Have At Least One Gas Or Store Credit Card

For the longest time, I resisted getting a store card, such as a Macys credit card, because I saw no point in opening a new credit account just for one store.

But, now I know better. If you shop at one store a lot, and that store offers its own credit card, consider applying. These cards have some nice perks such as cash back or coupons.

More importantly, a store credit card can boost your credit. I cant document this, but I know getting a Macys card and keeping its balance at $0 each billing cycle boosted my FICO score by 20 points.

Just be sure you dont buy too much and run up a balance you cant clear each month. If you do that, youll be cutting into your available credit which will hurt your credit score.

What Does A 750 Credit Score Mean For Your Wallet

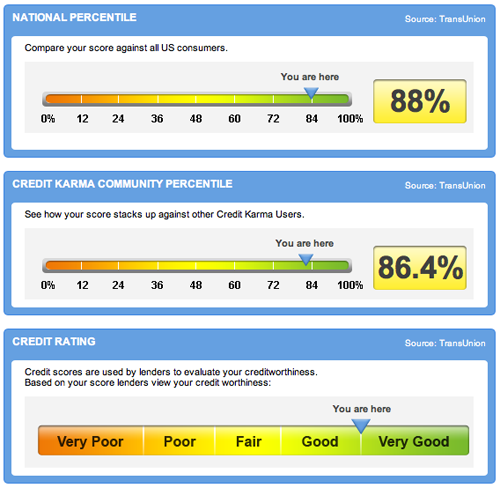

A 798 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

How Do You Get A 800 Credit Score

5 Habits to Get 800+ Credit Scorepay your bills on time all of them. Paying your bills on time can improve your credit score and get you closer to an 800+ credit score. dont hit your credit limit. only spend what you can afford. dont apply for every credit card. have a credit history. what an 800+ credit score can mean.

Read Also: Why Is There Aargon Agency On My Credit Report

Can I Buy A House With A 720 Credit Score

Some lenders will provide jumbo mortgages to people with in the 700 range. … Note, a 720 minimum score is also common for jumbo loans. So if you need a large mortgage, it might be worth raising your score a bit before applying. That way you’ll have more options when shopping and likely net a lower rate.

Dealing With Negative Information Which Impacts Your 718 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 718 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 718 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Improve Your Credit Score From 788 To 800+

A credit score of 788 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 788 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

Can You Get A Personal Loan With A Credit Score Of 718

Most lenders will approve you for a personal loan with a 718 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Don’t Miss: How Long Does Foreclosure Stay On Credit Report

What Are The Average 798 Credit Score Car Loan Rates In 2021

For those that have excellent credit scores, they can ensure that they will qualify for just about any type of loan that they wish to take out, whether it is an auto loan or a mortgage. Personal loans are also something that are easier for them to borrow with such a high credit score. It is important to provide proof of your income when applying for any loan, though.

| FICO Credit Score |

|---|

| 3.34% |

All the calculation and examples below are just an estimation*.Individuals with a 798 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO scores were charged 14.8% in interest over a similar term.

So, if a vehicle is going for $18,000, it will cost individuals with excellent credit $326 a month for a sum of $19569 for more than five years at 3.4% interest. In the meantime, somebody with a lower credit score paying 14.8% interest rate without an upfront installment will spend $426 a month and wind up burning through $25584 for a similar auto. That is in excess of a $6015 distinction.

The vast majority wont fall in the highest or lowest class, so heres a breakdown of how an extensive variety of FICO scores can influence the aggregate sum paid through the span of a five-year loan:

| FICO Range | |

|---|---|

| $7,582 | $25,584 |

How Long Does It Take To Get An 800 Credit Score

Depending on where you’re starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

A good credit mix includes a few major credit cards, a real estate loan, and another type of installment loan. These accounts must be a few years old to show that you can handle a variety of credit responsibilities over a long period of time.

You May Like: When Do Companies Report To Credit Bureau

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

Can I Get A Car / Auto Loan W/ A 798 Credit Score

Trying to qualify for an auto loan with a 798 credit score is cheap. There is little to no risk for a car lender .

Taking out an auto loan out with a 798 credit score, should be easy.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Age Of Your Credit History

Another factor weighed in your credit scores is the age of your credit history, or how long your active accounts have been open.

Canceling a credit card can affect the age of your credit history, especially if its a card youve had for a while, so weigh that potential impact when youre deciding whether to close a card. Only time can offset the impact of closing an older account, but youll also lose the credit limit amount on a closed card, which can negatively affect your credit utilization rate.

Heads up that card issuers may decide to close your accounts if youre not actively using them, so make sure you keep any accounts you dont want closed active with at least an occasional minimal purchase.

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

Read Also: Is 626 A Good Credit Score

Mortgage With 798 Credit Score

Mortgages are ideal to have when a person wants to purchase a first home, a second home or even a vacation home. For those that want to use the home for other purposes, this loan would be ideal. When the person has a 798 FICO score, they are then able to qualify for a wide variety of mortgage loans. They have to provide proof of income, but as far as the credit score, you should have no issue. Just ensures that your debt to income ratio is lower.

How Good Is An 800 Credit Score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Also Check: Does Affirm Report To Credit Bureaus

Have A Credit History

You not only want a good record of paying your bills and credit cards on time, you also want a long history of doing so. The older your credit accounts are, the better your credit score will be. You want to have credit accounts that have been open for 10 years or more.

Length of credit history accounts for 15% of a credit score, and closing old accounts can affect your credit score, Ross says.

Have At Least Three Credit Cards But Only Use One

This first step comes completely from my own experience after experimenting with different techniques.

To optimize your credit score, it works best to have no more and no less than three major credit cards.

These cards should have long, good payment histories, and low credit utilization .

Its best to use only one of these cards on a regular basis and simply keep the other two cards with a $0 balance.

Its not that you cant ever use the other two cards, but generally, I like to keep their balances at zero. This technique will maximize your credit score.

You May Like: Credit Inquiry Removal In 24 Hour Free

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

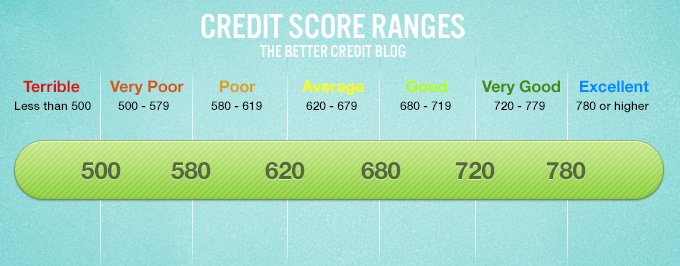

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Also Check: Does Balance Transfer Affect Credit Score

The Three Credit Reporting Agencies And Different Types Of Credit Scores

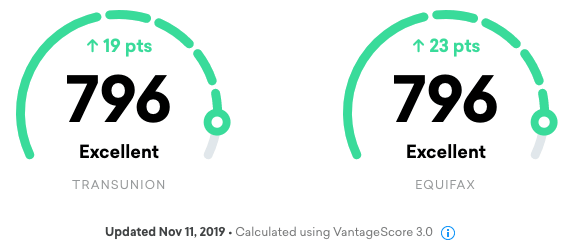

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 798 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

How To Increase Your Credit Score To 800 And Above

Having a high credit score gives you so many options.

You can get the credit cards with the highest rewards, and you can get the absolute lowest rates on any loans you use.

If you apply for a mortgage without an exceptional credit score, youre leaving so much money on the table.

It can even increase your chances of getting a job or getting into a nice rental, since employers and landlords often check it. Its the financial industrys best estimate of how responsible you are, and it can carry over to other realms outside of just finance.

Ive had an 800+ credit score since I was 22, and manage the corporate credit line of an engineering facility, which requires me to maintain very high credit. My current FICO score is actually perfect at 850.

This article gives an overview of how to improve your credit score fast and reliably, including the 4 biggest-impact tips you can implement this week.

Also Check: How To Report To A Credit Bureau Landlord