Use A Credit Card To Pay Your Rent

While your rent payments wont be listed as a separate tradeline on your credit report, using your credit card for your rent still can boost your credit score. Check to see whether your landlord accepts credit card payments, and note any service fees that might be charged for using a credit card. If youre using a rewards credit card to pay your rent, you can earn points or cash back on your rent payments.

When you use a credit card to pay your rent, make sure to pay off your full balance just as if you were paying rent. Thats the best way to stay out of debt, improve your credit score, and get the full benefit of making timely rent payments.

How To Report Payment History To Credit Bureaus Experian

Feb 21, 2021 Simply explain that you have an account thats not appearing on your report and that the lender has verified it is in fact being reported. Be

May 23, 2019 If your lender doesnt meet the credit bureaus criteria for mortgage reporting, the only way to get your mortgage reported is to have it moved

Generally, a mortgage history can only appear on your credit report if the loan is serviced by a lender who reports to one of the credit reporting companies.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Recommended Reading: How Bad Is A 500 Credit Score

How Does Positive Payment History Impact Your Credit

Payment history is the biggest factor in credit scores, so paying your bills on time, every time is the most important thing you can do to build a strong credit history.

If you are just starting to establish your credit, it can take time to build a solid history of positive payments. Here some tips to help you begin building your credit history:

Reporting Rent Could Be The Future For Landlords

Reporting rent payments to credit bureaus can have a positive impact on tenants and landlords. With Californias newly enacted law SB 1157 landlords are required to give tenants in low to middle-income housing the option to report their payments. Its likely other states will follow Californias lead.

This benefits tenants by giving them a way of increasing their credit score with on-time payments. This benefits landlords by helping them find tenants who are trustworthy and reliable, and see more on-time payments.

We believe reporting rent payments to credit unions is a win-win whether you live in California or elsewhere.

Read Also: What Credit Report Does Paypal Pull

Fix Your Credit And Improve Your Credit Score

Here are some tips on how to fix your credit and improve your credit score:

If you need help fixing your credit, contact a non-profit credit counseling service that can help you for little or no cost. You can also check with your employer, credit union, or housing authority to see what no-cost credit counseling programs may be available.

It takes time to build up or fix your credit. Unfortunately, there are a lot of fraudsters preying on consumers who want to fix their credit. Avoid any credit counselor or company that promises quick-fix credit repairs, promises to hide your bad credit history, requires upfront payment, or tells you to dispute accurate credit report information or to give false information to creditors.

Here are some resources to help you find a reputable credit counselor:

- Federal Trade Commissions Choosing a Credit Counselor: How to choose a credit counseling service

- Federal Trade Commissions : How to avoid credit repair scams

- Department of Business Oversights : Common questions about credit counseling services

What Happens If You Pay Your Mortgage 30 Days Late

You actually have a full 30 days after your payment due date before a lender is allowed to officially report a late payment to the credit bureaus. If you actually pay your mortgage payment late enough for it to show up on your credit report as 30 days delinquent, then you could be in store for some severe credit score damage.

Also Check: Does Paypal Credit Report To Credit Bureaus

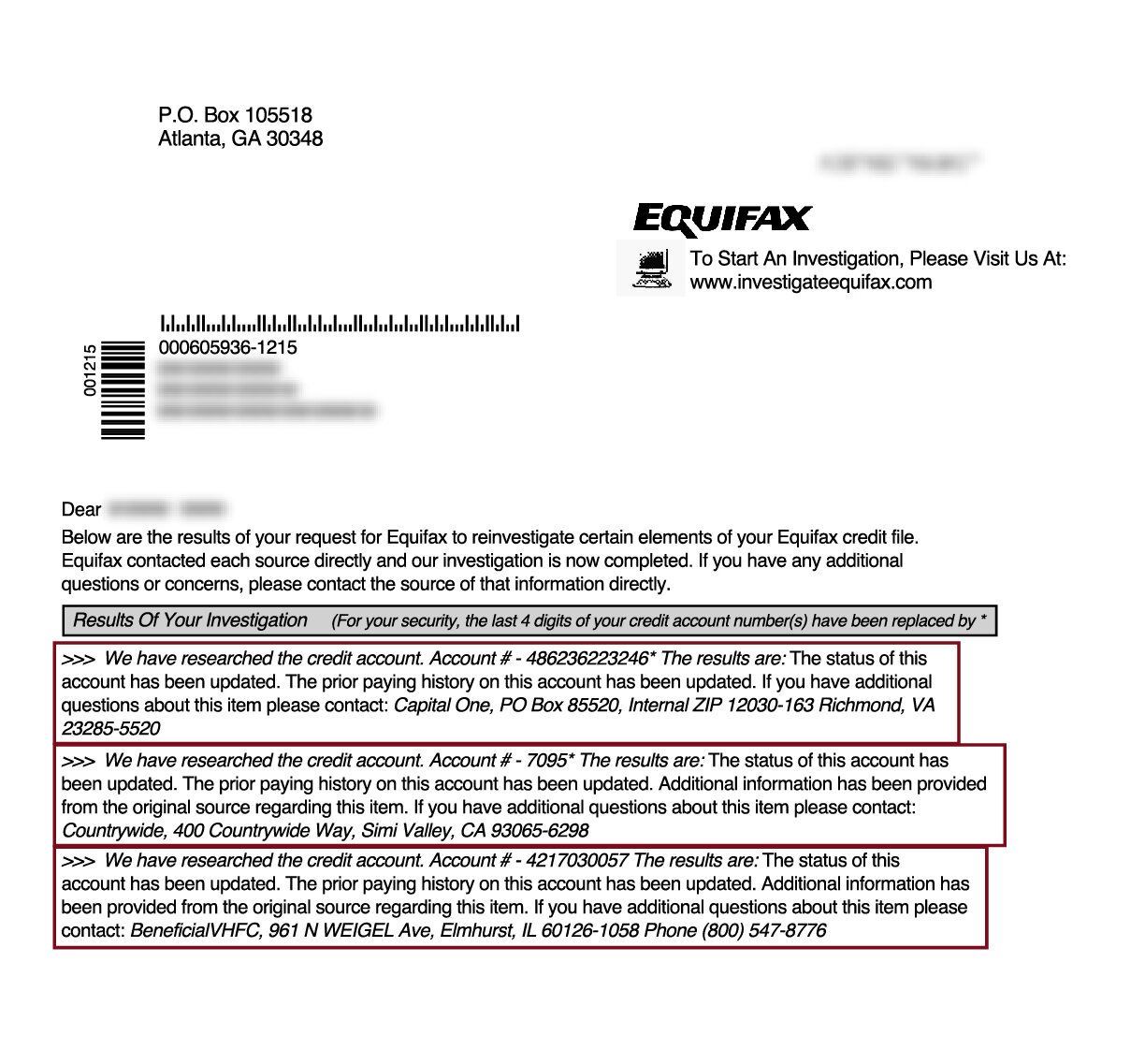

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Read Also: How To Unlock My Experian Account

How To Report Late Rent

Report Late Rent and Reduce tenant delinquencies by 36%

Report Late Rent and Reduce tenant delinquencies by 36%

For Canadian Landlords and Property Managers there has never been a tenant registry that enables them to report tenants rent payments. Leaving many asking the question, how do I report late rent on a tenant?

The Landlord Credit Bureau empowers Landlords and Property managers to report rent payments, paid, late or otherwise owing. For tenants who consistently pay rent on time LCB will reward them with a positive Tenant Record as well as an improved credit report. For those tenants who choose to not pay rent, they will receive a negative Tenant Record, and this will be reported on their credit report.

LCB is a Reporting Agency in Canada.

LCB handles notifying tenants that their rent payments are reported to LCB and of the benefits and consequences for late rent payments and non-payment of rent. Tenants can view and monitor their records, and if information is disputed, there are multiple mechanisms in place to handle such disputes. LCB will then investigate.

With LCB you can also report former tenants. In the case of former tenants who owe unpaid rent, the amount you record will automatically roll over each new month, until you login and record it as paid. You can also report a positive rent payment history for former tenants.

How to report Late Rent Payments?

It is easy with Landlord Credit Bureau, and it is free to sign up.

Ready to make renting easier?

How To Find Out If Your Rent Is Being Reported

The easiest way to find out if your rent payment is being reported is to ask your landlord. Landlords can sign up directly with Experian or TransUnion or use a rent payment service that is part of their property management software.

This type of program enables landlords to enter information about your payment history each month and submit rent payments to the associated credit bureaus. All three major credit bureaus Experian, Transunion, and Equifax do include rent payment information in a credit report if they receive it.

Also Check: When Does Capital One Report To Credit

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

How Are Mortgage Late Payments Affect Your Credit Score

Mortgage Lates Will Sink Your Credit Scores 1 Late mortgage payment must be 30+ days past due to impact credit scores 2 If youre only a few days late youll likely only have to pay a late fee 3 So it typically doesnt happen by accident 4 Impact will vary based on credit history and number/severity of late payments

Also Check: Does Paypal Credit Report To Credit Bureaus

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Does Paying Rent Build Credit

Simply paying your rent will not help you build credit. But reporting your rent payments can help you build credit especially if you are new to credit or do not have a lot of experience using it.

A 2017 TransUnion study followed 12,000 renters for a year as they reported their rent payments. Scores rose 16 points on average within six months after rent reporting began, according to the study. The largest increase was for scores below 620, which is considered bad credit.

Having rental payment information in your credit report can be useful if you rent again. Landlords prefer tenants who can show a history of paying on time.

But other strategies to build credit are more efficient than rent reporting because they influence all types of credit scores and usually report to all three credit bureaus. They also can cost less or, in the case of authorized usership, nothing.

-

You can become an on someones else credit card and benefit from their good credit history.

-

You can get a secured credit card, which requires a deposit and often serves as your credit limit.

-

You can get a at many credit unions or community banks. Your loan payments are reported to the bureaus and you get access to the funds only after you have paid it off.

Recommended Reading: Does Opensky Report To Credit Bureaus

How To Remove Mortgage Late Payments From Your Credit Report

You may need to use this letter next time you apply for a mortgage or any other line of credit. If you need to resolve the mortgage late payment immediately, once your credit is pulled by a bank or lender, simply send the letter to the credit reporting company the bank or lender used to pull your credit.

Credit Reports & Mortgages What To Do With An Invisible Loan

Lender not reporting: Some mortgage lenders especially smaller firms do not always report mortgages to the credit bureaus, unless there is a problem.

Aug 31, 2011 I am holding the note for a property I owner financed. I need the payments recorded with a credit reporting agency as I plan on selling 12 posts · Happy New Year Everyone,. I am holding the note for a property I owner financed. The buyer has Building Credit By Owner Financing BiggerPockets25 postsAug 26, 2016Does Using Seller-Financing Affect Your Debt 7 postsSep 5, 2020More results from www.biggerpockets.com

Also Check: Credit Report With Itin Number

What Type Of Information You Can Report To Credit Bureaus

Paying Rent

Can pay the rent build credit? Yes. Rent is something that is usually not taken into account when updating your credit report, which is unusual because for many it can be the biggest monthly expense. Equifax, Experian, and TransUnion are willing to include rent payments in your credit reports if you report them. With that being said, not all credit scoring systems, such as FICO and VantageScore, take rental payments into consideration. For example:

- Newer versions of FICO do take rent payments into account

- When reporting rent to credit bureaus, the most used versions of FICO dont consider rent payments

- VantageScore does calculate rent payments as well

When choosing a rent-reporting service, there are a few aspects that you need to keep in mind, such as:

Does your property manager already use a service for reporting rent to credit bureaus? If so, it will save you a lot of time and money.

- Which credit bureaus do the service report to?

- Will you have free access to credit scores such as FICO or VantageScore?

- Are the overall costs within your budget?

- When can you expect the information to appear on your credit report?

- How are cases where your lease is disputed/broken handled?

Bills

DID YOU KNOW: A persons payment history makes up the biggest part of the credit score, so taking preventative measures such as paying bills in a timely manner is the easiest way to improve your credit score.

How Do Landlords Benefit By Reporting Rent Payments To Credit Bureaus

While it might seem that this law only benefits tenants, it can significantly help landlords as well. Whether you are in California or not, landlords have the option of reporting rent payments to credit bureaus. And there might be a lot of benefits to doing so.

For landlords, here are some of the benefits that go along with reporting rent payments to credit bureaus:

Also Check: When Does Paypal Credit Report To Credit Bureau

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

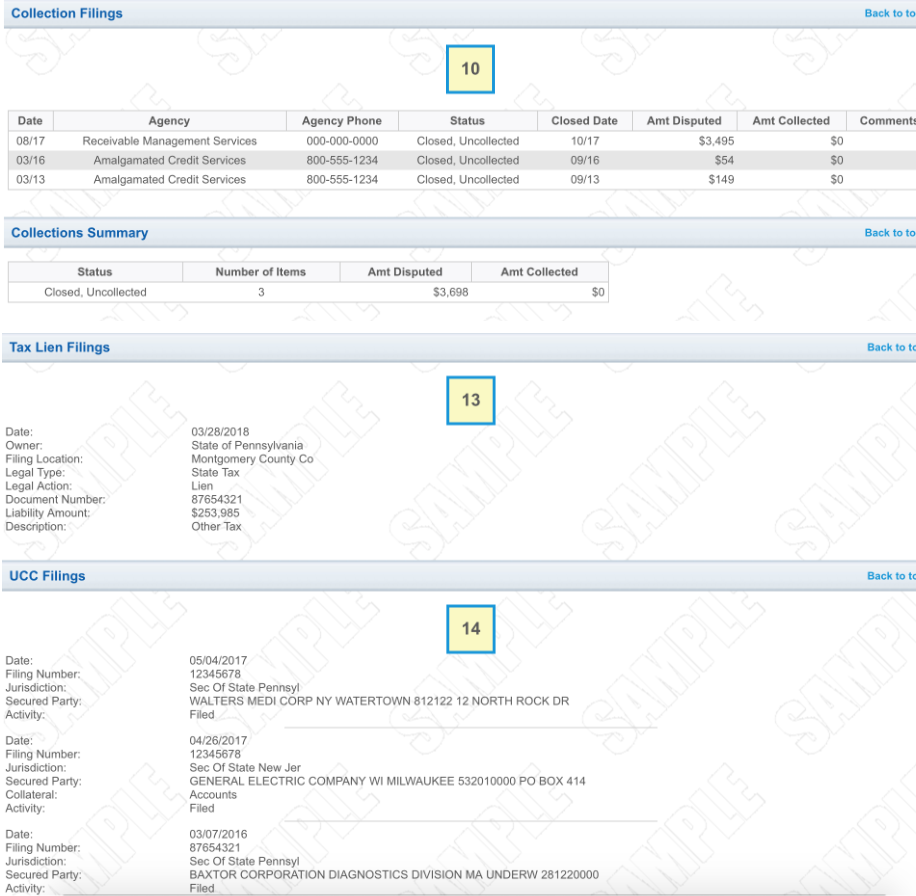

Should You Pay The Debt Collector Or The Original Creditor

If you already have an account in collections, meaning the original creditor has already closed your account and transferred it to another owner, you should not pay the lender that the loan was originally from. The debt now belongs to someone else, so it would be pointless to pay the original creditor.

Read Also: Does Klarna Report To Credit

Warning: Alternative Data Isnt Always Helpful

But be careful. Adding more information to your credit profile can help. But it can also work against you.

For example, a credit score that takes into account alternative data, such as your bank account information, could potentially rate you more negatively if you have limited funds in your account or have recently had a lot of big expenses.

Similarly, just as a missed payment on your credit card can hurt you, so can a late electricity payment or a lapsed phone bill.

Before you share more information about yourself and your financial history, think carefully about whether you really want to show that much information to lenders.

If you prefer to have more control over your information, you can also choose to only work with self-reporting services, such as Experian Boost or a rent reporting service, that let you choose exactly what gets reported.

Does Rent Payment Affect My Credit Score

Today, rent payments make up the largest expenses for most individuals across the world. Unfortunately, rental payment history does not contribute to most peoples credit reports. Meaning, paying your rent on time wont affect your credit score.

However, reporting your rent payments to credit bureaus can help change this narrative. Credit bureaus provide credit issuers and lenders with the relevant information needed to make loan decisions.

When you report your rent payments to major credit bureaus TransUnion, Experian, and Equifax they add your rent payment data in your credit reports.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus