How Can I Improve My Credit Score

The first thing you should do when trying to improve your credit score is to take a look at your credit report. Annualcreditreport.com is a government-run website that allows all Americans one free annual copy of their credit report from each of the three bureaus: Experian, Equifax, and TransUnion.

Many people with bad or fair credit scores will find things on their credit report that arent supposed to be there. Credit bureaus sometimes make mistakes, and so do those who are reporting to the credit bureaus. Its up to you to keep an eye on your own credit report and make sure that everything is proper.

If you find something on your credit report that seems suspicious, there are things you can do.

If you see something on your credit report that looks like someone took out a loan in your name, or might be some sort of error, report it to the credit bureau. You can file a dispute with the credit bureau that issued the report.

Check to see if something is clearly in error. You may see a loan that looks like its in your name, but it could be connected to someone with the same name. If you see any entry that you dont recognize, then you should file a dispute.

Contact the pros. There are services that will help you navigate the dispute process and put you on the right track to improved credit. The Credit Pros specializes in credit repair for anyone who needs it, regardless of their situation.

Living With A 620 Credit Score

Some individuals dont learn about their FICO scores impact until they apply for a loan. Dont put yourself in that position. Instead, take the time to learn how your score affects both your finances and future life choices. This may seem like a daunting prospect, but the truth is that you have more control over your score than you may think.

With a credit score of 620, your credit applications wont necessarily be rejected. However, getting that loan could cost you more than it would cost someone with a better credit score. Many factors are considered when evaluating a loan application. One of those factors is the kind of loan youre trying to obtain. Being above or below 620 can mean a difference of several percentage points of interest, translating to thousands of dollars.

| % of People16% | Interest Rate30.25% | ImpactApplicants may be forced to pay a deposit or fee, or may not be approved for credit at all. |

| % of People17% | Interest Rate18.85% | ImpactPeople in this number range are generally classified as subprime borrowers. That denotes a less-than-desirable credit standing. |

| % of People21% | Interest Rate14.5% | ImpactThe percentage of borrowers likely to become seriously delinquent in the future is only 8 percent in this range. |

| ImpactApplicants here tend to get better than average interest rates from lenders. | ||

| Interest Rate11.4% | ImpactPeople in this number range gain eligibility to the most favorable interest rates. |

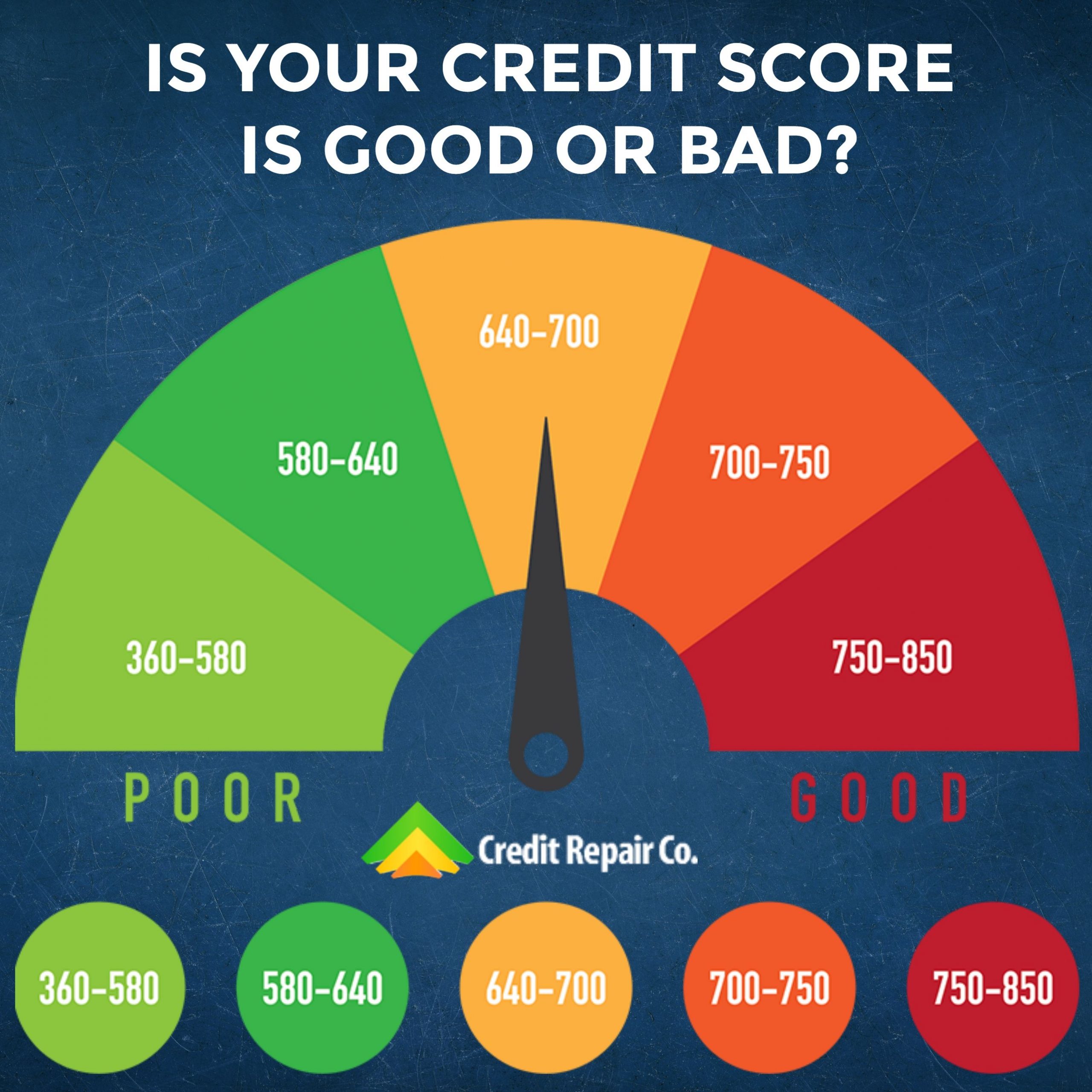

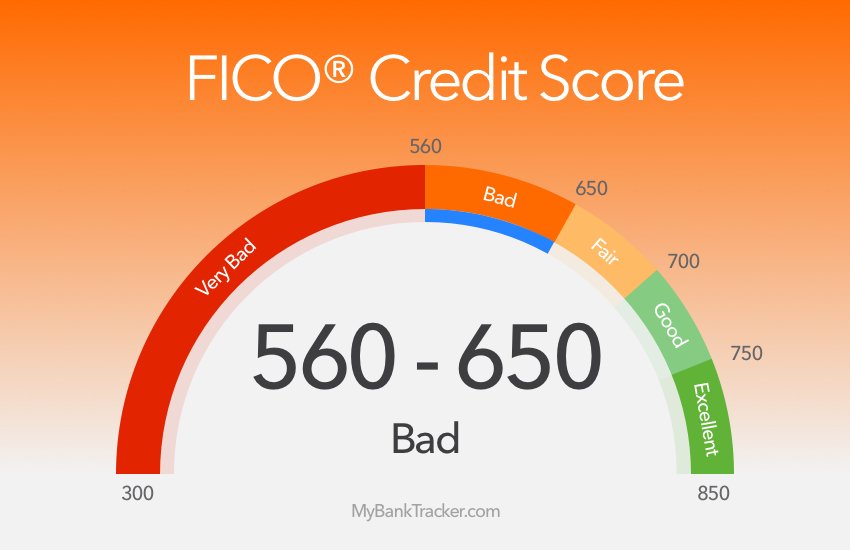

What Is A Bad Fico Score

FICO Score 8the most widely used version of the FICO scoring modelranges from 300 to 850. Borrowers with lower scores represent a higher risk to lenders. According to this model, a score of 669 or below isnt a good credit score. Further, scores between 580 and 669 are considered fair scores less than 580 are considered poor or bad.

In addition to the FICO Score 8 model, some lenders use different FICO scoring models for different types of loans. For example, when you apply for an auto loan, a lender may use your FICO Auto Score. This score ranges from 250 to 900 higher scores represent less risk.

Recommended Reading: Which Credit Score Does Carmax Use

What Is Considered A Bad Or Poor Credit Score

The exact meaning of a bad credit score will vary depending on who you ask, but generally speaking, a score below 580 can be considered bad or poor. People with bad credit have much higher loan costs, and they are often only considered for very risky loans with higher interest rates.

While it can still be possible to improve your credit score, it will take some effort, financial discipline, and a little bit of help.

Will I Be Approved For A Credit Card

You can definitely get approved for a credit card with a credit score of 620. However, you probably wont be able to qualify for credit cards that do not require an initial deposit, and may not qualify for some cards that offer perks such as cash back, airline and hotel points, zero percent interest, and no annual fee.

At the 620 credit score level, youre not eligible for the cards that have perks, points, rewards, and cash-back, but youre also not restricted to secured cards only. Credit issuers have several unsecured cards available that are no-frills lines of credit specifically meant to help users rebuild their credit scores.

There is one important caveat with credit cards: Only apply for credit if you are reasonably certain you will be approved. Every application for credit, regardless of approval status, causes a small drop in your credit score. Applying for credit too often and too frequently can result in a constantly declining score, from which itll take a longer amount of time to recover. Choose your cards carefully.

Recommended Reading: Credit Score To Get Care Credit

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not go over your credit cards or bank accounts limit.

Moving Past A Fair Credit Score

While everyone with a FICO® Score of 600 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 39% of Americans with a FICO® Score of 600 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

You May Like: What Company Is Syncb Ppc

What Does A 600 Credit Score Mean

When we think about credit score, we think of them regarding Good or Bad. In reality, theres only one number you need to remember, and thats 660 or 680.

In that number range, thats where we get in a cut off called prime credit. This is the credit mark where banks will start accepting loans, and youll start seeing lower rates. Anything thats under a prime credit score will be viewed as bad, and youll have limited options.

But just because you have a score of 600 doesnt mean you have bad credit. Its very easy to get a score under prime. Just one loan default or missed payment can get you there. Also, maxing out your credit cards can also hurt your score.

And you might have a low credit score because you dont have a solid credit history. A lot of college students have low-credit because they never had to use a credit card or take out a loan. People who have avoided using credit cards might have a score of 600 or lower.

You also want to avoid credit and debit cards that arent building credit because theyll cause problems in the long term. While its not going to stop you from getting employed, it will be difficult to get a mortgage or an emergency loan. Youll have to be forced to pay higher premiums on your credit insurance.

Why Having Good Credit Is Important

Having good credit can help you in many ways. The most obvious is by helping you qualify for better interest rates on loans.

According to May 2020 data from myFICO, increasing your credit score from a range of 620639 to 760850 could lower your monthly payment by nearly $200. Thats a big deal!

But even if you arent planning to apply for a mortgage or another form of financing, your credit scores can still affect your life. Your credit report information could affect your home and car insurance rates, your eligibility for rental housing, and depending on where you live, it may potentially affect your job applications.

With so many ways that your credit report and scores can influence your life, its important to keep close tabs on both and take quick action when you notice credit file mistakes.

You May Like: Does Square Capital Report To Credit Bureaus

Improve Your Credit Utilization Rate

Your credit utilization rate is a metric that represents how much of your available credit you use, calculated as a percentage. Ideally, the utilization rate should be about 30 percent of your available credit at any given time.

In order to lower your credit utilization rate, a three-prong approach is most effective. First, pay down your balances on as many open accounts as possible. This lowers the amount of credit that you have in use. Second, apply for an increase in your credit limit. This results in a ratio of used credit versus available credit that leans more strongly in your favor. Third, keep unused credit card accounts open instead of closing them, which cuts off a line of credit with an available limit and weakens your credit utilization rate. Experian: How to Improve Your Credit Score

Mortgages Without A Credit History

Mortgage lenders accept borrowers without any credit history in certain circumstances. Some major banks, such as TD and CIBC, offer specialmortgage programs for new immigrantsthat have a limited or no Canadian credit history, or for foreign workers on a work permit. Private mortgage lenders may also accept borrowers without any credit history.

Don’t Miss: Leasingdesk Hard Inquiry

How Many Americans Have A 600 Credit Score

The credit scoring agencies dont release the actual number of people with a certain credit score but they do offer ranges occasionally. Credit scores have been increasing since the 2008 recession but many Americans are still unfairly locked out of the financial system.

One-in-four Americans have a credit score below 600 FICO while about 10% of the population have a score within the 600 to 649 range.

We usually think about credit scores when we need money or are looking at our credit card statements. Your credit score affects the interest rate you get on loans and whether a lender approves you for a new loan but it also means a lot more.

One of the most unfair ways a credit score can affect your life is through your car insurance. Insurance companies are actually allowed to charge bad credit drivers more for insurance, something called credit-based insurance. Drivers with bad credit may pay as much as 20% more in premiums for insurance than good credit borrowers.

You may not be able to get a home mortgage with a 600 credit score and you might even have a hard time renting. Landlords can pull your credit report and FICO score before accepting your application and may deny bad credit borrowers as too risky.

As if all that werent bad enough, potential employers look at your credit as well. That sub-prime credit score may keep you from getting a job in finance or management.

What Negatively Affects My Credit Score

If youre wondering why your credit score appears to be so low, or you dont have a credit score at all, here are several factors that can negatively impact your credit:

- Overdue bill payments

- Identity theft

- Excessive third-party inquiries

Each item has its own level of severity and the power to damage your credit score. Combined, their strength can cripple it.

There is a chance that some errors may be contributing to your low credit score. Your credit score is based off of the information in your , which lists personal information, open credit accounts, bill payments on loans and other financial information thats reported by creditors, lenders or collections agencies.

If you check your credit score and are surprised that its so low, from each of the three credit bureaus and make sure that all your information is accurate. If you find inaccurate information, you can dispute it. If the inaccuracies are removed, it may improve your credit score.

Errors on credit reports are not uncommonover 25 percent of credit reports contain errors. Be sure to check your credit report regularly.

Also Check: Ic Systems Pay For Delete

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Capital One Secured Mastercard

A huge perk of the Capital One Secured Mastercard is that you can find out whether you are pre-approved for it before actually applying. This means that it will not reduce your credit score to see if youre eligible for the programa huge perk for people in your position. It also has a $0 annual fee, and its late payment fees only go up to $40, which is less than many other cards.

You May Like: 686 Fico Score

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Use A Secured Credit Card

When you cant get approved for conventional credit cards thanks to blemishes on your credit report, consider secured credit cards. With a secured card, youll put down a deposit that determines your spending limit, often as low as a few hundred dollars.

The down payment becomes the security for the credit you are being extended. As you use the card and make on-time payments, the issuer reports your positive history to the credit bureaus, which in turn improves your credit score.

Learn about Self’s secured credit card for building credit.

Read Also: Is Credit Wise Score Accurate

Use An App To Boost Your Score

Experian offers a service called that can improve your score by about a dozen or so points. Youll sign up and connect your bank account to get credit for on-time payments for expenses like your phone and electric bills. The best thing about Boost is that youll start seeing an increase immediately to begin improving your credit score one step at a time.

Tips To Improve Your Credit

This is especially important when youre in the fair credit range, for at least two reasons:

- If youre at the bottom of the fair credit range, youll want to move toward the top, and

- Your goal should be to move above the fair credit range.

When rebuilding fair credit, take time to learn the right way to rebuild credit yourselfknow your rights and the signs of a credit repair scam. If its too good to be true, it probably is.

Here are tips to help you do just that.

You May Like: Unlocking Credit Report

What To Expect When Building On Your 600 Credit Score

Like weve said, it shouldnt take long to increase your credit if you have a good grasp of the fundamentals and build your credit only with good habits. Armed with that knowledge, if you see a gradual increase in your credit score, it would be best not to apply with every lender there is. Instead, continue building your credit and making your report emanate trustworthiness. That would be key in getting your big purchases and help you tick off that life goal of yours.

A 600 Credit Score Can Be A Sign Of Past Credit Difficulties Or A Lack Of Credit History Whether Youre Looking For A Personal Loan A Mortgage Or A Credit Card Credit Scores In This Range Can Make It Challenging To Get Approved For Unsecured Credit Which Doesnt Require Collateral Or A Security Deposit

| Percentage of generation with 300639 credit scores |

|---|

| Generation |

| 27.3% |

Poor score range identified based on 2021 Credit Karma data.

Most credit scores range from 300 to 850, and lenders tend to look at scores in the 500 to 600 range as less than ideal. Why does it matter what lenders think? Because they use credit scores to help assess the risk associated with lending money to you.

With a poor credit score, you might have trouble qualifying for credit. Maybe youve already been rejected for a credit card youve had your eye on, or maybe you only seem to qualify for loans with high interest rates and fees.

If thats the case, dont lose hope. Understanding what goes into your credit scores and yes, you have more than one credit score is the key to building your credit. Perhaps youve already heard that your scores are calculated based on information in your credit reports, but what does that really mean?

In this article, well show you how important credit information can influence your credit scores. Credit bureaus like Equifax, Experian and TransUnion collect this information from lenders and financial institutions and use it to build your credit reports. The information in those reports is then run through various credit-scoring models and, voilà, your scores come out on the other end.

Recommended Reading: What Is Syncb/ppc