What Happens When You Pay A Judgement Off

Not for most people. Getting the judgment paid, even for less than the balance owed if that is agreed to, will result in a satisfaction of judgment being filed. Be sure that any pay off agreement, whether in full, or for less than the judgment balance, includes filing the satisfaction with the court.

The Types Of Judgments:

- Unsatisfied Judgments: If a judge orders you to repay and you havent done so, the judgment is unsatisfied. Unsatisfied judgments wreak significant havoc on your credit score!

- Satisfied Judgments: If youve made arrangements to pay off the court-ordered debt or have paid it off already you have a satisfied judgment. This still hurts your credit because you had an account go into the legal system before paying it very costly for the debt collector.

- Vacated Judgments: If youve successfully appealed a judges decision, youll have a vacated judgment which is a great outcome. The credit bureaus will have to remove it from your credit history.

- Renewed Judgments: If you get a judgment vacated and the debt collector decides to sue you again, you may have a renewed judgment on your credit report.

- Default Judgment: If you dont appear in court after being sued, a judge could issue a default judgment that looks bad on your credit. Be sure to answer all court summons to avoid this kind of judgment. You could ask a judge to remove the default after the fact but its a tough sell.

Once again, the NCAP changes have made civil judgments less likely to stick to your credit reports public records section. But if you cant get the negative item removed through invalidation, try to get a satisfaction of the judgment or a vacated judgment.

Public Records Could Plague Your Credit For The Better Part Of A Decade

Even if you repay the money you owe, public records with negative information typically remain on your credit reports for seven to 10 years.

Public records with adverse information may even occasionally wind up on your credit reports by mistake. According to a 2012 study by the Federal Trade Commission, one out of five consumers had an error on at least one of their three credit reports that was corrected by a credit reporting agency after it was disputed.

The good news is, in some cases, you may qualify for relief.

Experian®, Equifax® and TransUnion® have begun removing unverifiable public records from about 12 million credit reports.

The three major consumer credit bureaus recently adopted stronger public record data standards for consumer credit reports, requiring tax liens and civil judgments to include your name, address and either Social Security number or date of birth.

Millions of old public records dont contain all of this information, so the credit bureaus are removing them from consumer credit reports.

Theyre also removing medical collection accounts that have been or are being paid by insurance.

If you spot an error or an unverifiable public record that doesnt belong on your credit report, Credit Karma may be able to help you dispute it. And if all else fails, we can show you ways you can rebuild your credit.

Just remember, youre not alone. Were here to help.

Read Also: Is Experian Credit Score Accurate

What You Can Do To Prevent A Judgment

The easiest way to avoid ending up with a judgment is to pay at least the minimum payment on all your debts, on time, every month. When this isnt possible because youre facing a financial hardship, contact your lenders right away. They may be willing to work out payment arrangements for missed or late payments to help prevent you from becoming delinquent on your loans.

If you establish a payment arrangement, but still are in danger of missing the scheduled payment, be sure to contact the lender beforehand. By being proactive and showing concern to meet your obligations, the lender may work with you to help you get through the hard times.

Also, as an LGFCU member, if you need additional help with managing debt, call or visit your local branch for no-cost financial counseling.

The advice provided is for informational purposes only. Contact a financial advisor for additional guidance.

What To Do If There Is A Court Judgment Against You For A Debt

A court judgment means that the court has decided you owe the debt to the judgment creditor. Depending on where you live, the court might be called either the local court or the magistrates court.

The laws in each state and territory about the debt vary.

If the court has decided you owe the debt, then the judgment creditor has at least 12 years to take further action to recover the debt from you.

If you are getting court notices or demands about a debt you owe, get legal advice immediately. You can get free and independent legal advice from consumer credit community legal services. To find your nearest service, check our page on Legal Advice.

Recommended Reading: How To Improve My Credit Score Fast

What Happens To A Judgement After 10 Years

California state court money judgments automatically expire 10 years after they become final. … If these forms are timely filed and served, the judgment is renewed for another 10 years. It is commonly believed that if a judgment creditor misses the 10 year deadline, the judgment is extinguished and is unenforceable.

How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries | |

| Money owed to or guaranteed by the government | 7 years |

| 7 years or until the state statute of limitations expires, whichever is longer | |

| Unpaid taxes | Indefinitely, or 7 years from the last date paid |

| Unpaid student loans | Indefinitely, or 7 years from the last date paid |

| Chapter 7 bankruptcies | 10 years |

Read Also: Does Paypal Go On Credit Report

Is A Consent Judgement Good

Because of these issues, a consent judgment is rarely the way to go in a collection lawsuit. This is a real judgement that messes up your credit report. For most people, this is a bad choice to make in their collection case. There are very few cases where it’s appropriate to agree to a consent judgment.

Do I Still Have To Pay A Debt That Fell Off My Credit Report

Your debt isnt simply erased once it falls off your credit reports, but your liability for owing it might vary if the debt is past its statute of limitations.

If you never paid off the debt and the creditor is within the statute of limitations, youre still liable for it and . The creditor can call and send letters, sue you or get a court order to garnish your wages.

If you never paid off the debt, but its past its statute of limitations, the debt is now considered time-barred. How you choose to act on a time-barred debt thats fallen off of your credit report is your choice. According to the FTC, you can do one of the following:

- Pay part of the debt

- Pay the total outstanding debt

Regardless of which option youre considering, talk to an attorney about your best path forward before contacting a debt collector.

Depending on the state you live in, debt collectors might be allowed to call you to try to collect on a time-barred debt. However, creditors and debt collectors cant sue you or threaten a lawsuit to collect on a debt thats outside of the statute of limitations.

If youre looking to put your debt behind you and move on with a clean slate, a surefire way is to pay what you owe, or at least an agreed-upon part of what you owe. Before making the phone call, make sure you know:

- That the debt is legally yours

- The date of the last payment on the account

- How much you owe the creditor

- What you can realistically afford to pay per month or in a lump sum

Also Check: How To Fix Missed Payments On Credit Report

When A Judgment Lapses

If a judgment creditor doesn’t renew a judgment on time, then that judgment lapses. A judgment may also lapse if the creditor doesn’t do anything to execute on that judgment for a certain period.

When a judgment lapses , the creditor can no longer legally enforce it. So, a creditor can’t:

- make you appear for a debtor’s examination.

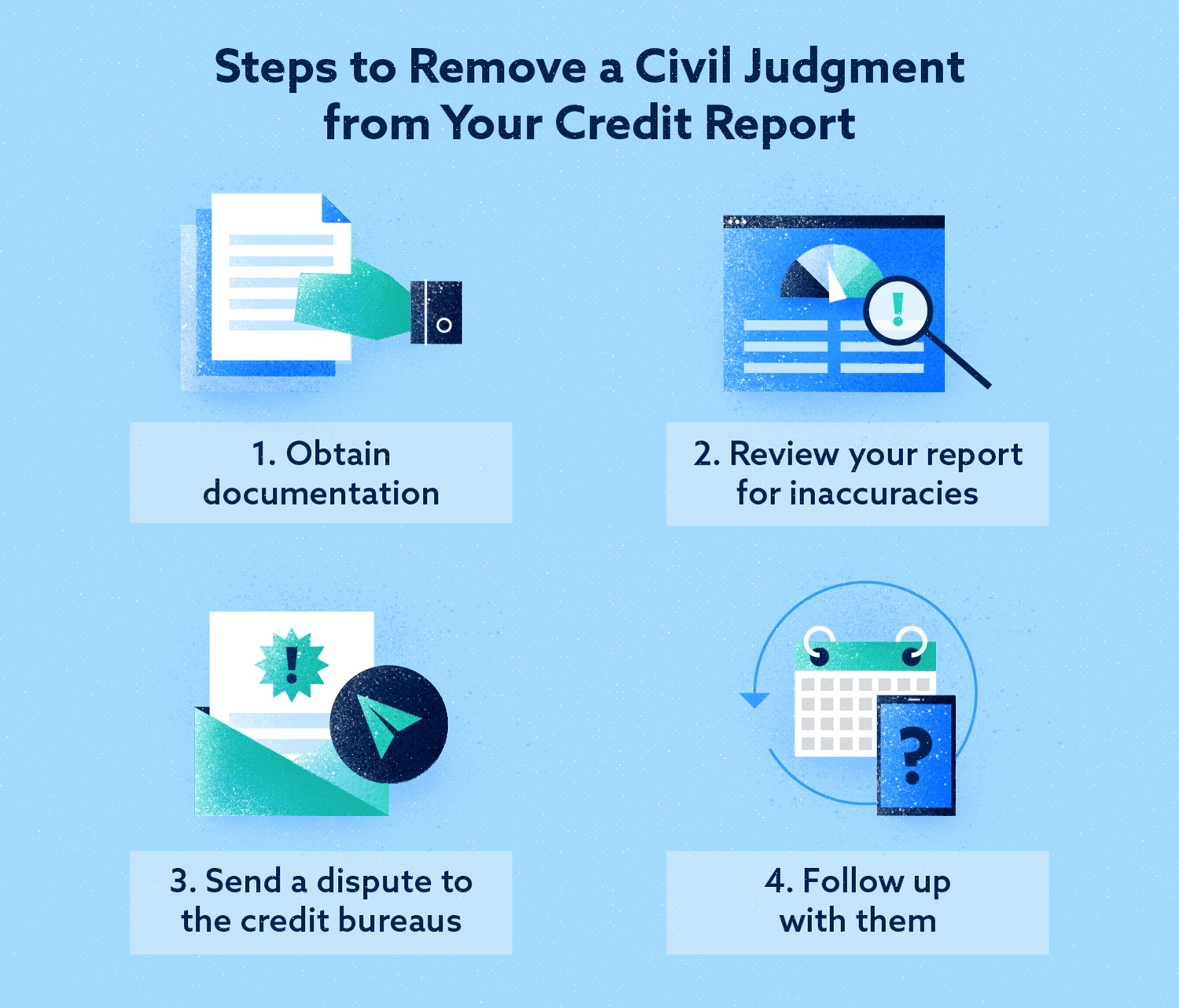

Write To The Credit Bureau

The second step is to provide the letter from the credit provider to the credit reporting agency alongside a request that they remove the judgement from your record. For some credit reporting agencies, just this step alone will be sufficient to remove the court judgement from your credit rating.

Unfortunately, other credit reporting agencies may simply add a notation to your credit report saying that you have repaid the judgement debt. Some future credit providers may be satisfied with seeing that you have repaid the judgement debt. However, for most lenders, even just having a court judgement on your credit report will deter them from providing you with credit.

Also Check: How To Get My Credit Score Up Fast

What If My Credit Report Has A Mistake

Say your credit report still has a ding even after the statute of limitations and credit reporting time limit have passed. In that case, you can dispute the error.

First, figure out which credit bureau you’re dealing with. That’s the company that collects credit information. The main ones are Equifax, Experian, and TransUnion. Once you find the right one, you should be able to start the process online, by mail, or by phone.

With luck, it’ll be set right quickly, and then you can ask that credit bureau to spread the news about the change. They’ll contact any company that saw your credit report in the last six months. Hopefully, you’ll never have to ask, How long does a judgment last? again!

Continue Improving Your Creditworthiness

You might not have to worry about removing judgments from credit reports for the time being. But other negative marks, such as late payments and charge-offs, could be hurting your credit and holding you back.

As you work on improving your credit by making on-time payments and paying off debts, you could hire a credit repair company to review your credit report. Federal law gives you the right to dispute items on your credit report, and if something isnt correct, timely, or verifiable, the credit bureaus must remove that item.

After discussing your specific situation and credit history, a credit repair specialist may be able to spot mistakes that you didnt notice when reviewing your credit report.

Credit Saint has an A rating with the BBB, five-star reviews on comparison sites, and offers a money-back guarantee if you dont see anything deleted from your credit report in the first days. There are also different packages available to consumers based on their budget and needs.

Read Also: Does Opening A Checking Account Affect Credit Score

What Should I Do Next Time If A Debt Collector Sues Me

If you get sued, you will need to pay the debt quickly or appear before a judge in court. The worst thing you can do is ignore the lawsuit. However, thats precisely what most people do, so usually, the creditor wins by default as the defendant doesnt show up for court.

If you dont show up or lose your case in court, a default judgment will be issued against you. Typically, you will be penalized by having a tax lien placed upon your house or having your wages garnished.

In some cases, you may even be forced to forfeit your belongings. These side effects are even more severe than the damage done to your credit score, so you really need to address the lawsuit, get legal help, and show up in court. Otherwise, you have a long, hard road to financial recovery ahead of you.

It never hurts to talk to a legal professional ahead of time to explore your options. But, at the very least, you need to attend your hearing, so you dont automatically give up your rights to a fair trial.

So How Do I Get Rid Of Negative Public Records

Unfortunately, its not that easy.

The three major credit bureaus wont accept certain poorly sourced public records, and theyre proactively removing some tax liens and civil judgments if they cant verify whos responsible for repayment, along with some recent medical debts.

But theres no legal recourse for you to remove other, accurate public records from your credit reports.

If you spot an error on your TransUnion® credit report, Credit Karmas Direct Dispute tool may be able to help you challenge it. Since 2015, weve helped members remove more than $7.9 billion in erroneous debts.

You may also dispute errors on your Experian® and Equifax® credit reports directly through their websites.

Also Check: How To Check Credit Score Discover

What To Do If Youre Already Facing A Lawsuit

If youre already getting sued over a debt, dont ignore the court summonsmake sure to show up. By not appearing, you might lose the case by default .

Your best option is to hire an attorney that specializes in consumer debt. Theyll discuss your rights and options and help you chart the best course of action.

Takeaway: Judgments should no longer appear on your credit report, but they can disqualify you from getting credit anyway.

- Judgments used to stay on credit reports for 7 years or longer, but they havent been included in credit reports since 2017.

- The only public record that can still show up on your credit report is bankruptcy.

- Although judgments wont show up on your credit report, theyre still public records that lenders may see when you apply for a loan.

- You can remove any judgments on your credit report by filing a dispute with the credit bureau that reported it.

- To avoid getting a judgment, contact your creditor or debt collector as soon as possible to negotiate repayment or debt settlement. As a last resort, you can file for bankruptcy.

Article Sources

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

You May Like: How Often Does Discover Report To Credit Bureaus

Why Do Judgments No Longer Appear On Credit Reports

Judgments, which are court rulings that settle a lawsuit, no longer appear on credit reports. This is because of the National Consumer Assistance Plan , which was introduced by the three credit reporting agencies in 2015. 3

This plan was part of a settlement agreement following a lawsuit between the three main credit bureaus and 32 state attorneys general. The plans goal is to improve the accuracy of credit reporting and make it easier for consumers to dispute errors on their credit reports. 4

The NCAP limits how public records can appear on credit reports. Currently, the only public records that still appear on credit reports are bankruptcies. 2 Civil judgments and tax liens never appear.

What Personal Property Can Be Seized In A Judgement

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

Recommended Reading: Do Direct Debits Build Credit Rating

Derogatory Mark: Missed Payments

If you are at least 30 days late, expect a derogatory mark on your credit report. Missed payments typically stay on your credit reports for 7½ years from the date the account was first reported late. The later the payment goes moving to 60 days late, 90 days late and so on the greater the damage to your credit scores.

What to do: Pay your bill as soon as you can afford to. If youve never or rarely been late before, you might be able to get the creditor to drop the late fee. Call the customer service number, explain your oversight and ask if the fee can be removed. You can also write a goodwill letter. If paying the bill is not an option, call your creditor and let them know about your financial situation to see if you can work out a hardship plan.

The negative effect on your credit scores will fade over time. Try to stay on top of all your payments so positive information in your credit reports dilutes the effect of the missed payment.

Dont Miss: Does Requesting A Credit Limit Increase Hurt Score

Reviving Dormant Or Lapsed Judgments

If a judgment against you has lapsed, it probably hasn’t gone away forever. Many states allow creditors to “revive” dormant judgments, perhaps subject to a time limit. State laws vary on how the time period is calculated. The clock might begin to run from the time the creditor last tried to collect on the judgment, or it might run from the time the judgment later went dormant.

Recommended Reading: How To Remove Things From My Credit Report