomas Nitzsche, a certified credit counselor and financial educator with ClearPoint Credit Counseling Solutions, and the owner of an 800+ credit score.

If a bill goes unpaid long enough and the debt is sold to a third-party collection agency, that will be reported to credit bureaus, Nitzsche says. But being late can lead to fourth-level reporting parties, such as online searches, that credit bureaus can become aware of.

From late utility bill payments to magazine subscriptions or even $10 medical co-pays that people dont think are important enough to pay on time, all bills should be paid on time.

Any bill I get is treated as a serious situation, he says.

Payment history counts for 35% of a credit score, says Katie Ross, education and development manager for American Consumer Credit Counseling, a national financial education nonprofit group.

Recommended Reading: How To Get Free Credit History Report

Review Your Credit Reports

Dont forget to review your credit reports regularly and dispute any errors you find. Many Americans dont realize that their credit reports contain inaccurate informationyour credit report might list a credit account that actually belongs to someone with a similar name, for exampleand those kinds of errors can drag down your score.