How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

5 MINUTE READ

What About Business Loan Inquiries

Business loan applications are subject to similar inquiries about the financial capability of the business, which can affect their credit score. Unfortunately, many small businesses in Australia either do not know about or neglect the importance of business credit scores. On the other hand, your business credit score is separate from your personal credit score. This means any inquiries you make as a business, as long as youve registered your business name with ASIC, wont impact your personal credit score.

Did you find this helpful? Why not share this article?

This article was reviewed by Personal Finance Editor before it was published as part of RateCity’s Fact Check process.

Jodie Humphries

Personal Finance Editor

Jodie Humphries is an experienced Personal & Home Finances Editor for RateCity with expertise in financial topics, including credit, loans, superannuation, mortgage and housing, insurance, telecommunications, and more. For over a decade, Jodie’s journalism and editing career has seen work published at both Finder and Sharesight, and as one of RateCity’s chief contributors, Jodie spends her time working on ways to make personal finances within reach of everyone in Australia.

What Is A Soft Credit Inquiry

A soft inquiry or a soft pull is a credit check that will not lower your credit score points. Employers and landlords will do a soft inquiry as a part of your background check. Many credit card issuers and lenders offer pre-approval checks which require only a soft pull. Its a good way to check if you qualify for a specific product since youve got nothing to lose in this case. For instance, there are , so you can do a soft pull to see if you qualify for some of them.

Also Check: Will Checking Credit Score Lower It

Do Credit Inquiries Affect My Fico Score

FICO’s research shows that opening several credit accounts in a short period of time represents greater credit risk. When the information on your credit report indicates that you have been applying for multiple new credit lines in a short period of time , your FICO Scores can be lower as a result. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.

If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with higher risk, but most are not affected by multiple inquiries from auto, mortgage or student loan lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on your credit scores.

When You Apply For A Mortgage

When you want to buy a house, the first step is to get prequalified for a mortgage. Its a helpful step for everyone because it ensures youre shopping within your budget. During this process, lenders will typically check your credit using a soft inquiry, which doesnt hurt your credit score. However, some may process a hard inquiry.

Once youve found a house and need to finalize the mortgage, your lender will need to process a hard inquiry on your credit report, which will affect your credit score. How many points does a mortgage inquiry affect ? Its usually five or less.

If youre going to shop around for the best mortgage rate, which is a good idea, try to lump your applications together within a small window of time. When you do so, all the inquiries count as one, minimizing the negative impact on your credit score. The credit scoring bureaus can vary in their allowable time frame, but typically, its 14-45 days.

Don’t Miss: Who To Contact About Credit Report

How Does Prequalification Affect Credit Scores

There are two types of credit inquiries that financial institutions run to determine whether a person qualifies for a loan. A soft credit inquiry, which is used during the prequalification process does not affect credit scores, so there is no risk in trying to find out whether youre at least in the ballpark for approval for a specific loan or credit card. Viewing your own credit scores and reports also counts as a soft inquiry.

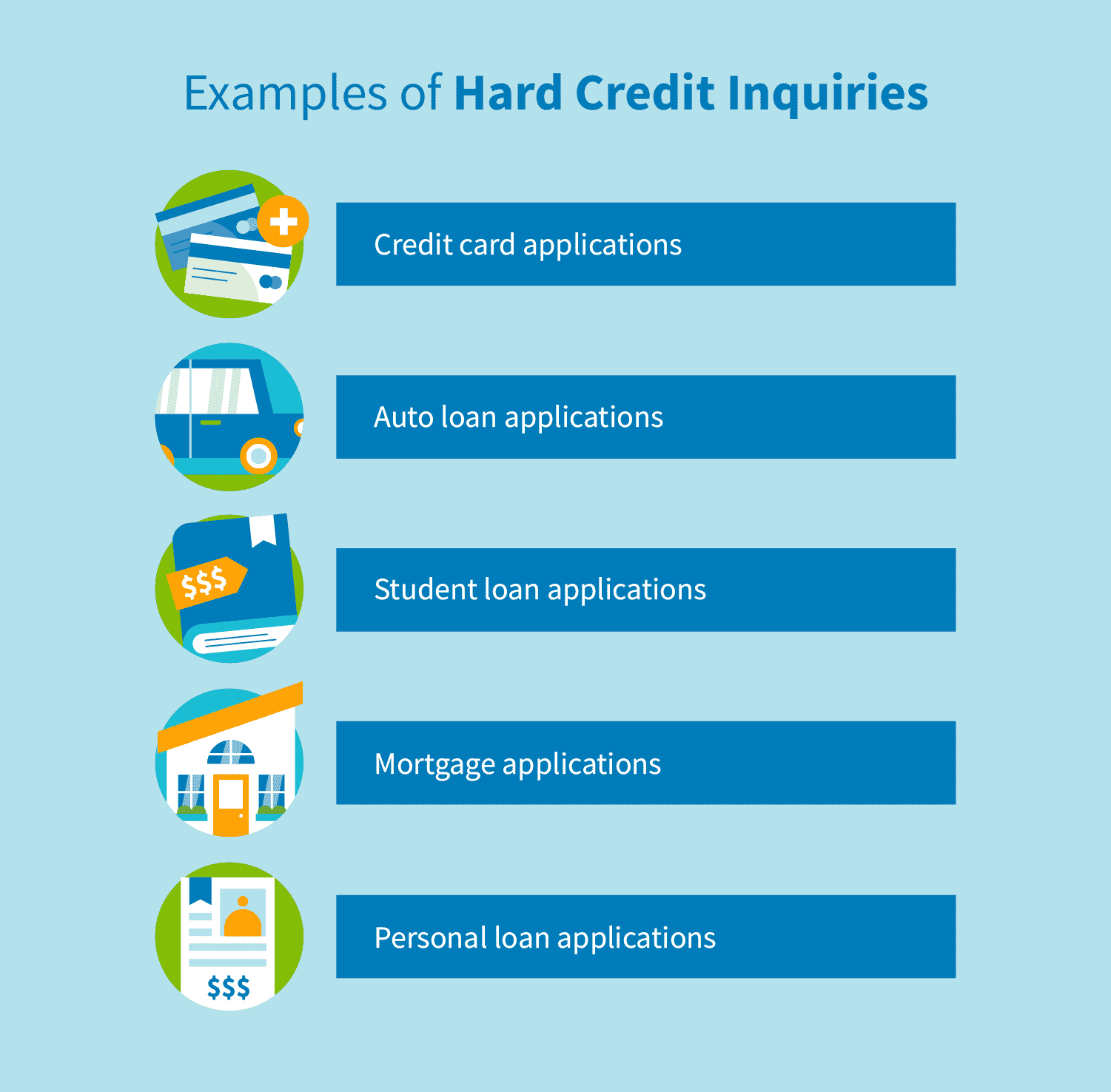

A hard credit inquiry, which takes place when you actually apply for a loan or credit card, will have a negative impact on credit scores, although the impact will be temporary. Hard inquiries are made during the pre-approval or approval process, when the lender examines your credit report to determine whether there is anything that would make you a credit risk.

But what about shopping for a mortgage? Does getting prequalified for a mortgage hurt your credit score?

Just like other loans or credit cards, mortgage prequalification doesnt hurt your scores since its also based on a soft inquiry. Having your credit report evaluated is a mandatory and necessary part of the mortgage process, Bey said. Because of that fact alone, there would be no benefit to the bank or anybody involved in the transaction to punish the prospective buyer for having their credit evaluated by a bank.

Read Also: Does Paypal Report To Credit Bureaus

Hard Credit Inquiry Vs Soft Credit Inquiry: Whats The Difference

Not all are created equally. Depending on the situation, you might encounter a hard credit inquiry or a soft credit inquiry when borrowing money. A soft credit inquiry allows the financial institution to assess where your credit stands to some degree. But it wont leave a mark on your credit report. As far as your credit report goes, a soft credit inquiry doesnt make an impact. However, not all credit inquiries are minimally invasive. Instead, there are also hard credit inquiries.

A hard credit inquiry happens when a lender or financial institution requests your full credit report from a credit bureau. The information on your credit report affects your credit score, but some financial institutions like to take a closer look at the information for themselves to assess things like your debt-to-income ratio.

Typically, your credit score will dip by 2 to 10 points after a hard credit inquiry. Although the information stays on your report for up to two years, the negative impacts usually stop after a few months. This is why it is important to understand when your credit is going to be pulled and which type of credit pull is being performed. Opening a savings account only has the potential to trigger a soft credit inquiry and it doesnt impact your credit score.

Recommended Reading: Is 818 A Good Credit Score

Hard Vs Soft Credit Inquiry

A credit inquiry is a request that potential lenders, employers, and landlords send to consumer agencies to check your credit score. Credit inquiries or credit pulls help lenders assess your creditworthiness based on your previous usage of credit.

Not all credit checks affect consumers credit scores. Theres a difference between hard inquiries and soft inquiries.

Exceptions To The Impact On Your Credit Scores

If you’re shopping for some types of loans, such as a mortgage loan, multiple inquires for the same purpose within a certain period of time are generally counted as one inquiry. The timeframes may vary, but range from 14 days to 45 days, depending on the credit scoring model being used. All inquiries will show on your credit reports, but generally only one within the specified period of time will impact your credit scores. This exception does not apply to credit cards.

You May Like: Does Rent Go On Credit Report

How A Mortgage Can Hurt Your Credit

There is, of course, the other side to the story. If you have trouble repaying your mortgage on time, your credit score will almost certainly suffer. Although it’s always a good idea to make your mortgage payment on or before the due date, the real trouble for your credit begins about a month after you miss a payment. Most mortgage lenders extend a grace period of 15 days before they’ll penalize you with a late fee. If a payment is 30 days or more past due, they will report it as late to the credit reporting agencies.

Even one 30-day late payment can have a lasting effect on your credit. Payment history accounts for 35% of your credit score and is the biggest factor in its calculation. A late payment will appear on your credit report for seven years, though its effect diminishes over time. An isolated 30-day late payment is less damaging than multiple late payments or one that extends to 60 or 90 days past due.

An unpaid mortgage that goes into foreclosure creates its own set of problems. In a foreclosure, multiple missed payments cause your mortgage to go into default. As part of your loan agreement, your lender has the right to seize your property and sell it to recover their money. The missed payments that lead up to foreclosure120 days or four successive missed payments is typicalwill seriously damage your credit. The foreclosure itself also becomes a negative item on your credit report. Worst of all, you lose your home and any financial stake you have in it.

Hard Vs Soft Credit Inquiries: Do They Affect Your Credit Score

Youre ready to apply for a mortgage loan. When your mortgage lender checks your credit reports will this hurt your three-digit FICO credit score?

The short answer? Probably. Because when a lender pulls your credit after youve applied for a car, mortgage or personal loan, thats known as a hard inquiry. According to FICO, the company behind the FICO credit score, a single hard inquiry could cause your credit score to fall temporarily, usually by less than five points.

But heres the complicated part: Not all inquiries will do this. And depending on how old your credit is and how many open credit accounts you already have, even a hard inquiry might not cause your score to dip.

As with most matters regarding credit scores, the impact of credit checks can be a bit confusing.

Don’t Miss: Does Carvana Report To The Credit Bureaus

Whats The Difference Between A Hard And A Soft Credit Inquiry

A hard inquiry is when a lender checks your credit because you applied for a loan. A soft inquiry occurs without a loan application, like when companies send you promotional offers.

Soft inquiries dont affect credit scores. Hard inquiries will decrease your and are only affected for a few months.

Soft credit inquiry: Soft inquiries dont impact your credit score. An example of a soft inquiry is an employer conducting a financial background check on a potential new employee candidate.

These inquiries dont submit a new credit application, as they are just looking at your overall credit score. You can perform a soft inquiry and look up your credit score.

Hard credit inquiry: When an individual pursues an application for a new loan or line of credit, the lender performs a more in-depth assessment. This assessment looks at the buyers credit score and credit report to determine if theyre suitable for the credit or loan request.

This comprehensive assessment looks at an individuals credit history reported by the three main credit bureaus,Equifax, TransUnion, and Experian.

Get pre-approved for a mortgage today.

How Many Points Does A Hard Inquiry Affect Your Credit Score

In general, hard inquiries dont have as much of an impact on your credit score as other credit factors. Credit inquiries are only responsible for 10% of your credit score while your payment history makes up 35% of your score.

For most people, according to FICO, a new hard credit inquiry will only drop your credit score between one and five points. While a hard inquiry stays on your credit report for two years, it only impacts your score for one year.

Its important to note that these inquiries can stack up. For example, if you get a new mobile phone and service plan in January and then apply for a new credit card in February, you may see a bigger hit to your credit score than just five points due to multiple hard inquiries.

However, there is a way around racking up multiple hard inquiries if youre rate shopping for a loan or mortgage. Heres how.

Recommended Reading: How Long To Build Up Credit Rating

How To Dispute Hard Inquiries

If theres an incorrect, outdated or unverifiable item on your credit report, you may be able to file a dispute with the credit bureau or the company that sent the information to the bureau and get it removed. Disputing items that are hurting your credit scores could be one way to quickly increase your scores.

What Is A Hard Inquiry

A hard inquiry is when a lender checks your credit report and has your permission to check it.

This is part of the application for a credit card, car loan, student loan or mortgage. These are the kinds of inquiries that consumers fret over, since they stay on your credit report for two years for all the world of lenders and creditors to see.

If your soon-to-be landlord checks your credit as part of the application process for renting an apartment, thats a hard inquiry, too.

Basically, any time you tell someone its OK to check your credit report, FICO counts it as a hard inquiry.

Recommended Reading: How Long Does Bad Debt Stay On Your Credit Report

Do Credit Inquiries Affect Your Credit Score

Although it may seem a little unreasonable, some inquiries do affect your credit score negatively. But the good news is that once youre familiar with the process, you can lessen their impact significantly. Consider finding out about the types of credit inquiries and their specific impact.

For instance, both hard and soft inquiries show up on your credit report but may not impact it the same. This is one reason you should examine your report annually at a minimum. It also helps to check to make sure that youre maintaining a good credit score and there are no fraudulent, illegal or incorrect inquiries.

Understanding Hard Inquiries On Your Credit Report

When a lender requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry. What does a hard inquiry mean for your credit scores? And how long does a hard inquiry remain on your credit report?

Reading time: 3 minutes

Highlights:

- When a lender or company requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry

- Hard inquiries usually impact credit scores

- Multiple hard inquiries within a certain time period for a home or auto loan are generally counted as one inquiry

Some consumers are reluctant to check their credit reports because they are concerned that doing so may impact their credit scores. While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is in your credit reportand checking your credit may help you get in the habit of monitoring your financial accounts.

One of the ways to establish smart credit behavior is to understand how inquiries work and what counts as a hard inquiry on your credit report.

What is a hard inquiry?

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year. Depending on your unique credit history, hard inquiries could indicate different things to different lenders.

Exceptions to the impact on your credit score

Read Also: What Is A Charge Off On My Credit Report

How Much Will Credit Inquiries Affect My Score

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores.

For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. While inquiries often can play a part in assessing risk, they play a minor part are only 10% of what makes up a FICO Score. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report.