New Credit Accounts And Applications

When you apply for new credit, lenders make what is known as a hard inquiry on your credit file and this is reflected in your credit history. The number of recent credit accounts or inquiries and their frequency will impact your credit score.

If you have many inquiries within a short period of time, lenders may assume that you are having financial difficulties and therefore pose an increased credit risk.

Inquiries made by you such as when you request your credit score or report, are referred to as a soft inquiry and do not impact your score in any way.

Factoring Rent And Utility Payments Into Your Credit Score

You can add alternative data to your credit reports. For example, even though rent and utility bills generally dont typically appear on your reports, there are services that allow you to add them, such as Experian Boost and other paid services like LevelCredit.

Adding your regular payments to your credit report will allow you to build credit by having them factored into your credit score.

Boost your credit with the bills you’re already paying

5.0/5

Checking your own credit score also doesnt lower your it because its considered a soft inquiry. Pre-approved offers from loan and credit card companies are also soft inquiries.

Lenders can still consider information thats not factored into your credit score

Some types of information arent factored into your credit score but can still be considered by lenders during the application review process. For example, prospective lenders may look at your current job, your income, and how long youve been doing your current job to determine how likely you are to repay a loan. 8 However, they still cant consider protected classes, such as your race or sex.

How Many Credit Scores Do You Have

While there are several different versions of the , the most commonly used version is the FICO score. Developed by FICO, formerly Fair Isaac Company, the FICO score is used by many creditors and lenders to decide whether or not to extend credit to you. According to myFICO.com, the consumer division of FICO, there are at least 10 different FICO scores used for varying purposes.

The VantageScore, which was created by the three credit bureaus, is another common credit score. Many free credit score services offer the VantageScore 3.0.

Also Check: Does Having A Mortgage Help Credit Score

How New Credit Can Increase Fico Scores

If the new line of credit helps diversify the types of accounts you currently have, this can increase the “credit mix” factor of your credit score. It shows lenders you can obtain and manage different kinds of credit, which can lower their risk of lending you money.

Let’s say you open a new credit card account and then don’t use that card for any new purchases. Over time, this can lower your credit utilization which could mean an increase in your credit score.

If you have a bad “payment history” and are starting from scratch to create a positive one, then opening new credit can help with that. If you can prove to lenders that you can pay your bills on time, this will help increase your score in the long run.

You should carefully consider if you need a new credit account. In the next section, you can learn about how to improve your FICO Score.

How Many Recent Inquiries You Have

An inquiry is when a lender makes a request for your credit report or score. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years. FICO Scores have been carefully designed to count only those inquiries that truly impact credit risk, as not all inquiries are related to credit risk.

There are 3 important facts about inquiries to note:

- Inquiries usually have a small impact

- Many types of inquiries are ignored completely

- The score allows for “rate shopping”

Remember: It’s OK to request and check your own credit report.

Checking your credit report won’t affect your FICO Scores, as long as you order your credit report directly from the credit reporting agency or through an organization authorized to provide credit reports to consumers, such as myFICO.

You May Like: How To Boost Credit Score

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

Your Credit Card Provider

Many credit card providers also offer cardholders the ability to check their credit scores for free. Oftentimes, these tools include access to view your score history and see what led to recent changes. Some providers also let customers forecast how their scores would react to variables like on-time payments, credit limit increases and taking out a mortgage.

Keep in mind, however, that most providers require cardholders to opt in to this service, so make sure you sign up if you want to access your score.

Heres a look at popular credit card providers with credit score tools.

Also Check: How Long Does An Eviction Stay On Your Credit Report

How Can You Check Your Credit Scores

Reading time: 2 minutes

-

There are many different credit scores and credit scoring models

-

You can purchase credit scores from a credit bureau or get one free from some banks and credit unions

Many people think if you check your credit reports from the two nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports do not usually contain credit scores. Before we talk about where you can check your credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score there are many different scores used by lenders and other organizations. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time.

Score providers, such as the credit bureaus Equifax and TransUnion along with companies like FICO, use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the two nationwide credit bureaus may also vary because some lenders may report information to both, one or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you check your credit scores? Here are a few ways:

In addition to checking your credit scores, its a good idea to regularly check your credit reports to ensure that the information is accurate and complete.

What’s In My Fico Scores

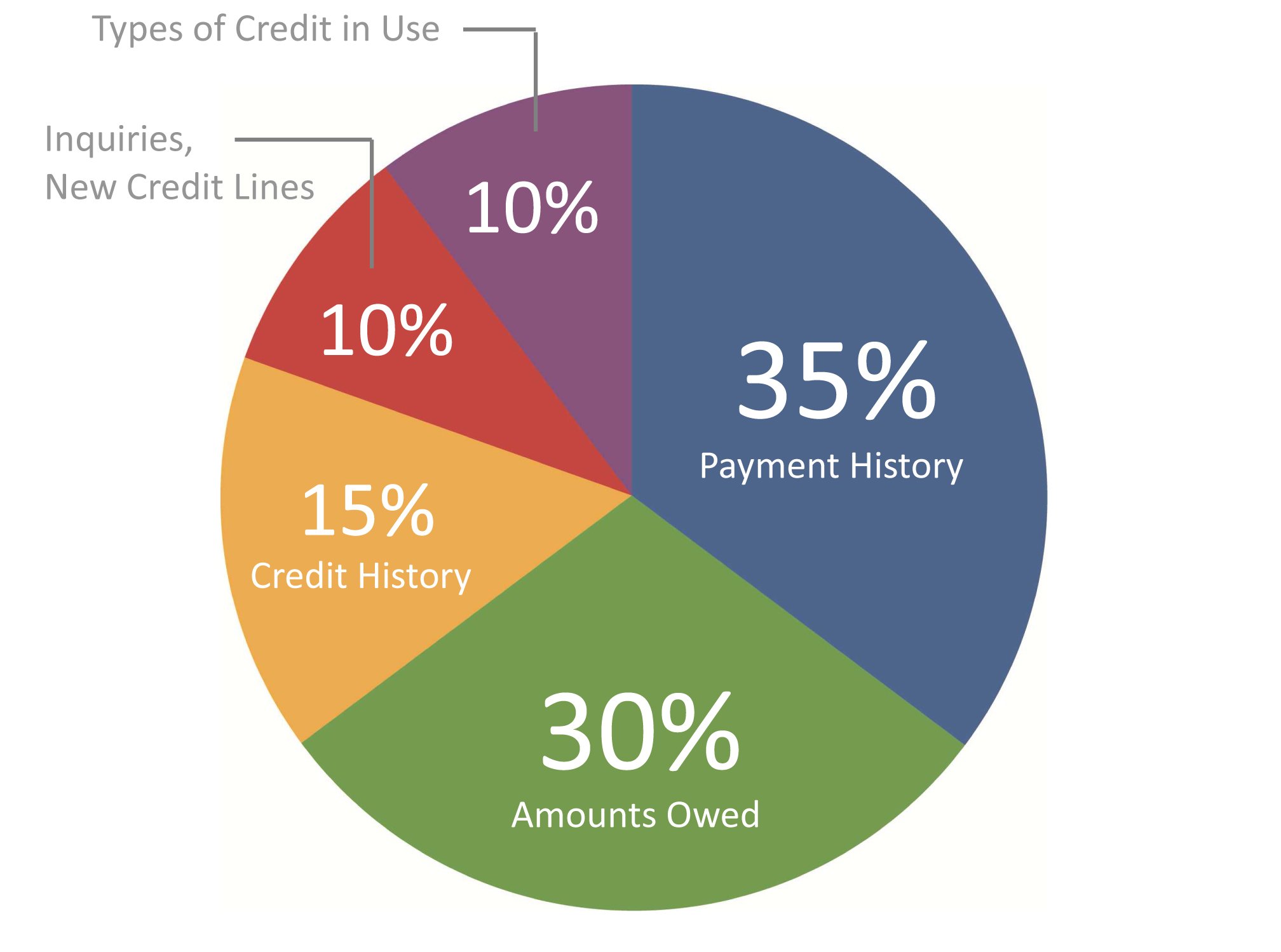

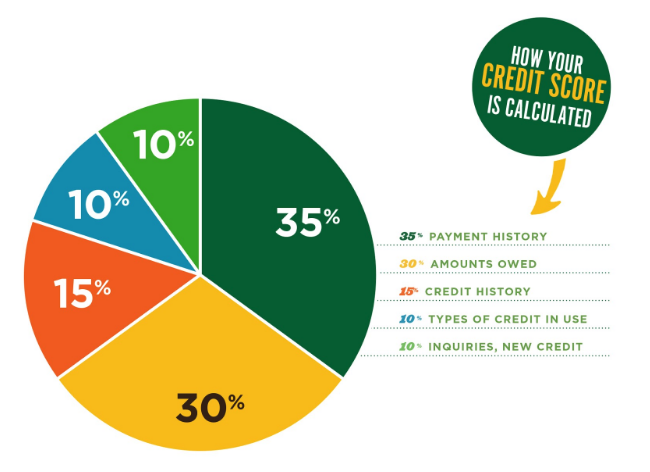

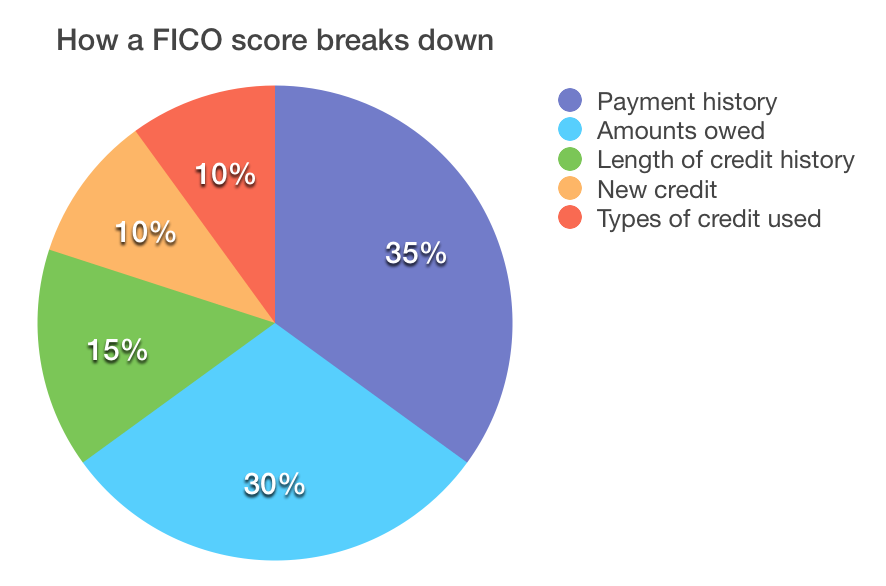

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.

Also Check: How To Access Credit Report

Understanding How A Fico Credit Score Is Determined

This video from the Continuing Feducation series provides a short overview of credit scoreshow they are determined and why they are important.

To provide students with online questions following each video, register your class through the Econ Lowdown Teacher Portal.

This video is included in an online booklet for Boy Scouts to earn the Personal Management merit badge, one of the requirements to become an Eagle Scout. Learn more about the badge and other videos featured in the booklet »

Length Of Credit History15%

A consumers credit history length accounts for 15% of their credit score, making it the third most impactful factor. To evaluate the length of a borrowers credit history, the scoring models identify the average age of all accounts the ages of the oldest and newest accounts the length of time each account has been open and the date on which each account was last active.

For this reason, its best not to close older accounts in good standingespecially if you plan to apply for a mortgage or other large loan soon. Improving this aspect of your score typically requires time and patience. That said, becoming an authorized user on an older account in good standing may help you boost the age of your credit and improve your score.

You May Like: What Credit Score Do You Need To Buy A Car

How Is A Vantagescore Determined

Like FICO, VantageScore uses the information in your credit report to determine your score. Its model analyzes the data, and just like FICO, attempts to predict how likely you are to pay back a loan.

While FICO and VantageScore measure the same thing, they go about it differently and may assign different levels of importance to different portions of your credit report. The five main categories of information that may impact your Vantage score are:

How Your Credit Score Is Used

When you apply for a credit card or loan, the creditor or lender uses your credit score to inform their decision on whether to issue you credit or not. The credit score gives a snapshot of how reliable you are as a borrower, which lets lenders know whether you are a good risk for a loan or credit card or not.

Lenders aren’t the only ones who check credit scores, however. Your utility company, landlord, and cell phone company may all check your credit score to get a picture of how reliable and financially stable you are.

These higher interest rates are designed to lower the risk that lenders take on by offering loans or credit cards to less reliable borrowers.

Also Check: What’s A Credit Score

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

How Much Is Owed

When you apply for credit, how much you already owe really matters to a lender. Your current payments will determine if you can manage any more payments in your budget for the additional money you borrow.

While you might think that you can handle more credit, statistically speaking, theres a chance you might not be able to. If you are close to maxing out all of your credit cards or your line of credit, it means that you are a higher risk to lenders. Higher risk to a lender means that theres a greater chance that you wont keep up with your payments.

Another aspect of this part of your credit score reflects how much of your available credit limits you use on an ongoing basis. If you usually use 60% or more of your credit limit on a credit card or line of credit, it will impact your credit score negatively. This is because if something were to happen to your income and you owe a lot of money, you would find yourself struggling to keep up with payments.

Also Check: How Long Does Bad Credit Stay On Report

What Credit Scores Are Made Of

FICO is relatively forthcoming about the overall factors that make up its credit-scoring models.

Payment history: 35% of a FICO score is made up of your payment history. If you get behind in making loan or credit account payments, the longer and more recent the delinquency, the greater the negative impact on your credit score.

Amounts owed: 30% of your FICO score is based on the relative scale of your current debt. In particular, your debt-to-credit ratio is the total of your debts divided by the total amount of credit that youve been extended, across all accounts. In general, lenders like to see a debt-to-credit ratio below 30%, but the lower the better.

Length of credit history: 15% of your score is based on the average age of all accounts on your credit history. This becomes a significant factor for those who have very little credit history, such as young adults, recent immigrants and anyone who has largely avoided credit. It can also be a factor for people who open and close accounts within a very short period of time.

New credit: 10% of your credit score is determined by your most recent accounts. Opening too many accounts within a short time frame might have a negative impact on your score, as the scoring models will interpret this as a sign of possible financial distress.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

You May Like: Does Loan Me Report To Credit Bureaus

How To Boost Your Credit Score The Traditional Way

The best way to improve your credit score is to focus on its two most important factors: payment history and amounts owed. Consistently paying your bills on time is the most important way to improve your credit score.

Thankfully, most lenders wont report delinquencies less than 30 days old and many wont even report payments that are 30 to 60 days late. But once you get beyond 60 days, each late payment will have a dramatic effect on your credit score.

Thats why its vital that you use every necessary resource to make all of your payments on time. This includes setting up alerts and reminders, as well as implementing automatic payments from credit card issuers and other lenders. Nearly all credit cards offer these features.

Related: 6 things to do to improve your credit in 2021

Next, you want to lower your debt-to-credit ratio. This is the total amount of debt you have, divided by the total amount of credit that youve been extended, across all accounts. The two ways to decrease your debt-to-credit ratio are to decrease your debt and to increase your credit.

Related:

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Don’t Miss: What If My Credit Score Drops Before Closing

How New Credit Can Lower Fico Scores

When applying for new credit, an inquiry is placed on your credit report. That means, for instance, if you’re trying to get a new credit card, the lender will “inquire” into your credit report from one of the three major credit agencies. Depending on the other factors in your report, this inquiry can lower your score by a few points.

A new credit card or line of credit will also affect your length of credit history. This part of your score is made up of your “oldest” account and the average of all your accounts. Opening new credit lowers the average age of your total accounts. This, in effect, lowers your length of credit history and subsequently, your credit score.

New credit, once used, will increase the “amounts owed” factor of your credit score. Amounts owed is composed of credit utilization the ratio of your credit balances to your credit limits. Very often, the lower your credit utilization , the higher your credit score. When you open and use a new credit card or line of credit, you’re getting closer to your credit limit, which could mean a lower score.

What Is A Credit Score

A credit score is a number that helps lenders, like banks, insurance companies and landlords assess how well youve managed your financial obligations. It is one of several factors they may consider when deciding a rate of pay for services, whether to loan you money or whether to enter into a business agreement.

Don’t Miss: What Does Mop Mean On A Credit Report