Earning A Good Credit Score

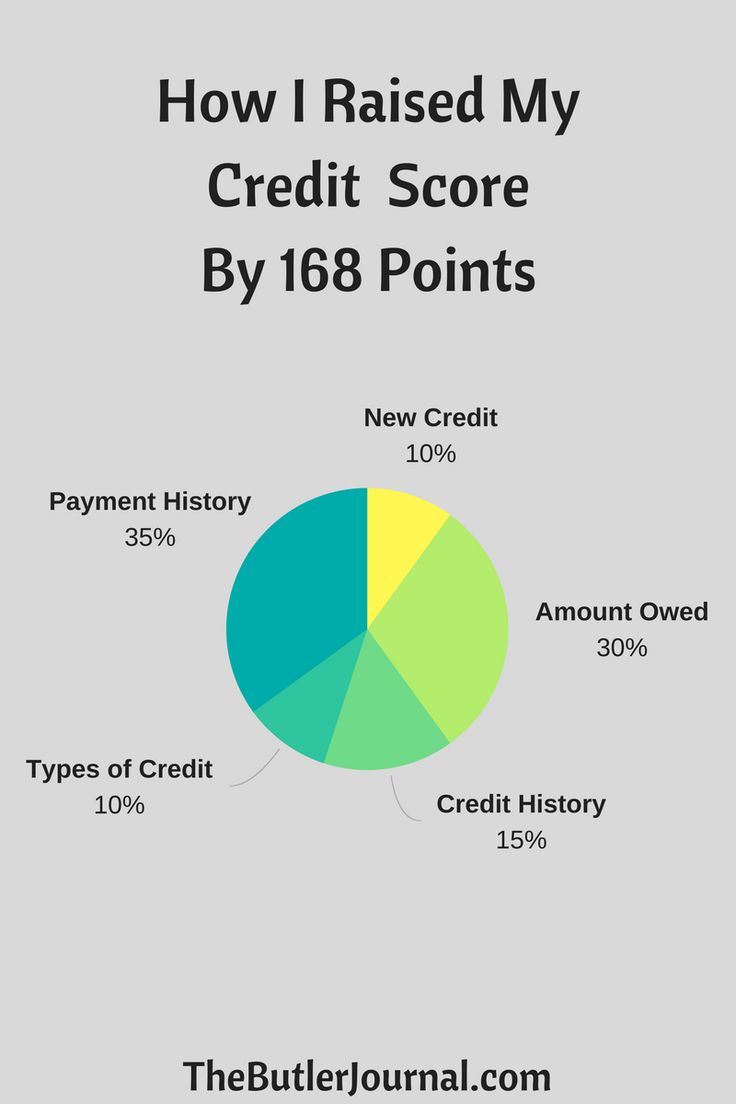

Unfortunately, we don’t start with a clean slate as far as credit scores are concerned. Individuals have to earn their good numbers, and it takes time. Even when all other factors remain the same, a person who is younger will likely have a lower credit score than an older person. That’s because the length of accounts for 15% of the credit score.

Young people can be at a disadvantage simply because they do not have the depth or length of credit history as older consumers.

How To Get Good Credit At A Young Age

This article was co-authored by Derick Vogel. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act competency.There are 9 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status. This article has been viewed 494,459 times.

Having good credit can open the door to many financial possibilities, such as purchasing a home or car at a low-interest rate or receiving a larger bank loan. These benefits are great in building personal wealth and becoming financially independent. For this reason, it would be smart to follow certain steps to get good credit at a young age. Doing so will teach you how to be financially responsible and afford you more time to establish a high credit rating.

How To Improve Your Credit Score

While its not an exact science, there are a few things that can definitely help to improve your credit score.

1. Keep an eye on your credit report

According to FICO, which produces one of the most widely used credit scores, the first thing you should do if youre aiming to improve your credit score is to know exactly whats in your credit report.

This will let you quickly see if theres anything that shouldnt be on there, like mistakes or fraud, which can have a massive effect on bringing your credit score down.

Knowing whats on your credit report is one of the most important things you can do for setting up your financial future.So click here to get your credit report for free!

You May Like: What Credit Score Do You Need For Paypal Credit

Does My Age Affect My Personal Credit Score

The short answer is no. Your date of birth doesnt necessarily impact your personal credit scorebut the age of your credit profile does.

What it means is the age of your credit report. Yes, your credit report has an age just like anything else, writes Gerri Detweiler for Credit.com. And that age has a positive or negative value in your credit scores. This value equates to 15% of the points that make up your overall credit scores. The question now becomes how the credit scoring models determine the age of your credit file and how the age impacts your credit score.

In a nutshell, how many years you have under your belt isnt as important as how many years your credit history doesat least so far as your personal credit score is concerned.

Having a 10- or 20-year-old credit account is good for your personal credit scoreprovided the account is current. This is another area without a quick fix if your goal is to build or improve your score. Detweiler recommends three common-sense pieces of advice to ensure you get the best score available in this category:

1. Get started and be patient: We all started in the same spot, with no credit and no credit report, she says. If you are a young consumer or have chosen not to ever use credit than its time to get started. Theres no substitute for time.

Teach Teens How To Use Credit Wisely

Teach your teens how to manage money before they get a credit card. This may help them avoid future problems with credit cards.

Start teaching children how to manage money at an early age. It will help prepare them to make good financial decisions and avoid debt problems when using credit later on in life.

Show your teens how you use credit wisely, for example, by paying your bill in full each month. If you had credit card debt in the past, make sure your teens understand what happened and how hard it was to pay it down.

If your teens see you using credit wisely, they may be more likely to follow your example.

Also Check: How To Get Credit Report With Itin Number

Great Credit At Any Age

None of this means you cant have an excellent credit score as a young adult. If youre handling your credit obligations well, your credit score will reflect that. Being an authorized user on an older account with a positive payment history can boost your credit score when youre young.

Similarly, not every older adult has an excellent credit score. Serious credit mistakes, like repossession and foreclosure, can seriously damage your credit score at any age.

Considering The Number Of Accounts You Have Open:

Apparently, having multiple and varied accounts is beneficial to your credit score. Experts suggest you shouldnt close older accounts, saying 15% of your credit score hinges on the length of your credit history. Once you see your credit report, it might be tempting to close those old, unused accounts, but that can actually hurt your score. You want to keep them open and show as much of your credit history as possible.

If your credit score doesnt reflect what the average 30-something has, its time to take action. But remember, its never too late to start making positive changes that will affect you for years to come.;That one brief interaction between my two friends reminded me of the real value in having a financial buddy in your inner circle. It reminded me that when we are there for one another, when we build communities of;real;support, and when we encourage our friends and keep each other in check, we can get shit done in a BIG;way. We can do the things that might have once seemed;impossible to our past selves, and we can do it with a little help from our Financially Savvy FriendsTM.

Recommended Reading: What Credit Score Does Carmax Use

Average Credit Score In America: 2021 Report

By:;Christy Bieber | April 20, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Amidst bad economic news in 2020, there was a bright spot. Consumer credit scores increased by leaps and bounds thanks to a reduction in late payments and an aggressive effort to reduce credit card debt.

With reduced consumer spending, thousands of dollars in government stimulus funds, and smart tactics like loan consolidation and balance transfer cards, many people got a better handle on their debt.

But there may be change afoot for credit scores, too — President Joe Biden has expressed interest in a public credit reporting agency that would take the place of credit bureaus like Experian, TransUnion, and Equifax. That would cause a huge shift in how we keep track of creditworthiness.

Until that happens, though, we’ll continue to use systems like the FICO® Score. Let’s take a look at how the average American’s credit looks in 2021.

Length Of Credit History Vs Credit Age

The “length of credit history” means how long any given account has been reported open, says Rod Griffin, director of public education for Experian, one of the three major credit bureaus.

Generally, the longer an account has been open and active, the better it is for the credit score,” Griffin says. “Thats particularly true for an account with a positive payment history that has no delinquency.

The credit scoring algorithms calculate;the average of how long all your accounts have been open. That average age of accounts is your credit age.

Its all but impossible to get a score higher than 800 if youre young, because your credit age likely will be less than that of a person;who has had credit for years.

Read Also: How To Remove Items From Your Credit Report Yourself

Keeping Hard Inquiries To A Minimum:

What is a hard inquiry you ask? MyFico.com says, Hard inquiries are inquiries where a potential lender is reviewing your credit;because youve applied for credit with them. These include credit checks when youve applied for an auto loan, mortgage or credit card. Asking for too many of these hard credit checks will reduce your credit score a few points at a time, more specifically one additional credit inquiry will take less than five points off a FICO Scores. To lenders, hard inquires typically signal youre taking on some kind of additional financial obligation, which might affect your ability to pay back other debts.

What Is The Difference Between Cibil Equifax Experian & High Mark

These are four credit information companies that function under the RBIs approval.They have various similarities and differences that are listed below.

1. CIBIL

-

It is the oldest and most popular in India today and also offers market insights and portfolio reviews for businesses apart CIBIL score and reports for individuals.

-

Its scoring system ranges from 300 to 900, with 900 being the highest and 300 being the minimum CIBIL score.

-

It offers businesses a Company Credit Report and a CIBIL Rank.

2. Equifax

-

It was granted its license in 2010.

-

Its scoring system is on a scale of 1 to 999, with 1 being the lowest and 999 being the highest score.

-

It also offers additional facilities like credit risk and fraud management, portfolio management and industry diagnostics.

3. Experian

-

It received its license for operation in India in 2010, but is an international company in existence since 2006.

-

The Experian score ranges from 300 to 900 with 300 being the lowest and 900 being the highest.

-

It offers several services for consumers and organisations like customer acquisition, collection and money recovery, customer management, data analytics, customer targeting and engagement.

4. High Mark

You can choose any one from these companies to calculate your credit score and so can lenders and other parties.

Recommended Reading: What Is A Good Credit Score Number

Average Credit Score By City

The city with the highest average credit score is Honolulu, which has an average score of 716. Some of the cities with the lowest average credit scores are Newark, NJ and Detroit . Below, you can find your citys average credit score and see how it compares statewide and nationally.

| 590 |

You dont need a lot of money to build a good or excellent credit score. Anyone can do it, as long as they spend within their means and always pay their bills on time. But its still interesting to see how the average credit score changes by income level.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Don’t Miss: How To Get My Own Credit Report

What Is The Average Credit Score In America

Bianca Peter, Research AnalystMay 6, 2020

The average credit score in the U.S. is 680 based on the VantageScore model and 703 based on the FICO score model. That means the average American has a fair-to-good credit score.

Below, you can learn more about the average credit scores by year, state, age and more. Reviewing these credit score statistics will give you a better sense of how good your credit score is relative to those of your peers. Credit-score averages can also tell us a lot about the health of consumers finances and the strength of the economy.

Finally, its important to note that while many different types of credit scores exist, the most popular ones all use the standard 300 to 850 credit-score range. Theyre also based on the same information your credit reports and produce very similar results in most cases, according to the Consumer Financial Protection Bureau. So, it doesnt really matter whether an average credit score is based on a VantageScore or FICO model, as long the data is consistent. After all, there isnt one real credit score.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.;

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

You May Like: Why Did My Credit Score Drop 20 Points

Why Is Good Credit Important

Having a good credit score is very important for many reasons. It allows you to be approved for loans including mortgages and business loans, and additionally if you are a renter many landlords look for a good credit score in order to lease their properties to reliable tenants. In addition, you will be able to get access to the best credit cards and interest rates if you have a good credit score.

Average Fico Score Remains In Good Score Range

FICO® Scores, which range from 300 to 850, are the credit scoring model most commonly used by lenders for evaluating a borrower’s creditworthiness. A FICO® Score of 711 is considered “good” by most lending standards. Approximately 21% of Americans had a FICO® Score that fell in the “good” in 2020.

Here are the FICO® Score ranges:

- 800-850: Exceptional

- 300-579: Very poor

Recommended Reading: Does Bluebird Report To Credit Bureaus

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Average Credit Score In The United States: 711

The average FICO® Score among American consumers is 711, according to myFICO. This is classified as a “good” score.

This is an increase of five points from 2019’s average score of 706. It continues a multi-year trend, as the average FICO score increased in nine of 10 previous years.

However, while most recent increases were one or two points annually, this year’s increase is the largest in a decade.

Also Check: How Long For Things To Fall Off Credit Report

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

How To Earn Better Credit Scores

A FICO Score of 711 is considered a good credit score by most lenders. So, if you have a credit score thatâs close to the national average, youâll probably be able to qualify for many types of financing. However, you shouldnât expect to receive a lenderâs best offers when it comes to interest rate and borrowing terms.

Of course, for certain types of financing, lenders and credit card issuers may require an exceptional credit score range. You could have trouble qualifying for such accounts if your FICO Score is merely average.

If your credit score is at or below average, it may benefit you to work on improving it. Here are four expert tips that may help you move your credit score in the right direction.

You May Like: Does Debt Consolidation Affect Your Credit Score

Canadian Credit Score Ranges

In Canada, from 300 to 900, with the higher the score the better. Having a healthy credit score can open financial doors and make sure you have access to credit products and loans in the future when you need them.

Its important to keep in mind that while a healthy credit score is important, its never a good idea to become obsessed with having a perfect score. Its very hard to get a perfect score. What you should do is focus on the overall health of your finances and your credit score will reflect that.

Find out how to increase your credit score without increasing your debt.