Total Mortgage Expense Dti Ratio

The FHA’s rule of thumb is that your mortgage payment should not be more than 31 percent of your gross monthly income. The rest of the mortgage industry calls this the front-end ratio.

Total Mortgage Payment

- Some personal loans

*For installment debt, submit your loan documents showing your monthly installment payment.

Once you submit these documents, your lender takes the total amount of your mortgage expenses, plus all your recurring monthly revolving and installment debt and weighs that against your pre-tax income. The FHA’s rule of thumb is that your total fixed payment expenses should be no more than 43 percent of your gross monthly income.

You can exceed the FHA’s 31/43 rule if you have compensating factors, such as a high credit score or a large down payment. Expect that if you have a DTI above 43 percent and a credit score below 620, you will undergo additional underwriting scrutiny.

Whats The Minimum Score Needed To Qualify For An Fha Loan

Do you want to take out a new mortgage? If youve got at least a 500 credit score, you could qualify for an FHA loan with 10% down. With a 580 credit score, you could put down as little as 3.5% on the new house. Despite the low credit-score requirements, most FHA borrowers dont have low credit scores. In 2018, the average credit score for an FHA borrower was 670. People with credit scores below 579 made up a tiny fraction of FHA borrowers just 0.83%.

However, the FHA doesnt just guarantee purchase loans. Here are the credit-score requirements for other FHA-insured mortgages:

Bad Credit Mortgage Faq

What credit score is considered bad credit?

Can a cosigner help me get approved?

Yes, a cosigner with a good credit history could help you secure a loan, assuming your lender allows cosigning. However, this is a big ask since the mortgage loan would affect your cosigners ability to borrow for his or her own needs. Plus, your cosigner would be on the hook for your mortgage payments if you cant make them and in the event of foreclosure or even late payments, their credit would take a huge hit. Most home buyers prefer co-borrowing with a spouse or partner. Co-borrowers become co-owners of the home and share in its equity.

Will a bad credit mortgage require higher closing costs?

While theres not necessarily a direct correlation between lower credit scores and higher closing costs, borrowing with bad credit does limit your loan options, which can lead to higher borrowing costs. For example, lets say you have a FICO score of 510 and can find only one lender willing to approve your FHA loan. If that lender charges a higher-than-average loan origination fee, you wont have the option of shopping around for lower fees from other lenders.;

Does mortgage insurance cost more when you have bad credit?How do mortgage lenders afford bad credit loans?Should I improve my credit score before buying real estate?

Don’t Miss: Does Barclaycard Report To Credit Bureaus

What Credit Score Do You Need To Buy A House

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

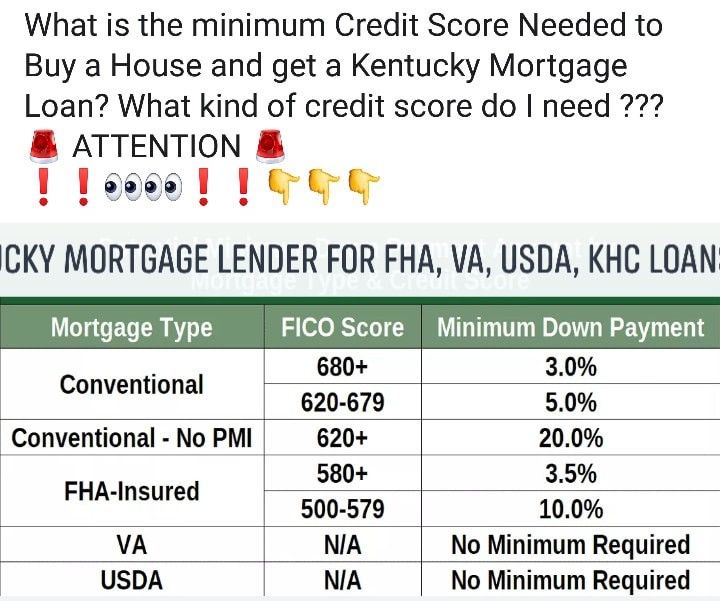

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

Tip #1: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

You May Like: How To Remove Items From Credit Report After 7 Years

Cons Of A Small Down Payment

- May be trapped in your house: A small down payment means you may not have enough equity pay a real estate agent to sell your house if you have to move suddenly. While thats usually not a problem, it could be an issue if you decide to take a job across the country.

- Bigger monthly payments: A small down payment means a bigger monthly payment. With FHA loans, a bigger principal balance on the mortgage also means paying more for required mortgage insurance.

Fha Credit Score Standards

You credit score and credit history are different but related sources of information lenders use to decide whether to approve your loan application. Your score is a predictive statistic and guess at your likelihood of repaying a loan.

When it comes to credit scores, bigger is better. Why? Lenders offer the best rates to borrowers who have the highest FICO credit scores.

The FHA minimum credit score is 500. However, if you want a loan with a 3.5 percent down-payment, then you must have a credit score of 580 or higher.

If you have a FICO credit score between 500 and 579, you are still eligible for an FHA loan. Borrowers with low scores must come up with a 10 percent down payment.

The 580 credit score standard is a bit deceiving in practice. It is common for lenders to place the bar higher and require a 620, a 680 or even higher score. Lenders may not go below the FHA’s minimum credit score, but are free to require higher scores.

These higher standards are known as lender overlays and they vary from lender to lender. Lenders add overlays as a precaution, especially on credit score requirements, because borrowers with low credit scores are more likely to default. Lenders worry about their overall FHA default rate. Lenders with high default rates are not allowed to stay in the FHA program and may receive financial penalties for making too many bad loans.

Don’t Miss: Which Credit Score Is Accurate

How To Calculate Your Dti Ratio

There are two ways to calculate a DTI ratio. Most loan officers call one the front-end ratio and the other the back-end ratio. The FHA uses different terminology to express the same ideas. Your loan officer might use either set of terms to describe your DTI.

How does your DTI measure up? Use our quick and easy calculator to find out.

Conventional or conforming lenders call the typical maximum ratio the “28/36 rule.” For FHA loans, it’s the “31/43 rule.”

What Are Fha Mortgage Loans

FHA home loans are government-backed mortgage loans that give Americans with low credit scores or a lack of funds the opportunity to purchase a home with only a small down payment.;

As opposed to a traditional loan, 3 parties are involved in an FHA home loan:;

- Borrower

- Lender

- Federal Housing Administration

The FHAs involvement provides security for both sides, reducing the lenders risk and helping the borrower get approved for the loan.;

Don’t Miss: How To Get A Detailed Credit Report

What Else Lenders Are Looking For

Its not just the credit score requirement you need to meet. Lenders look at three main factors when evaluating a borrower, according to Grech.;

The first is credit, which includes your existing debts and monthly payments, credit score, and whether youve had a foreclosure or bankruptcy before.;

The second is income. What theyre looking for is stability in your job, Grech says. They usually like to see you in your job for at least a year or two, and they look at how much you make, which dictates how much of a house payment you can afford.

The third is where your down payment money comes from. Is it going to come from money you have saved up? A gift? A 401 loan or stock? Grech says. Lenders and brokers tend to favor personal savings over gifts. Its not often that it makes the difference between an approval and a denial, but if there are other risk factors present such as a low credit score, high debt-to-income ratios, or derogatory credit events, we do occasionally see it factor in, he says.

Fha Loans In Nc And Sc

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.;

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less than perfect credit scores.;

You May Like: Does Experian Affect Your Credit Rating

How Does Interest Work On An Fha Loan

FHA loans can be either fixed- or adjustable-rate loans.

- With fixed-rate loans, the rate doesnt go up or down based an index rate, so your mortgage payment is more stable and predictable throughout the life of the loan.

- Adjustable-rate mortgage loans, or ARMs, move along with a specific benchmark index interest rate, such as the London Interbank Offered Rate, or Libor, which is a rate used by some large banks to charge each other for short-term loans. That means the interest rate and monthly payment can adjust periodically.

Adjustable-rate loans may have lower initial rates than fixed-rate loans, but they can go up over time.

For example, an adjustable-rate loan may be structured as a 3-1 ARM. This would mean your interest rate would be fixed for the first three years and could change annually after the initial three-year period. The loan could be set up so its interest rate could increase by up to 1% each year, with a maximum increase of 5% over the life of the loan.

The length of your mortgage loan also affects the rate you pay. The Consumer Financial Protection Bureau has an online tool that lets you explore potential rates based on a number of factors, including where you live, loan type, down payment and loan term.

Compare Low Credit Score Home Loans

Some mortgages arespecifically designed to help lower credit applicants get into homes. Here areseven different options that may work for you:

| Mortgage Type | |

| Borrowers with credit scores from 500-620 | |

| VA Loan | |

| Buying a house in a rural area | |

| Conventional Loans | Borrowers with moderate to good credit |

| Freddie Mac Home Possible |

Recommended Reading: Can You Self Report To Credit Bureaus

Learn More About Fha Loans

For more on FHA loans including the advantages of the FHA option and how it works, we invite you to explore your FHA loan options.

If youd like to see how FHA or another mortgage option could work for you, you can apply online with Rocket Mortgage®;or give one of our Home Loan Experts a call at 785-4788.

Take Steps To Keep Your Credit Rating High

Home buyers looking to take advantage of great FHA loan benefits should already know they need to establish the best possible credit rating. Applicants with a better credit rating increase their options for mortgage or refinance loans. In order to qualify for the low 3.5 percent FHA loan down payment, applicants will need a FICO score of at least 580. Those that don’t meet that criteria will have to put a down payment of 10 percent on the mortgage they want.

FHA loans are designed to help home buyers, so these government-insured loans usually come with more lenient requirements than typical mortgages or refinancing terms from traditional lenders. While the benefits don’t vary much between someone with good credit and excellent credit, there is a very noticeable margin for those with bad credit and average to good credit.

You May Like: How To Remove From Credit Report

What Are The Types Of Fha Loans

The FHA offers a variety of loan options, from fairly standard purchase loans to products designed to meet highly specific needs. Here’s an overview of FHA loans commonly used to buy a house:

» MORE:;Learn more about FHA 203 loans and Title I loans

|

FHA Loan Type |

|

|---|---|

|

Can be used to make improvements that make the home more energy-efficient. |

The home must be professionally assessed to qualify. Improvements must be deemed cost-effective. |

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE:;Facts about FHA home loans

Read Also: Does Paypal Credit Report To Credit Bureaus

Low Credit History By Loan Form

The minimum overall credit score one should be eligible for a mortgage in 2021 depends upon the kind of mortgage you are really looking to receive. Ratings vary whether you are trying to get a loan covered by the national Housing management, better known as an FHA funding; one protected by U.S. office of Veterans Affairs, generally a VA loan; or a main-stream home loan from a personal loan company:

Old-fashioned residential loans are actually home loans that proceed with the criteria fix by Federal National Mortgage Association and Federal Home Loan Mortgage Corporation. Theyre uninsured by any federal company.

Should your credit score rating try sturdy a lot of financial institutions start thinking about FICO many 740 or more staying excellent sort youll often have the option to qualify for a traditional mortgage with a low advance payment needs and low interest rate.

Old-fashioned loans are normally good for people with good or exceptional debt, as these lending products need a higher credit score rating than an FHA funding.

Cash advance loans frequently offer the most acceptable interest rates and versatile compensation durations, such as for instance 15- and 30-year financial names.

Low credit score rating necessary: At Quicken Financial products, your credit rating for an established financing must certanly be 620 or higher. A variety of lenders online installment AZ get various requirement allowing it to require a unique rating.

FHA Loans

Fha Loan Vs Conventional Loan: Which Is Right For You

FHA loans are commonly compared to conventional home loans to determine which will best fit your situation.

When you meet with your Mortgage Coach at Dash Home Loans, well look at various types of loans available to you. Well help you compare FHA loans to conventional loans as well as others that;are applicable in your situation. Our Mortgage Coaches are experienced and will provide in-depth information, but as youre researching loans yourself, here are a few differences to keep in mind:

- The minimum credit score for an FHA loan is 500. For a conventional loan, it is 620.

- Down payments for FHA loans are 3.5%, at least. For conventional loans, it is typically 3% to 20% depending on the lender.

- Loan terms for FHA loans are 15 or 30 years, while conventional loans offer 10, 15, 20, and 30 year loans.;

- You have to purchase mortgage insurance with FHA loans, but not with most conventional loans.

- Conventional loans can be more restrictive with what is allowed to be used for gifts for down payment. One hundred percent of your down payment can be a gift with an FHA loan regardless of the down payment percentage. However, there are restrictions here too. If your credit score is below 620 and you get an FHA loan in NC, SC, or another state, you may need to pay at least 3.5% of the down payment yourself.

Don’t Miss: Can You Have A Bankruptcy Removed From Your Credit Report

What Makes Up Your Credit Score

The FICO credit score takes into account information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score is made up of the following:

- Payment;History:;35 percent of your total score

- Total Amounts;Owed:;30 percent of your total score

- Length of Credit;History:;15 percent of your total score

- New;Credit:;10 percent of your total score

- Type of Credit in;Use:;10 percent of your total score

Based on this formula, the largest part of your credit score is derived from your payment history; and, the amount of debt you carry;versus the amount of credit available to you. These two elements account for 65% of your FICO score.

To put yourself in the best position to qualify for a mortgage, then, at the best possible terms, focus on these areas first.

Pay your bills on-time whenever possible, and pay revolving credit accounts to at least 20% of your available credit limits at least 30 days prior to applying for a mortgage.

This will improve your FICO scores and mortgage loan terms measurably.

Verify your mortgage eligibility