Home Equity Loan Or Line Of Credit

Homeowners can use the equity in the home for a one-time, lump-sum loan or line of credit to consolidate debt. It has the same impact on your credit score as any other loan, meaning your score will improve if you make on-time payments and will suffer if you miss payment. Since youre using your house for collateral, a worst-case scenario is that you lose your house if you dont make on-time payments. A home equity loan is similar, but a lump sum rather than a revolving line of credit.

Debt Consolidation And Credit Scores: First The Bad News

Most forms of debt consolidation involve using a new loan to pay off two or more old accounts. And applying for a new loan usually means authorizing a hard pull of your credit report. According to FICO, each hard pull, or inquiry, causes your credit score to drop as much as five points. That drop is temporary inquiries remain on your credit report for two years but only impact your credit score for one.

Five points might not seem like a big deal. But what if you apply for more than one consolidation loan or even prequalify with more than one lender? The impact could be minimal or significant depending on the consolidation loan you choose.

How Does Debt Consolidation Affect Your Credit Score

Quick Answer

Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary. Understanding your options and how they affect your credit score can help you determine the right steps.

In this article:

Debt consolidation has the potential to help or hurt your credit scoredepending on which method you use and how diligent you are with your repayment plan. But there are ways to lessen the negative impact on your credit score and use consolidation to build your credit score over time.

Recommended Reading: How Often Is Credit Score Updated

Understand The Risks And Pitfalls First

JGI/Jamie Grill / Getty Images

If your credit card bills are piling up and you just cant juggle any more, a balance-transfer card or loan can consolidate your debt, but doing so may also have a lasting impact on your credit.

While combining your outstanding balances can simplify repayment, reduce stress, and most importantly, save you money on interest over time, this approach can ding your credit score and history if youre not careful.

Learn how debt consolidation can hurt your credit.

Exactly What Is A Debt Settlement Company

When youre struggling with debt, it can be hard to know where to turn. Do you try to negotiate with your creditors on your own? Or do you hire someone to help? Debt settlement companies act as intermediaries between borrowers and their creditors. They can sometimes help reduce or eliminate debt.

There are a few things to keep in mind before you work with a debt settlement company. Read reviews and understand the process to ensure you get the best terms possible. Different companies offer different deals, so its essential to do your research before deciding.

Don’t Miss: Does Applying For Credit Card Hurt Credit Score

Debt Consolidation And Credit Utilization

Once you consolidate your debt, good things may happen to your credit score. Consolidating credit cards reduces your credit utilization ratio. Credit utilization makes up 30% of your credit score. And you should try to keep that ratio as low as possible.

How do you calculate your By dividing your total credit card balances by the sum of your credit card limits. For instance, if you have three cards with credit limits of $3,000, $2,000 and $10,000, your total credit is $15,000. And if your balances are $2,000, $2,000 and $8,000 , your utilization is $12,000 / $15,000, which is 80%. Thats very high and would probably drag your credit score down considerably.

Explore Your Debt Consolidation Options

- How it works: Once you know your numbers, you can start looking for a new loan to cover the amount you owe on your existing debts. If you’re approved for the loan, you’ll receive loan funds to use to pay off your existing debts. Then you start making monthly payments on the new loan.

- Consider your options. Wells Fargo offers a personal loan option for debt consolidation. With this type of unsecured loan, your annual percentage rate will be based on the specific characteristics of your credit application including an evaluation of your credit history, the amount of credit requested and income verification. Some lenders may have secured loan options which may offer a slightly lower interest rate, but keep in mind you are at risk of losing your collateral if you fail to repay the loan as agreed.

- Use our online tools. Wells Fargo customers can use the Check my rate tool to get personalized rate and payment estimates with no impact to their credit score. Funds are often available the next business day, if approved

Don’t Miss: What Do Landlords See On Your Credit Report

Schedule Your Free Debt Analysis

Potential clients speak with a certified debt specialist regarding their financial situation.

The debt specialist evaluates the callers financial situation and suggests the optimal debt relief strategy.

Clients choosing to enroll in our debt relief program are then guided through the enrollment process.

How Debt Consolidation Can Harm Your Credit Score

Debt consolidation can do minimal damage to your credit score because every application for a debt consolidation loan generates a credit inquiry. According to FICO, the inventor of the most popular credit scoring models,For most people, one additional credit inquiry will take less than five points off their FICO Scores.

You May Like: What Is The Highest Credit Score Number

Hard Inquiries Ding Your Credit Report

When you apply for a new credit account to consolidate debt, the lender will check your credit, leading to a so-called hard inquiry on your credit report. Each hard inquiry can temporarily lower your credit score by up to five points because lenders look at new credit applications as a sign of risk.

To avoid a big hit, only apply for a loan or balance transfer card you can qualify for. Dont apply for new accounts left and right and cross your fingers for approval. Multiple hard inquiries created by a credit card or personal loan application in a short period of time will definitely hurt. While those inquiries will only impact your credit score for a year, the records will linger on your credit history for two years, which could be a red flag to future lenders.

Why Credit Inquiries Lower Your Credit Score

However, if you apply with multiple lenders for a debt consolidation loan, the effect can be much greater. Because, FICO says, Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.

Read Also: What Is Considered A Low Credit Score

Do Consolidation Loans Hurt Your Credit Score Get The Facts

Estimated read time:6minutes

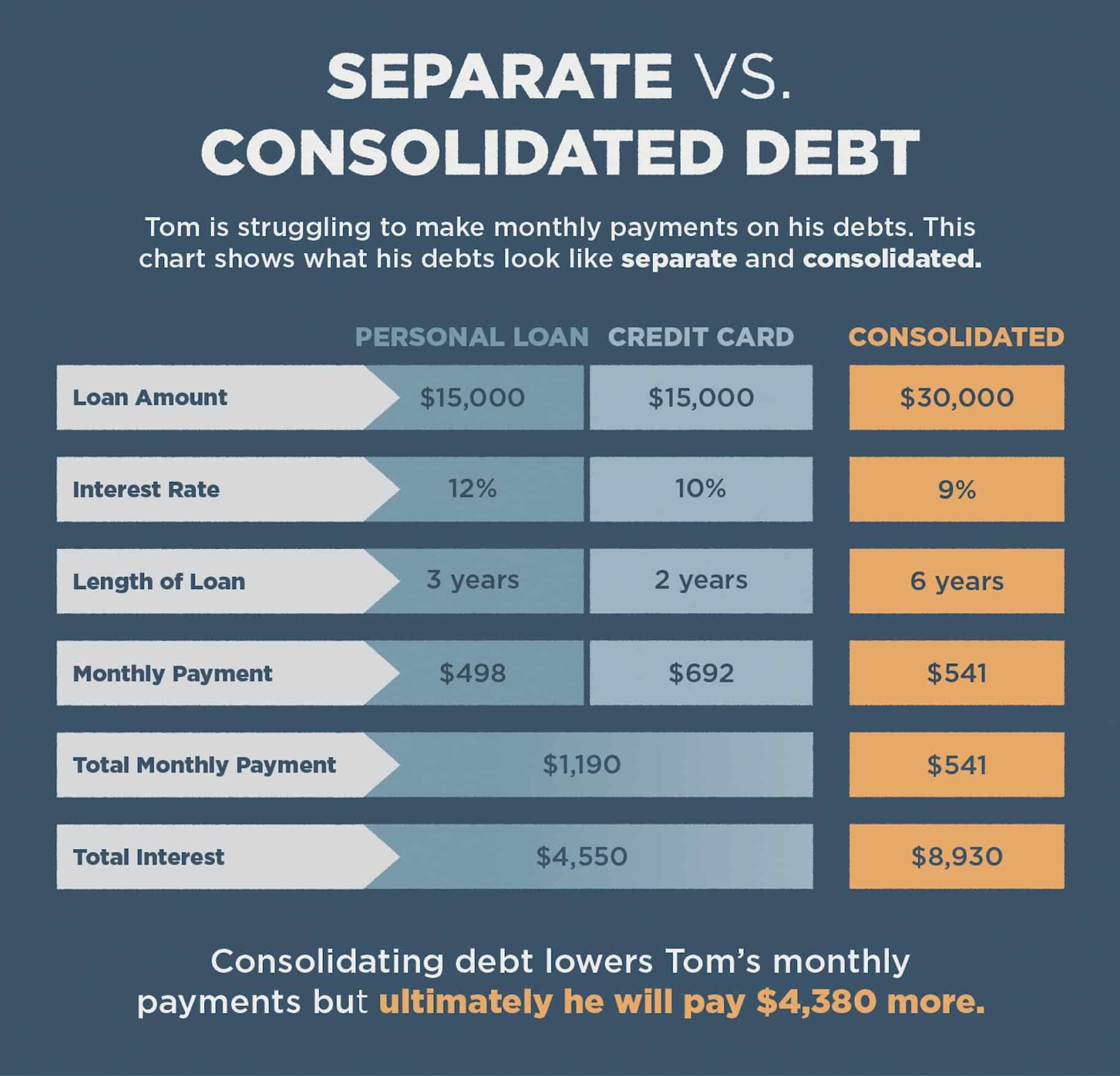

If you’re in debt over your head, it could feel like you’ll never get out. You may have even considered options like debt settlement and bankruptcy. Before you do that, you should think about a debt consolidation loan. In short, debt consolidation loans are those that offer a significant amount of money to consumers at a lower interest rate than your , making it beneficial to refinance debt and change your situation before you approach other less favorable options. Here are the ins and outs of debt consolidation loans and your credit score:

What Is The Debt Settlement Process

One way to handle debt is to contact your creditors directly. Explain your financial situation and try to work out a plan. This may take some time and effort, but it could result in a lower total amount owed, a different interest rate, or other agreements. Continue making payments as usual during this process.

There are pros and cons to using a third-party company or lawyer to help with your debt. On the one hand, you will have to pay for their services either as a flat fee or as a percentage of your savings. On the other hand, this could help you settle your debt for less than what you owe, which would be a good outcome.

Assuming you have decided to go with a debt settlement company, you should know a few things. Most importantly, you will have to stop making payments to your creditors and instead make deposits into a savings account set up by the company.

This money will then be used to either pay off your debt or cover any fees you may owe. However, keep in mind that by doing this, you may fall even further behind on payments, and your credit score could take a significant hit.

You must agree to new terms to settle your debt a lump-sum amount, lower monthly payments, or a complete debt discharge. However, nothing is set in stone, and settlement is only possible once an agreement has been reached. Depending on the settlement method, ongoing payments may be required until the debt is completely paid off.

Read Also: Is 808 A Good Credit Score

Diverse Forms Of Credit

Use a personal loan for your debt consolidation and you could increase the types of debt that you have.

Adding an installment loan to the mix can improve your credit, says Harzog. With debt consolidation, you have a chance to show you can handle different types of credit, not just revolving lines like credit cards.

Taking Out A New Loan Can Temporarily Hurt Your Credit Scores

Of course, there is one potential downside to consolidating your debt: taking out a new loan can cause a small temporary dip in your credit scores. Thats because when you apply for a new loan, the lender will do a hard inquiry on your credit reportwhich will cause your scores to drop a few points. However, this dip is usually only temporary as long as you make all of your payments on time and keep your balance low, your scores should rebound within a few months. In fact, once you consolidate and pay off your debt, you may even see an improvement in your scores over time thanks to that lower credit utilization ratio we talked about earlier.

Also Check: Why Is Mortgage Not On Credit Report

Adhere To A Strict Payment Schedule

Its essential that you carefully evaluate the affordability of a debt consolidation loan or line of credit before opening it and that you make the necessary monthly payments thereafter. Otherwise, youll just wind up missing payments, wasting money on interest, and incurring credit score damage all over again. The only difference will be that youll have wasted a lot of time and debt consolidation may no longer be an option for solving your problems.

The best approach is to use a calculator to determine how much you can afford to allocate toward debt payments each month. This will give you a sense of what type of debt consolidation is feasible as well as whether or not youll have to adjust how much you spend on other things.

How Debt Consolidation Affects Credit Scores

When you consolidate debt, you pull several levers at once that help or harm your credit. Here are some short-term causes of a credit score drop when consolidating debt:

- New credit applications The first possible damage to your credit scores can happen before you even consolidate: When you apply for that personal loan or balance transfer credit card, the lender will perform a hard inquiry on your credit, which will lower your credit scores by a few points.

- New credit account Opening a new credit account, such as a credit card or personal loan, temporarily lowers your credit scores. Lenders look at new credit as a new risk, so your credit scores usually have an additional temporary dip when taking out a new loan.

- Lower average age of credit As your credit accounts get older and show a positive history of on-time payments, your credit scores rise. Opening a new account adds a new newest account and lowers your average account age and may lower your scores for a while.

But it isnt all bad. Here are some positives for your credit scores from a debt consolidation:

Recommended Reading: How To Get A Paid Judgement Off Your Credit Report

How Can Debt Consolidation Help My Credit Score

Depending on how you choose to consolidate, your credit score mayexperience a positive bump. Here’s how consolidating could improveyour score, based on how credit scores are calculated.

- Lower your credit utilization: Credit utilization accounts for 30% of your credit score. The less credit you’re using of your total available credit, the better your credit score will be. Opening a new account increases your available credit while your total debt remains the same. This can increase your score because you’re now using less of your available credit.

- Lead to faster debt payoff: Since less debt means lower credit utilization, paying down your debt faster helps you to increase your credit score faster. Here’s how debt consolidation can help with that: If your total monthly payment goes down as a result of a lower interest rate, you can afford to pay more than the minimum on your consolidated debt each month. If you do this, you’ll pay off your debt more quickly than you would’ve without consolidating.

- Reduce or eliminate late payments: A good payment history accounts for 35% of your credit score. Debt consolidation can help you achieve this goal in two ways. First, the more bills you have to juggle, the more likely you are to let something slip through the cracks. And second, by reducing the total amount you owe every month , you also reduce the chances that you lack the funds to make your monthly payment.

Consolidate Your Debt With A Sofi Personal Loan

If youre ready to say goodbye to high-interest credit cards and to juggling multiple payments each month, a SoFi personal loan may be a good option.

Benefits of our personal loans include:

Fast, easy, and convenient online application process

Low interest rates

No hidden fees

Fixed rate loan

You deserve peace of mind. And by taking out a personal loan to consolidate debt, the stress of juggling multiple credit card payments can be history. Ready for your fresh start?

Learn more about how using a SoFi personal loan to consolidate high-interest credit card debt could help you meet your goals.

Don’t Miss: When Does Bankruptcy Fall Off Credit Report Canada

Debt Consolidation And Credit Scores

Proper management of consolidated debt can boost your credit score. It can improve your payment history, reduce what you owe, and more. If mishandled, consolidation could damage your score. Knowing what goes into your credit score makes this relationship easier to understand.

FICO weighs the following:

- Payment history : Timeliness of payments, history of accounts in collection or bankruptcy

- Amount owed : Your credit utilization rate lower is better

- Age of credit : How long accounts have been open older is better

- Account types diversity is preferred

- New credit applications : Hard credit inquiries, applications for multiple accounts in a short period fewer is better

It Requires A Hard Inquiry Of Your Credit

Any time a lender checks your credit score with a hard inquiry the credit bureau will make note. The lender wants to make sure you arent possibly amassing more credit than you can reasonably handle. After all, just because youre merely shopping around and seeing if you qualify, they dont know if you might actually be using all the credit that you are being offered.

Debt consolidation loans require a hard pull of your credit, which can result in your score dropping as much as 10 points. Thats why its smart to do your research and know more about whether you want to pursue this path prior to having a lender pull your credit. Thankfully, most hard inquiries will only stay on your credit report for two years.

Also Check: Does American Express Give You A Free Credit Report

Monitor Your Spending & Payment Habits

A budget only works if you stick to it. You therefore need to regularly monitor your monthly expenses as well as your ability to pay for them and adjust accordingly. The Island Approach can be a helpful ally in this pursuit. More specifically, now that you have all of your debt consolidated into a single account, you should open a credit card account to use purely for everyday expenses. You should always be able to pay for such purchases in full, so if finance charges show up on this account at the end of a given billing period, youll know that youre overspending.

It Could Cause Hard Inquiries On Your Credit

Every time you formally apply for credit, the creditor makes a hard inquiry, also known as pulling your credit, to check your creditworthiness. Each hard inquiry generally reduces your credit score by a few points. If you are shopping around and applying for debt consolidation loans at multiple banks at once, your credit could take a temporary hit. Fortunately, numerous hard inquiries within a set period, anywhere from 14 to 45 days, are typically combined into one when your credit score is calculated.

Remember that a hard inquiry isnt necessary every time you talk to a lender or visit a website. Its possible to do your research and get prequalified for a loan without having to go through the hard inquiry process. Many lenders will let you shop for rates and prequalify online by doing a soft credit check, or soft pull, that does not affect your credit score. This enables you to take the first steps to see if you qualify for a loan, but without dinging your credit.

Before deciding to move forward with a lender, read the fine print and make sure you understand whether or not you are ready for your credit to get checked with a hard inquiry as part of the loan application process.

Also Check: How Long Before A Debt Is Removed From Credit Report