Deal With Your Past Due Accounts

Settle any past due accounts current as soon as you can to stop adverse credit reporting. If in case you dont have the means to pay the delinquent balance, reach out to the creditor or lender to request a payment arrangement and make adjustments to your budget to free up funds that can be used to help repay whats owed.

Why Is My Credit Score 620

Several credit issues can result in a score of 620. Individuals with fair credit scores usually have late monthly payments on their credit reports, some of which may have gone to collections. Others are on the path to repairing their credit, as it takes time to recover from more severe credit occurrences, such as bankruptcy, foreclosures or judgments. Some of these issues can stay on your credit report and drastically hurt your score for several years if you dont remove them.

A 620 credit score is right on the border of the credit requirements for some loans, such as a conventional loan. Though you may be able to get installment loans or revolving lines of credit with a 620 credit score, you wont get very competitive interest rates. It is important to work on building your score to earn the most competitive rates and gain access to more sources of funding. This article provides some pointers on how to do this.

How To Check Your Fico Score

Knowing your FICO Score can help you get a handle on your finances and prepare you for the loan or credit card application process. Luckily, there are a number of ways to check your credit score. Start by reviewing your credit card statements and card providers website. Many issuers offer customers free FICO scores each month, while others even offer the service to non-cardholders.

Alternatively, you can visit FICOs website and choose from one of three monthly plans that provide access to FICO scores, credit reports, identity monitoring and other services.

Also Check: How Long Does Irs Tax Lien Stay On Credit Report

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

What Can I Do To Boost My Credit Score To Good

Seeing an increase in your credit score used to take time and effort, but now you can instantly boost your credit score by using a new tool called Experian Boost®ø. Experian Boost works by giving you credit for past on-time utility and telecom payments. Experian Boost is free to use and can help you boost your score in just a few minutes.

While Experian Boost can help you instantly see an increase in your FICO® Score, it’s important to establish good credit habits so your score can improve even more over time.

Here are a few more steps you can take to help increase your credit score now and over time.

You May Like: How Long Does Information Stay On Your Credit Report Uk

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

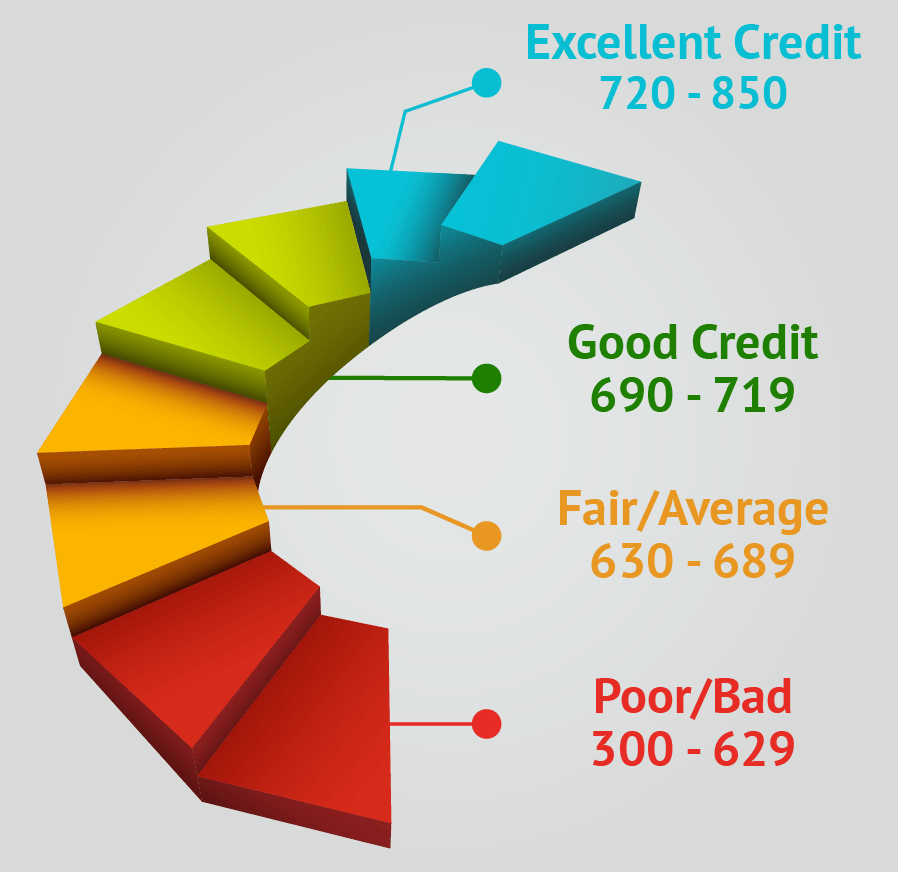

What Is Fair Credit

What is considered a fair credit score? Before we define what a fair credit score is, we should answer the question: What is a bad credit score? A credit scoring system typically starts at a low 300 and increases to 850 . A fair credit score range is between 580 and 669 points.

Two companies dominate the credit scoring industry: FICO and VantageScore. Having a fair FICO or VantageScore credit score means that you dont have bad credit, but you dont have great credit either. An average score is what most people tend to have if they arent strict about keeping up with their credit payments or loan repayments. Your credit score will affect your rental applications, loan applications, and credit card qualifications.

Recommended Reading: Do Cell Phone Bills Go On Your Credit Report

Poor Credit Score: Under 580

An individual with a score between 300 and 579 has a significantly damaged credit history. This may be the result of multiple defaults on different credit products from several different lenders. However, a poor score may also be the result of a bankruptcy, which will remain on a credit record for seven years for Chapter 13 and 10 years for Chapter 11.

Borrowers with credit scores that fall in this range have very little chance of obtaining new credit. If your score falls in it, talk to a financial professional about steps to take to repair your credit. Additionally, so long as you can afford to pay a monthly fee, one of the best credit repair companies may be able to get the negative marks on your credit score removed for you. If you attempt to obtain an unsecured loan with this score, be sure to compare every lender youre considering in order to determine the least risky options.

Doing things such as paying down debt, making timely payments, and maintaining a zero balance on credit accounts can help improve your score over time.

Climbing The Credit Score Chart

Generally, people with a good credit score have a long history of making their credit card and other loan payments on time. Payment history typically makes up 35% of the total calculation. Amounts owed typically makes up about 30%. Other considerations are length of , about 15% credit mix , about 10% and new credit about 10%.

Don’t Miss: What Seer Rating Qualifies For Tax Credit 2015

What Impacts Your Fico Score

In general, FICO scores are calculated based on five major factors, each with its own weight. Heres what impacts your FICO Score.

Payment History

Accounting for 35% of your credit score calculation, payment history is the most impactful component of your credit score. This metric includes several factors like the number and severity of late payments and the presence of adverse public records like lawsuits and bankruptcies. To improve your credit scoreor keep it strongmake consistent, on-time payments on all of your accounts.

Amounts Owed

The amounts owed category represents the total outstanding balances on all of your accountsor how much money you owe. As the second most important element of your credit score, it accounts for 30% of the calculation. For that reason, making more than the minimum payment each month and paying down debts quickly can improve your credit score.

Length of Credit History

In general, the longer your credit history, the higher your score. Even though the length of your credit history only accounts for 15% of your score calculation, it can be a frustrating metric to manageespecially if youre building credit for the first time. While you cant go back in time and open credit accounts sooner, you can strengthen this portion of your score by keeping your oldest accounts open and in good standing.

New Credit

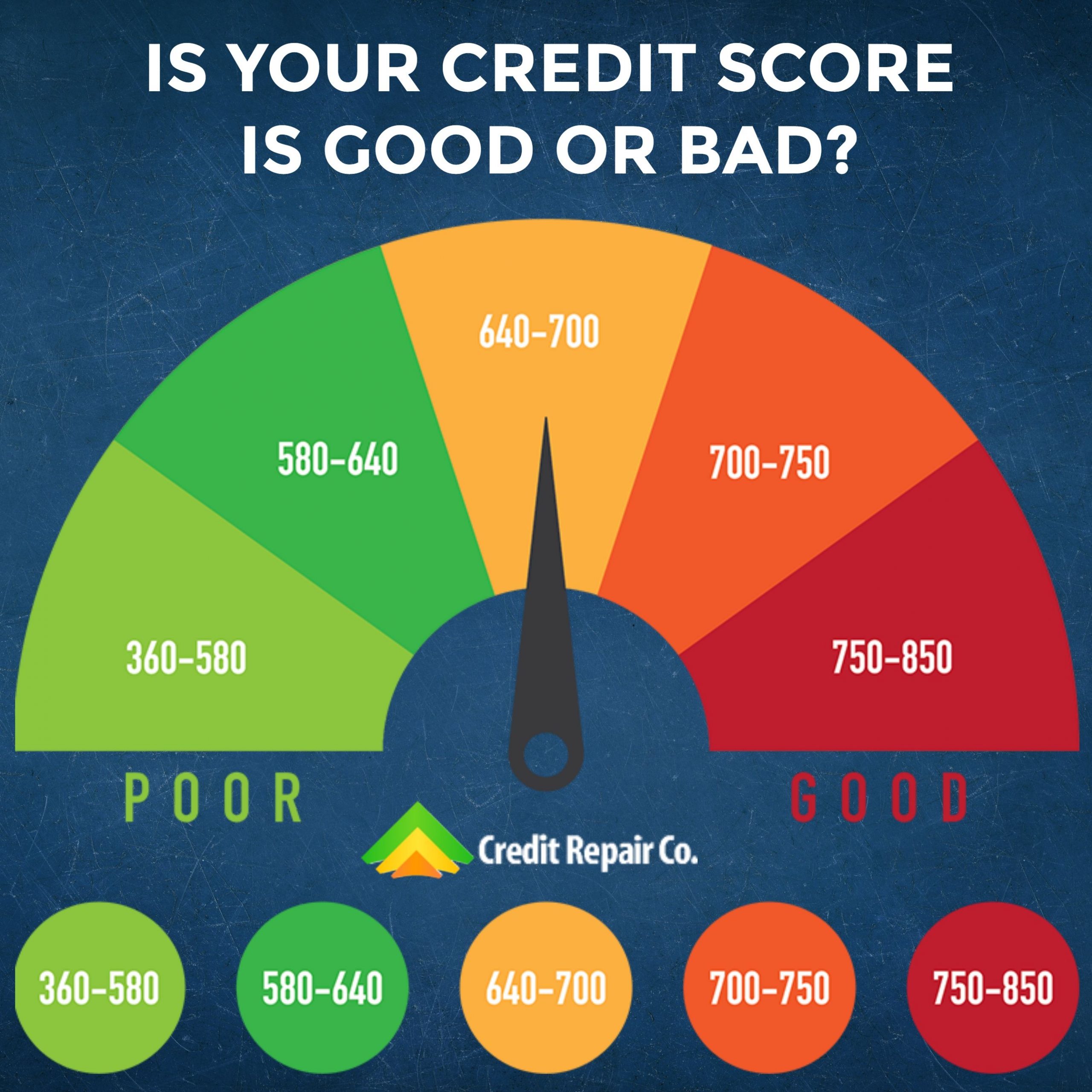

Fico Credit Score Range

FICO credit scores range from 300 to 850, and are classified into five categories that represent a consumers likelihood of repaying debts and the amount of risk he poses to lenders. These are the five FICO credit score ranges:

- Poor . A score under 580 is well below average and classified as Poor under the FICO scoring model. Consumers with scores in this range are considered risky borrowers.

- Fair . Still below average, scores between 580 and 669 are considered Fair on the FICO scale. Borrowers with a FICO Score in this range may be approved by many lendersthough they likely wont be offered favorable terms.

- Good . FICO scores in the Good range are at or above the national average. Because of this, most lenders are willing to extend funds to borrowers in this category.

- Very Good . A Very Good FICO Score is in the range of 740 to 799. Because this level of score is above average, it indicates to lenders that the consumer is low risk and likely to pay off their loan on time.

- Exceptional . Consumers with a FICO Score of 800 or above are considered Exceptional. Not only are these borrowers most likely to get approved, but they also have access to the most competitive rates and other loan terms.

Also Check: How To Get Free Credit History Report

How To Improve Your Credit Score Before Applying

If your score is lower than you wish and you want to increase your chances of receiving better loan terms, take time to improve your score before applying. Use these strategies to build your credit fast:

- Pay all of your bills on time. On-time payment history is one of the most important factors when building credit. Be sure to pay all of your bills on time leading up to applying for a personal loan.

- Become an authorized user. An authorized user is someone who is added to an existing credit card account. When you become an authorized user, the cards history will appear on your credit report. If the primary account holder has a history of on-time payments, your credit score may experience a boost.

- Pay off existing debt. Your debt levels impact your credit utilization ratiohow much of your total available credit you use, represented by a percentage. The higher your ratio, the harder it is to qualify for a personal loan. Paying off existing debt before applying can help boost your score by decreasing your credit utilization ratio.

- Request a credit limit increase. Paying off existing debt is not the only way to reduce your credit utilization ratio. Because your credit utilization looks at how much of your available credit you use, increasing your credit limit can achieve the same goal. To request a credit limit increase, contact your card provider. This may require a hard credit check that temporarily dings your score.

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores. They are interested in your credit record. Learn more about what landlords really look for in a credit check.

You May Like: How To Increase Your Credit Score Quickly

Comparing Fico And Vantagescore Rating Systems

Each system utilizes a different set of standards to determine your credit score over time.

FICO Score Range

- Length of credit history: 15%

- New credit: 10%

These reports are continually generated. As your rating changes, so do your prospective credit-related options. FICO ratings can be highly coveted in the world of high finance, yet possess some obvious pitfalls for entry-level clients, e.g., the need for a six-month trial period.

Various rating agencies and credit bureaus are viewed differently by different lenders, businesses, and credit card providers.

There are also many benefits provided through using varied account types, such as rotating loan agreements with low-interest rates, good auto loans while maintaining a good, steady income to expense ratio. This can also be important when trying to maintain a steady fair credit score.

Focusing on a variety of savings options, job offers, and trading on the financial markets can help improve credit reports and your finances.

Pay particular attention to:

- Recent activity of credit accounts.

- The type of credit youre using.

- The length of your credit usage.

- The number of credit accounts you have.

VantageScore Range

| 300 499 |

What Is The Difference Between A 610 Credit Score And A 650 Credit Score

A difference of 40 points on your credit score may not seem like much, but it can make a big difference in your financial life. A 610 credit score is considered fair, while a 650 credit score is considered good. This means that people with a 610 credit score may have difficulty getting approved for loans and credit cards, and they will probably pay higher interest rates than people with a 650 credit score. There are plenty of ways to improve your credit score, so if your score is in the 610 range, dont despair. Talk to a credit counselor or financial advisor to get started on the road to a better credit score.

Don’t Miss: How To Get My Own Credit Report

Understanding Credit Score Ranges Is Really Important

Knowing where you fall on a credit score range can be immensely helpful because it can give you an idea of whether youll qualify for a new loan or credit card. Your credit scores can also help determine the interest rates youre offered higher rates could add up to lots of money over time.

Lets take a deeper look at the different credit score ranges and what they can mean for you.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Recommended Reading: How To Report Rent Payments To Credit Bureau

Use A Secured Credit Card

When conventional credit cards are unavailable due to credit history blemishes, turn to secured credit cards.

A secured credit card works by putting down a deposit that is the full amount of your spending limit. This can be as little as a few hundred dollars, and acts as the security for the credit you are being extended. Then as you use the card and make on-time payments, those are reported to the credit bureaus and will improve your credit score.

How Can I Improve My Credit Score

Improving your credit scores really comes down to the same categories of behavior that can get your score in trouble. You’ll just need to throw the car into reverse and start doing the “right things.” If you stay on course, over time your credit scores will likely improve, and so can your access to credit. Those actions include these:

Establishing good credit habits like these can make a difference and help you improve your credit scores over time.

Don’t Miss: How To Print Credit Report From Credit Karma