Common Credit Reporting Errors

When reviewing your reports, some common personal information and account reporting errors include:

- Personal Information reporting errors. Check to see if your name, address, birthdate and Social Security number are correct. If your report contains inaccurate personal information, it could be a sign that your identity has been stolen.

- Accounts that dont belong to you. Its possible that someone with a similar name could have an account accidentally listed on one of your reports. This could also mean that someone has stolen your identity and opened an account in your name.

- Incorrect account status. When reviewing your reports, make sure your account balance, account numbers and credit limits are accurate. Also, double-check that closed accounts arent reported as open.

- Expired debt. Negative remarks, such as collection accounts and late payments, typically remain on your credit reports for up to seven years. In most cases, the negative information automatically falls off of your credit report. If it doesnt, this could mean the time clock on the debt was reset, which may be an error.

- Reinsertion of incorrect information. Incorrect information that was disputed and removed from your credit report in the past can sometimes reappear. This means you will have to redispute the incorrect information with the credit bureaus or the creditor that is providing the information to have it removed again.

How Soon After The Statement Closing Date Do Credit Card Companies Report To Credit Bureaus

A large part of your credit score is based on the information your credit card company reports to credit bureaus. The information credit card companies report helps FICO, a credit scoring company, determine your total credit card utilization and your payment patterns. Credit card companies don’t all report to credit bureaus on a specified date patterns vary among providers.

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

Don’t Miss: When Does Capital One Report To Credit

High Balance On Credit Report

In addition to your last reported credit card balance, your credit report also includes a high balance. This balance is the highest balance ever reported to the credit bureaus for that credit card account.

The high balance remains the same each month unless a higher credit card balance is reported. While some creditors and lenders may include the high balance in a manual evaluation of your creditworthiness, this balance isn’t currently included in your credit score.

How And When Are Credit Card Payments Reported To Bureaus

Commonly, credit card issuers report cardholder activity to the three major credit bureausExperian, TransUnion and Equifaxat the end of every billing cycle. Billing cycles can vary between 28 and 31 days, and reporting schedules vary by lender. Your lenders may also report to each bureau at different times, only report to specific bureaus or not report your payment history at all. This means you could theoretically check your score every week and see a different number each timeespecially if you have multiple credit cards or other forms of debt that are all reported at different times each month.

Because changes to your account aren’t reported immediately, you may check your credit report and think it doesn’t look current. Your credit report may show a different account balance than what you see on your credit card statement, but that’s typically not anything to worry about. Because credit card issuers don’t constantly report your account status, the balance you see there will reflect what it was the last time it was reported to the bureaus.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

When Do Companies Report To Bureaus

Since the credit bureaus update the reports and scores that lenders use update 24 to 48 hours after companies report to them, it could prove helpful to break down when this typically occurs.

Reporting cycles run every thirty days , with some industries holding to month-end for all customers, while others process segments throughout the month for efficiency reasons.

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Recommended Reading: Care Credit Dental Credit Score

Is It Important To Know When Your Issuers Report

Knowing when your creditor report to the credit bureaus could certainly be important in the above scenario. The problem is, you may not be able to pinpoint exactly when your credit card issuer will report. You can call and ask, and you might get an answer, but you also might not. Or the answer you get may change over time. This is why it is important to know where you are on your credit cards at all times so you can avoid these types of issues .

I am not saying you cant use a credit card to make a big-ticket purchase. There are times when it makes perfect sense to do just that, like if you have a cash back credit card. In addition, using a credit card offers strong consumer protections and may offer extended warranties, theft and damage protection and price protection that you dont get if you pay in cash. Credit cards have a place in your financial life and can be a great tool if used wisely.

Really No Credit Check

That’s right 🙂 We want our service to be accessible to everyone and that means no credit score requirement. You use your own money to fund your deposit to open your card and as a result there are no strict credit requirements. Please note there will be a credit check as part of the card’s underwriting process. You may not be approved for the card if you have an active bankruptcy in the courts. In very rare situations the issuing Bank may request a copy of your Drivers License to verify your identity.

Don’t Miss: Which Credit Score Does Carmax Use

What You Can Do

If youre concerned about your credit utilization in relation to credit reporting, you might consider asking your credit card issuer for a higher credit limit. Having more credit available and not using as much may help boost your credit. Just be sure to do your research first. And keep in mind that having more available credit could actually hurt your scores if it tempts you to rack up more debt.

Additionally, you can make multiple payments throughout the month to lower your overall balance. That way, when the balance is reported to the bureaus, your credit utilization is in good shape.

If you want to get a better handle on your credit, you can always check your credit reports from Equifax and TransUnion on and dispute any errors you see.

Why Isnt The Account Showing Up

Issuer and credit bureau policies can give you a good basic understanding about why a tradeline may or may not be included on your authorized users credit reports. But aside from the exceptions laid out in these policies, here are a few other reasons an account might be MIA:

Your issuer doesnt report any authorized user activity. While its common for issuers to report authorized user accounts, its not mandatory. In some cases, although rare, lenders may choose not to report authorized user accounts, says Rod Griffin, the director of consumer education and awareness at Experian, in an email.

You left out required information when creating the account. Under the National Consumer Assistance Plan, an initiative launched by the three major credit bureaus, lenders reporting to credit bureaus must report certain information about authorized users, including their date of birth. While you might be able to add someone to your account without providing this information initially, it wont be reported to credit bureaus unless you include this information. For example, AmEx notes that you can add an additional cardholder without providing their date of birth or Social Security number, but if that information isnt added within 60 days, the additional card would be closed.

About the author:Claire Tsosie is an assistant assigning editor for NerdWallet. Her work has been featured by Forbes, USA Today and The Associated Press. Read more

Read Also: What Is Cbcinnovis On My Credit Report

You May Like: Aargon Agency Settlement

Best Credit Monitoring Apps In 2021

When looking for a credit monitoring service thats right for you, McCreary recommended comparing the services and benefits each service offers, while Saavedra noted that signing up for a free trial or even using a free version before investing in a paid subscription is worth considering to experience the offering first-hand and determine what information is most useful to you.

Pros And Cons Of Business Credit Cards That Do Report Activity

Which way is better? It depends on your situation. As long as you pay your business card on time and avoid high balances, having a business card that appears on your personal credit reports with Equifax, Experian and TransUnion should not be a problem, and may even help your credit scores.

But if you charge everything you can on your card to rack up rewards, for example, then your personal credit could suffer. Why? Credit scoring models take into account your debt usage or utilization ratio, which compares the balances reported against available credit limits, often for each card as well as all credit cards totalled together. A high balance on a business card that appears on an individuals personal credit can mean a high debt usage ratio which can lower credit scores.

On the other hand, if your personal credit history is a bit thin, a business card that reports your full account activity may help. For example, if you avoid credit cards and use a debit card, then you may have a thin credit profile that could benefit from the boost another card can help provide.

Choosing a business credit card that does not report to personal credit may be helpful if you know there will be times you need to run up charges that put you close to the limit or carry a balance think holiday inventory, or that big tradeshow, for example and you dont want that activity to bring down your scores.

Following are the policies of the major business credit card issuers at a glance:

Read Also: Why Is There Aargon Agency On My Credit Report

How To Remove An Authorized User From Any Chase Card

You have two options if you want to remove an authorized user from one of your Chase cards:

. You can call Chase by dialing the number on the back of your Chase credit card. You can also call: 1-800-432-3117.Send a secured message. Login to your Chase account and select Secure messages from the side bar . You can use this form to request an authorized user removal.

Whether You Have Recent Missed Payments Or Defaults On Your Report

Missed payments can stay on your credit report for seven years and bankruptcies for 10. You will more than likely need to re-establish a history of making payments on time, as well as reducing your principle debt every month, by paying more than the minimum payment due. Although missed payments stay on your report for seven years, their impact fades over time. All may not be lost if you’ve missed your payment by a few days. If the missed payment is an exception rather than the rule, then pay the bill as soon as you can and ask the lender if they could refrain from reporting the late payment to the bureaus this one time. There’s no guarantee this will work, but it mightyou could set up automatic payments in return, as a goodwill gesture. Just be sure that you catch that missed payment as soon as possible, because its impact on your credit score will get worse with every day it’s in default.

Read Also: Does Capital One Report Authorized Users To Credit Bureaus

Popular Chase Credit Cards For Authorized Users

Below are some popular Chase credit cards to add authorized users. Adding an authorized user to these cards can allow you to earn rewards on the authorized users spending, build the authorized users credit score or get card benefits for the authorized user.

Great for earning rewards with an authorized user

Chase Freedom Unlimited®

What To Do If You Get Rejected

If Chase rejects you for a credit card, dont give up. for 10 to 15 different credit cards over the years. And, while it hurts, you need to learn to fight for yourself. If you receive a rejection letter, the first thing you should do is look at the reasons given for your rejection. By law, card issuers must send you a written or electronic communication explaining what factors prevented you from being approved.

Once youve figured out why Chase rejected you, you can . Tell the person on the phone that you recently applied for a Chase credit card, were surprised to see Chase rejected your application and would like to speak to someone about getting that decision reconsidered. From there, its up to you to build a case and convince the agent why Chase should approve you for the card.

For example, if Chase rejected you for having a short credit history, you can point to your stellar record of on-time payments. Or, if Chase rejected you for missed payments, you can explain that those were a long time ago and your recent record has been perfect.

Theres no guarantee that your call will work, but Ive had about a third of my rejections reversed on reconsideration. So, its worth spending 15 minutes on the phone if it might help you get the card you want.

Related: Why I wont keep my Chase Sapphire Preferred after the first year

You May Like: Does Paypal Credit Report To Credit Bureaus

Discover Identity Theft Protection

For $15 per month, Discovers Identity Theft Protection service offers credit monitoring from all three bureaus, alerts you if a bank account opens in your name, scans thousands of sites on the dark web for your personal information and notifies you of significant credit balance changes greater than $5,000 and credit limit changes greater than $100 reported to Experian. As its name suggests, the service offers identity theft insurance up to $1 million covering legal expenses, stolen funds and lost wages. Child Identity Protection, which monitors fraudulent use of your childs personal information and social security number on the dark web, can include up to 10 children at no additional cost.

What Is An Authorized User

An can use your credit card to make purchases. When you add a user to your Capital One credit card, this user receives their own card in the mail which they can then use to make purchases, both online and in-person.

The charges that authorized users make are added to your credit card bill just like yours. When the bill comes due, though, you are responsible for paying off these charges as the primary cardholder. Its important, then, to reach an agreement with any authorized users before you add them to your account set limits on how much these users can spend each month and a date when users must pay you for the charges theyve made.

Essential reads, delivered weekly

You May Like: Does Opensky Report To Credit Bureaus

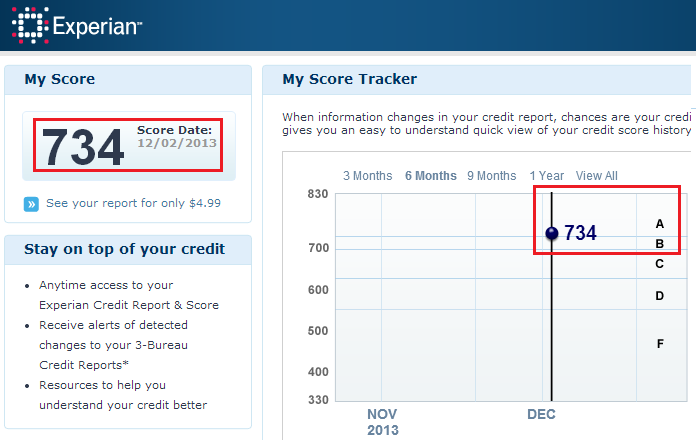

How Often Do Credit Scores And Credit Reports Update

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Working to improve poor credit is largely a waiting game. You may be disappointed at how slowly improvement seems to occur and impatient about seeing results.

To understand how often and why credit scores change, it helps to know how often credit reports, the source of the data that is used to calculate scores, are updated with fresh information.