Who Can See If I Have An Eviction On My Record

Evictions first require the landlord to obtain a civil judgment against you. The civil judgment is recorded on your public record and can remain there forever if no action is taken to have it removed. Public records, as the name suggests, are available to the public. Pulling individual public records is impractical however, since credit reports contain a “Public Records” section, the civil judgment will often show up there. Also of note, even if seven years have passed and the eviction is gone from your public records, the civil judgment may still show up on your credit report.

How Do I Get An Eviction Removed From My Credit Report

Try negotiating a settlement with your previous landlord in exchange for an agreement to contact the credit bureaus and have the eviction removed. You can offer to pay a portion of your past-due rent or eviction fees, but the landlord has no obligationto accommodate you. They may insist you pay all past-due rent plus fees.

If you have been able to work out a deal, make sure you have a way to hold your former landlord accountable for notifying the credit bureaus. This could include asking them to provide you with copies of the letters they send and slips for certified mailin exchange for a check.

If you canât come to an agreement with your former landlord, an eviction or judgment should roll off your credit report after seven years. If yours hasnât disappeared, write to the credit bureau and ask them to remove it. Provide them withproof of the timing to support your request.

If seven years havenât passed and your landlord wonât work with you, the eviction will remain.

Next Steps For Removing Evictions From Your Credit Report If You Cant Do It Yourself

There are only two things you can do if you cant remove evictions from your credit report. You can give up and forget about maintaining a clean credit history or find someone to help you work it out. However, the last thing you want to do is give up when you can find help elsewhere. This is where DoNotPay comes in handy.

Also Check: How Do Banks Check Your Credit Rating

What Happens If You Get Evicted

As with most court proceedings, you are allowed to have an attorney when your case is heard. Not having a lawyer can put you at a severe disadvantage compared to the landlord. Fortunately, there are organizations that can help tenants facing an eviction fight in court, such as community legal services and legal clinics sponsored by your local bar association.

But if youve had your day in court and lost, the judge will likely issue an eviction order forcing you to move out as soon as possible. If you dont leave when ordered to, many jurisdictions allow the police to help enforce a judges eviction order. Thats why you should be looking for a short term living arrangement anytime youve received an eviction notice and are awaiting a court date.

Is There A Way You Can Have The Unscrupulous Landlord Blacklisted

Theres no landlord blacklist yet, but if youve been wrongfully evicted or if you believe that your rights have been violated, you should get in touch with the US Department of Housing and Urban Development in your area.

The Fair Housing Act states that renters must be treated fairly, and any violation of this law is considered a serious offense. Contact your local housing authority right away.

You can file a complaint against your landlord with the Office of Fair Housing and Equal Opportunity .

- Online lodge a complaint online

- Email download the complaint form from the HUD website, fill up the necessary information and email it to your local FHEO office

- Phone call your local FHEO office to file a complaint

- Mail print out and fill up the complaint form and mail it to your local FHEO office

Dont forget to provide all the pertinent details when you file a complaint. These include, but not limited to the following:

- Your name and address

- Name and address of your landlord

- A detailed description of your grievance against the landlord

Read Also: What Is Considered An Excellent Credit Score

How To Rent With An Eviction Record

Landlords can deny your tenancy application if you have an eviction on your record. But there are a few things you could do to help you find a place to rent easily. These include:

- Explain the eviction. Talk to your new landlord and explain what happened they might understand your side of the story and allow you to rent.

- Offer to pay upfront. If your record shows that you were sued for unpaid rent by your previous landlord, you can offer to pay your rent upfront.

- Get a co-signer. Getting a co-signer gives your landlord peace of mind knowing that you have someone who is backing you financially.

An eviction stays in your record for at least seven years and can hurt your chances of renting a property. However, if you believe you were evicted unfairly, you can petition the court if you have enough evidence to support your case. Lastly, if you’re offered a place to rent, consider rebuilding your rental history by making timely payments and always ensuring the property is in good condition.

What Happens If I Dont Remove The Eviction From My Credit Report

If you dont remove the eviction from your credit report, it could affect your ability to get approved for a mortgage, car loan, or credit card. An eviction will also negatively impact your credit score, which could lead to higher interest rates and other financial penalties.

Disputing an eviction on your credit report can be difficult, but its important to take action if the eviction impacts your credit score. By following the steps in this guide, you can work to get the eviction removed from your credit report. If youre not sure where to start, hiring a credit repair professional may be the best option for you.

Recommended Reading: Do Remarks Affect Credit Score

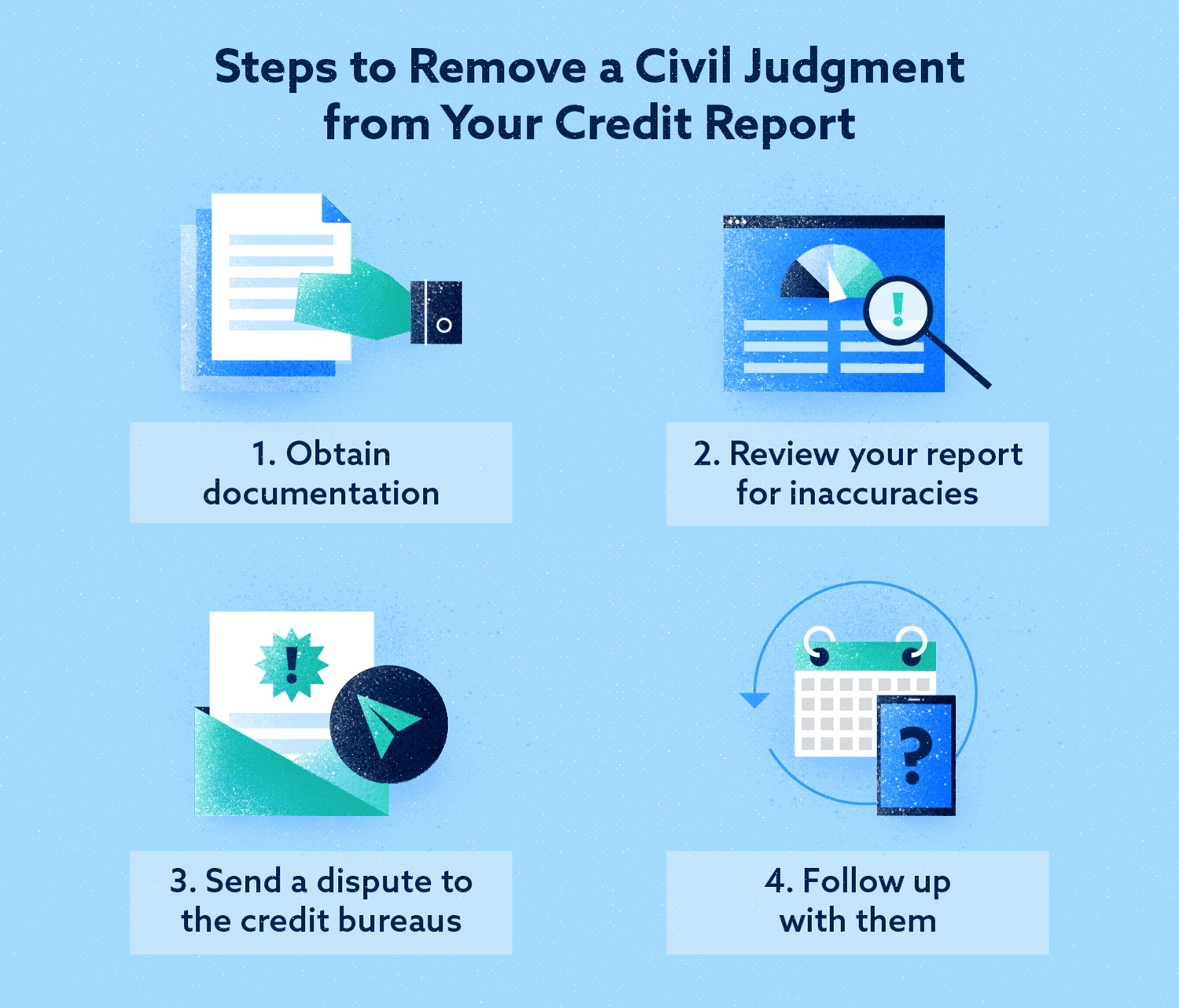

How To Dispute Inaccurate Eviction Information On Your Credit Reports

If eviction-related information has been incorrectly reported to the credit reporting agencies, you can file a dispute with the three firms .

You should get a copy of your report from each agency and look carefully to review exactly what has been reported. If you see inaccuracies, contact the reporting agencies and start a dispute. Know that by providing any supporting evidence will help your case, such as canceled checks that can prove payments were made.

If a judge dismisses a civil suit brought by your landlord, you can also petition the credit agencies to remove the information. Youll need to get copies of court records and submit them to each agency per their process, which you can find on their respective websites.

Likewise, if you believe the collections information is incorrect, you can dispute it with the credit reporting agencies to try to have it removed from your report.

Im Having Problems With My Former Landlord Not Updating The Eviction On My Credit Report

Unfortunately, this is something youll need to handle directly with your landlord as neither nor any other service can make them update the information on your account. The best advice we can offer here would be to pay off what remains owed and have them note it as paid in full. This way, they wont continue reporting the debt until it gets to a point where it has been paid off.

Read Also: How To Remove Inquiries From Credit Report Sample Letter

What To Do If You Receive An Eviction Notice

When you receive an eviction notice, you are being informed that a legal process has been initiated. This can lead to the court issuing an eviction order. Some evictions are curable, meaning that theres action that can be taken to fix the problem and remain in your home. For example, if youre behind on your rent payments, you can catch up.

But with an incurable eviction notice, youll have no choice but to vacate. Thankfully, you always have the right to appear in court and fight the eviction. The rules vary from state to state and even in certain cities, so its up to you to learn the laws of your community or contact an attorney that can help you.

How Do I Contest A False Eviction On My Credit Report

If a civil judgment or eviction is incorrectly listed on your record, you can petition the court in the county where the case was filed to have the record expunged or sealed. Generally, if you can provide evidence that proves the eviction should never have been entered into your public record, it will be expunged. If you feel the eviction was entered under false or fraudulent pretenses, you can still attempt to have it expunged or seal, but you will most likely need an attorney’s help to fight the falsified eviction.

When you file a petition with the court to have the eviction removed, you will need to pay a filing fee and prepare for your time in front of the judge. If the civil case against you from your current or previous landlord resulted in a civil judgment but did not result in an eviction, your chances of getting the judge to expunge the eviction are higher.

Also Check: What Is Ic Systems On My Credit Report

Avoid Eviction If You’re Able

Do your best to avoid eviction in the first place by being proactive and working with your property manager. But if you’ve already faced that stressful situation, knowing how to get an eviction off your record can empower you. It will take some effort, but in the end, you’ll be ready to find the perfect place to live.

Alex Heinz Alex Heinz is a writer with experience in a variety of industries from tech to lifestyle. Her work has appeared in Business Insider, TechCo and PopSugar. She’s lived in a handful of large cities including New York and San Diego, giving her first-hand knowledge of the ins and outs of renting. In her spare time, you can find her exploring new hikes with her dog.

If You Believe You Were Wrongfully Evicted Take It To Court

Eviction laws vary by state, so check with the agency that governs renter’s rights in your state by searching “landlord tenant laws.” Let’s say your property manager didn’t follow proper eviction procedures, or you can prove that you didn’t violate the terms of your lease agreement. You may be able to petition the court to remove the eviction from your public record. The legal aid organization in your area may be able to help with your case if your income is below a certain threshold.

Don’t Miss: How Does A Credit Card Settlement Affect Your Credit Score

What Happens When You Get An Eviction Notice

The specific requirements may vary by state, but what typically happens is that youll receive a summons and complaint delivered by a law enforcement official, such as someone from your local Sheriffs office.

This notice not only tells you when and where to arrive for your court hearing but also what the landlord is suing you for. It could be for you to simply leave the property, or the landlord might also be seeking past due rent payments.

Its important to go to the court hearing if you want to defend yourself against your landlord. If you dont go, the landlord usually wins by a default judgment.

Youll be held liable for the consequences laid out in the summons: eviction and potentially back rent plus court fees for all parties involved. However, in some states, you might be able to prevent the eviction entirely if you can make the rent payments and court fees at the hearing itself.

Can You Dispute An Eviction With The Credit Bureaus

Credit bureaus do not report evictions, so you will not be able to dispute them. If you have a collection on your credit report, you can dispute the collection and have it removed. This can be a complex process. Paying the collection debtwill not change your credit score or remove the collection from your credit report. Paying the debt will simply close the account with the debt collector. The collection account will still be visible on your credit report, which means your credit score will be significantly lower than it could be for up to seven years.

Recommended Reading: How To Remove Public Records From Credit Report

Attend The Ex Parte Hearing

At the hearing, the judge will review the paperwork for accuracy. If the parties have signed a stipulation and all the correct court procedures have been followed, there is no reason why a judge would not grant the application. Following the judges determination, the court will issue an order pursuant to the requests made in the ex parte application.

After this process is complete, soon after, the tenants judgment will be vacated, and the record will be masked.

Our law firm vacates unlawful detainer judgments. To speak to one of our tenant lawyers, please contact us at 415-504-2165.

How To Avoid Eviction In The First Place

As always, prevention is the better option. You can avoid getting evicted from the property youre renting by taking the right measures. These include making timely rental payments, maintaining the property, and following the terms of your rental agreement.

If you find yourself facing financial hardship and you think you wont be able to meet the payment deadline, talk to your landlord right away. Landlords are humans, too. They understand that things dont always go your way. Most of them appreciate tenants who are honest and upfront, especially when it comes to paying rent. Your landlord can help you out by creating a new payment scheme thats more suitable for your current financial situation.

Communication is key here. Landlords prefer long-term tenants rather than go through the hassle of finding and screening new tenants. In most cases, landlords are willing to helpyou just have to take the first step and talk to them.

Dont Miss: What Credit Bureau Does Usaa Use

Don’t Miss: Does Irs Report To Credit Bureaus

Protect Your Credit And Your Reputation As A Tenant

When facing an eviction, finding a new place to live is just one challenge. While an eviction may not directly hurt your credit, it could lead to problems down the line. To learn more about your legal rights, how to approach your landlord, or how to respond to an eviction, ask a lawyer.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

Do Evictions Show Up On A Background Check

Evictions do not show up on criminal background checks unless there was an associated charge or misdemeanor that had to be settled in civil court. Evictions will show up in an eviction history check for as long as they are on record with the courts these files are typically on file for seven years.

Also Check: How To Create A Credit Score

Sky Blue Credit Repair

Sky Blue Credit Repair is another credit repair company that has been in business since 1989. They have an A+ rating by the Better Business Bureau and have high customer satisfaction.

Just like Credit Saint, Sky Blue Credit Repair can help you dispute eviction from your credit report. They also offer a money-back satisfaction guarantee on all of their services.

Both Credit Saint and Sky Blue Credit are reputable companies with a long history of helping people repair their credit. If youre struggling to remove an eviction from your credit report, hiring one of these professionals may be the best step for you.

Does Filing A Dispute Cost You Anything

You dont have to pay anything for filing a dispute. Under the Fair Credit Reporting Act, consumers have the right to dispute with the consumer reporting agency the accuracy or completeness of any information in their report. The process involved in disputing credit reports is different between credit reporting agencies.

Don’t Miss: How Often Should You Check Your Credit Score

Can You Repair The Damage Or Remove The Information From Your Credit Report

If a landlord has turned over any unpaid money due to a collection agency, paying off what you owe can help. As stated above, once the balance is paid off, some of the newer credit-scoring models will remove it from your credit reports. Plus, it just looks better to future lenders to see that you have rectified the debt.

Going forward, the best way to repair any credit damage from an eviction is to tune up your financial health. By paying your bills on time and keeping your debt low, your scores will eventually start to improve.

While damaging information can stay on your credit report for seven years, debts carry less weight the older they get as more positive information is added to your credit reports. You may choose to seek help from a nonprofit , which can help you organize a budget to start repairing your credit health.

How Does An Eviction Impact Your Future Housing Prospects

Unfortunately, an eviction will almost undoubtedly hurt your ability to secure housing in the future.

Many landlords perform credit checks on prospective tenants. So, if your credit report contains debts owed through collection agencies or civil judgments, that will raise a big red flag on your application.

Even if a landlord cant tell that the collection debt is rent-related, theyll still question your ability or propensity to pay the rent on time each month.

Youll also have trouble getting approved for a mortgage, credit card, or personal loan during those seven years because your credit score will take a huge hit.

Also Check: How Long Do Late Payments Stay On Your Credit Report

Read Also: How To Pull My Credit Report For Free