How To Get A Collection Removed From Your Credit Reports

Advertiser Disclosure

Credit Card Insider is an independent, advertising supported website. Credit Card Insider receives compensation from some credit card issuers as advertisers. Advertiser relationships do not affect card ratings or our Editors Best Card Picks. Credit Card Insider has not reviewed all available credit card offers in the marketplace. Content is not provided or commissioned by any credit card issuers. Reasonable efforts are made to maintain accurate information, though all credit card information is presented without warranty. When you click on any Apply Now button, the most up-to-date terms and conditions, rates, and fee information will be presented by the issuer. Credit Card Insider has partnered with CardRatings for our coverage of credit card products. Credit Card Insider and CardRatings may receive a commission from card issuers. A list of these issuers can be found on our Editorial Guidelines.

Collections On Your Credit Report

When an account becomes seriously past due, the creditor may decide to turn the account over to an internal collection department or to sell the debt to a collection agency. Once an account is sold to a collection agency, the collection account can then be reported as a separate account on your . Collection accounts have a significant negative impact on your credit scores.

Collections can appear from unsecured accounts, such as and personal loans. In contrast, secured loans such as mortgages or auto loans that default would involve foreclosure and repossession, respectively. Auto loans can end up in collections also, even if they are repossessed. The amount they are sold for at auction may be less than the full amount owed, and the remaining amount can still be sent to collections.

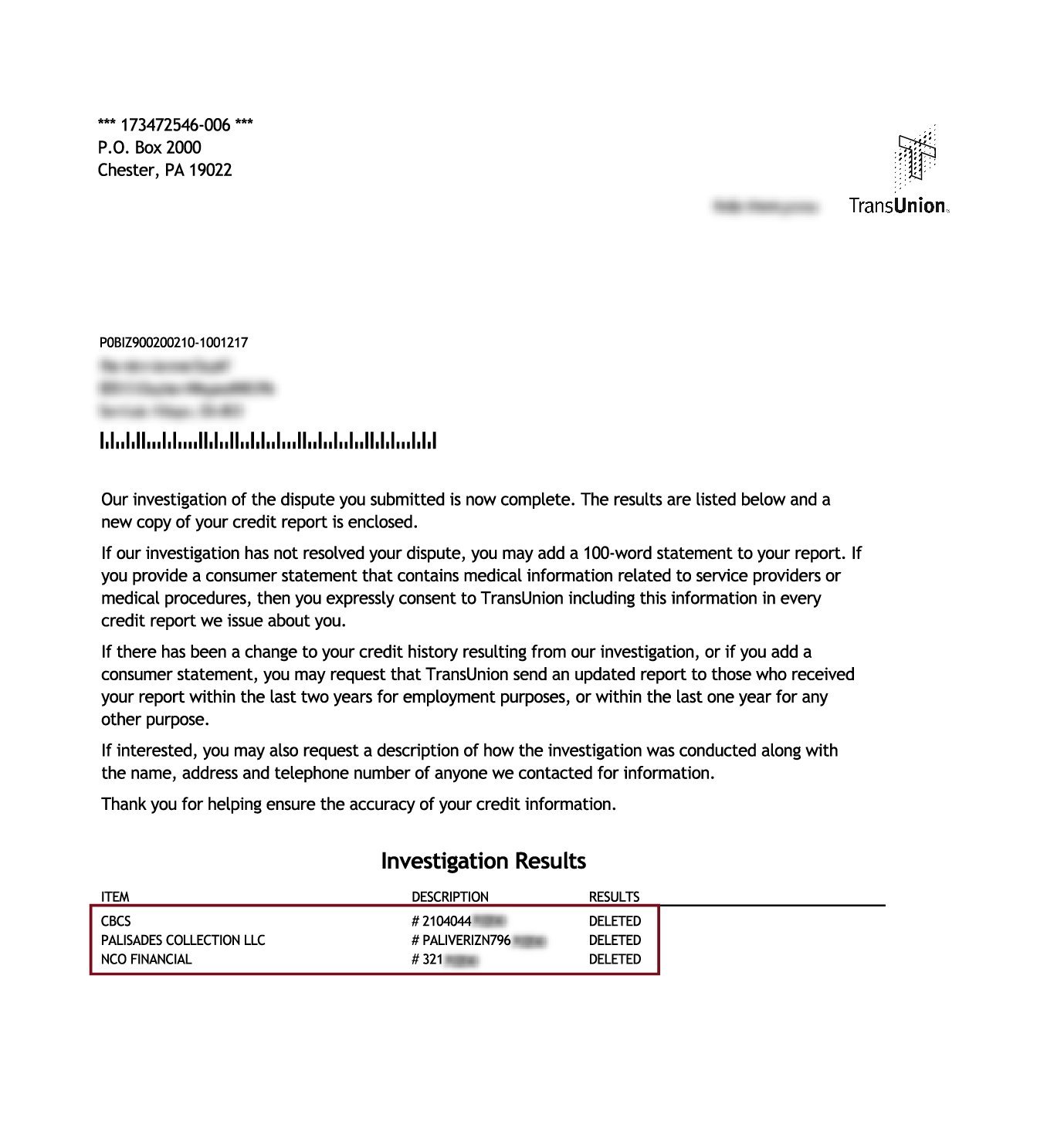

Collections can be removed from credit reports in only two ways:

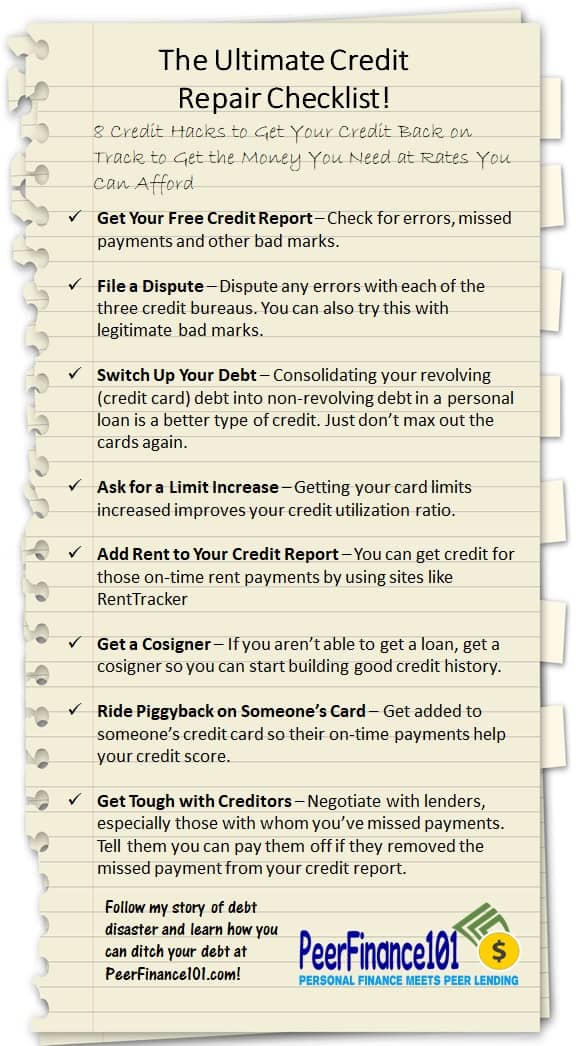

Do Your Research & Check All Credit Reports

To get details on your collection account, review all of your credit reports. You can do this by visiting AnnualCreditReport.com. Normally, you can only get one free copy of each report annually. However, due to the Covid-19 pandemic, you can check your reports from all three credit bureaus for free weekly until April 20, 2022.

Your credit report should list whether the collection is paid or unpaid, the balance you owe and the date of the accounts delinquency. If you dont know who the original creditor is and its not listed on your report, ask the collection agency to give you that information.

Afterward, compare the collection details listed on the credit report against your own records for the reported account. If you havent kept any records, log into the account listed to view your payment history with the original creditor.

Also Check: Does A Late Payment Affect My Credit Rating

How Long Does A Collection Account Stay On Your Credit Reports

The fact is that a collection account will not be removed from your credit report just because the account has been settled or paid.

Even after a collection account has been paid, the credit bureaus are still legally allowed to continue to report the collection for up to seven years from the date of default on the original account, thanks to the Fair Credit Reporting Act.

To put it another way, a collection account can remain on your credit reports for up to seven years from the date the original debt became 180 days past due, regardless of whether the account has a $0 balance.

Insider tip

If you have an unauthorized or otherwise unverifiable collection account on your credit reports, you can submit a 609 dispute letter regarding that account. This will force the credit bureaus to attempt to verify the account. If they cant, theyll have to remove it from your reports. But take note that this wont erase your debt; it just removes the record from your credit reports.

How Delinquent Debts Are Reported On Your Credit Reports

After your debt has been transferred or sold to a debt collector, it will probably appear twice in your credit history. According to the credit reporting agency Experian, this is how it works: The debt starts as a current, never late account. As you get behind on the payments, it is typically reported as being 30 days late, 60 days late, 90 days late, and so forth.

Don’t Miss: How To Get Public Records Removed From Credit Report

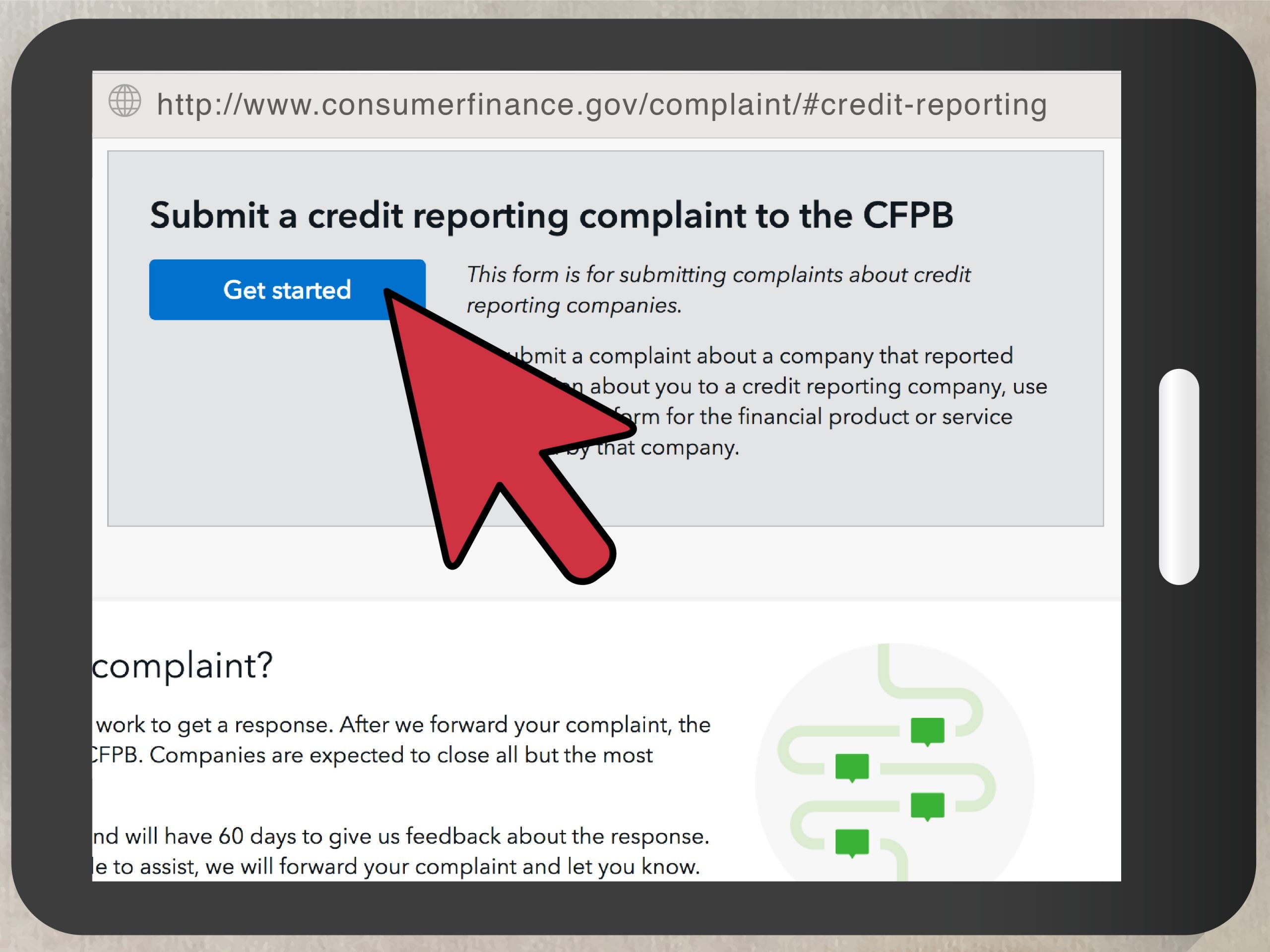

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Try To Set Up A Pay For Delete

If steps 1 and 2 dont work and youre not able to get collections deleted, the next step is to negotiate a pay for delete. This is when a collection company agrees to remove a collection account from your credit report if you pay off the balance.

The Credit Bureaus have cracked down on collection agencies allowing pay for deletes. Credit Bureaus dont like this type of practice, and many creditors no longer allow this. But there are still many debt collectors that will remove collections from your report.

Its worth asking if they will do this for you. If so, its the easiest way to get collection accounts removed.

Click here to view a;sample pay for delete letter

You May Like: Does Having A Mortgage Help Credit Score

What Are Typical Collection Accounts

Wondering what companies report bad debt or collections? You may be surprised at the various types of reporters. Voluntary reporting can be done by:

- Rental companies

- Government agencies

Typically, people report amounts in excess of $100 when delinquent. They usually submit delinquencies greater than 30 days, but some smaller amounts may stray onto the report.

Some accounts will list delinquencies of 30+ days, 60+, 90+, etc. The greater the delinquency date, the most damage is done to your score, and the worse you look to potential lenders.

Contrary To The Majority Of People Imagine Submitting Instance Of Personal Bankruptcy Can Be Healthy For You And Increase Your Capital

it is most likely that in the event that youre contemplating circumstances of bankruptcy, the financing achieve scoring are fighting, and youre probably tired of getting by prices fanatics and loan providers, or more against pay garnishments, evictions, litigation, and foreclosures.

Typically just should all that task stop with bankruptcy, but personal bankruptcy usually facilitate your personal accounts. Many of your debts will probably be become gone, and even though you will notice a basic problem in your credit ratings get, after case of bankruptcy proceeding loans really starts to rebound immediately, and you will probably normally end by having an better overall credit score scoring.

you can expect a totally free of prices debate to try your own guy finances, the money you owe, in addition to your targets. Should bankruptcy get your solution that will be great, we will enable can get on the way to monetary solvency and find out the best means ensure your overall credit score standing recovers as rapidly as .

Part 7 will launch clear away a lot of or all consumer financial obligations so they cannot must be compensated. Part 7 is currently over in certain times and you should start debt which is repairing, nevertheless it keeps by yourself credit status for decades.

You May Like: How To Report Unauthorized Credit Card Charges

Do I Need To Notify Credit Bureaus Of Paid Collections

If you pay off or settle a debt with a collection agency, the status of the collection account on your credit report should update to “paid” or “settled” within a month or two. You do not need to do anything to make that happen; the collection agency should notify the three national credit bureaus to update their records.

If that doesn’t occur, you can file a dispute with each of the bureaus to have the records corrected. You’ll likely need to provide proof of payment, such as a cancelled check.

In This Post We Cover:

- What collections are and how they affect your credit

- How to check your credit report for collections

- How to remove collections from credit report in Canada

- Tips to help manage credit going forward

Your credit reports and scores are an important part of your financial life. When collection items land on your it can cause your score to drop, making it harder to get approved for car loans or other types of credit. You might be wondering how to remove collections from credit reports and whether that could help your score. There are some steps you can take to minimize the impact of collections on a credit report. If youre successful, this could make it easier to qualify for a car loan and/or get a better rate when you borrow.

Recommended Reading: How To Put Fraud Alert On Credit Report

Are You Being Called By Civil Recovery

Many people tend to panic when they see calls from Civil Recovery. They do not know the right response but they do not want to feel pressured either. Debt collection companies can get extremely rude and threatening if you dont pay off the money you owe. However, if only consumers knew their rights, they would know that debt collectors have no right to engage with consumers in this way.

Have collections on your credit report?

Get FREE credit repair consultation right now!

Get Ahead Of Your Medical Debt

Find out what expenses your health insurance company covers and what youll be responsible for yourself. Do this as soon as you can. Then, you wont be surprised by any medical bills that arrive in the mail with a looming payment deadline.

Prepare in advance as much as possible so you can start making payments. Its an unfortunate reality you have to deal with even when youve already been through health issues.

You May Like: How High Can A Credit Score Go

Request A Debt Validation Letter

You will have 30 days from when the debt collector first contacts you to get the debt validated. It must be done in writing, which is why youll need to write a debt validation letter.

Once the letter has been sent, the collector must provide proof of the debt to continue collection efforts. If the collector cant provide proof or doesnt respond within 30 to 45 days, the debt must be removed from your report by the credit bureau. You can also dispute the collection after its aged off.

Once you have your reports and documentation, its time to determine the appropriate plan of action. If you find inaccuracies, its time to dispute them.

Make A Deal With The Collection Agency

If a debt collector contacts you, offer to pay right away with the contingency that they dont report it or remove it from your credit report. Hopefully, you can work out a plan to pay the debt and get back on track, even if it takes a while.

You want to avoid having any medical collection accounts appear on your credit report at all costs. Not only are they difficult to remove once they are on there, just one medical item can drop your credit score by as much as 100 points.

Read Also: What Is Credit Score Out Of

How Long Does A Repo Stay On Your Credit Report

Repossessions are removed from your after seven years. The seven-year countdown begins on the date of the first late payment that resulted in repossession.

When you finance a car, the lender retains ownership until the loan is paid in full. The car serves as security for the loan.

When you fall behind on your car loan payments, the lender arrives to physically take back the vehicle. In the majority of instances, the lender has made numerous unsuccessful efforts to contact the borrower and collect payment.

Request A Goodwill Deletion If You Have Paid The Debt

The first step, if you have paid the collection account, or have been making regular on-time payments, is to mail the collection agency a goodwill letter that explains your situation.

Dont go into too many details, but let the debt collector know if youre trying to buy a house but cant because of the negative information on your credit report.

Then kindly ask the debt collector to remove collections from your credit report out of goodwill.

With some newer scoring models of FICO and VantageScore, they ignore a collection marked as paid, though many lenders still utilize older formulas that will still weigh a paid collection account against you.

If this sounds overwhelming, you might want to reach out to a credit expert.It costs some money but is less expensive than you might thinkconsidering you are getting your own lawyer to fight on your behalf.

Read Also: Does Experian Affect Your Credit Rating

How Long Can A Debt Collector Pursue An Old Debt

Each state has a statute of limitations about how long a debt collector can pursue old debt. For most states, this ranges between four and six years. These statutes govern the amount of time that a debt collector can sue you, but there is no limit to how long a collector has to try and collect on a debt. If you are being contacted about a debt that you believe is not yours or is outside the statute of limitations, do not claim the debt; instead, ask the company to validate that the debt is yours.

Ways To Remove Collections From Credit Report

Still, there is a chance you could get the collection removed. A collection stays on your credit report for seven years from the time of your last payment, and there are three ways to get it taken off.

Recommended Reading: Does Having More Credit Cards Help Your Credit Score

How Do Collections Affect Credit

Some lenders use older versions of both credit scoring systems that still count paid collection accounts, however, and there’s no way to know ahead of time which credit scoring method a lender will use when deciding to approve a loan application. So while paid collections on your credit report may still hurt your chances of approval, paying off the account gives an opportunity to do the least possible damage.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To Get Transunion Credit Report

What Is A Charge

When a creditor gives you a loan or line of credit, it assumes you’re going to pay back what you borrow. If you fall behind or stop making payments altogether, your account can become delinquent. Once an account has been delinquent for an extended period of timetypically meaning it’s 120 to 180 days latethe creditor may charge it off.

A charge-off means your account is written off as a loss. At this point, the account may be assigned or sold to a debt collection agency. The debt collector can then take action against you to try to get you to pay what’s owed. That can include calling you to ask for a payment, sending written requests for payment, or even suing you in civil court to try and obtain a judgment.;;