How To Remove Late Payments From Your Credit Report

Late payments can be deleted or updated to never late on your credit report. Its actually quite easy if you do it correctly, and you can choose from a few different options.

The method you should select depends on your general credit history, your relationship with the creditor, and the amount of time or money youre willing to put towards these efforts.

Here is an overview of four ways you can successfully remove a late payment from your credit report.

Checking Your Credit Report In Canada

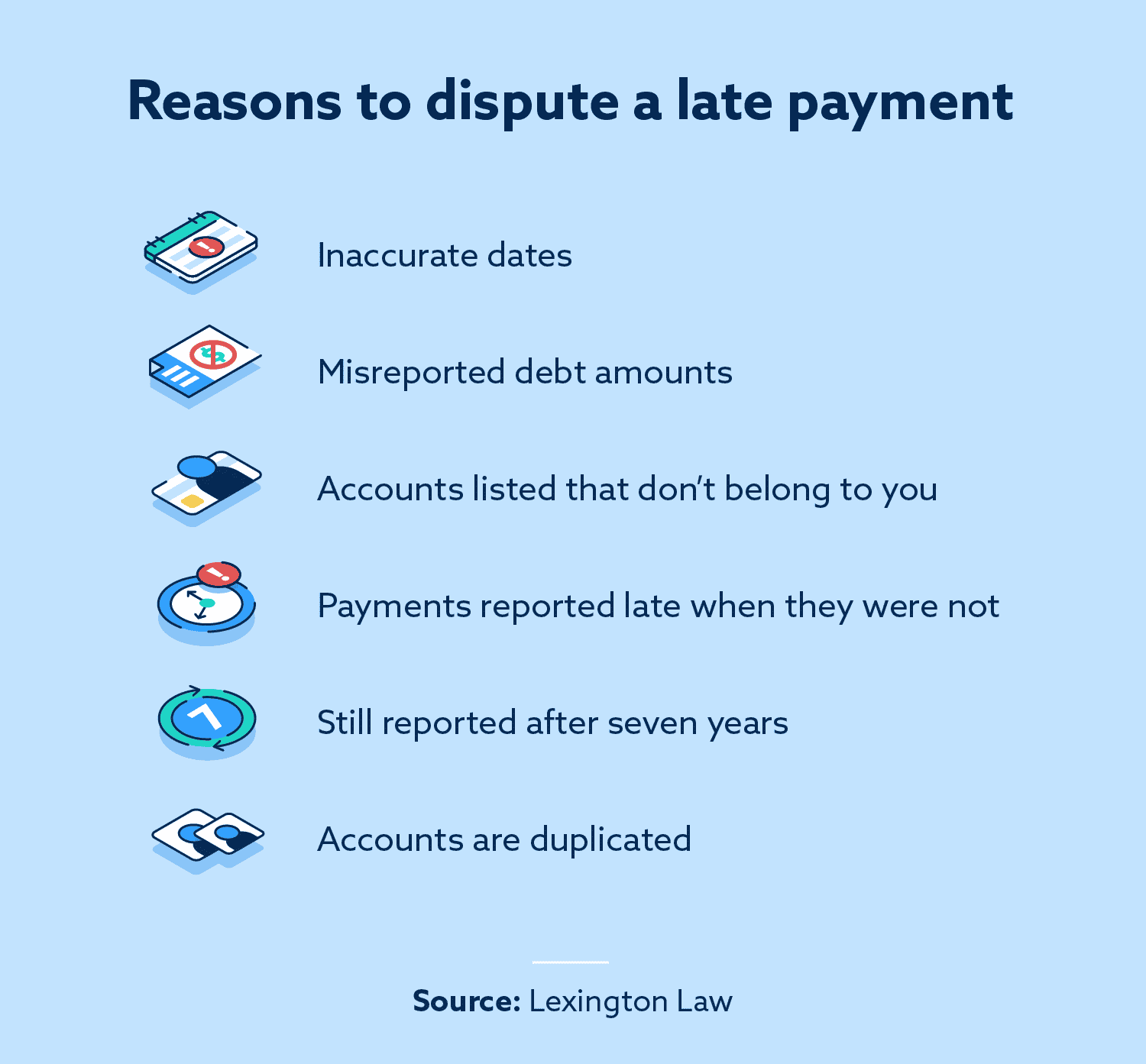

Now that youre aware of what can happen if theres an inaccuracy on your credit report, lets talk about what kinds of common errors you may come across:

- Inaccurate Personal Details Simple mistakes such as the wrong name, birthdate, or mailing address can spell disaster because you could end up with someone elses credit information .

- Wrong Account Information Its also possible that your lender didnt report your payment or account activity correctly. For instance, if you paid your debt on time but it was accidentally labelled as late or defaulted.

- Falsified or Stolen Accounts Identity theft and fraud are two unfortunate events that can affect your credit, not to mention complicated and time-consuming to deal with afterward.

- Uncorrected Negative Information Missed payments and other negative credit actions stay on your report for several years . If so, a bureau may forget to remove the information after the allotted time period.

Errors In Credit Reports

Your credit report is a detailed summary of your financial activity over the past 7-10 years. Credit reports typically contain information about open and closed credit accounts, payment history, collection actions, and public records such as bankruptcies. Credit scoring software uses the information in your credit report to generate your three-digit . Lenders use this score to assess your creditworthiness and to determine your interest rates.

Your credit report and credit score may also come into play when you buy car insurance, lease an apartment, or apply for a job. Despite how important it is for lenders and other furnishers to report information accurately, finding mistakes on your credit report is surprisingly common. Over the past decade, multiple studies have revealed that between 20-34% of people have errors on their credit reports.

Inaccuracies on your credit report can be a very serious problem. This is especially true for negative items such as incorrect balances, duplicate debts, or payments reported as late. These errors are sometimes the work of hackers or identity thieves, but most of the time theyâre simply mistakes. Still, even an innocent slip-up can wreak havoc on your credit score and potentially cost you a lot of money, so itâs important to make sure your reports are accurate.

Don’t Miss: Is 714 A Good Credit Score

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Do All Late Payments Appear On My Credit Report

Generally speaking, creditors must wait until a payment is at least 30 days past due before reporting it to the credit bureau. If you have a good relationship with your lender and a good payment standing, its possible your lender may even extend that time to cut you some slack but could still charge you a late fee. If your payment is 90 180 days late, your lender could also take it a step further and send a notice of late payment to the credit bureau which could result in them actually closing your account.

Also Check: Does Affirm Go On Credit Report

How To Dispute Inaccurate Information On Your Credit Report

You can also dispute any inaccurate information on your credit reports with the appropriate credit bureaus. Once a dispute is filed with the bureau, it will reach out to the creditor that supplied the information and ask them to verify it and respond to your claim.

If the creditor makes a change in response to your dispute, it must notify all other consumer reporting agencies to which it reported the information of the change.

Because each bureau handles disputes independently, you should check your report with each to make sure the changes have been made. If they haven’t, contact each of the credit reporting companies that are reporting the information separately to initiate a dispute with them.

Experian has an online portal you can use to submit a dispute, or you can file a dispute by phone, mail or fax if you prefer. Equifax and TransUnion have similar systems and options.

Filing a dispute is free, and you can attach or send copies of supporting documentation to verify your claim. However, some items that appear on your credit report typically aren’t disputable, such as correct legal names and addresses.

Once a credit bureau concludes its investigation, it may verify, update or delete the item in question. Disputes are generally resolved in 30 daysalthough they may be completed even sooner.

Why Do I Have A Late Payment On My Credit Report

Generally speaking, there are two main reasons why late payments appear on credit reports. The first is that you were late making a payment or missed the payment entirely, and the second is that a creditor mistakenly reported a missed payment.

If a missed payment was mistakenly reported, the error can be relatively easy to fix. If you missed a payment and are at fault, itll be a lot more difficult to have that late payment removed from your credit report.

Don’t Miss: Is 650 A Good Credit Score

How To Remove Late Payments From Credit Report

As weve just outlined, late payments can have a big impact on your overall credit. Your score will likely drop as a result, and it will affect your ability to access credit in the future.

Therefore, its important to do everything in your power to remove late payments as quickly as possible. Lets get into how you can accomplish late payment removal.

How Do You Dispute An Inaccurately Reported Late Payment

Use this method if theres an incorrect late payment on your credit reports that didnt actually occur. If you were at fault, learn more about removing actual late payments below.

You can also use this method if you actually made a late payment but theres some inaccurate information associated with it. In this case, you probably shouldnt expect to have the late payment record completely removed. Instead, your creditor will probably just correct the error but the delinquency will stay on your report.

Disputing items on your credit report is free. You may need to dispute the late payment with several companies in all. Heres the basic procedure:

Remember to be patient. This process may be solved successfully at step 2, or it could take longer. You shouldnt have much of a problem with the major credit card issuers if they clearly made a mistake, even if you have to spend more time on the phone than youd like. But, its possible that other credit card companies might be more difficult to work with, like issuers of subprime cards.

MoneyHack

Recommended Reading: How Bad Is A Judgement On Your Credit Report

Ask For A Goodwill Adjustment

This method is perhaps the simplest one that you can use, although its success depends on your previous payment history with the creditor.

All you have to do is write a goodwill letter in which you explain why you were unable to make your payments on time, and ask that the creditor give you a goodwill adjustment. In other words, ask if they will remove the late payment from your credit report out of goodwill.

This method obviously works best when your overall payment history is positive with the creditor .

Here are a few examples you can use in your goodwill letter as the reason why you were late.

Make sure to address the creditor with suitable respect, using language that is formal and appropriate. Freely acknowledge that you are the one in the wrong, as you have failed to make a payment when it was due.

Its not a good idea to argue with the creditor about the unfairness of any aspect of the payment in your goodwill letter. You agreed to make the payment, and you failed to do so.

Its as simple as that. So, accept your mistake and dont protest too much.

You need to explain to the creditor why you were unable to make the payment on time. Try to make your case honestly and convincingly.

Once youve accepted your mistake, explained the reason for it, then you can humbly ask the credit if they could possibly forgive the late payment.

Sometimes creditors dont forgive late payments, so your goodwill letter might not have any effect at all. Nonetheless, its worth a try.

How Long Do Late Payments Stay On Your Credit Report

Late payments remain on your credit report for up to seven years. However, contrary to popular belief, you do NOT have to wait up to seven years before being able to get a mortgage, car loan, or any other type of credit again.

Your credit score will steadily rise as time goes on. Even better is that there are several ways to get the late payment permanently deleted.

Keep reading to find out how you can get a late payment removed from your credit reports.

You May Like: What Credit Score Is Needed To Buy A New Car

How Do I Remove Late Payments From My Credit Report

Ask the creditor for forgiveness by writing a goodwill letter, aka a late payment removal letter. Though it does not always work, some creditors allow a goodwill adjustment provided you are in good standing with them or have rare late payments.

If the goodwill letter to the creditor is successful and they forgive your late payment, your credit report can be positively adjusted.

Although this method can be somewhat hit or miss, it doesnt hurt to give it a shot. As with any contact you make with creditors, be sure to have agreement details in writing to ensure accountability from the creditor.

You can think of writing a goodwill letter as a helpful tool within your credit toolbox. Not only will you want to write a goodwill letter, but then it is essential to stay on track in the future.

Your payment history makes up 35% of your score, so focusing on making timely payments can help boost your score. Once you get a goodwill adjustment, it is unlikely you will get the same opportunity from that creditor in the future.

Can A Late Payment Be Removed If It Was Caused By The Covid

It is possible for a lender to remove a late under the CARES ACT if you had a late payment for the month of February2020 or after that

The economic fallout from the coronavirus has caused lenders to make exceptions for those who suffered a loss of income or health complications as a result of the pandemic.

If you found yourself in this situation, the first step would be to simply call the creditor and see if theyll be able to issue a courtesy removal of the late payment. They may ask you to prove your loss of income or health complications.

Some creditors have guidelines that state that late payments can only be removed if you called before you fell behind and asked for a deferment.

Recommended Reading: What Is A Hard Inquiry On Your Credit Report

How Late Payments Can Affect Your Credit Scores

As your payment history is one of the most important credit scoring factors, even a single late payment can have a big impact on your credit scores. The number of points your score will drop will depend on your overall credit profile.

If you had excellent credit, you might see a big drop in your scores after a single late payment. Your score may continue to drop as you fall 60, 90, 120, etc. days behind.

But those who already have poor credit might not see as much of an impact from one additional late payment because its not necessarily a major change in their behavior. The previously low credit score may have already calculated in that they were likely to fall behind on a payment in the future.

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

Recommended Reading: How To Get 850 Credit Score

Dispute The Late Payment

If the first two options arent successfully getting your late payment removed, its time to file a credit dispute directly with credit bureaus. The Fair Credit Reporting Act allows you to do this if you find any inaccurate information regarding the late payment on your credit report. Creditors must verify the information and remove inaccurate information from your credit report within 30 days.

To begin the dispute process, you will first need to request your credit report. The FCRA allows you the right to at least one free credit report every 12 months from each of the three major credit bureaus.

Check your credit report to ensure that the date, payment amount, and other details are correct. If anything seems off, send a dispute letter to each of the three credit bureaus reporting the late payment.

You should get a response from the credit bureau about your dispute within 30 business days, which is required by law. This is a good option if you have the time and inclination to research and execute an effective dispute.

Filing A Small Claims Lawsuit Against The Creditor

Finally, if the first three steps do not yield results, I often help my clients file a small claims suit.

Heres whats great about this I have seen many judges rule in a consumers favor if they can prove wrongdoing by the creditors.

Research your states civil code to see what violations were committed pertaining to credit reporting. Also check for breach of contract, or unfair business practices.

Small claims court also requires consumers to show monetary damages.Proof of monetary damages could include documentation that a consumer was turned down for credit. It could also be that they received unfavorable financing terms due to the specific late payment.

Something to remember when trying to remove remarks from credit reports via legal actionSimply filing a suit will not make the creditor buckle.

The case has to be strong and well documented. What you may find surprising is, that even in the event the creditor does not show up to court, the judge will still look at the merits of the case and rule accordingly.

I normally recommend hiring an experienced professional or attorney if you are going to go down this path.

This is due to the complexities involved with filing and winning a small claims case to erase your late payment,

I do offer a free consult to determine if legal action is the right course for you.

You May Like: What Goes Into Your Credit Score

How Do Late Payments Impact Credit Score

When you miss a payment, your credit score is affected. When you are late with a payment by 30 days or longer, as much as 100 points can be taken from your credit score. Your payment history is an essential part of the credit score, which is why its taken into account when calculating it. Therefore, one single late payment is enough to drag down your score.

How To Dispute Late Payment Errors

There are several ways to challenge a report of a delinquent payment when you are not really at fault.

Identify which credit report shows the late payments

Hopefully youâve been monitoring your credit reports with Canadaâs two credit bureaus and so you can easily verify on which report the late payment is listed. When you reach out to your creditor to ask them to fix the credit report error, it will certainly help your case to present them with accurate information about where the wrong payment information is listed.

Contact your creditor to fix the mistake

The next step is to reach out to your creditor to ask them to fix the error. Remember that the lender has no interest in making a negative report and harming your creditor-client relationship â especially if you are a good client and make payment on time. After you contact the lender, they will then investigate your claim and confirm that there was an error. The creditor would then inform the credit bureau that the late payment was an error and it will be removed from your report.

If needed, contact the credit bureaus

Read Also: How To Put A Judgement On Someone’s Credit Report