What Should I Do If A Creditor Tries To Sue Me

When a creditor tries to sue you, you’ll receive a court summons. Many people ignore the summons and don’t show up to court. If you’re not there to defend yourself, the judge usually issues a default judgment against you.

The judge may even order that your wages are garnished or place a lien on your property. If you show up, you can try to defend yourself. If you’re not sure what to do, then you can seek out an attorney for legal advice on how to handle the summons.

If You’ve Had A Judgment Taken Against You For A Debt There Are A Few Ways You Can Remove Judgments From Your Credit Report You Can Appeal For A Vacated Judgment Dispute The Inaccuracies Or Simply Pay It

If you’ve had a judgment taken against you for a debt that you owe, you’re probably familiar with the impact it has on your finances and your credit score. Judgments usually show up under the public records section of your credit report.

There was a time when judgments could show up on your credit report at any time, but recent legislation has made it more difficult for them to be reported. The new rules required public records data to contain a consumer’s name, address, social security number, and/or date of birth.

In response, the credit reporting agencies Experian, Equifax and TransUnion also came to an agreement known as the National Consumer Assistance Plan to ensure that accurate reporting is followed and consumers are aware of their rights.

However, if judgments meet certain criteria set forth by the Fair Credit Reporting Act , they can still be put on your credit report and damage your credit.

Our guide explains what a judgment is and how you can remove it from your credit report.

Can You Get A Good Credit Score With A Ccj On Your Credit Report

There are several ways to boost your credit score once your CCJ is closed.

- Make sure you are registered with the electoral roll at your current address.

- Ensure repayment of your CCJ and any other credit agreements.

- Do not apply for more than one line of credit every 3 months.

Itâs also a good idea to obtain your statutory credit report and review it for accuracy. You may learn that there are discrepancies on your credit report that need to be corrected. With some time a good credit score is well within your reach.

Recommended Reading: The Higher Your Credit Score The Brainly

Speak To One Of Our Financial Counsellors

While our free financial counsellors cant give you legal advice, they can refer you to a legal service that can. They can also help you work out what you can repay and assess your overall financial position.

Financial counsellors arent judgemental about your circumstances theyre here to offer you free, confidential and independent advice and assistance.

To speak to a financial counsellor you can:

- the National Debt Helpline on 1800 007 007 open Weekdays from 9:30 am to 4:30 pm.

- Use our live chat service by clicking the chat icon in the bottom right corner of your screen. Live chat is available 9:30am-4:30pm weekdays. If you send a message outside these hours a financial counsellor will get back to you.

- Make an appointment to see a financial counsellor in your local area Find a local Financial Counsellor.

Learn How To Remove A Ccj From Your Credit File

If you’ve recently received a county court judgment , you may be concerned about the consequences if it isn’t taken off your credit file. Here, we give you some helpful advice about the three ways to remove a CCJ from your credit record.

If you’ve recently received a county court judgment , you may be concerned about the consequences if it isn’t taken off your credit file. County court judgments on your credit record will have a negative effect on your credit rating and could prevent you from obtaining certain financial products.

Anyone with a CCJ on their credit file may find it difficult to get credit, and this could mean struggling to get a mortgage, loan, credit card, or even potentially a contract for a mobile phone. In certain circumstances, it could even have worse consequences – for people in some lines of work, it could result in job loss.

With this in mind, it isn’t surprising that so many people wonder how to remove a CCJ from their credit file and inquire about how long a CCJ lasts. The good news is that it is possible to have CCJs removed from your credit report.

Here, we give you some helpful advice about the three ways to remove a CCJ from your credit record.

Recommended Reading: Paypal Credit Affect Credit Score

County Court Judgments And Your Credit Rating

You might have a county court judgment against you if you owe someone money and a court ruled that you have to pay it back.

Your credit rating could be affected if you have a CCJ against you. This means it might be difficult for you to borrow money or get credit, for example from a bank or a shop.

The CCJ will appear on your credit report – this is the information that a credit reference agency provides to the company you want to borrow money from. The company will then use the information to decide whether to lend you money.

When Can A Default Be Removed

There are two main ways a default can be removed from your credit file:

Its important to check your account because errors do occur. If you see a default that you are sure is a mistake or you want to contest, you should bring the matter up with the lender that placed it there.

Reasons to argue a case include:

- The lender didnt try to collect the payments

- Mistaken identity and admin errors

- You were in arrears by fewer than three months

- Duplicate defaults

- The debt was Statute Barred

If they do not agree to remove it for whatever reason, you can then ask the credit reference agency to do it for you providing evidence.

Removing a default can be a tiresome process and you may want the help of Step Change or Citizens Advice as you go through the process.

Defaults will only stay on your credit file for six years from the date it was added. Once these six years have passed, the default will automatically be deleted.

If you catch up with your monthly payment, the default still wont be removed until the six years have elapsed.

If the default was added later than it should have been, you could ask for it to be adjusted so it falls off your credit report at an earlier date.

Recommended Reading: Ntb/cbna

What Is Your Credit File

Everyone in the UK has a credit rating which provides their financial history for the previous six years. The activity makes up a , which is accessible to any lender or creditor that you have applied to for new credit. Based on your score, lenders can accept or reject your application. It is also looked at by banks when you apply for a bank account and by mortgage providers.

How To Remove A Default Judgement From Your Credit

My question involves collection proceedings in the State of: FloridaI have a court date set for tomorrow that I cannot appear at . I know I am going to get a default judgement. I have tried to contact the attorney as I want to pay this off IN FULL before the court date, but he is not returning my calls. At this point I am thinking he would rather go to court so he can tack on added fees/court costs to the amount due. In any event, what happens after I get the default judgement? When I pay it off in full will it be removed from my credit report, or how do I go about removing it from my credit?I just want this nightmare to be over.

Don’t Miss: Approval Odds For Care Credit

Setting Aside A Judgment By Consent From A Creditor

In some instances, a judgment creditor will agree to sign consent orders to set aside the judgment. If so, they need to file the orders in court. After filing the orders, the credit reporting agency receives an automatic notification and can update your credit report.

However, many judgment creditors like banks and other lenders are often reluctant to provide consent to set aside and remove a judgement. Obtaining consent is even more difficult if you have not completely repaid the debt.

Despite this, the creditor may agree to sign consent orders to set aside a partially paid judgment debt if you enter into a deed of settlement. A deed of settlement typically permits the creditor to obtain a new judgment against you if you default on the deed.

Judgment On Your Credit Reports

-

Removing a judgment from your credit reports

-

Dismissing/disputing a judgment

-

Vacating a judgment

If a creditor or collection agency has sued you then that results in a money judgment. A judgment wont guarantee that the creditor will be paid because he still has to hunt for your bank accounts and assets — but if he knows where they are they can apply to seize them. This is a very stressful situation to be in because you are constantly worrying will today be the day my bank account gets hit, will the judgment creditor seize my car.

A money judgment acts as a security for the debt you owe, like how a house secures a mortgage or a car secures a loan. By placing a judgment against you the creditor can continue to monitor your assets to find an in to collect.

Hopefully, here we can show you some protection methods if you’ve got a judgment against you are worried about what will happen if you are sued. There may be several things you can do including fighting the judgment, vacating the judgment, and settling the judgment out of court.

Steps:

You May Like: Does Overdrafting Affect Credit Score

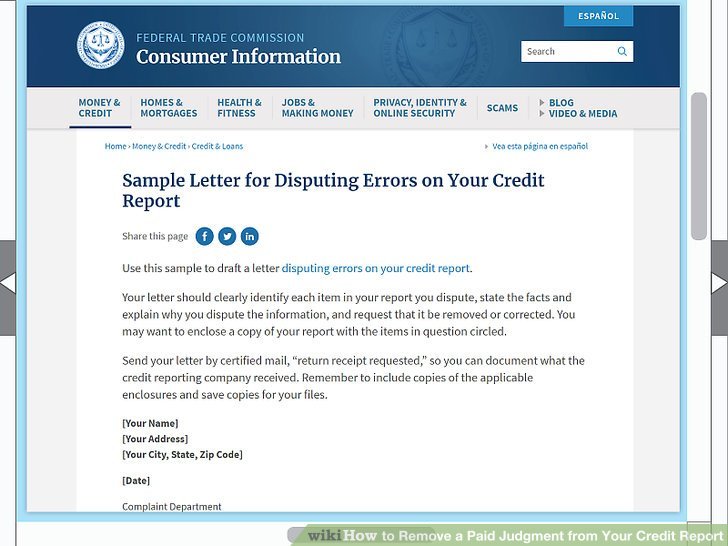

How To Remove Judgement From Credit Report

Lenders can update their records if the judgment is no longer valid.

You can submit a request to remove your public record from credit reports after it has been satisfied or released by the court, which means that you paid off what was owed. This will be reflected on Public Records and allow them to update their databases accordingly.

If filing bankruptcy, this will automatically remove the judgment from your credit report.

Suppose you are eligible to have a Chapter 13 bankruptcy. In that case, this allows for any remaining balances on judgments or liens against assets to be repaid over an extended period which can help ensure that they do not appear on future reports after being discharged by the courts.

However, if filing Chapter 13 bankruptcy, this will automatically remove the judgment from your credit report.

If you have paid in a full letter or court documents showing that any judgments on your reports are satisfied and figured out by the courts, then those entries can be removed off of public records after being satisfied. This information will need to be sent directly to all three major credit bureaus.

Set Aside A Judgement

Setting a judgement aside is a relatively simple process. But before you begin the process, make sure that its possible to do so with your judgment type and state. To remove a judgment from your credit report, you must file an appeal to the original creditor or collection agency.

Eliminate Judgments from Credit Report Permanently

If You Don’t Owe The Debt

If you don’t owe the debt, you can ask the court to re-open the case against you – this is called setting aside your CCJ. You can only do this if you can prove you have a genuine legal reason for not owing the money.

You can ask the court to set aside the CCJ by filling in form N244. Youll probably have to pay a fee for your case to be looked at again.

If the court agrees that you dont owe the money, your CCJ will be removed from the Register.

Removing the entry could take up to 4 weeks. It should be easier for you to get credit after the entry has been removed.

Also Check: Speedy Cash Open 24 Hours

Your Options When You Have A Judgment Debt

When your creditor has a judgment debt against you, your options are:

- Consider trying to make a repayment arrangement with the creditor directly . Only agree to repayment arrangements you can afford.

- If you can make repayments, start making them while you negotiate. This demonstrates what you can afford and shows you want to repay the debt.

- If you make an agreed repayment arrangement with the creditor, get the arrangement confirmed in writing. Keep details of the repayments you make .

- If you are late with a payment on a repayment arrangement or an instalment order, call the creditor immediately and explain why. Try to make an arrangement to catch up. If you cannot make an arrangement call us.

Pay The Debt If You Owe It

A simple way if you can possibly afford it would be to pay off the debt, assuming its accurate and yours and cant be removed through the validation process.

Pay the debt only if its yours and the court case was handled properly, meaning you cant likely lodge a successful appeal. Paying the debt wont always result in the credit bureaus removing the civil judgment from your credit report.

If possible, make your payment to the creditor contingent upon the creditor helping you remove the debt from your credit report.

Get this agreement in writing, and dont give a creditor or collection agency your bank account information or credit card number. Stick with old-fashioned check writing.

Your agreement doesnt have to pay off the entire balance. You could negotiate down. If the money is going to a collection agency this strategy is particularly helpful.

Don’t Miss: Affirm Credit Score Required

Ways To Remove A Ccj From Your Credit Record

If youve received a CCJ , this could have some serious consequences for you if its not removed from your credit record.

It can hinder you in obtaining credit, such as a mortgage or even a mobile phone contract. Depending on your line of work, it may even mean that you could lose your job.

There are however 3 ways that you can get the CCJ removed.

Does Your Credit Score Go Up When A Default Is Removed

When a default is registered on your credit report, it reduces your score. Thus, once a default is removed, no matter why it was removed, your score will increase. But having a default removed is not the only thing you need to consider to improve your credit score. You can build it up in other ways.

You should also keep in mind that the negative impact of having a default will dwindle as time goes on. Lenders will put less scrutiny on a default on a credit report from a date over five years ago than they will one that was added last month.

Also Check: What Does Thd Cbna Stand For

Removing A County Court Judgment From Your Credit Record

If your business has 1 or more county court judgments against it, this may mean that you have been disorganised or that you dont understand the implications. It can commonly also mean that your company is in financial difficulties.

The decision as to whether to try and remove a CCJ will often depend on which of the above applies. Whilst we are not lawyers and do not actually deal with the legal work to try and remove a CCJ we do advise small business owners for whom things have got on top of them and where they are ignoring mounting problems.

If your business may still be financially viable there are good reasons for removing any CCJs by paying them off and restructuring your finances, perhaps negotiating with creditors or HMRC. We have a lot of experience with this, so please do get in contact with us.

If your company has county court judgments against it, this will likely increase the chances of a creditor liquidation being commenced against your company, will possibly speed up that process and result in a more hostile form of liquidation where your actions will be looked at very closely by a liquidator appointed by the creditor.

Your business credit rating will also be reduced by having court judgments recorded against it.

These are all reasons why just leaving a CCJ in place and continuing to trade on may be a bad idea.

If youre company has received a CCJ and you would like immediate confidential advice, please get it in touch.

What Is A Default Notice

A Notice of Default letter is a warning from a creditor that you have missed payments on your credit agreement. They typically send the default notice when you have not been paying for three to six months. They will contact you and ask for full payment, giving you at least two weeks to catch up. If you do not pay the money owed, the account will default and you may:

These notices can only be sent on credit covered by the Consumer Credit Act, such as credit cards, personal loans and mobile phone contracts. If you have paid within the time given, no further action will be taken but you should avoid missing further payments or you will get another letter.

This budgeting resource could help! If you cannot afford the missing payments, speak with the company to see if they can offer a repayment agreement over many months.

Read Also: Why Is There Aargon Agency On My Credit Report