What My Improved Credit Score Allowed Me To Do

In August of 2011, I had to purchase a car so I could switch jobs.

When I filled out the credit application to see if I qualified for lower financing rates, my credit score came back as 731.

In other words, I raised my credit score from 621 to 731 in just five months!

This is a very big deal because, at 621, I would have been denied a loan for the car, or would have had an interest rate that exceeded 9% on the auto loan.

Since I chose to get a secured credit card, I was able to take the car loan on my own and qualify for the low rate of 3.99% financing.

The difference in the loan between the two interest rates would be $750 over the life of the loan, far surpassing the cards annual fee, and the opportunity cost of my secured credit card holding my $1,100 for five months.

What Is A Credit Score

A credit score is a numeric summary of your credit history, a commonly used method for lenders to predict the likelihood that you will repay any loans they make to you.

There are no exact cutoffs for good scores or bad scores, but there are guidelines for each. Most lenders view scores above 720 as ideal and scores below 630 as problematic.

Consumers are becoming more aware of how raising their credit score improves their financial outlook and Homonoffs study has evidence of it. She found consumer behavior improved dramatically when people were aware of their credit score.

Many people thought they had a great score, but then found out they overestimated it, she said. They realized they had to start changing credit behaviors, so they stopped making late payments, they paid off cards with a balance and their scores improved.

The FICO credit score is used by 90% of the businesses in the U.S. to determine how much credit to offer a consumer and what interest rate to charge them for that credit.

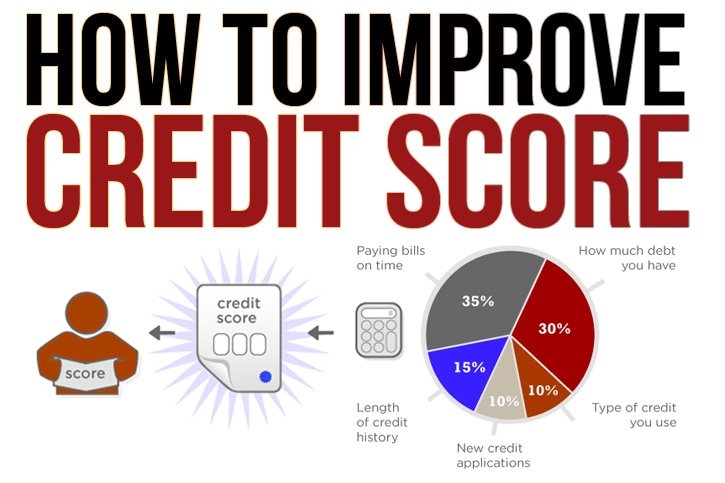

FICO uses five major components in the equation that produces your credit score. Those five include:

What Are The Benefits Of Raising Credit By 100 Points

Learning how to raise your credit score by 100 points has a variety of benefits. A good credit score comes with advantages that are worth working toward. Here are a few examples of the potential benefits of raising your credit score by 100 points.

Raising your credit score by 100 points might unlock many of the benefits above. If your credit needs a significant amount of work, a 100-point increase could still get you closer to those valuable perks.

Don’t Miss: How To Get Credit Report Without Social Security Number

How To Raise Credit Score By 200 Points

A few points on your credit score can mean the difference between getting approved for a loan at a reasonable interest rate and being denied a loan altogether. If your credit score is currently under the 600-mark, its time to take some steps to give it a boost. Here are some ways you can effectively raise your credit score by 200 points:

Dont use more than 30% of your credit card limit Just because your company allows you to spend a certain amount of money on your credit card doesnt mean you should max out your card every month. To get your credit score up, keep your credit card spending to no more than 30% of your credit limit. Doing so will increase your score as you pay your card on time every month.

Settle old debt Creditors are sometimes willing to negotiate with borrowers to eliminate certain negative items from their credit in order to receive payment. You may be able to do this with your creditors it doesnt hurt to ask. Settling your old debt can do wonders for your credit score and will even help you avoid any issues in the future.

Make all debt payments in full Any secured credit cards or lines of credit should be paid off in full whenever possible. This will help you give your credit score a boost.

Become An Authorized User On Someone Elses Account

As an authorized user you can piggy-back on a friend or family members good payment history. Just ask the account holder to make you an authorized user. Youll have to provide some personal information but not much else.

Your friend, the account holder, wont have to take any risk. He or she doesnt even have to give you a credit card.

This wont help you score as much as successfully using a secured credit card or credit-builder loan would. But every little bit helps, right?

You May Like: Does Increasing Credit Limit Hurt Score

Raise Your Credit Limit

The first way to raise your credit score quickly is to ask your credit card company for a higher credit limit. Its important to note that this only works if you dont use the increased limit youre asking for.

This method works because 30% of your credit score comes from your credit utilization. Remember, thats the amount of credit you have available compared to the amount youre using. If you increase the amount of credit you have available without using anymore more of it, then your credit utilization goes down. As a result, your score will go up.

Every company has a different procedure to raise your credit limit. Also, they all have different requirements and qualifications. Usually you cant raise your limit within 6 months of getting a new card. You also cant get your limit raised within 3 months of getting your limit raise.

Its also important to note that most companies will run a credit check on you to raise your limit. Usually this is a soft credit check, so it wont impact your score. However, some companies use a hard credit check when determining whether or not to approve a request for an increased limit. If thats the case, then this can cause your credit score to go down. Thats especially true if you get denied for the credit limit increase. Your credit card company will tell you what kind of checks they do for approval on a limit increase request.

How To Improve Your Credit Score By 100 Points In 30 Days

As a member, I frequently check in to see how my credit is doing and make sure theres nothing suspicious going on there.

I really like Credit Karma because its free and provides detailed information about changes to your credit score. Also, you can link all your accounts to monitor your debt to savings ratio, and the site provides suggestions for financial products to apply for and why.

Another great feature I like to play around with is my spending. When I connect my bank account, I can categorize each transaction and see where all my money is going, which gives me a clear view of my spending habits.

One day when I logged in to my account, I was very excited to see that my credit score had increased by almost 100 points! I had managed to raise my credit score by 92 points in just one month.

In this article, Im going to share with you the steps I took to improve my credit.

Recommended Reading: Credit Score Without Social Security Number

Raise Your Credit Score 100 Points In 6 Months With These Aggressive Tactics

NEW YORK You might be surprised at just how much progress you can make in improving your credit in six months or a year.

In fact, with a few nifty tricks, you can boost your credit score some 50 to 100 points in no time flat.

Especially if you’re looking at buying a house somewhere in the near future, you’re going to want to aggressively pursue raising your credit score for the best rates possible, says John Heath, managing attorney with LexingtonLaw.

Here’s how to make that happen.

First Things First: Pull Your Credit Report

To know what you can do for starters, you’re going to have to pull your credit report and look it over. That’s where any path toward a higher credit score, aggressive or otherwise, is going to begin. What you’re looking for is anything that’s questionable, anything you don’t recognize. “If there’s an ID theft issue, contact the appropriate law enforcement agency,” says Heath. But if you do see something that you don’t recognize, don’t assume that you’ve been a victim. It could be — and probably is — something far less insidious, such as an error.

How Long It Takes To Raise Your Score

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

You May Like: Reporting Tenants To Credit Bureau

Identify The Negative Accounts

Now that you have your credit report go through it and highlight accounts with a negative status. Highlight any late payments, collection accounts, or any other negative information. Make sure your personal information is correct, including your address, employer, and phone number.

Items to focus on

Option 1 Request A Credit Limit Increase

Another way to reduce your credit utilization ratio if youre carrying high balances is to bump up your credit limits.

For example, if youre carrying $700 in debt on a card with a $1,000 credit limit, your credit utilization is 70%. If youre successful in increasing your credit limit to $2,000, then your utilization rate drops to 35%.

Some issuers make it easy to request a credit limit increase via your online account. For example, Citi allows cardholders to make such a request on the Credit Card Services page:

You can also call the number on the back of your card to make the request. Know that some issuers may conduct a hard pull on your credit before granting you a higher credit line, which can ding your credit score a few points. Your score will recover, but inquire exactly how your request will be handled before you allow them to proceed so you know what to expect.

Note: If youve only had the card a few months, have a history of late payments or are carrying really high balances, your request may be denied until youre seen as a less risky customer.

How much will this action impact your credit score?

The impact a credit line increase could have on your credit score depends on much of an increase you get. If its enough to bring your utilization under 30%, you should see a reasonable increase in your score. However, it wont improve your score as much as paying off your balance and bringing your utilization to or near zero.

Recommended Reading: How To Get Credit Report Without Ssn

Pay Down Credit Card Debt

After your payment history, your amounts owed are the most important part of your credit score calculation. But this doesn’t just mean how much debt you have overall. Creditors also want to know how much of your available credit you’re using . This is called your .

Your utilization is determined by dividing your credit card debt by your credit card limits. For example, let’s say you have a credit card with a $1,000 balance and a $5,000 limit. The utilization rate for this card would be: $1,000 ÷ $5,000 = 0.2 = 20%.

Credit score calculations look at both your overall utilization ratio and your ratio for individual cards. A lower utilization rate is better. In fact, an ideal credit utilization is below 10%.

When you pay down your credit card debt your utilization rate decreases.

For most people, the number one way to improve credit score fast is to pay down credit card balances. Once your lower balance is reported to the credit bureau, your credit score should improve. This is how to build credit fast if you have high utilization. However, this can help build credit even with moderate utilization.

If you’re unsure how to get started, check out our guide to paying off debt.

Get Rid Of Your Late Payments

Creditors are open to expunging late payment report records, if one of these three scenarios apply to you:

* The late payment report is a mistake, and you had paid your bill on time

* Your late payment is more than seven years old

* Youve made a late payment and catch it before it makes it onto your credit report

* If this is the case, you can write whats referred to as a goodwill letter to explain to your creditor why your payment was late. You may be able to resolve the situation, especially if its your first missed payment. However, there is no guarantee that your creditor will update your account.

Being friendly and honest is a must in this scenario, and it will very likely increase your chances of getting your late payments removed. If at first the creditor refuses, dont give up. You can always call again later and try your luck with another representative.

You May Like: Does Paypal Credit Report To Credit Bureaus

Find Out When Your Issuer Reports Payment History

Theres something called a credit utilization ratio. Its the amount of credit youve used compared to the amount of credit you have available. You have a ratio for your overall credit card use as well as for each credit card.

Its best to have a ratio overall and on individual cards of less than 30%. But heres an insider tip: To boost your score more quickly, keep your credit utilization ratio under 10%.

Heres an example of how the utilization ratio is calculated:

Lets say you have two credit cards. Card A has a $6,000 credit limit and a $2,500 balance. Card B has a $10,000 limit and you have a $1,000 balance on it.

This is your utilization ratio per card:

Card A = 42% , which is too high.

Card B = 10% , which is awesome.

This is your overall credit utilization ratio: 22% , which is very good.

But heres the problem: Even if you pay your balance off every month , if your payment is received after the reporting date, your reported balance could be high. And that negatively impacts your score because your ratio appears inflated.

So pay your bill just before the closing date. That way, your reported balance will be low or even zero. This lowers your utilization ratio and boosts your score.

Raise Your Credit Score 100 200 Points Really Fast

Lots of people have situations where their credit score takes a hit. Many of these people are looking for ways to boost their credit score quickly. This article will help explain how you can boost your credit score.

Well cover what it means to boost your credit score, what goes into a credit score, and different ways to cause your credit score to go up as quickly as possible. Use this information to get your credit score to a better place. Dont let a low credit score undermine your ability to get valuable loans and lines of credit prevent you from getting the job or home youve always wanted.

Read Also: What Is Syncb Ntwk On Credit Report

The Bottom Line About Building Credit Fast

When youre working to fix your credit, it takes good behavior over time. However, lowering your utilization rate by paying down existing debt, getting a new credit card or requesting a credit line increase on an existing card can provide the quickest credit score boost.

Any late payments and debts sent to collection should be handled promptly otherwise, theyll just cause more pain once they hit your credit reports. Its also wise to review your credit reports on a regular basis. in order to spot errors that might be dragging down your credit score.

Knowing what actions to take that can help improve your credit score and being a responsible borrower can boost your chances of increasing your credit score by 100 points or even more.

Pay On Time Every Time

The most vital thing you can do to build and maintain good credit is pay on time. This means every bill, every debt — every month. This is called your payment history, and it’s more than a third of your credit score. Even one payment more than 30 days late can hurt your score for years. If you think you can’t make a credit card payment, call your card company before you’re late to arrange a payment plan.

No matter what, be sure to make at least the minimum required payment on your accounts every month. Ideally, pay in full.

If you’re struggling with remembering due dates, you can set up automatic payments. The autopay feature will make your payments for you, in the amount you decide when you set it up.

This suggestion isn’t necessarily for how to build credit fast — it’s how to build credit for life.

Don’t Miss: How To Get Credit Report Without Social Security Number

Can You Improve Your Credit By 100 Points

If youre struggling with a low score, youre better positioned to quickly make gains than someone with a strong credit history.

Is a 100-point increase realistic? Rod Griffin, director of public education for credit bureau Experian, says yes. The lower a persons score, the more likely they are to achieve a 100-point increase, he says. Thats simply because there is much more upside, and small changes can result in greater score increases.

And if youre starting from a higher score, you likely dont need a full 100 points to make a big difference in the credit products you can get. Simply continuing to polish your credit can make life easier, giving you a better chance of qualifying for the best terms on loans or credit cards.

Here are some strategies to quickly improve or rebuild your profile: