Length Of Credit History

If you have had credit available to you for a long time, your credit report should provide an accurate picture of how you use credit and if you had one, how you got through a difficult time. For someone who has not used credit for very long time, it is difficult to tell if they really know how to use credit responsibly.

Good or bad, most information will be automatically removed from someones credit report after 6 7 years, so the only way to keep a credit report active, is to use credit, at least very minimally, on an ongoing basis.

Time is needed to get a true picture of how responsible someone is with credit. This is why the length of your credit history is the third most important factor in your credit score calculation.

Your score will reflect how long it has been since you first obtained credit, how long each item on your credit report has been reporting and whether or not you are actively using credit right now.

If you have recently obtained credit for the first time, your credit score will not be very strong. However, if you have been using credit responsibly for many years, this factor can work in your favour.

If you have been involved in a bankruptcy, consumer proposal, orderly payment of debt or debt management program, your credit history will essentially restart whenever you complete your program.

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

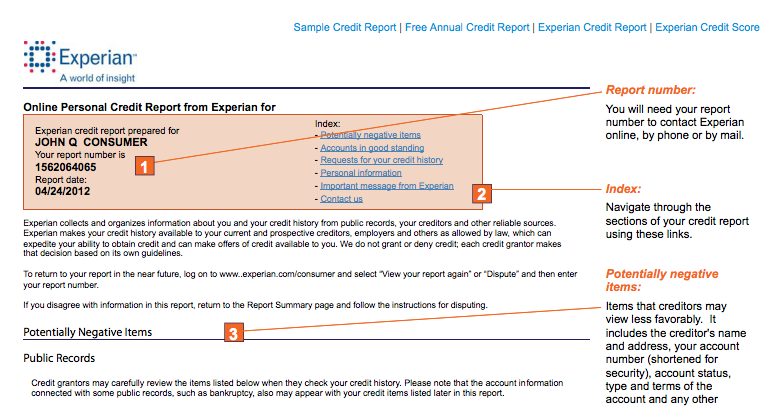

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail see “How to Dispute Credit Report Information” for more details.

Moving Past A Fair Credit Score

While everyone with a FICO® Score of 600 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 39% of Americans with a FICO® Score of 600 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Recommended Reading: Is 524 A Good Credit Score

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

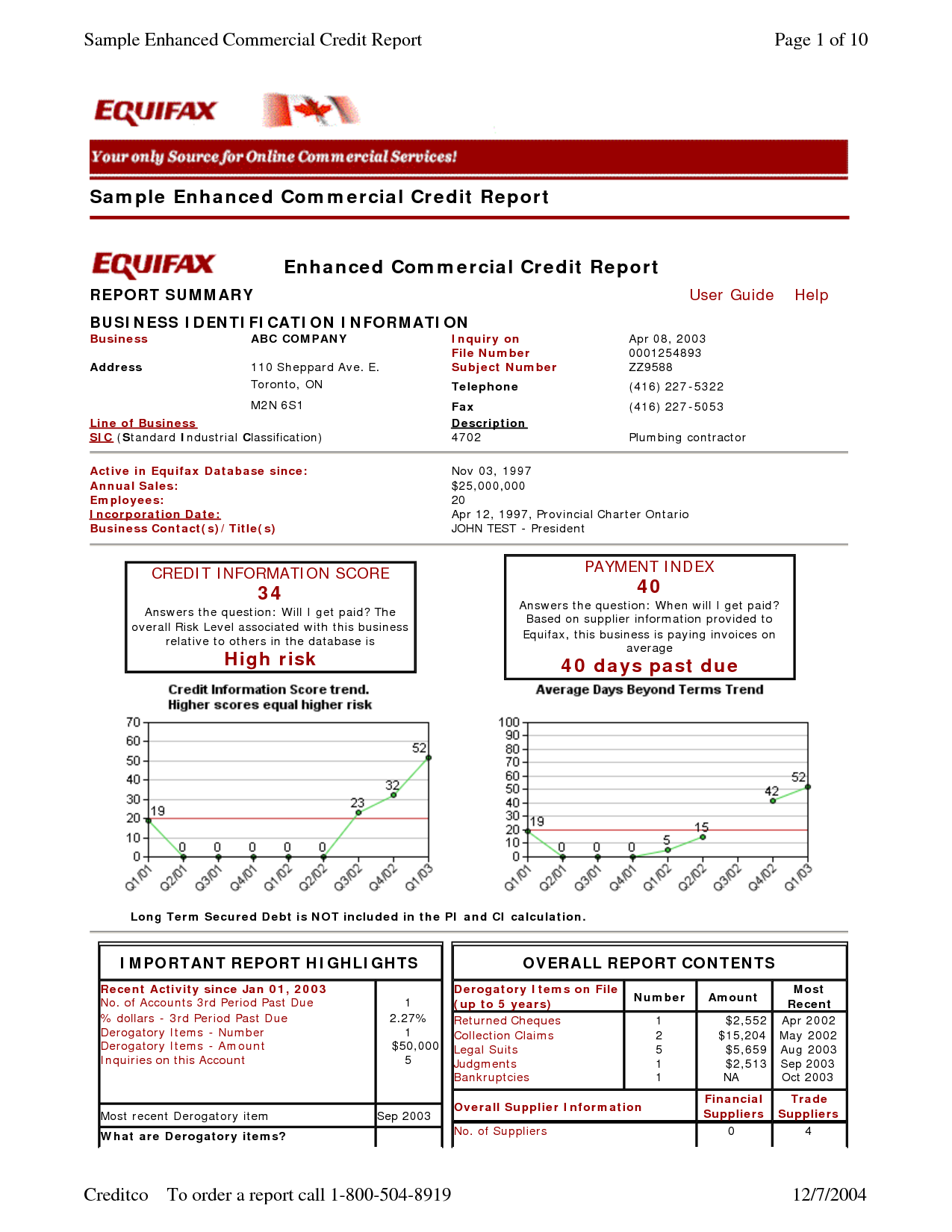

How To Build A Good Business Credit Score

It is challenging to build credit for your business, although, if the right habits and processes are adopted early on, your business will be on its way to healthy credit. Credit scores for businesses shouldnt be overlooked because they can help get your business off the ground and maintain a healthy status.

Measuring Business Credit Scores

Before starting to build your credit, its important to understand what criteria credit bureaus are looking at. In general, they aim to answer the following questions:

- What do you owe right now?

- How much credit are you currently using?

- How timely have your payments been?

- What are the industry and the age of your company?

Divide your Finances

Regardless of whether your business is incorporated or a sole proprietorship, having separate finances for personal and business purposes is a good idea. By having isolated business accounts, you will ensure that your business credit score is clean, accurate and represents the activity of the business, not your personal activity. You dont want the activity of the business interfering with your personal score and vice versa.

Open Business Credit Accounts

Using a personal line of credit for business purchases? Read this first.

Pick Vendors Wisely

Which credit bureau to lenders check in Canada? Find out here.

Always Pay on Time or Earlier

Heres how you can rebuild your credit after a late payment.

Maintain Accurate Information

Make Use of Available Credit

Public Records

You May Like: How To Remove Car Repossession From Credit Report

There Are Places To Get One But You Need To Be Careful

Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP& A.

In todays banking environment, the decision to offer you a mortgage or grant you a credit card sometimes comes down to one simple thing: your . Based on information in your , this numerical rating provides an easy way to assess your risk of defaulting on a loan. No wonder, then, that consumers are eager to find out their score, and if possible, as part of a free credit check.

Who Looks At Your Credit Report

You likely feel like your credit has become either a major tool or a major drag when it comes to your financial success, and with good reason. Over just the past two to three decades, credit scores have been adopted into decision-making processes that go far beyond qualifying for a credit card.

Virtually all consumers know that if you want to qualify for a credit card, the potential card provider will make its decision based largely upon your credit rating. Additionally, most also understand that mortgage lenders, car loan providers, banks, and credit unions also use your credit score when deciding to approve a loan.

In addition to these obvious credit score viewers, many other decision-makers are looking at your credit score:

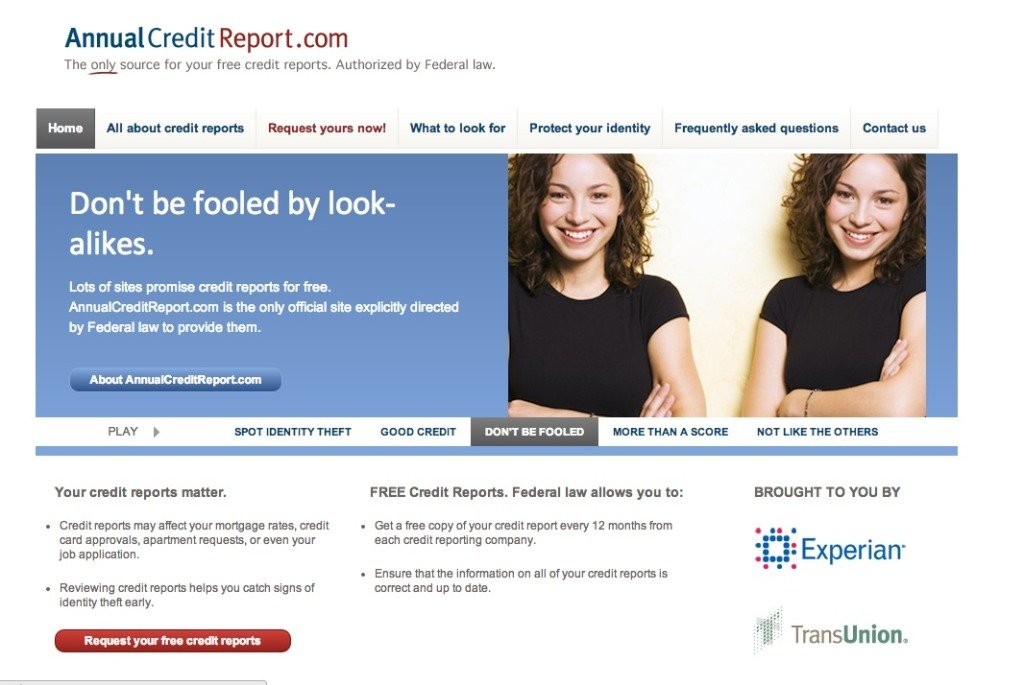

Finally, you should check your own credit regularly. Exercise your right granted by the 2003 FACT Act to pull your credit report through each of the three major consumer reporting agencies every 12 months. Go to www.AnnualCreditReport.com or call 877-322-8228 to request your report today.

You May Like: Aargon Agency Settlement

Safely Request Your Credit History

The most common website from which consumers can receive free credit reports is AnnualCreditReport.com. In 2003, the Fair and Accurate Credit Transactions Act was passed, allowing every consumer access to an annual free credit report. The three major credit bureaus worked together to create AnnualCreditReport.com for this purpose.

The website has SSL encryption and is considered a secure site. You may request your credit report from each agency yearly, and some consumers request one from each one every four months to receive free reports on a quarterly rotation.

Experian is the only credit agency that also provides your FICO score for free. If you want a credit score from either Equifax or TransUnion, you will have to pay a fee to the agencies.

Many major credit card issuers, like Bank of America and Wells Fargo, offer cardmembers free credit scores. Interestingly, a growing number of credit card issuers are now offering free credit scores to anyonenot just cardmembers. For example, you don’t have to have a credit card or an account with Chase or Discover to check your credit score for free.

Your credit history is different from your credit score.

Credit Score: Is It Good Or Bad

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score.

Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications. Other lenders that specialize in “subprime” lending, are happy to work with consumers whose scores fall in the Fair range, but they charge relatively high interest rates and fees.

17% of all consumers have FICO® Scores in the Fair range

.

Approximately 27% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Also Check: Does Zebit Report To Credit Bureaus

How Do I Get My Full Credit Report

Since the FACT Act went into effect in 2004, American adults have had the right to view their credit report at no cost from each of the three major consumer reporting agencies . Here are the simple steps: Request your free report online at AnnualCreditReport.com.

You will provide your name, social security number, and current mailing address

You will then be directed to each of the CRAs to get your credit reports. Each CRA will ask you four questions to confirm your identity. These multiple-choice questions are based upon information available on your credit report. Do not hesitate to answer, None of the above if you do not see the correct answer or if the questions are not applicable.

It is common for a CRA to deny your online request. However, you should then attempt to get your report by phone or by mail.

When successfully pulled, you will have access to view and print your report immediately and have up to 30 days to dispute the accuracy of any information.

Request your free report by phone at toll-free 877-322-8228.

The recorded instructions will inform you of the requirements, but you should have your full name, social security number, and current mailing address ready to provide.

Request your free report by mail by printing and completing the form available here and sending in a stamped, #10 envelope to Annual Credit Report Request Service, PO Box 105281, Atlanta GA 30348-5281.

What To Look For When You Review Your Credit Report

Monitoring your credit report is even more important during uncertain economic times since fraudsters like to take advantage of these situations.

You should keep an eye out for common credit report errors and signs of fraud when checking your credit report, such as:

- New accounts that you didn’t open

- Identity errors

- Incorrect reporting of account status

- Data management errors

- Balance errors

If you notice any errors, dispute them as soon as possible. Check out our step-by-step guide on how to dispute a credit report error.

Learn more:

Also Check: Opensky Payment Due Date

How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach won’t give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

When Is A Credit Report Pulled

If you are applying for a mortgage to buy a new home or you want to lease a new car, the lender who is providing you the loan will then pull your credit report in order to determine if you are eligible for a loan, also known as your creditworthiness. Other times a credit report will be pulled is when you are planning on renting an apartment or if you just want to browse your current credit standing yourself.

Read Also: 611 Credit Score

What Is A Credit Report

A is a summary of how you pay your financial obligations. It contains information based on what you have done in the past. Lenders use it to verify information about you, see your borrowing activity and find out about your repayment history. Some of the information on your credit report is used to determine your credit score.

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Also Check: Zzounds Payment Plan Denied

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

How Often Should I Check My Credit Report

Its generally recommended that you check your credit reports a minimum of one time a year, but you can check them as often as you like. Before you apply for credit, it can be a good idea to review your reports for errors to increase your chances of securing more favorable terms, such as lower interest rates.

How To Get Your Credit Score

Unlike your free annual credit report, there is no free annual credit score. Some companies you do business with might give you free credit scores. Other companies may give you a free credit score if you sign up for their paid credit monitoring service. This kind of service checks your credit report for you. Sometimes its not always clear that youll be charged for the credit monitoring, so if you see an offer for free credit scores, check closely to see if youre being charged for credit monitoring.

TIP: Before you pay any money to get your credit score, ask yourself if you need to see it. Your credit score is based on whats in your credit history: if you know your credit history is good, your credit score will be good. It might be interesting to know your score, but you can decide if you want to pay to get it. For more on credit scores, see the article Credit Scores.

Also Check: Does Zzounds Report To Credit Bureau

How Does A Credit Report Review Work

Money Fit by DRS has long provided free credit report analyses as a nonprofit to consumers across the country. The process can take as little as 20 minutes or last as long as two or three one-hour sessions. During normal business hours , you can choose to meet with a certified counselor by phone or via web conferencing. At any time, you may correspond with our certified counselors via email, although we recommend that you remove any personally identifying information from attachments and the body of your email .

What Does A Credit Score Affect

Your credit scores across all three credit reference agencies are vitally important as they will impact how likely you are to be accepted for all kinds of financial products, from credit cards and bank accounts to mobile phone contracts. Having a good credit score opens up more favourable terms and conditions, including lower interest rates and more flexible credit limits. A bad score, meanwhile, may mean you can only get credit from a specialist lender.

Don’t Miss: Which Business Credit Cards Do Not Report Personal Credit