Cnbc Select Reviews Credit Report Basics And How You Can Get A Free Credit Report So You Can Start Monitoring Your Credit Now

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Monitoring your credit report is a smart and simple way to be proactive about your finances. Checking your credit report regularly can help you spot fraud early and ensure the correct information is reported to the credit bureaus. There are many resources available so you can get a free credit report as often as once a month.

Below, CNBC Select reviews credit report basics and different ways you can get a free credit report, so you can start monitoring your credit now.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

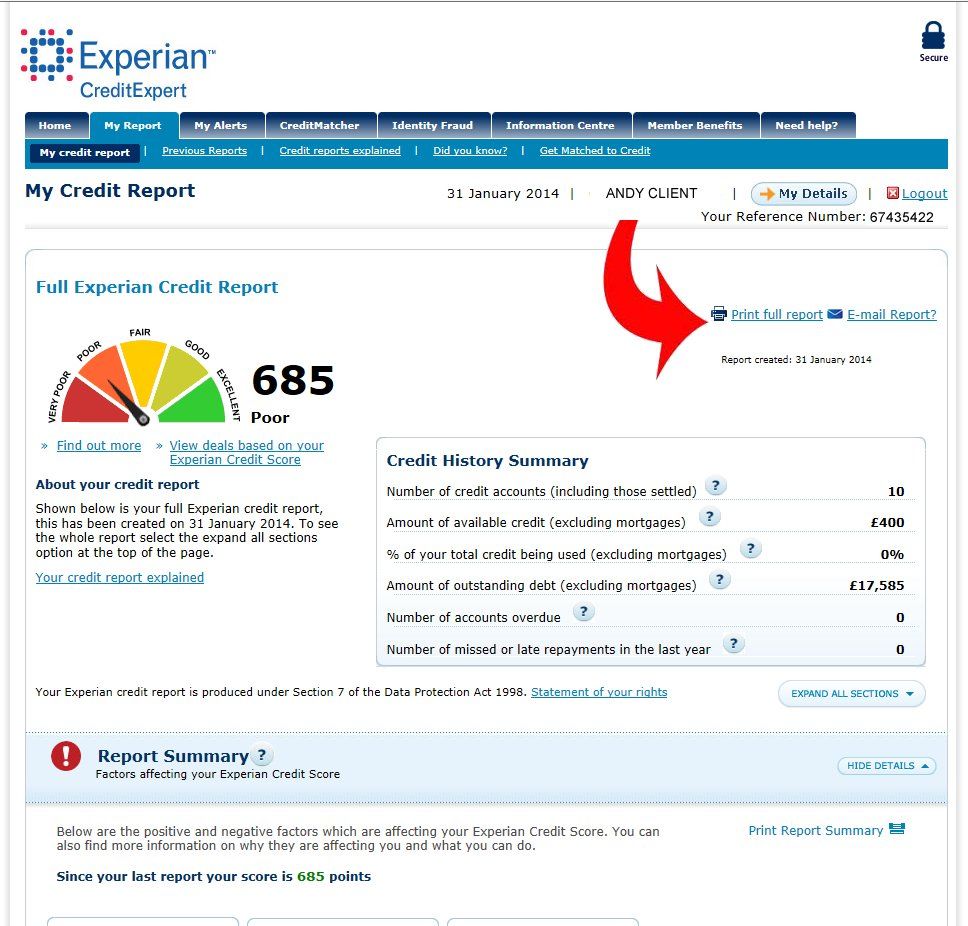

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

Also Check: Care Credit Score Needed 2021

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Also Check: How Long Does A Voluntary Repossession Stay On Your Credit

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

If I Qualify What Steps Do I Need To Take

Changes to the loan forgiveness program will take place in two parts.

The agency will first loosen some of the rules that had prevented eligible borrowers from discharging their loans, via a limited waiver. The government, for example, will allow payments on any of a person’s loans to count toward the total number required for forgiveness.

The Public Service Loan Forgiveness waiver will be available to borrowers who have direct loans, Federal Family Education Loans and Perkins Loans.

Parent PLUS loans are not eligible under the limited waiver.

The department said it would automatically credit borrowers who already have direct loans and have proved they work in an eligible field. Others who haven’t enrolled in the program or have ineligible federal loans will have to apply for forgiveness, which may require them to consolidate their loans. Borrowers will have until October 2022 to apply.

To find out more about loan consolidation, visit StudentAid.gov/Manage-Loans/Consolidation.

The Education Department also plans to review all Public Service Loan Forgiveness applications that had been denied and to give federal employees automatic credit toward forgiveness.

Other changes will come about more slowly via regulations made by “rule-making,” a lengthy and complicated bureaucratic back-and-forth between the government and other stakeholders.

For more information, visit StudentAid.gov/PSLFWaiver.

Also Check: Aargon Agency Payment

How To Order Your Free Annual Credit Reports

The three major credit reporting companies have set up a toll-free telephone number, a mailing address, and a central website to fill orders for the free annual credit report you are entitled to under law. These are the only ways to get free credit reports without any strings attached. If you order your report by phone or mail, it will be mailed to you within 15 days if you order it online, you should be able to access it immediately. It may take longer to receive your report if the credit reporting company needs more information to verify your identity.

Do not attempt to order free credit reports directly from the credit reporting agencies. Free credit reports advertised by other sources are not really free!

To order:

- – Call 877-322-8228 .

- – Complete the Annual Credit Report Request Form available online, the only truly free credit report website, and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- *Onlineat annualcreditreport.com.

What Is The Fair Credit Reporting Act Or Fcra

The Fair Credit Reporting Act is an important law that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you have the right to dispute incomplete or inaccurate information on your credit reports. In most cases, the credit bureau must investigate your case and correct or remove any inaccuracies within 30 days.

Don’t Miss: Can You Get An Eviction Removed From Your Credit

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

You May Like: Ollo Optimum Mastercard

Save Irs Letters About Stimulus Ctc

Along those lines, the IRS is sending letters this month to taxpayers who received the third federal stimulus check in 2021, as well as the advanced Child Tax Credit payments.

These letters will inform each taxpayer what they received through these programs in 2021 they are important documents to hold onto because you’ll want to refer to those amounts when filling out your tax return.

A major reason tax returns were delayed in 2021 was because taxpayers made mistakes in reporting their 2020 stimulus payment amounts on their returns, resulting in their tax filings getting flagged for manual review.

“Don’t have any problems that are caused from your own negligence,” Everson advised.

The IRS will send two letters:

- Letter 6419 informing taxpayers of their advance CTC payments. The agency began sending these letters in December and will continue to do so in January.

- Letter 6475 about the third stimulus check. That letter will be sent in late January.

Keep both of these letters and refer to them when you complete your tax return, tax experts said.

Free Credit Score Reviews

You can access a free copy of your credit report from AnnualCreditReport.com each year. If you want to monitor your FICO score specifically, you also have the option to pay for updates from MyFICO.com. Several companies also offer “free credit scores” to consumers who sign up for their services.

Services that provide free credit scores use information from your credit report to estimate your creditworthiness. While these estimated credit scores usually are fairly indicative of your actual credit health, they are for informational purposes only. In addition to a free credit score, many of these services also provide daily credit monitoring, including email updates. The following websites offer free credit scores and a slew of additional perks:

You May Like: Aargon Agency Debt Collector

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day timeframe if your tax return involves either of those tax credits.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

With reporting by the Associated Press.

How Often Should I Check My Credit Report

Its generally recommended that you check your credit reports a minimum of one time a year, but you can check them as often as you like. Before you apply for credit, it can be a good idea to review your reports for errors to increase your chances of securing more favorable terms, such as lower interest rates.

Recommended Reading: Serious Delinquency On Credit Report

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Don’t Miss: When Does Usaa Report To The Credit Bureaus

How To Check All Three In One Go

CheckMyFile gives you a 30-day trial to see your Experian, TransUnion and Equifax reports in one place. After that, it’s £14.99 a month. It’s really only for those who want the monitoring, as a combination of Clearscore, Credit Karma and Experian will provide monthly snapshots of these three agencies for free.

To cancel, either call 0800 086 9360 or log into your account, then click through ‘Expert Help’, ‘I need help with my account’ and then ‘I’d like to stop my subscription’.

Tip Email

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

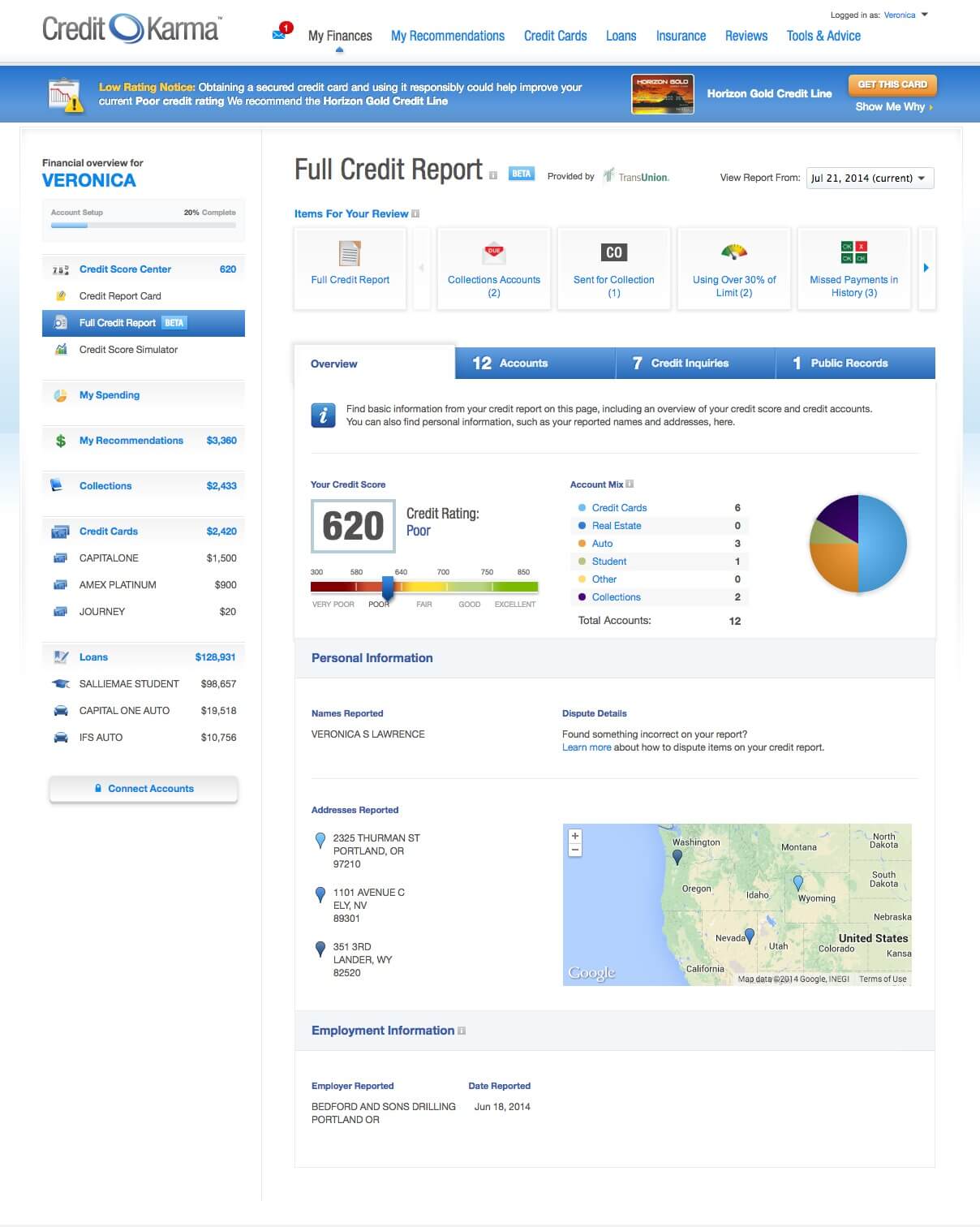

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Don’t Miss: How To Get Public Records Off Your Credit Report

What Is The Difference Between Your Credit Report And The Credit Report Card

The Credit Report Card is a product offered by Credit.com. It provides information about your credit report and breaks it down into five areas that most impact your score so you can see how youre doing with each. You can get your full credit reports from AnnualCreditReport.com for free or with a paid subscription through ExtraCredit.

What To Do About Inaccurate Information

- Clearly identify the inaccurate information on your credit report and dispute it, in writing, to both the credit reporting agency that issued the report with inaccurate information and any creditors associated with the information.

- For more information, review the FTCs online Disputing Errors on Credit Reports article.

- If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and future reports. If inaccurate information is not removed or reappears, you may wish to consult with a private attorney regarding possible legal actions.

Here is contact information for the three credit reporting agencies and links to their web pages informing consumers how to dispute inaccurate information:

You May Like: Check My Credit Score With Itin Number

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

Eric Clapton Sues Woman For Selling Bootleg Concert Cd On Ebay

Despite making headlines, others in the music community have alienated him, Clapton said. I would try to reach out to fellow musicians and sometimes I just dont hear from them, he said. My phone doesnt ring very often. I dont get that many texts and emails anymore.

Meanwhile, Clapton has been known to throw his support behind other anti-vax activists, including donating more than $1,300 to a British rock group who were slapped with fines for breaching COVID-19 protocol during a show in 2021.

Aside from his work with the Brown Eyed Girl singer, Clapton also released the song This Has Gotta Stop last year, with a similar message: I cant take this BS any longer / Its gone far enough / You want to claim my soul / youll have to come and break down this door.

Read Also: How To Get A Repossession Off My Credit

Can I Buy A Copy Of My Report

Yes, if you dont qualify for a free report, a credit bureau may charge you a reasonable amount for a copy of your report. But before you buy, always check to see if you can get a copy for free from AnnualCreditReport.com.

To buy a copy of your report, contact the national credit bureaus:

Federal law says who can get your credit report. If youre applying for a loan, credit card, insurance, car lease, or an apartment, those businesses can order a copy of your report, which helps in making credit decisions. A current or prospective employer can get a copy of your credit report but only if you agree to it in writing.